In this briefing:

- The GER Weekly EVENTS Wrap: Don Quijote, M1, Healius and Upcoming M&A Catalysts

- Last Week in Event SPACE: Nexon, Bandhan Bank, M1, Healius, Faroe, Toshiba, Swire

- ECM Weekly (12 January 2019) – Futu, China East Education, China Kepei Education, Viva Biotech

- Accordia Golf Trust (AGT SP): MBK + ORIX + AGT = Time for Outperformance? 9.5% Dividend Yield

- Bleak Future for Indusind Bank

1. The GER Weekly EVENTS Wrap: Don Quijote, M1, Healius and Upcoming M&A Catalysts

In this week’s GER M&A wrap, we highlight the dwindling likelihood of a follow-on deal for Don Quijote Holdings (7532 JP) , which is now trading below terms. Secondly, we take a contrarian view on the M1 Ltd (M1 SP) deal and contend there is less likely to be a bidding war. Finally, we update on rejected by Healius (HLS AU) and provide a comprehensive list of upcoming catalysts for near-term M&A deals.

The rest of our event-driven research can be found below.

Best of luck for the new week – Rickin, Venkat and Arun

2. Last Week in Event SPACE: Nexon, Bandhan Bank, M1, Healius, Faroe, Toshiba, Swire

Last Week in Event SPACE …

The reported sale of NXC Corp/Nexon Co Ltd (3659 JP) is possibly a fishing expedition.

- Ideally, own Bandhan Bank (BANDHAN IN) on a deal break, or wait for this deal and its spread to season a bit.

- It’s still not clear that a bump or counterbid will be forthcoming in the M1 Ltd (M1 SP) deal, but at S$2.07, the risks are better than they were higher.

- Healius (HLS AU) (unsurprisingly) rejects the indicative offer but Jangho is not out of the picture; nor is the possibility of a third party.

- Negative newsflow and a small kiss to the Offer help DNO ASA (DNO NO) clinch Faroe Petroleum (FPM LN).

- Expect Toshiba Corp (6502 JP)‘s buybacks to continue, slowly.

- Swire Pacific Ltd Cl A (19 HK)‘s discount to NAV is out of whack; so are the As versus the Bs.

- Plus CCASS and expected upcoming events for key M&A transactions.

(This insight covers specific insights & comments involving Stubs, Pairs, Arbitrage, share Classification and Events – or SPACE – in the past week)

M&A – ASIA-PAC

Nexon Co Ltd (3659 JP) (Mkt Cap: $12.6bn; Liquidity: $37mn)

Douglas Kim revisited the news that Kim Jung-Joo wants to sell his stake in the Nexon Group. Travis Lundy also chimed in with his read of the situation. The key questions are whether Kim Jung-Ju would sell NXC (and NXMH) – which holds a 48% stake in Nexon Co – as reported by the local press, or whether NXC and NXMH would sell their stakes in Japan-listed Nexon. The implication being that if they sold the stake in Nexon, it would mean buyers would get a large stake in a single company, whereas there is a bunch of other stuff floating around in NXC and its subsidiaries.

- The other question is whether Tencent Holdings (700 HK) or another buyer buying NXC would trigger a mandatory Tender Offer for the shares in Nexon in Japan. The letter of the law in the TOB Rules would indicate not, but Travis reckons Yes. If the Kim family sold their stake in NXC Corporation to a buyer, he thinks it is HIGHLY likely that the buyer would be obliged (by Japanese authorities) to conduct a tender offer for the shares of Nexon that they wanted to buy.

As a trade, this does not look like a great risk arb bet (where you make a bet that a company will get taken over) at first glance if the total trade for NXC is going to be ₩10tn. It would be a good trade if the ₩10tn number were made up of say ₩3tn of assets (in NXC), then the assumption that the current market price adding ₩7tn of assets to arrive at that total of ₩10tn would be an “estimate” of current value rather than an estimate of what it would take to get the deal done, and current market value is a significant premium to book (where NXC has heretofore reported its financials and Nexon). In that case, one might imagine that a bidding war could result in a higher price for Nexon, and an easy exit at ¥2000+/share.

- Either way it would be a chunk of change which would make many buyers – even buyers from China thought to be quite wealthy – balk. A priori, Travis would want to own Nexon vs Tencent, Electronic Arts (EA US), Netease Inc (Adr) (NTES US), and others, but it is not necessarily a comfortable trade.

links to:

Travis’ insight: Would a Sale of Founder’s Holdco NXC Corp Trigger a Tender Offer for Nexon (3659 JP)?

Douglas’ insight: Korea M&A Spotlight: Will the Nexon Group Sell the Korean or the Japanese Company?

M1 Ltd (M1 SP) (Mkt Cap: $1.4bn; Liquidity: $2.9mn)

Konnectivity Pte. Ltd officially announced the launch of its Offer to by M1 Ltd (M1 SP). The Close is 4 February, but the Offer is not Final.

- If you think there will not be a bump and the deal may or may not go through at S$2.06, unless you are so big that your selling would dramatically impact the price, the right trade here is to sell in the market.

- If you think there is a possibility of a bump as the Offeror seeks to a) get Axiata to tender and b) to get everyone else to tender so they can delist and squeeze out minorities, but if no bump there is a quasi-certainty that Konnectivity Pte will gain 50%+1 share at S$2.06, then buying at S$2.07 is not a bad trade depending on your likelihood of bump and bump price.

- If Konnectivity bump, they have two choices: Bump a little bit and declare final so that everyone who played for a bump decides to sell (that might mean a bump to S$2.15 or so); or bump a lot and get Axiata out.

- Travis believes a bump is certainly possible but also thinks this deal gets done if there is no bump. If Axiata countered at, say S$2.15, he would be inclined to buy at S$2.15 to expect a further counter by Konnectivity.

(link to Travis’ insight: M1 Offer Despatched – Dynamics Still Iffy)

Gruh Finance (GRHF IN) (Mkt Cap: $2.5bn; Liquidity: $0.5mn)

Bandhan Bank (BANDHAN IN) (“BBL”) and GRUH announced together on January 7th that their respective boards have considered and approved a Scheme of Amalgamation where Bandhan Bank will be the acquiring entity and GRUH Finance will become the acquired entity. At the exchange ratio of 568 Bandhan Bank shares per 1000 GRUH Finance shares, GRUH Finance’s price currently translates to a PER and PBV of 51.8x and 12.5x respectively which is significantly higher than the average for its comparable peers (PER=14.9x; PBV=2.0x).

- This is a great deal for Housing Development Finance Corporation (HDFC IN) which currently owns 57.8% of GRUH Finance. It will own 15% of the merged entity. Considering HDFC Ltd already owns 19.72% as the promoter of HDFC bank and that RBI does not allow the promoter of one bank to hold more than 10% in another bank as a promoter, HDFC Ltd will have to divest a stake that is at least equivalent to 5% of the merged entity.

- This deal is perhaps less good for Bandhan shareholders. GRUH is being purchased expensively, and minorities are getting hit. This is possibly so that the promoter can get closer to the obligation to the RBI to drop his stake to 40%. That ‘excuse’ is widespread in the media but may not bear up under scrutiny.

- Travis thinks both names could have further to fall and sees no compelling reason to expect growth to surprise on the previously expected upside as branch openings are frozen. A deal break would not solve that, but a shareholder disentanglement on the Bandhan side would.

(link to Travis’ insight: Bandhan Bank To Buy GRUH: A Pricey Bank/NBFC Deal)

Healius (HLS AU) (Mkt Cap: $1.2bn; Liquidity: $5mn)

As widely expected, Healius’s board rejected the unsolicited and conditional proposal from Jangho Group Co Ltd A (601886 CH) at A$3.25/share. Pricing under the proposal is okay, at best, valuing Healius roughly in sync with Sonic Healthcare (SHL AU), its nearest peer. Optically, the indicative offer is underwhelming, 20% below the recent high in March last year, and below where Jangho was accumulating its stake in early 2016.

- Operationally, Healius is not without issue, including increasing salaries, failure to secure key contracts, an inability to retain doctors at its medical centres, and the forced resignation of its CEO two years ago after he was charged by ASIC.

- An offer from Jangho would also fall under FIRB’s remit, specifically sensitive patient data in the hands of a foreign owner, and it is up for debate whether maintaining such information in a secure site in Australia (as applied in Jangho’s acquisition of Vision Eye in 2015) will alleviate these concerns.

- This deal is unlikely to get up under the current terms following the board rejection, but I do expect Jangho to bump its offer; or a third party to enter the fray. On a risk/reward basis I still tilt positive at a 18% gross spread (and up 7% from the post-rejection closing price) to the indicative offer.

(link to my insight: Healius And The (Likely) First Salvo)

Pci Ltd (PCI SP) (Mkt Cap: $190mn; Liquidity: $0.2mn)

For those who like plain vanilla, PCI announced Pagani Holding (an SPV indirectly owned by Platinum Equity Advisors) had made a S$1.33/share cash offer for the company by way of a scheme. Chuan Hup Holdings (CH SP), which holds 76.7% in PCI, has given an irrevocable undertaking to vote its stake in favour of the scheme resolution. So this is a done deal. The more interesting facet here is that Chuan Hup is currently trading at discount to its net cash after factoring in the proceeds from the sale of PCI shares.

(link to my insight: PCI Ltd – All Over Before It Starts)

M&A – EUROPE

Faroe Petroleum (FPM LN) (Mkt Cap: $762mn; Liquidity: $13mn)

As anticipated in my insight (DNO Closes In On Faroe) last week, DNO ASA (DNO NO) bumped its Offer for Faroe, which has now been declared unconditional. Tendered shares get paid in 14 days. The final closing date of the offer is the 6 February.

- The 5.3% bump to GBP 1.60/share shortly followed a prior announcement from DNO which referenced a statement made the previous day by the Norwegian Petroleum Directorate of a 30% reserves downgrade at Faroe’s Oda field from 47.2mn MMboe to 32.7 MMboe.

- The Final Offer price represents a premium of 52.4% to Faroe‘s share price of GBP 1.05 at the close of business on 3 April 2018, and values Faroe at ~£641.7mn. Despite open hostilities to the initial offer, Faroe’s board has now accepted the increased Offer and recommends shareholders tender.

- DNO now owns or has 76.49% acceptances so can now make preparations to move to delist Faroe. If total acceptances exceed 90% of the voting rights, DNO will exercise its rights to compulsorily acquire the remaining Faroe shares not tendered, also at GBP 1.60/share.

(link to my insight: DNO/Faroe – And That’s A Wrap)

EVENTS

Toshiba Corp (6502 JP) (Mkt Cap: $17.8bn; Liquidity: $122mn)

The company bought back 16% of volume in the month (in December), and 15% of rolling 4-week ADV if only the first 20 days were days on which the company bought – which based on execution prices seems likely.

- Travis expects a similar rate to continue and expects the lower trading volumes seen in December to continue. The period of excitement is over until Toshiba gives people a reason to get excited.

- Travis is not particularly bullish Q3 results or Q4 forecasts for the company and the stock has rebounded perhaps more than the market has off lows. With Apple Inc (AAPL US) guiding suppliers to lower iPhone production yet again, TMC could run into a soft spot.

(link to Travis’ insight: Toshiba Buyback: Proceeding Apace, But That’s Slow)

STUBBS/HOLDCOS

BGF Co Ltd (027410 KS) / Bgf Retail (282330 KS)

I calculate a discount to NAV of 55% against a one-year average of 32%, which appears excessive for a simple single stock Holdco structure. Both Sanghyun Park and Douglas Kim have discussed this aberration in their insights (Korean Stubs Spotlight: A Pair Trade Between BGF Co. & BGF Retail & BGF Holdo Trade: Status Update & Recommended Action).

- The key stub assets include South Springs, one of the largest golf resorts in Korea, and brand royalty, each accounting for around 7-8% of NAV. The remaining, immaterial ops include an ad agency, an “Amazon Fresh”-like fresh food delivery start-up, management consulting, dividends, and rent.

- This looks like a decent stub-setup, with a likelihood of the discount narrowing from here – typically, the Korean Holdcos trade within a 20-40% discount band – rather than clearing 60%. And there is no tender offer overhang in 2019. But apart from the optics, there are no obvious catalysts at the stub level for the nine-month discount-widening trend to reverse.

(link to my insight: StubWorld: Time For A BGF Setup? An Unlikely Boost for Kingboard)

Kingboard Chemical (148 HK) / Kingboard Laminates Holdings (1888 HK)

Kingboard, which hasn’t been in the news since it sold its 9.6% stake in Cathay Pacific Airways (293 HK) to Qatar Airways back in November 2017, is coming up “expensive” on my monitor, after KBC’s mid-week price outperformance over KBL.

- The new news this week is that KBC announced it is acquiring a handful of floors of the Overseas Trust Bank Building here in Hong Kong. Pricing looks okay with reference to property sold nearby, but probably towards the high-end for mid-floor office space in Wan Chai.

- This is a connected transaction as the seller of the properties is Hallgain Investments – a vehicle largely owned by senior management of KBC – which owns 39.02% of KBC. The net rental on the properties is $1.35mn or a yield of 0.15%, which hardly augurs a case to go long the stub.

(link to my insight: StubWorld: Time For A BGF Setup? An Unlikely Boost for Kingboard)

Briefly …

- In his insight Hankook Tire Worldwide Stub Reverse Trade: Massive Price Divergence Is Created Today, Sanghyun discussed this (mainly) single stock Holdco structure. Using Sanghyun’s numbers, I back out a discount to NAV of 37% vs. a one-year average of 38.5%. The parent is very illiquid – less than US$1mn/day – while Hankook Tire (161390 KS) trades ~US$9mn.

- Hansae Yes24 Holdings Co, Ltd. (016450 KS) is another small-cap (& illiquid, ~US$0.5mn/day) Holdco, discussed in Sanghyun’s insight Hansae Yes24 Holdings Stub Trade: Macy’s Lowered Guidance Will Revert Back 5Y High Holdco Discount. Using his numbers, I get a 48% discount to NAV, right at its widest inside a year, and compares to a 12-month average of 43%.

2018 M&A Wrap

I compiled a summary of the 93 M&A transactions, with a collective deal size of ~US$215bn, published on Smartkarma in 2018, and analysed which sectors attracted the most interest: (Mostly Asia) M&A in 2018: What Was Hot, And What Was Not

SHARE CLASSIFICATIONS

Swire Pacific Ltd Cl A (19 HK) / Swire Pacific Ltd-Cl B (87 HK)

The premium for Swire’s As over the Bs – [19 HK/(5* 87 HK)] – continues to increase and is now at its highest since October 2003.

- I tackled this share class last August (Swire’s Interims and Bifurcating Dual Class) when the premium was 18%. Since September 2015, the two classes of shares can be unified leaving John Swire & Sons with 55% of the equity (& 63.7% of the vote). The pushback then, and now, is why bother? And the HKEx giving permission to Xiaomi Corp (1810 HK) to list with dual-class shares lessens the chance of such a unification.

- Logically though, this premium should narrow (eventually one would expect) and investors are betting on this. The $ value traded for the Bs on Wednesday was the highest since mid-December 2017, and the third highest $ value traded in 21 years. And volume for the Bs has been increasing recently, having doubled in size in the past year compared to the 5-year average.

- As an aside, Swire’s discount to NAV (adjusting for the privatisation of HAECO) is trading at it narrowest inside a year:

OTHER M&A UPDATES

Advanced Semiconductor Mfg Corp Ltd. (3355 HK)‘s merger by absorption has been approved by shareholders.

CCASS

My ongoing series flags large moves (~10%) in CCASS holdings over the past week or so, moves which are often outside normal market transactions. These may be indicative of share pledges. Or potential takeovers. Or simply help understand volume swings.

Often these moves can easily be explained – the placement of new shares, rights issue, movements subsequent to a takeover, amongst others. For those mentioned below, I could not find an obvious reason for the CCASS move.

Name | % change | Into | Out of | Comment |

15.00% | Kingston | Outside CCASS | ||

13.70% | CCB | China Int’l | ||

46.55% | CCB | China Goldjoy | ||

11.42% | HSBC | UBS | ||

10.04% | HSBC | Outside CCASS |

- Source: HKEx

UPCOMING M&A EVENTS

| Country | Target | Deal Type | Deal Size US$ mm | Event | E/C | |

| Aus | GrainCorp | Scheme | $1,738 | 17-Jan | Binding offer to be announced | E |

| Aus | Stanmore Coal | Off Mkt | $140 | 22-Jan | Deal Close Date | C |

| Aus | Healthscope | Scheme | $3,259 | 23-Jan | New Zealand OIO approval. | E |

| Aus | Greencross | Scheme | $476 | 25-Jan | FIRB Approval | E |

| Aus | Sigma Healthcare | Scheme | $416 | 31-Jan | Binding offer to be Announced | E |

| Aus | Eclipx Group | Scheme | $662 | 1-Feb | First Court Hearing | C |

| Aus | MYOB Group | Scheme | $1,258 | 11-Mar | First Court Hearing Date | C |

| HK | Sinotrans Shipping | Scheme | $431 | 14-Jan | Listing to be withdrawn from HKSE | C |

| HK | Hopewell Holdings | Scheme | $2,723 | 28-Feb | Despatch of Scheme Document | C |

| India | Bharat Financial | Scheme | $2,385 | 30-Jan | Transaction closes | E |

| India | GlaxoSmithKline | Scheme | $4,645 | 27-Mar | India – CCI approval | E |

| Japan | Pioneer | Off Mkt | $230 | 25-Jan | Shareholder Vote | C |

| Malaysia | Unisem (M) Berhad | Off Mkt | $438 | 17-Jan | Settlement Date | C |

| NZ | Trade Me Group | Scheme | $1,761 | 22-Jan | Scheme Booklet provided to Apax | C |

| Singapore | PCI Limited | Scheme | $44 | 25-Jan- | Release of Scheme Booklet | E |

| Taiwan | LCY Chemical Corp. | Scheme | $1,563 | 23-Jan | Last day of trading | C |

| Thailand | Delta Electronics | Off Mkt | $2,109 | 28-Jan | SAMR Approval | E |

| Finland | Amer Sports | Off Mkt | $5,349 | 23-Jan | Extraordinary General Meeting | C |

| Norway | Oslo Børs VPS | Off Mkt | $352 | Jan | Offer process to commence | E |

| UK | Shire plc | Scheme | $60,257 | 22-Jan | Settlement date | C |

| US | Red Hat, Inc. | Scheme | $33,584 | 16-Jan | Special meeting to vote for merger | C |

| US | iKang Healthcare | Scheme | $1,580 | Jan | Offer close date, (failing which) 31-Jan-2019 – Termination Date | C |

3. ECM Weekly (12 January 2019) – Futu, China East Education, China Kepei Education, Viva Biotech

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Despite a shaky 2018 Q4 market and the disappointing Softbank Corp (9434 JP)‘s IPO, we have been getting a steady stream of newsflow on upcoming IPOs.

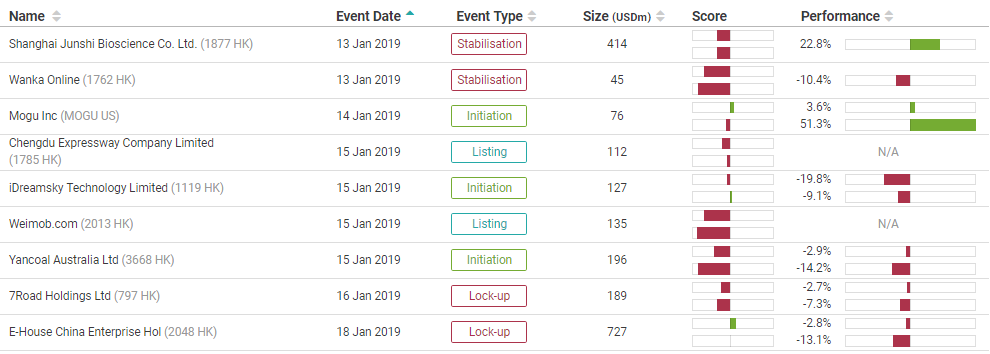

Starting with upcoming IPOs, Chengdu Expressway Company Limited (1785 HK) and Weimob.com (2013 HK) will be listing next week on Tuesday, 15th January. Weimob was priced at the low end of its price range while Chengdu Expressway’s IPO was at a fixed price of HK$2.20. We are bearish on both IPOs. Weimob is overly reliant on Tencent for its SaaS and Ads business and, at the same time, Tencent will only own less than 3% stake after listing. Whereas Chengdu Expressway has been a well-managed company but valuation implies limited upside. Trading liquidity will likely remain tepid as like Qilu Expressway Co Ltd (1576 HK) which listed mid last year.

In the pipeline, we are hearing that Kepei Education (KEPEI HK) will likely open its book next Monday. We will be following up with a note on valuation. In other IPOs that are coming in this quarter, Helenbergh China and Zhongliang, both property developers, are looking to IPO in this quarter. Viva Biotech Shanghai Ltd (1577881D HK) is also looking to list in Hong Kong Q2 while Urban Commons, a US property developer, is planning a US$500m REIT IPO in Singapore.

Activity seems healthy for the ECM space, but sentiment has not been the best as seen from Xiaomi’s high profile IPO that took a hit just as its lockup expired. Its share price has corrected from a high of HK$22.20 to just above HK$10.34 this Friday. This should not have been a big surprise since many have already pointed out that its valuation should really have been closer to that of a hardware business and we pointed out that the IPO’s trajectory would likely be similar to Razer.

This reminds us of a particular listing last year, Razer Inc (1337 HK) , and, in fact, both bear quite a handful of similarities. Strong portfolio of investors, hardware business with software capabilities, expensive valuations, and etc. The stock did well at first but has come back down to earth since then.

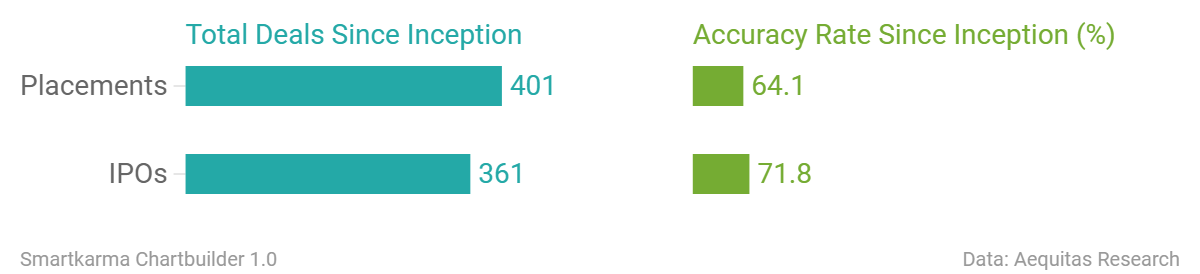

Accuracy Rate:

Our overall accuracy rate is 72% for IPOs and 64% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- China Tobacco International (Hong Kong, US$100m)

- China East Education (Hong Kong, US$400m)

- Ebang International (Hong Kong, re-filed)

- MicuRx Pharma (Hong Kong, re-filed)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Urban Commons plans IPO of up to US$500m at Q1-end

- Viva Biotech plans IPO in the second quarter

- CStone Pharma plans US$400m IPO in Feb

- Global Switch plans about US$1bn HK IPO

- China’s Wanda files for US IPO of sports unit to raise up to US$500m

Smartkarma Community’s this week Analysis on Upcoming IPO

- Futu Holdings IPO Preview: Running Out of Steam

- Futu Holdings Pre-IPO – Great Metrics but in a Commoditised Industry

- China Tobacco International (IPO): The Monopolist Will Not Recover

- China Tobacco International IPO: Heavy Regulation, Declining Margins – A Bit Late to IPO Party

- IPO Radar: AutoCorp, Honda’s Avatar in Thailand

List of pre-IPO Coverage on Smartkarma

4. Accordia Golf Trust (AGT SP): MBK + ORIX + AGT = Time for Outperformance? 9.5% Dividend Yield

Accordia Golf Trust (AGT SP) has not been a great success story since its IPO in August 2014. The stock went to market at a unit price of 0.97 SGD and was recently traded at 0.53 SGD. If we include the dividends received since the IPO (0.2387 SGD) the ‘real‘ adjusted price is still only 0.76 SGD.

In the past we have attended several management meetings and the 2017 company AGM but were disappointed on multiple occasions by management that either 1) did not care, 2) did not know how or 3) was held back by other corporate Japanese factors from creating shareholder value.

Over the last six months several new developments are potentially creating a cocktail that could finally create sustained value for AGT unitholders:

- Appointment of new CFO who assures investors no repeat of “membership deposit debacle”

- New five-year funding secured from two lenders

- MBK Partners buys ORIX Golf Management

- Value investor Hibiki Path Advisors buys 6.2% of the company

- Clear focus on acquisitions and using its balance sheet strength

With its 2019 financial year ending in March, investors can be hopeful that its dividend in FY20 can grow to a minimum of 5 SGD cents suggesting a yield of 9.5%. If management injects assets a higher DPU is possible.

5. Bleak Future for Indusind Bank

Indusind Bank’s reckless decision to provide a Rs 20 bn (8% of the bank’s capital) unsecured bridge loan to IL&FS, an insolvent infrastructure company has led to a significant de-rating of its valuation multiple. In the 3QFY2019 results call, Ramesh Sobti, the bank’s CEO believes that the bank will eventually need to provide only 40-50% of this exposure and the bank has currently provided only 26.5%. The bank’s guidance on this appears to be as optimistic as its initial appraisal when it disbursed the loan, without any apparent scrutiny of the company’s financials. Shareholders in the bank need to be more realistic and factor a 100% write-off on the unsecured IL&FS exposure and need to examine all the bank’s loans more carefully for similar high-risk lending. The glory days of this once fancied stock are over and a bleak future beckons.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.