In this briefing:

- DoubleDragon Properties (DD PM): From Overhyped to Undervalued; Multi-Bagger in the Making?

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Better off Buying the Parent

- CanSino Biologics (康希诺) IPO: Valuation Update (Part 3)

1. DoubleDragon Properties (DD PM): From Overhyped to Undervalued; Multi-Bagger in the Making?

This Insight was written by Nicolas Van Broekhoven and Lloyd Moffatt.

What is an Orphan Stock?

An attractively valued company with a minimum market cap of USD $1 billion but no sell-side coverage.Doubledragon Properties (DD PM) meets those criteria.

Why Read This Report?

Learn about the Philippines youngest self-made billionaire*, Edgar ‘Injap’ Sia, how he created one of the largest fast-food chains (Mang Inasal) in the country and successfully sold it to Jollibee Foods (JFC PM) for over USD$100 M.

After selling Mang Inasal in 2010, Sia started building DoubleDragon (DD) as he joined hands with Tony Tan (founder of Jollibee Foods (JFC PM) ). DD was listed in 2014 at a market value of USD$85 M (PHP2/share) and reached a market cap of over USD$3 B USD two years after listing (PHP70/share).

DD’s valuation mid-2016 was overhyped and overvalued.

From mid-2016 to late 2018 the share price fell by approximately 75%. Last year the stock bottomed at PHP17.2 despite fundamentals improving drastically between 2016 and 2018.

This has created a unique opportunity to invest in a diversified property company whose main earnings contributor will come from building neighborhood malls in suburban communities outside Metro Manila. It is forecast that 90% of its revenues would be recurring in nature by FY20.

We value DD on a blended a) P/E multiple and b) Cap Rate basis.

DD recently traded around PHP 22/share and is currently valued at 9.5x FY20 P/E, a steep discount to its industry peers. Assuming the company achieves PHP10.8 B in recurring revenues by FY20 the market is currently valuing the company at a 21% Cap Rate vs 7% for its primary peer Sm Prime Holdings (SMPH PM). DD should trade at a discount to SM (long track record, higher liquidity, included in PSE index) but the gap is too wide.

We argue DD should trade at a) 15x P/E and b) 10% cap rate. Combining the two valuation methods we arrive at a blended Fair Value of PHP 40.31/share, or 83% upside from current levels.

Assumptions | Fair Value |

15x 2020 P/E | PHP 35 |

10% Cap Rate | PHP 45.63 |

BLENDED FAIR VALUE | 40.31 PHP |

The founders control 70% of the company and expect to grow the current USD$1.2B market cap exponentially the coming 3-5 years. DoubleDragon is a potential multi-bagger in the making.

Catalysts to unlock value at DoubleDragon would be:

- FY18 results publication by early April 2019

- Delivery of 100 operating CityMalls by FY20

- The passing of workable REIT law

- Delivery of PHP5.5B FY20 profit target

- FCF inflection point coming closer in FY20

- Re-discovery by sell-side firms as index inclusion looms

- Visibility into FY21-FY25 dividend potential

Footnote: *Injap was reported as having USD$1 B in assets by Forbes in 2017, as the share price of DD has fallen we estimate this has dropped to approximately USD$ 400-500 M, which would still rank him among the top-25 wealthiest individuals in the Philippines.

2. Dongzheng Auto Finance (东正汽车金融) IPO Review – Better off Buying the Parent

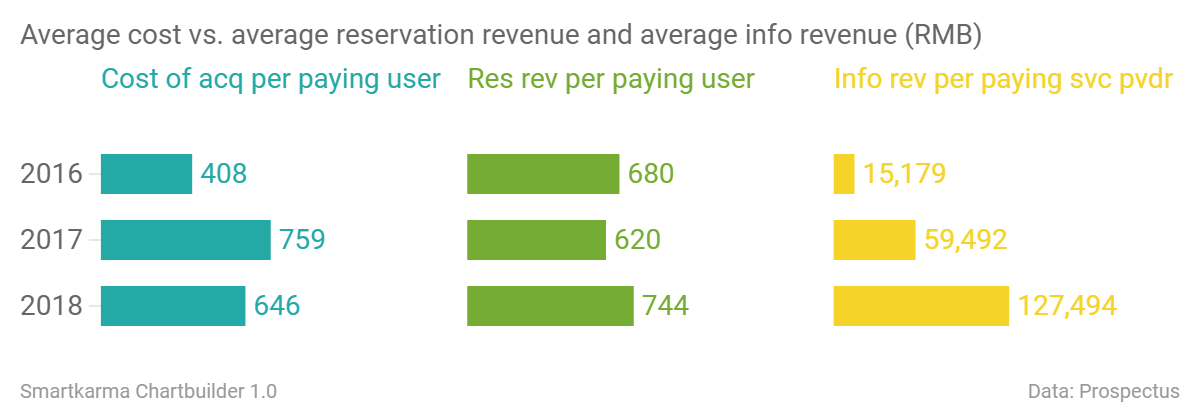

Dongzheng Automotive Finance (2718 HK) is raising up to US$428m in its upcoming IPO. We have covered the background of the company in Dongzheng Auto Finance (东正汽车金融) Pre-IPO Review – Dependent on Dealership Network for Growth.

In this insight, we will look into the company’s valuation, compare it to listed auto peers, and run the deal through our framework.

3. CanSino Biologics (康希诺) IPO: Valuation Update (Part 3)

CanSino is a China-based biotechnology company with a focus on vaccine development. In our previous insight (link to Part 1 and Part 2), we have discussed CanSino’s drug pipeline, the competitive landscape, and the valuation.

As the company is starting pre-marketing, we will provide an updated valuation based on new information obtained from the approved application document. Our base case valuation for CanSino is USD 856 million on a pre-money basis. Majority of the rNPV based SOTP valuation still comes from its meningococcal conjugate vaccine (MCV2 and MCV4). Over the past few months, the company has completed Phase III for MCV4 and submitted NDA (new drug application) for MCV2 candidates.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.