https://www.bloomberg.com/gadfly/articles/2018-02-27/alibaba-tencent-retail-push-smacks-of-self-service?unique_ID=636553189197430074

Has Passive Investing Peaked?

Has Passive Investing Peaked?

Written by Warren Yeh

Head of US, Smartkarma

The first book I ever read on investing was Burton Malkiel’s “A Random Walk Down Wall Street”, originally published in 1973 and considered by many to be the Bible of passive investing. By the time I read it in the early 80’s, Professor Malkiel was Dean at the Yale School of Management and a board member of the Vanguard Funds.

It left such an impression that I put my next paycheck into the Vanguard 500 Index Fund. Shockingly, despite my bold investment, index funds (deemed “un-American” due to their defeatist “can’t beat’em join’em” attitude) remained a tiny fraction of total assets in the years that followed. In fact, by the end of 1990’s – almost 30 years later – actively managed funds still accounted for roughly 90% of funds under management.

However, since 2000, the growth of passive management (index funds and ETFs) in the US has accelerated dramatically. In particular, over the last 10 years, passive management has not only gained market share but has clearly done so at the expense of active management.

![]()

Source: “Tracking US Asset Flows”, Morningstar

Much of this growth can be attributed to ETFs with the introduction of the SPDR S&P 500 ETF Trust (SPY). Celebrating its 25th birthday this year, SPY is now just one of nearly 7200 ETFs worldwide according to London-based research firm ETFGI. ETFs now account for 10% of US equity ownership and 36% of daily trading volume.

As a result of these funds flows, actively managed US equity funds are now 60% of assets while passively managed funds account for nearly 40%.

ETF ($bn) | Index ($bn) | Total Passive ($bn) | Active ($bn) | Total Assets ($bn) | % Passive | |

1999 | 31.20 | 334.90 | 366.10 | 2,632.60 | 2998.70 | 12.2% |

2016 | 1,329.40 | 1,805.60 | 3,135.00 | 5,044.10 | 8,179.10 | 38.3% |

Source: Itzhak Ben-David, Francesco Franzoni, Rabih Moussawi, “Exchange Traded Funds (ETFs)”. Annual Review of Financial Economics, Vol. 9, 2017

High Fees + Underperformance = Switch to Passive

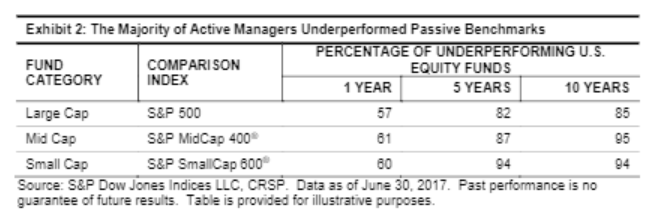

The simple reason for the move to passive investment is the combination of high fees and lousy performance. In the midst of this current bull rally, active managers have underperformed a highly resilient index. According to the recent S&P Dow Jones SPIVA Scorecard, over 80% of all active managers underperformed on a net basis over the last 10 years across almost all categories.

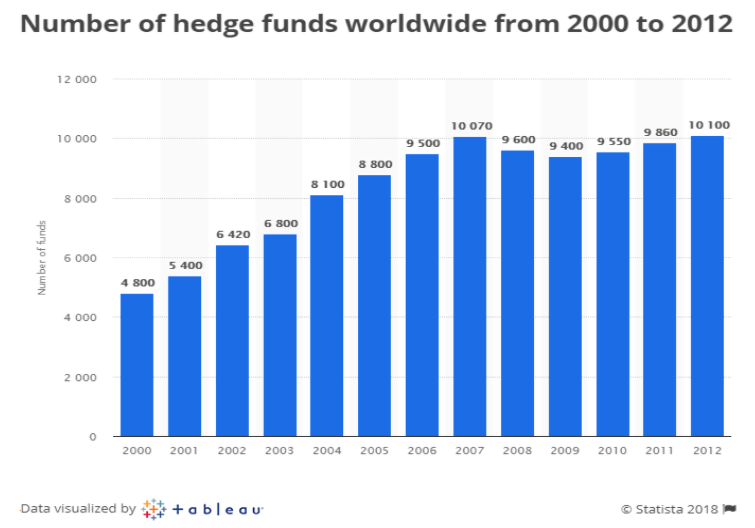

A factor that may have contributed to the underperformance of active managers was the increasingly crowded and overcompensated playing field. The proliferation of hedge funds since 2000 and massive compensation schemes attracted many players into the asset management world.

Source: Statista

I don’t think it’s a freak accident that the peaking in the number of hedge funds in 2007 coincides with the beginning of accelerated growth in passive assets.

While assets managed by hedge funds are still small relative to total actively-managed assets, the fees generated reached headline levels that often drew strong criticism and painted many active managers with the same brush. Any active manager’s underperformance became a magnified liability. Public funds had no choice but to allocate to passive strategies for far lower fee levels.

Too Much of a Good Thing?

If passive investing is a good thing, then we are now getting too much of it. Here are some of the problems.

Every stock in the particular index is treated the same way.

For every dollar that is invested in a passive fund, the tracked index members get the same pro rata allocation of that dollar (usually by market capitalization) regardless of the underlying company quality. This means that correlation among index members is high and dispersion is low. As such, the worst companies will follow the best companies in a bull market and vice versa when sentiment reverses. If these features of correlation and dispersion are maintained over extended time periods then quantitative algorithms will model this tendency as the norm further exacerbating the issue.

Some companies are found in multiple indices and thus represented across multiple ETFs. According to Bloomberg, Apple (AAPL) can be found in 198 different indices. This can range from 1.3% of the Bloomberg World Index to 69% of the NASDAQ US Large Cap Growth Index. As money pours into a variety of ETFs for a variety of different reasons, AAPL shares will be bought across many different categories. Is it a surprise then that AAPL’s largest owners are Vanguard, Blackrock, and State Street? After all these three institutions account for 83% of the US ETF market and 70% globally. Look across any S&P 500 stock and three of the top five owners will be index funds.

Passive funds own a lot of stock but do not vote actively.

Proxy voting data from 2016 show that index funds vote with management 97% of the time. That shouldn’t be surprising. Low fees at these funds do not typically support an active proxy war. But it also means that issues like executive compensation, stock buybacks, and other practices condoned by boards may go unchecked, especially if boards recognize that the majority of shareholders are passive.

ETFs can exacerbate market volatility.

On May 6, 2010, bad news surrounding Greek debt resulted in an equity market sell-off. That’s understandable, but the S&P 500 dropped 9% in 20 minutes. How does this happen?

The majority of ETFs are open-ended. This means that when the ETF price rises above the NAV of its basket of index components then market makers (called “Authorized Participants” or APs) will sell newly-created ETF shares and buy index constituents. But when the index components sell-off and ETF owners dump their ETFs, then APs are supposed to buy the ETFs and sell the components. In situations where liquidity for the index components dries up (ie bids fall away), APs have been reluctant to perform this arbitrage function. The downward spiral quickly becomes self-fulfilling.

The Flash Crash of 2010 resulted in circuit breakers being applied to slow down these death spirals. But that seemed to have backfired on Aug 24, 2015 when 327 ETFs were halted due to limit down restrictions and 11 ETFs were halted 10 or more times. Again, APs were inactive when pricing clarity was limited.

It would be unfair to pin all the blame on APs for ETF dysfunction. Many of the most volatile ETFs are leveraged synthetic ETFs designed to provide multiples of daily index percentage rises and falls. Instead of buying the physical assets to replicate the index, synthetics enter into swap agreements with a counter-party (which many times may be an affiliated entity) basically guaranteeing the index return. How that counter-party offsets the liability is fairly irrelevant to the end user of an ETF. But during periods of extreme volatility, counter-party risk can create a domino effect that’s unanticipated. I don’t know about you but I still get a little nervous whenever I see the words “counter-party” and “leverage” in the same paragraph.

Conclusion

Flash crashes are just one symptom or warning sign of a situation that has spiraled a bit too far. As indexing grows it becomes more self-fulfilling. Unlike other market phenomena, there is no self-correcting mechanism. In my opinion, we are reaching a tipping point where active managers are becoming more important than ever. Fees have been negotiated down, many funds have closed and passive continues to snowball (US ETFs in January attracted $68.1 bn the most ever in a single month). But until the remaining managers show some outperformance, the default mechanism will continue to move toward passive. Ironically most active managers I have interviewed feel that this outperformance can only come when the market sells off. Assuming the sell off unwinds the overowned index names, active managers need to be invested in those less-followed, un-indexed, and ignored ideas or else they get swept down the same drain. Unconflicted independent research that examines these less-followed ideas will be critical in surviving the next market decline. And those active managers who want to outperform during that period need to be investing in those ideas now in order to be the winners going forward.

Has Passive Investing Peaked?

Has Passive Investing Peaked?

Written by Warren Yeh

Head of US, Smartkarma

http://www.asiaasset.com/news/New_Product_DM2302.aspx

https://www.businesstoday.in/current/policy/rbi-repo-reverse-rate-urijit-patel-mpc-minutes-of-meeting/story/271245.html

http://www.assetservicingtimes.com/assetservicesnews/dataservicesarticle.php?article_id=7994

https://www.waterstechnology.com/regulation-compliance/3511366/smartkarma-debuts-full-suite-of-mifid-ii-compliant-research-tools

http://www.integrity-research.com/smartkarma-adds-high-touch-services/

Smartkarma’s community of independent Insight Providers now offer value-added services globally including analyst calls, corporate access, financial models & bespoke projects.

SINGAPORE, LONDON, 21 February 2018 – Smartkarma, Asia’s largest provider of independent investment research, today announced the global launch of Premium Services, a suite of value-added services, allowing asset managers to deepen their engagement with independent research providers. Smartkarma’s innovative platform-based solution has up-ended the traditional research model by providing access to a large network of independent, transparent, analysts and insight providers. With the launch of Premium Services, this now extends into other services beyond content, including analyst calls, corporate access, financial modelling and bespoke research, all accessed in a fully compliant manner.

Smartkarma’s Premium Services launch follows the recent announcements of its expansion across Europe and the US, as well as its recent Series B funding announcement. Quinlan and Associates have forecast a growth in independent and boutique insight providers, due not only to regulatory obligations, but also the move towards a more dynamic and collaborative solution for the currently fractured investment research market. Smartkarma’s ecosystem has shown strong growth since its launch in 2016, with the top 10 clients alone having over $13.5 trillion under management.

Smartkarma’s Premium Services provides clients with a holistic solution, outside of the traditional bank research model, which has shown significant strain under the MIFID II regulatory rules. In contrast to the current cumbersome processes to establish interaction with analysts and analyst firms, ensuring compliance is an easy, transparent process with Premium Services. Once compliant, clients can easily work with all Insight Providers across the network, without any fear of inducement, a key requirement for MiFID II.

Premium Services allow the buy side the flexibility to engage with Insight Providers when and how they need, with simple and transparent pricing and a tiered subscription model, priced from $2,000 US per month. Clients can access Insight Providers whose work they appreciate and value, to get more in-depth knowledge on a specific topic, or to sense check a newly formulated trading idea. The addition of bespoke work also gives investors and portfolio managers the opportunity to request specific financial models or other research that will not be visible to others on the Smartkarma platform.

For Insight Providers, Premium Services enables monetisation of services that complement their written insight available on the Smartkarma platform, further strengthening their expert credibility. Over 400 Insight Providers covering in excess of 2,400 companies across 15 Asia Pacific markets publish regularly to the platform, covering areas that are underrepresented by traditional bank research including IPO/M&A analysis, event-driven special situations, and small and mid-cap company research.

Smartkarma Insight Provider and Chief Economist at Asianomics, Dr Jim Walker says, “Premium Services provides independent analysts like me, with an effective platform to reach a global community of buy-side clients interested in all of our services.”

Jon Foster, Co-founder of Smartkarma notes, “The finance industry is seeing unprecedented change and traditional bank-led models for research coverage and analyst interaction is no longer enough. The market wants more access to independent research that is compliant and actionable. Premium Services delivers this in a new and innovative way, allowing asset managers to dive deeper into the written ideas on Smartkarma and their next investment.”

Premium Services is now live across the Smartkarma platform and the service will also be available to European focused Insight Providers joining the platform this year.

Smartkarma: Media Contact: [email protected]

Chanda Shingadia: + 44 (0)7951 163615

About Smartkarma

Smartkarma unlocks the value of independent insight, providing investors with high-quality, unique, expert opinion on timely themes and topics across companies, industries, and markets in Asia via it innovative, collaborative cloud-based platform. Insight can be customized to individual investor needs and updated in real time as investment strategies change, helping investors consolidate relevant information and stay abreast of evolving, complex financial issues. In addition to large-cap bottom-up, coverage also includes frontier markets, small and mid-caps and in-depth event driven/IPO analysis, helping Smartkarma’s global client base generate new trade ideas.

Smartkarma saves investors and insight providers valuable time by providing new ways to create, engage with, and distribute insight with its innovative use of technology and direct access to experts through its responsive, intuitive platform. Its market changing business model also meets evolving regulatory requirements, such as MiFID II. For more information please visit www.smartkarma.com

Singapore Must Think like a Platform to Thrive as a Digital Hub

Co-written by Tan Chin Hwee CFA, CA

CEO-Asia Pacific, Trafigura

Tan Chin Hwee and Sangeet Paul Choudary For The Straits Times

With physical trade possibly declining, Singapore can expand and license its digital trade platform to global users. It can become a free data port as well.

Singapore’s strategic location has helped the island nation become a hub for global trade. But with digital technologies changing the nature of trade, Singapore’s locational and infrastructural advantages may no longer be as strong a control point as they were in the past. Singapore must reinvent itself as a hub for the age of digital trade.

And in the modern world dominated by platform companies that offer ways for customers and companies to connect with one another, Singapore must think like a platform nation.

It can make use of its innate advantages to develop ways for other nations and industries to connect through it digitally.

Today, digital technologies are changing the nature of globalisation in two important ways. First, automation of manufacturing is moving manufacturing back west. Adidas, for example, is moving production from China to Germany, owing to the lower cost of robotic manufacturing in Germany. As Western companies re-shore manufacturing, East-West physical trade flows, including the ones moving through Singapore’s hub, are likely to go down.

Second, global SME (small and medium-sized enterprise) trade is on the rise, driven by the rapid growth of digital platforms such as Alibaba and Tencent, which allow much smaller enterprises to participate in global trade without the need to invest in their own supply chains.

As these platforms scale further, we may see control over trade shifting from political countries to these digital platforms.

To formulate these new control points, Singapore must think like a digital platform. To understand this better, let us consider how Google succeeded in dominating the smartphone industry with the Android platform.

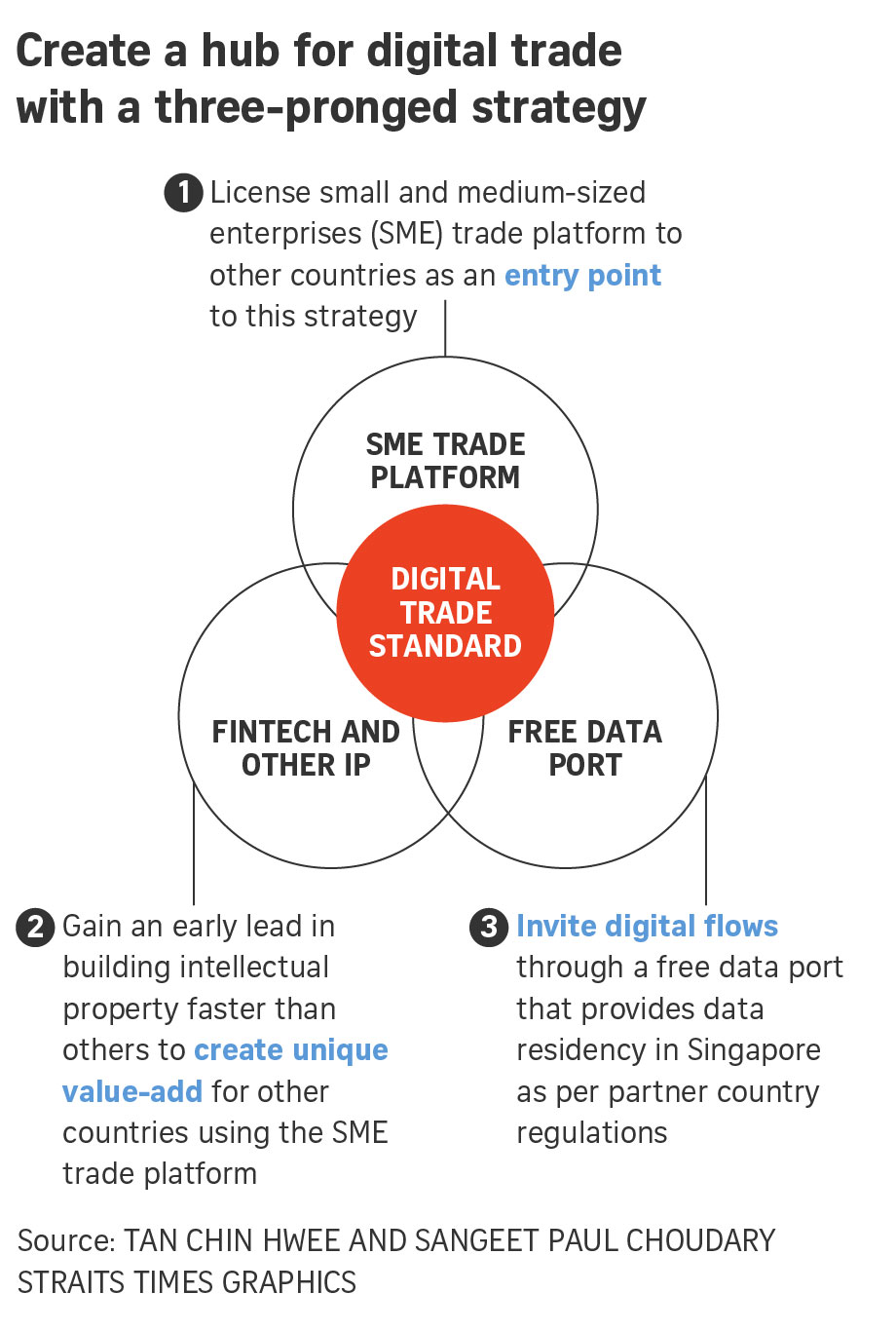

THREE-PRONGED STRATEGY

Google used a three-pronged strategy. First, it drove the adoption of Android among smartphone manufacturers such as Samsung by open-sourcing the operating system. This was Google’s entry strategy.

Second, it controlled unique IP (intellectual property) in the form of Google Maps and the Google Play app store. This IP served as Google’s key differentiator. Every smartphone manufacturer needed to license this IP. Google continues to invest in improving its mapping data and growing its app store as these two sources of IP make Android more attractive as the standard.

Third, Google leveraged its neutral position in the smartphone industry – as a non-manufacturer – to allay competitive fears among manufacturers who were using Android.

This three-pronged strategy – an adoption strategy with partners, control of unique IP, and the benefits of a neutral position – established Android as the dominant standard.

Singapore can leverage a similar three-pronged strategy to establish a standard for digital trade. Such a standard would enable multiple participating countries to collaborate, while enabling Singapore to establish itself as a hub for digital trade.

Much like Google’s strategy outlined above, Singapore’s road map to establishing a standard will involve an adoption strategy with partners, control of unique IP differentiators, and the benefits of a neutral position.

We elaborate further on these three initiatives below.

1. Drive adoption by licensing the SME trade platform to emerging economies

The first part of the three-pronged strategy serves as the entry point.

One such entry point could be digital SME trade, which has been growing with the rise of digital platforms. In the first quarter of this year, Singapore will launch its own SME trade platform, built on the blockchain, to allow SMEs to conduct digital commerce securely and seek new business partners and distributors, while managing a common audit trail between counterparties on the platform.

In the first instance, this platform allows Singapore SMEs to participate in digital commerce and grow their businesses. However, it can also serve as an entry point towards a larger strategy.

Once the success of the SME trade platform is demonstrated within Singapore, the country could open its platform technology, know-how and processes to emerging economies that are seeking growth driven by digital SME trade. These partner countries understand the importance of digital SME trade but do not have the capabilities to create such a platform, nor do they want their SME sector to become over-reliant on commercial platforms such as Amazon and Alibaba. When multiple countries start using the same platform, they start subscribing to the same data standards, leading to greater cooperation and interoperability among them.

This serves as a first step towards creating a standard for collaboration in digital trade. However, it does not yet position Singapore as the hub. This leads us to the second part of the three-pronged strategy.

2. Invest in IP

In order to create the right control points and be a hub for digital trade, Singapore must invest in creating unique IP that other countries using the SME trade platform find valuable. It needs to create and control unique IP that adds value to users of the SME trade platform.

Singapore already has a head start here with its financial technology (fintech) strategy. By creating a regulatory sandbox, the country is already encouraging innovation in fintech.

The fintech innovations emerging from Singapore can be used as value-add plug-ins to the SME trade platform.

For example, a data-driven credit scoring system could be used to extend trade financing to SMEs based on their trade activity data gathered on the platform. Similarly, insurance premiums for trade shipments could be personalised based on proprietary data from the platform. Other countries using the platform may not possess the technology or financial infrastructure to build these capabilities themselves, making the platform even more attractive for them to adopt.

As more countries use the platform, other IP creators could find it more attractive to create IP for this platform, owing to the higher demand. This growing IP, in turn, leads to greater usage of the platform. This creates a virtuous circle.

This would position Singapore as the central and most powerful point for processing digital trade data from participating countries, making it a hub for digital trade.

Other countries using the platform would send their digital trade data to Singapore using the platform’s secure APIs (application programming interfaces), in order to benefit from Singapore’s fintech innovation that plugs in to the platform.

This IP creates a unique and inimitable differentiator. It also allows Singapore to monetise digital trade activity in other countries, positioning it as a virtual hub over trade flows.

3. Become a free data port and set a standard for digital trade

As Singapore becomes the hub for digital trade, it can also leverage its neutral position to allay fears among partner countries.

In the past, Singapore’s creation of a free trade port attracted physical trade flows to the country. We believe that Singapore would be well served by establishing a similar free data port that positions it as a neutral country for processing global trade data.

A free data port – an idea also proposed by former civil service head Peter Ho at the IPS-Nathan Lectures last May – would allow data from other countries to be stored and processed in Singapore, but in accordance with their individual country-specific data jurisdictions.

A free data port and neutral governance further position Singapore’s SME trade platform as a superior alternative to other commercial platforms that facilitate SME trade.

We believe this three-pronged strategy will help Singapore to establish a standard for digital trade. As locational advantages become less relevant in a digital world, Singapore can re-position itself as a hub by constantly investing in and controlling unique IP that other trading countries value, while maintaining a neutral stance through a free data port.

There are a few specific nuances to consider here. First, digital trade allows Singapore to be location-agnostic. In physical trade, Singapore benefited only from trade flows towards Asean. But in digital trade, the SME platform could be licensed to small nations in Africa, Central America and Eastern Europe.

We believe that Singapore’s head start with fintech IP, coupled with its neutral stance as a free data port, will make the SME platform attractive.

Second, in addition to providing a free data port, Singapore could also act as the neutral convener and facilitator for driving digital and data policies across participating countries. To the extent that many of these countries are emerging economies and have still not fully evolved their data policies, this proactive facilitation further strengthens Singapore’s position as a neutral hub.

Third, to be a strong hub for digital trade, Singapore must continue to invest heavily in machine learning and data-analytic capabilities to gain intelligence from global trade data flows.

On a final note, physical trade will continue to be important as well. In addition to preparing for digital trade, the country should strengthen its hub position in physical flows by capturing and controlling important data.

For example, one way to exert greater control over supply chains may involve digitising warehouses and other supply-chain assets across South-east Asia.

Much as platforms like Airbnb create a market by digitising spare accommodation, Singapore could create new digital markets around the trade taking place through its port by digitising spare assets that lie further upstream and/or downstream from its port.

While others try to compete with the port only at a physical level, this could enable the country to combine flows through the port with these new data points to exert more control over the supply chain and make itself a preferred port.

We are entering a new phase of globalisation, where digital technologies rapidly change the nature of trade. With the starting points of this strategy in place, Singapore is well positioned to create a hub for trade in this new world across physical and digital trade. But to succeed in this new phase, the country needs to think like a digital platform.

•Tan Chin Hwee works in a multinational logistics company headquartered in Singapore and has a family office that has been investing in technology for many years. Sangeet Paul Choudary is founder of Platformation Labs in Singapore, co-author of Platform Revolution and author of Platform Scale.

First Published in The Straits Times on February 14, 2018. View here: https://goo.gl/kvg3jK

Has Passive Investing Peaked?

Has Passive Investing Peaked?