In this briefing:

- Jamuna Bank: Clearing Electoral Uncertainties

- Bank Mandiri (BMRI IJ) – Shape Shifting and Millenial Mortgages – On the Ground in J-Town

- ASIC Review of Allocation in Equity Raising – Some Truths, Some Half-Truths – No Improvements

- USD Peaking with the Economic and Political Cycle

- Bandhan Bank To Buy GRUH: A Pricey Bank/NBFC Deal

1. Jamuna Bank: Clearing Electoral Uncertainties

The Jamuna Bank Ltd (JAMUNABA BD) narrative is underpinned by a quintile 1 global PH Score™ and a low franchise valuation as well as a high Earnings Yield by global standards.

Established by a group of local entrepreneurs in 2001, experienced in trade, commerce, and industry, Jamuna Bank Ltd is the only Bengali named 3rd generation private commercial bank. JBL. has exhibited vibrant growth over 18 years. The Credit Rating Agency of Bangladesh classifies JBL as AA2 [very strong capacity and very high quality] for Long Term and ST-2 for Short Term.

JBL offers both conventional and Islamic banking. The Bank provides diverse services, encompassing trade, commerce, and manufacturing. The traditional focus has been on the corporate sector (especially textiles and manufacturing services) though SME lending and retail are fast-expanding. JBL is engaged with entrepreneurs in setting up enterprise ventures and BMRE of existing industrial units. Operations are centred on Dhaka and Chittagong though Rajshahi is an important market too.

All 122 branches are running with real-time online capacity while the bank has 243 ATMs, sharing with other partner banks and consortium throughout Bangladesh. In addition, JBL is a Primary Dealer of government. securities.

While the economy is in a relatively stable state, the Banking Sector presents a highly mixed picture. Funding and liquidity are adequate in the Banking System in general. At the main listed entities, ROA and ROE stand at around 1% and 12%. Capitalisation targets are moving in the right direction though there is a shortfall at a number of lenders. The sector is weighed down by SOCB asset quality and poor governance which needs to be addressed as it exerts a distortionary impact across the system. SOCB NPL Ratio stands at around 30% and is probably worse than this versus around 10% for the system in general. The system stressed Loan/Investment Ratio is probably double this level. Worryingly, private sector bank defaults are rising at a fast clip as LDRs climb at the same time.

Shares of JBL stand on an Earnings Yield of 17.7%, a P/B of 0.94x, and a FV at 9%, below EM and global medians. A quintile 1 PH Score™ of 7.9 captures value-quality attributes. Combining franchise valuation and PH Score™, Jamuna Bank stands in the top decile of opportunity globally. Recent strong share performance is not unrelated to the clearing of electoral uncertainty. And there seems a real tailwind behind these shares of late.

2. Bank Mandiri (BMRI IJ) – Shape Shifting and Millenial Mortgages – On the Ground in J-Town

A recent meeting with Bank Mandiri Persero (BMRI IJ) in Jakarta confirmed a positive outlook for loan growth and net interest margins for 2019, with continuing incremental improvements to credit quality, especially in the MidCap and SME space.

The bank is optimistic about loan growth in 2019 but with a shift in the shape of growth, with Midcap and SME loans moving into positive territory, a slight tempering of growth from large corporates.

Microlending continues to be a significant growth driver, especially salary-based loans, which have huge potential and are relatively low risk.

Mandiri is switching its focus on smaller sized mortgages and is even offering products specifically targeting millennials. It is also training staff in its branches to promote both mortgages and auto loans, which should help to boost growth in consumer loans.

The bank is investing heavily in growing both Mandiri Online mobile banking, as well as working closely with the major e-commerce players in Indonesia.

Management is optimistic about the outlook for net interest margins and comfortable with its funding requirements, with good visibility on credit quality.

Bank Mandiri Persero (BMRI IJ) remains a key proxy for the Indonesian banking sector, with an increasingly well-diversified portfolio and growing exposure to the potentially higher growth areas of microlending and consumer loans. The bank has fully embraced modern day banking with strong growth in Mandiri Online, which should help the bank grow its transactional business and its current and savings accounts (CASA). Its push to grow salary-based loans is another business with huge potential, given the low penetration of its corporate pay-roll accounts. According to Cap IQ consensus estimates, the bank trades on 12.5x FY19E PER and 11.0x FY20E PER, with forecast EPS growth of +16.5% and +11.8% for FY19E and FY20E. The bank trades on 1.9x FY18E PBV with an FY18E ROE of 13.9%, which is forecast to rise to 15.5% by FY20E. Given its higher growth profile and rising ROE, the bank looks relatively attractive compared to peers.

3. ASIC Review of Allocation in Equity Raising – Some Truths, Some Half-Truths – No Improvements

Over 2017-18, the Australian Securities & Investments Commission (ASIC) undertook a review of allocation in equity raising transactions. The review involved large and mid-sized licensees (brokers), Issuers, International investors and other international regulators. The results of the review were published by ASIC in Dec 2018. This insight highlights some of the key findings.

It’s good to see that some of the standard practices of banks allocating more to existing clients and participants of earlier deals have at least been acknowledged. Even though some institutional investors have outright labelled the allocation process as a “black box”, ASIC doesn’t seem to want to do much about it.

The area where ASIC is more concerned is the messaging to investors which highlights the different definitions of “well-covered” across banks. Although, the banks seem to have mislead the regulator on interpretation of “real-demand” with ECM bankers saying that all orders are taken at face-value. That raises a whole new level of questions on the messaging around demand for the deal.

4. USD Peaking with the Economic and Political Cycle

Out-performance in the US economy, as was seen in 2018, seems much less likely in the year ahead. Lower oil prices and slowing high tech sectors will dampen activity and assets in the US more than many other developed and EM countries. The boost to equities and growth from US tax policy has passed its peak. US politics is set to become increasingly partisan over the next two years of the Trump administration. US trade policy has softened in the wake on the sharp fall in US equities in Q4. Several EM countries have resolved their deep political distractions, and their economies have improved since mid-year. We can see the USD reversing more of its gains in the last year as the global economic outlook stabilises and the Fed enters an extended pause in rates policy.

5. Bandhan Bank To Buy GRUH: A Pricey Bank/NBFC Deal

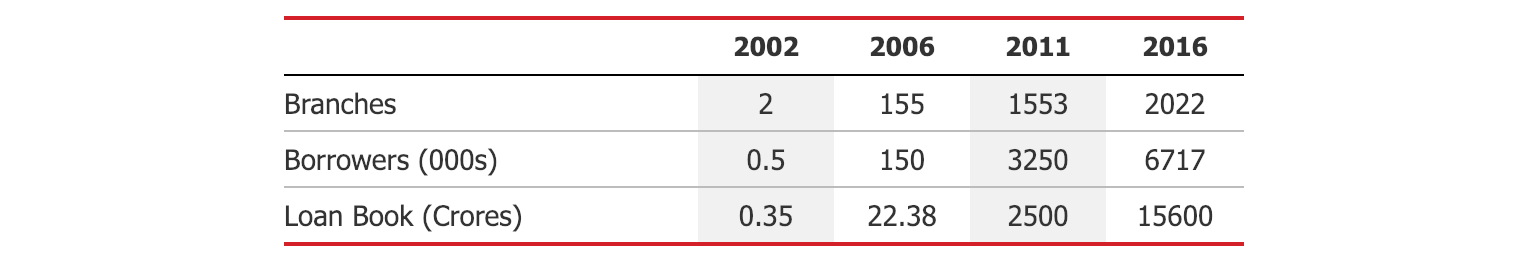

Bandhan Bank (BANDHAN IN) (“BBL”) and Gruh Finance (GRHF IN) (“GRUH”) announced together on January 7th that their respective boards have considered and approved a Scheme of Amalgamation where Bandhan Bank will be the acquiring entity and GRUH Finance will become the acquired entity. All media sources suggest it was something of a surprise to GRUH personnel and management.

The exchange ratio has been set at 568 Bandhan Bank shares per 1000 GRUH Finance shares.

Following the announcement, the shares of Bandhan Bank and GRUH Finance have declined by 4.8% and 16.4% respectively. The deal is trading at a gross/annualised spread of 10%/13+% assuming a deal completion date in late September as of Tuesday’s close (but not assuming any dividends).

The deal is conditional on receiving approvals from the Reserve Bank of India (RBI), Competition Commission India (CCI), National Company Law Tribunal (NCLT) and other relevant regulatory authorities.

Data Point | Data in the Data Point |

The Deal | Scheme of Amalgamation |

Acquiring Entity | Bandhan Bank Ltd |

Acquired Entity | GRUH Finance Ltd |

Terms | Exchange ratio of 568 Bandhan Bank shares for every 1000 GRUH Finance shares |

Conditions | Receipt of Approvals from the Reserve Bank of India (RBI), Competition Commision India (CCI), National Company Law Tribunal (NCLT), Ahmedabad Bench and Kolkata Bench, Securities and Exchange Board of India BSE Limited, the National Stock Exchange of India Limited and other regulatory authorities as may be necessary. 75% Shareholder approval by each company’s shareholders will be required as well. Bandhan’s result is a foregone conclusion. GRUH’s is not. |

Dividends? | Not mentioned. |

Indicative Timeline

Date | Event |

|---|---|

7 Jan 2019 | Announcement Date |

30 Apr 2019 | RBI Approval |

8 May 2019 | CCI Approval |

30 Sep 2019 | Possible Close Date |

Note that Indian Schemes of Amalgamation also require 75% shareholder approval from all combining parties. The vote for Bandhan shareholders is a foregone conclusion as the promoter Bandhan Financial Holdings has 82.3%. The GRUH vote is not certain but HDFC has 57.8% of the 75% required.

This deal is really pricey, and some shareholders of Bandhan Bank who will get diluted have voted with their feet. It is a pretty great exit from GRUH for HDFC. While the prima facie evidence suggests that the deal was done to appease the RBI and get closer to the promoter shareholder limit required in October last year, the shareholder structure and CEO Ghosh’s own personal history suggests that neither the 40% rule nor the salary freeze are real hurdles (though the branch opening freeze may be something BBL wants to lift).

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.