In this briefing:

- A Golden Future?

- Nissan: Overlooked Personnel Moves Suggest the Alliance Will Not Survive Long Term

- Uranium – About to Enter Its Own Nuclear Winter

- Dollar Yen BIG Short Phase II

- Korea M&A Spotlight: Will the Nexon Group Sell the Korean or the Japanese Company?

1. A Golden Future?

The ability to have stable prices has great value.

According to Edward Gibbon, the decaying Roman Empire exhibited five hallmarks: 1) concern with displaying affluence instead of building wealth; 2) obsession with sex; 3) freakish and sensationalistic art; 4) widening disparity between the rich and the poor; and 5) increased demand to live off the state. Most DMs and many EMs display similar symptoms today because fiscal and monetary policies, the foundation of both ancient and modern societies, are identical: increasing welfare outlays by artificially inflating the money supply. The Roman Empire took more than four centuries to destroy what the Republic had built in the previous five centuries because clipping and debasing coins inflated currency supplies slowly. Entering debits and credits in the books of commercial and central banks is much more efficient.

2. Nissan: Overlooked Personnel Moves Suggest the Alliance Will Not Survive Long Term

While most news coverage is intensely focused on former Chairman Carlos Ghosn’s first public statements, defence strategy and Japan’s rather arcane justice system, we believe that news regarding the sudden “leave” of two Nissan executives is worth paying attention to as it may have ramifications for the fate of the alliance overall. We discuss the details below.

3. Uranium – About to Enter Its Own Nuclear Winter

- Quantifying nuclear statistics with substantial discrepancies

- LT contracts & speculative hoarding driving recent 40% spot price increase

- Primary/secondary Uranium supplies currently 112% of 2017 demand

- Uranium supply deficits extremely unlikely before 2022

- Global Uranium demand to fall 25-40% by 2050

- Primary Uranium sector LT SELL

We have independently audited global nuclear construction statistics in order to determine future Uranium demand. Although near-term statistics match those in the public domain, long-term demand determined via construction pipeline illustrates substantial discrepancies. Compiling planned plant construction, operational extensions, nameplate upgrades, versus decommissioning announcements/events, and in many cases, public policy inertia; has led us to believe that despite historical primary supply shortages, global nuclear demand peaked in 2006.

Since plateauing and despite strong Chinese growth, nuclear power generation has fallen <2% over the past two decades, a decline that is predicted to accelerate as a number of developed and developing nations pursue other energy options.

The macro-trend not replacing existing nuclear infrastructure means (dependent on assumptions), according to our calculations, global uranium demand will decrease between 20 to 40% by 2050.

As opposed to signifying a fundamental change in underlying demand, we believe that recent Uranium price increases are the result of producers closing primary operations, and substituting production with purchases on the spot market to meet long-term contract obligations. In addition, hedge funds are buying physical uranium in order to realise profits on potential future commodity price increases. Critically, we determine that primary and secondary supplies are more than sufficient to meet forecast demand over the next four to five years; before taking into account substantial existing global uranium stocks, some of which are able to re-enter the spot market at short notice.

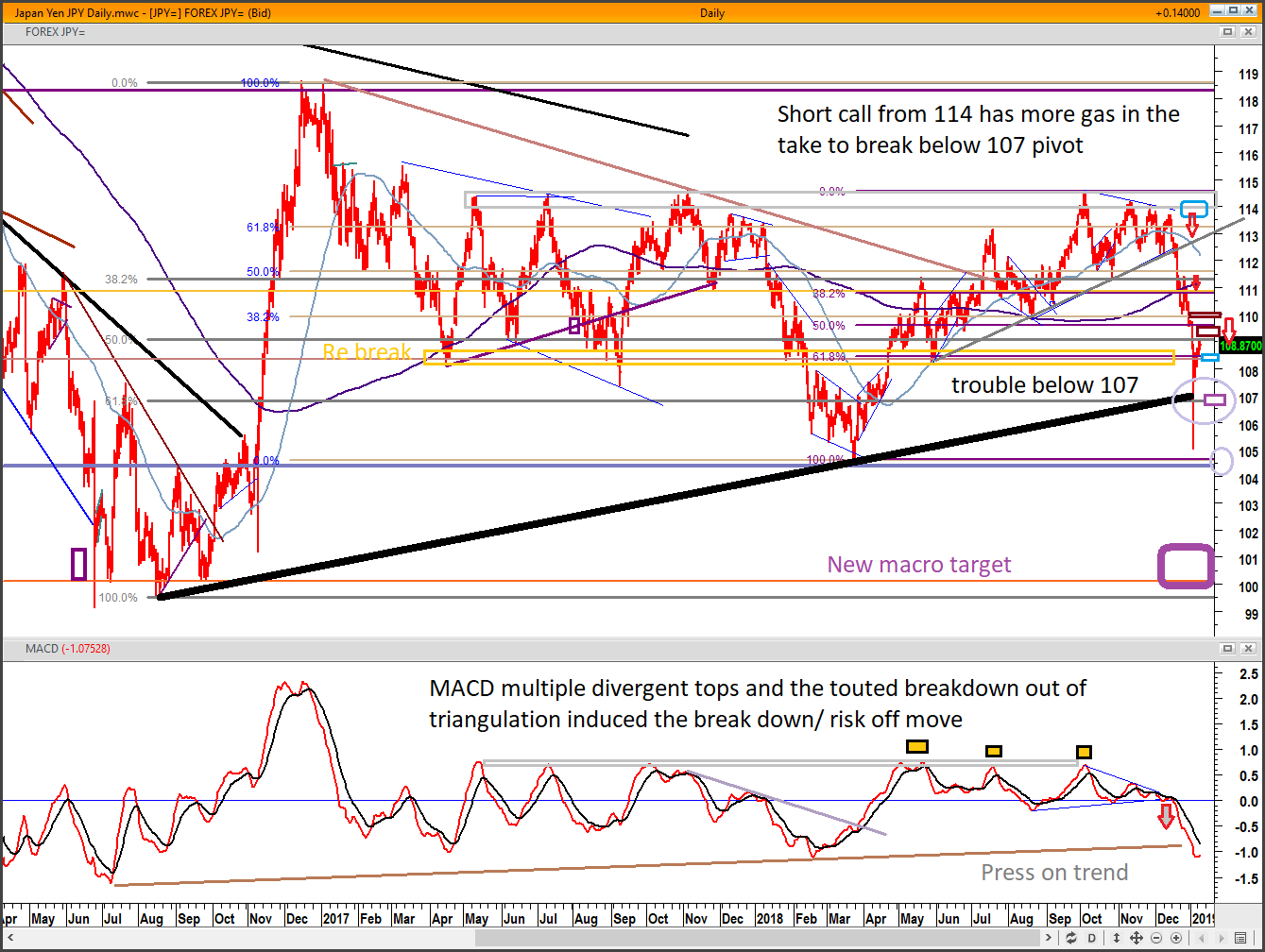

4. Dollar Yen BIG Short Phase II

Major top and short call at USD/JPY 114 and flash decline did have a direct impact on a risk assets and the Nikkei in line with our S&P and Nikkei short calls. The second phase of USD/JPY weakness will usher in the next downturn in risk assets in late Q1 after some tactical posturing. We do view SPX 2,600 as a good level to re cycle shorts with some range work in store for February.

High degree divergence is still not fully unwound and implies the USD/JPY is set for a new low and part of phase II of the pain trade. Japan’s Crowded Long Faces Exodus Pressure . Japan Bank Index Bearish Head and Shoulders .

JPY crosses versus the AUD, GBP and Euro are currently nudging up against key resistance points that represent an interesting pivot point to stage a fresh decline (good risk aversion barometers).

We are seeing the knock on effect in Asian FX.

USD/JPY will surpass our original downside target of 108-109.

5. Korea M&A Spotlight: Will the Nexon Group Sell the Korean or the Japanese Company?

According to a local media outlet called Chosun Daily, it stated that one of the bankers in the deal (Deutsche Bank), already sent teaser letters of this deal to Tencent Holdings (700 HK) and KKR and in the teaser letter, it mentioned about potentially selling nearly 47% of Nexon Co Ltd (3659 JP) (Japan).

The question about whether or not Kim Jung-Joo decides to sell NXC Corp (Korea) or Nexon Co Ltd (3659 JP) (Japan) has important consequences not just for him and his family but also to the minority shareholders of Nexon Co Ltd (3659 JP). If Kim Jung-Joo decides to sell NXC Corp (Korea), there may not be much upside for the minority shareholders of Nexon Co Ltd (3659 JP) since current regulations do not require the buyers to pay potentially additional control premium to the minority shareholders as well.

However, if Kim Jung-Joo decides to sell Nexon Co Ltd (3659 JP) (Japan), there may be an opportunity for the minority shareholders to gain from an additional control premium. We think that this is one of the reasons why Nexon Co Ltd (3659 JP) shares are up 13% YTD as some of the investors may think that there could be a higher probability that Kim Jung-Joo ends up selling Nexon Co Ltd (3659 JP) (Japan), instead of NXC Corp (Korea).

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.