The negative impacts of information overload on worker productivity are well-documented, so why do so many institutional investors suffer from it?

In this piece we examine why information overload exists, consider its impact on investors, and suggest ways that the current financial landscape can be altered to better serve fund managers.

What is ‘Information Overload’?

Information overload refers to the detrimental effect on decision-making that too much information can have on us as individuals. It is a form of sensory overload which leads to disorientation and comprehension errors; a massive red flag for senior executives concerned about their team’s bottom line.

The term was first popularized by Alvin Toffler’s futuristic novel Future Shock (1970). It has since been applied to any area or discipline where overexposure to content produces confusion and poor decision-making.

The Specific Causes of Information Overload

An important investigation on this issue by Julie Agnew and Lisa Szykman (both professors at the Mason School of Business, Williamsburg, VA), published in the Journal of Behavioural Finance (2004), found that there are three main causes of information overload. One is sheer volume. The second is overchoice, and the third factor is option similarity. If everything feels the same to buyers of investment research, differentiating one alternative from another can be an agonising process.

How Does Information Overload Hurt Investors?

Agnew and Szykman found that investors experiencing information overload suffer from passivity. Faced with a sea of undifferentiated content, asset managers are more likely to choose the path of least resistance, or the “default option”, even if that path means lower returns.

In an article by McKinsey Quarterly written on this subject, Derek Dean and Caroline Webb said: “information overload hits CEOs and their colleagues in the C-suite particularly hard because senior executives so badly need uninterrupted time to synthesize information from many different sources, reflect on its implications for the organization, apply judgement, make trade-offs, and arrive at good decisions.”

“The root of the problem is that our brain is best designed to focus on one task at a time. When we switch between tasks, especially complex ones, we become startlingly less efficient,” added Dean and Webb.

In a recent study published in Neuron, a renowned neuroscience academic research journal, participants who completed tasks in parallel took up to 30 percent longer and made twice as many errors as those who completed the same tasks in sequence.

The current financial services landscape, which requires asset managers to sift through piles of fragmented content, is ultimately not only inefficient but more likely to produce bad investments. With its negative impacts beyond refute, how can asset managers cope with information overload?

Solving Information Overload

To help drive smarter investment choices, research providers need to confront the phenomenon of information overload head-on. Brokers and investment banks who dominate the research space should re-evaluate their existing strategies and focus on providing concise, timely and differentiated analysis to buyers.

In Europe, where the investment research space is being transformed by a new piece of EU financial legislation known as MIFIDII, independents are gaining market share by providing a meaningful alternative to information overload.

“We are going from quantity to quality,” says George Kuznetsov (Head of Research at intelligence company Coalition) in a recent article by FT.com. Kuznetsov expects banks to “definitely” become more selective in the sectors they report on in an environment where clients will no longer support the 60-70-person research teams who operate at present.

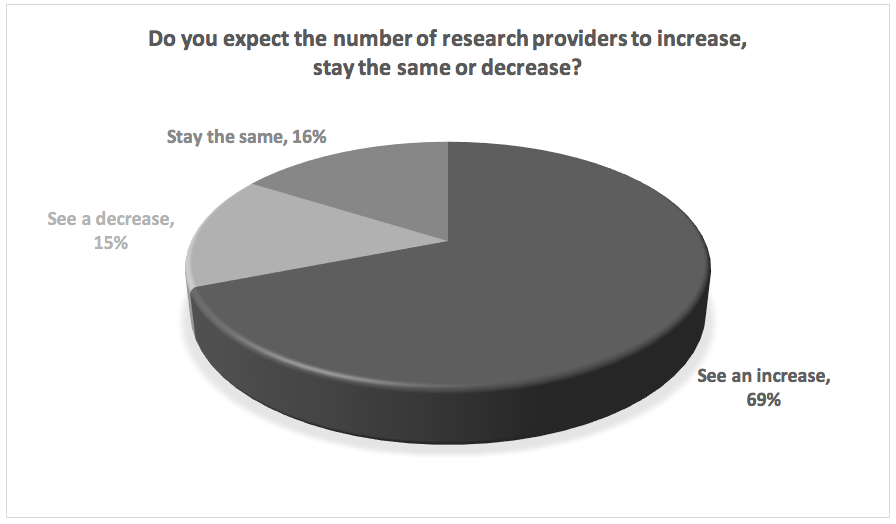

For independent research providers who provide timely, quality content with transparent pricing models, the market is poised for growth.

For more on MIFIDII and our coverage of the rise of independent research providers in Europe, read our blog post here.