In this briefing:

- Nintendo: Is the Hype Surrounding the Switch Slowly Dying Down?

- Recruit Holdings Down 30% From October; Still Not Cheap

- Japan: 2018 Market Review – Bear Market Rally Ahead

- Last Week in Event SPACE: Harbin Electric, MYOB, TMB Bank, Halla Holdings

- Are US Stocks A Buy Yet?

1. Nintendo: Is the Hype Surrounding the Switch Slowly Dying Down?

Nintendo reported their 2QFY03/19 in October with results showing growth at both the top line and bottom line albeit not living up to consensus expectations. Top line grew by 4.0% YoY to JPY388.9bn in 1H03/19 while OP grew by 53.9% YoY to JPY61.4bn. OP in the last quarter (2QFY03/19) was the second highest the company has experienced over the last five years. This growth has been mainly driven by the sales of Nintendo Switch hardware which sold just over 5m units in 1HFY03/19. However, YoY growth remained at 3.4% compared to 4.9m units sold in 1HFY03/18. This has left investors worried about Nintendo’s aggressive target of selling 20m units of the Switch for FY03/19. Of this target, the company has managed to achieve only around 25.0% in 1H. Nintendo’s financial performance follows a seasonal trend with the December quarter showing stronger performance due to increased sales during Christmas. While the company’s current quarter is likely to show strong results, we remain skeptical about the company reaching the aforementioned target for FY03/19.

Switch Sales Have Caused an Improvement in Nintendo’s OP….

….Despite a Slowdown in the Growth of Units Sales

Nintendo’s Last Quarter Has Also Failed to Live Up To Consensus Expectations

2. Recruit Holdings Down 30% From October; Still Not Cheap

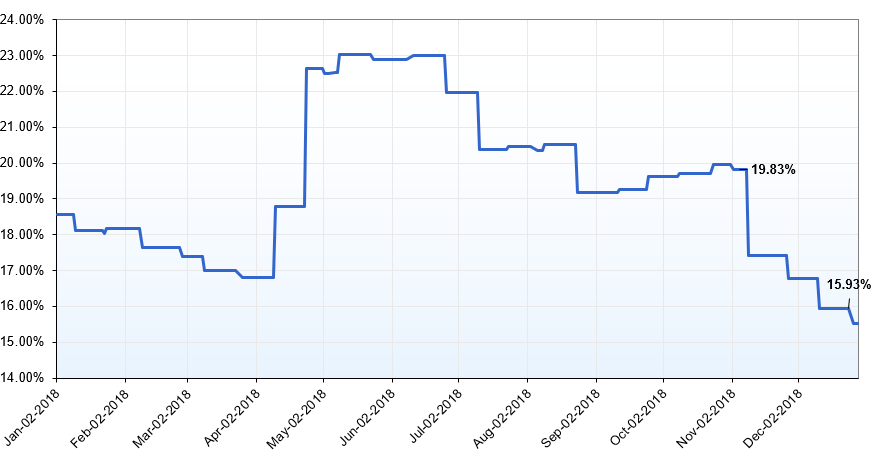

The share price of Recruit Holdings (6098 JP) has fallen by around 30% over the past three months from an all-time high of JPY3,826 (on 1st October 2018) to JPY2,705 on 24th December 2018. Prior to this, Recruit’s share price saw a strong upward rally during May-September following the company’s announcement that it would acquire Glassdoor Inc. (the company which operates the employment information website glassdoor.com).

We expect Recruit’s consolidated revenue to grow 7.7% and 6.5% YoY in FY03/19E and FY03/20E respectively, driven by the acquisition of Glassdoor and steady growth in Japanese staffing operations, partially offset by a likely slowdown in global labour market activity. We also expect Recruit’s consolidated EBITDA margin to improve by around 50bps due to higher margin from Glassdoor.

Despite the recent dip in share price and steady topline and bottom line growth over the forecast period, at a FY2 EV/EBITDA multiple of 14.0x, Recruit doesn’t look particularly attractive to us. Recruit’s internet advertising business and employment business peers, Yahoo Japan (4689 JP) and Persol Holdings (2181 JP) are trading at FY2 EV/EBITDAs of 7.7x and 9.6x respectively.

| FY03/18 | FY03/19E | FY03/20E |

Consolidated Revenue (JPYbn) | 2,171 | 2,338 | 2,490 |

YoY Growth % | 11.9% | 7.7% | 6.5% |

Consolidated EBITDA (JPYbn) | 258 | 288 | 312 |

EBITDA Margin % | 11.9% | 12.3% | 12.5% |

Source: Company Disclosures/LSR Estimates

3. Japan: 2018 Market Review – Bear Market Rally Ahead

2018 MARKET REVIEW – In this Insight, we shall review the performance of the Japanese stock market, during 2018 and look forward to the coming year. We shall look back at the year from a Sectors, Peer Group and Company perspective in separate Insights to follow next week.

BEAR MARKET RALLY AHEAD – From the January 23rd peak to the December 25th low, the All Market Composite declined 24.5% in Yen terms and 24.9% in US$ terms placing Japan in a bear market for the seventh time since the bursting of the 1989 stock market ‘bubble’. The average stock is now 35% below its one-year high compared with just 10% below at the beginning of the year. Total Market Value is still ¥123t above the low of 12th February 2016, and the question remains – are we replaying March 2008 or February 2016? In both cases, there were bear market rallies (25% and 17%) before the final downward leg – which entailed further declines of 50% and 13%, respectively. In our recent Insight on 21st December – Ticking the Bear Market Boxes – we commented that it was too early for contrarians to start ‘nibbling’. The 1,000 point Nikkei 225 (NKY INDEX) decline the next trading day, and the rebound into the year-end suggests that a case can now be made for, at least, a short-term rally. In the charts in the DETAIL below, we shall explore the case for (✓) and against (✕), and attempt to answer the question of the 2008 or 2016 reprise.

4. Last Week in Event SPACE: Harbin Electric, MYOB, TMB Bank, Halla Holdings

Last Week in Event SPACE …

- Just how will Harbin Electric Co Ltd H (1133 HK)‘s independent directors justify recommending an Offer to shareholders at a price which gave cash less cavalier than cash?

- MYOB Group Ltd (MYO AU)‘s directors grudgingly yet understandably enter an agreed deal with KKR.

- A TMB Bank PCL (TMB TB) / Thanachart Capital (TCAP TB) courtship is a possibility after an earlier Krung Thai Bank Pub (KTB TB) /TMB alliance failed.

(This insight covers specific insights & comments involving Stubs, Pairs, Arbitrage, share Classification and Events – or SPACE – in the past week)

M&A – ASIA-PAC

As previously discussed in Harbin Electric Expected To Be Privatised, Harbin Electric (HE) has now announced a privatisation Offer from parent and 60.41%-shareholder Harbin Electric Corporation (“HEC”) by way of a merger by absorption. The Offer price of $4.56/share, an 82.4% premium to last close, is bang in line with that paid by HEC in January this year for new domestic shares. The Offer price has been declared final.

- Of note, the Offer price is a 37% discount to HE’s net cash of $7.27/share as at 30 June 2018. Should the privatisation be successful, this Offer will cost HEC ~HK$3.08bn, following which it can pocket the remaining net cash of $9.3bn PLUS the power generation equipment manufacturer business thrown in for free.

- On pricing, “fair” to me would be something like the distribution of net cash to zero then taking over the company on a PER with respect to peers. That is not happening. It will be difficult to see how independent directors (and the IFA) can justify recommending an Offer to shareholders at any price below the net cash/share, especially when the underlying business is profit-generating.

- Dissension rights are available, however, there is no administrative guidance on the substantive as well as procedural rules as to how the “fair price” will be determined under PRC and HK Law.

- Trading at a gross/annualised spread of 15%/28% assuming end-July completion, based on the average timeline for merger by absorption precedents. As HEC is only waiting for approval from independent H-shareholders suggests this transaction may complete earlier than precedents.

(link to my insight: Harbin Electric: The Price Is Not Right)

KKR and MYOB entered into Scheme Implementation Agreement (SIA) at $3.40/share, valuing MYOB, on a market cap basis, at A$2bn. MYOB’s board unanimously recommends shareholders to vote in favour of the Offer, in the absence of a superior proposal. The Offer price assumes no full-year dividend is paid.

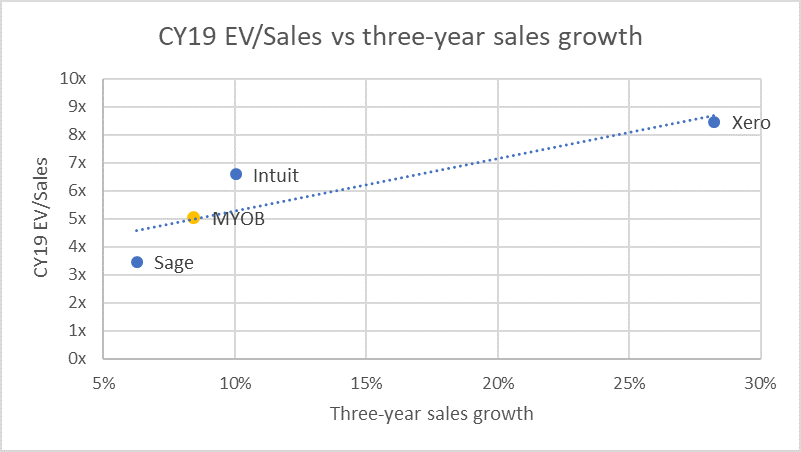

- On balance, MYOB’s board has made the right decision to accept KKR’s reduced Offer. The argument that MYOB is a “known turnaround story” is challenged as cloud-based accounting software providers Xero Ltd (XRO AU) and Intuit Inc (INTU US) grab market share. This is also reflected in MYOB’s forecast 7% revenue growth in FY18 and follows a 10% decline in first-half profit, despite a 61% jump in online subscribers.

- And there is justification for KKR’s lowering the Offer price: the ASX is down 10% since KKR’s initial tilt, the ASX technology index is off by ~14%, a basket of listed Aussie peers are down 17%, while Xero, the most comparable peer, is down ~20%. The Scheme Offer is at a ~27% premium to the estimated adjusted (for the ASX index) downside price of $2.68/share.

Bain was okay selling at $3.15/share to KKR and will be fine selling its remaining ~6.5% stake at $3.40. Presumably, MYOB sounded out the other major shareholders such as Fidelity, Yarra Funds Management, Vanguard etc as to their read on the revised $3.40 offer, before agreeing to the SIA with KKR.

If the markets avoid further declines, this deal will probably get up. If the markets rebound, the outcome is less assured. This Tuesday marks the beginning of a new year and a renewed mandate for investors to take risk, especially an agreed deal; but the current 5.3% annualised spread is tight.

(link to my insight: MYOB Caves And Agrees To KKR’s Reduced Offer)

TMB Bank PCL (TMB TB) (Mkt Cap: $1.2bn; Liquidity: $7mn)

The Ministry of Finance, the major shareholder of TMB, confirmed that both Krung Thai Bank Pub (KTB TB) and Thanachart Capital (TCAP TB) had engaged in merger talks with TMB. Considering an earlier KTB/TMB courtship failed, it is more likely, but by no means guaranteed, that the deal with Thanachart will happen. Bloomberg is also reporting that Thanachart and TMB want to do a deal before the next elections, which is less than two months away.

- TMB is much bigger than Thanachart and therefore it may boil down to whether TMB wants to be the target or acquirer. In Athaporn Arayasantiparb, CFA‘s view, a deal with Thanachart would leave TMB as the acquirer rather than the target. But Thanachart’s management has a better track record than TMB.

- Both banks have undergone extensive deals before this one: 1) TMB acquired DBS Thai Danu and IFCT; and 2) Thanachart engineered an acquisition of the much bigger, but struggling, SCIB.

- A merger between the two would still leave them smaller than Bank Of Ayudhya (BAY TB) and would not change the bank rankings; but it would give TMB a bigger presence in asset management, hire-purchase finance and a re-entry into the securities business.

(link to Athaporn’s insight: Sathorn Series M: TMB-Thanachart Courtship)

STUBS/HOLDCOS

Halla Holdings (060980 KS) / Mando Corp (204320 KS)

Mando accounts for 45% of Halla’s NAV, which is currently trading at a 50% discount. Sanghyun Park believes the recent narrowing in the discount may be due to the hype attached to Mando-Hella Elec, which he believes is overdone; and recommends a short Holdco and long Mando. Using Sanghyun’s figures, I see the discount to NAV at 51%, 2STD above the 12-month average of ~47%.

(link to Sanghyun’s insight: Halla Holdings Stub Trade: Downwardly Mean Reversion in Favor of Mando)

SHARE CLASSIFICATIONS

- LG Chem Ltd (051910 KS)‘s 1P is now at a 44.20% discount to Common. The dividend will be the same as last year of ₩6,000 despite lower earnings. The dividend yield for Common will be 1.68%, and 3.03% for 1P or a dividend yield difference of 1.35%, a four-year high. (link to Sanghyun’s insight: LG Chem Share Class: Another Pref to Watch as Div Yield Gap at 4Y High)

OTHER M&A UPDATES

Glow Energy Pcl (GLOW TB). In a strange twist to the tale, the ERC agrees to approve Global Power Synergy Company Ltd (GPSC TB)‘s takeover of Glow under a revised plan in which they have to: 1) sell Glow SPP1, a power plant with 124MW capacity and 90 tons/hr of steam; and 2) allow clients such as Pa Daeng to change providers. This will reduce Glow’s market share within the MapTaPhut area, but Athaporn Arayasantiparb, CFA thinks the purchase price (Bt139bn according to Bangkok Post) will have to be revised downwards too. For more on the original deal, see Deal Alert! GPSC Goes For the Jugular! and Anti-Trust Should Be A Non-Issue In The GPSC/Glow Deal.

- Unisem (M) (UNI MK). The Offer is now unconditional and will remain open to acceptances until the 7 January 2019.

- Stanmore Coal (SMR AU). The offer has been extended until the 22 January 2019.

CCASS

Often these moves can easily be explained – the placement of new shares, rights issue, movements subsequent to a takeover, amongst others. For those mentioned below, I could not find an obvious reason for the CCASS move.

Name | % change | Into | Out of | Comment |

Putian Communication (1720 HK) | 69.75% | Shanghai Pudong | Outside CCASS | |

37.68% | China Industrial | Outside CCASS | ||

16.23% | HSBC | Outside CCASS |

5. Are US Stocks A Buy Yet?

- 5%-like rallies on Wall Street are signs of a bear market not a bull market

- Bull markets require strong liquidity and low risk appetite, neither yet apply

- Risk appetite readings at minus 12.6 are still above the minus 40 criterion for an upturn

- Recent large fall in risk appetite consistent with upcoming economic recession