In this briefing:

- Celgene Acquisition by Bristol-Myers Squibb: A Call to Arbs

- ECM Weekly (12 January 2019) – Futu, China East Education, China Kepei Education, Viva Biotech

- Toshiba Buyback: Proceeding Apace, But That’s Slow

- Are Chip Oligopolies Real?

- Global Banks: Some New Year Pointers

1. Celgene Acquisition by Bristol-Myers Squibb: A Call to Arbs

On January 3, 2019, Bristol Myers Squibb Co (BMY US) and Celgene Corp (CELG US) announced a definitive agreement for BMY to acquire Celgene in a $74 billion cash and stock deal. The headline price of $102.43 per Celgene share plus one CVR (contingent value right) is a 53.7% premium to CELG’s closing price of $66.64 on January 2, 2019, before assigning any value to the CVR.

The logic behind the transaction is to create a biopharma powerhouse with leading franchises in oncology, immunology and inflammation (autoimmune diseases), and cardiovascular medicine. After completion, BMY will have six expected launches in the next 12-24 months representing over $15 billion in revenue potential, and an early pipeline that includes 50 high potential assets. In addition to amassing a powerhouse biopharma portfolio, the combination is expected to yield annual cost synergies of $2.5 billion by 2022.

Terms of the deal call for each CELG share to be converted into one BMY share and $50 cash, plus one tradeable CVR worth $9 if specific FDA approvals are received for three drugs by certain dates. The 1.0 BMY exchange ratio is fixed. Upon completion of the deal BMY shareholders will own about 69% of the combined company with former CELG shareholders owning the other 31%.

The deal is conditioned on approvals by both CELG and BMY shareholders as well as regulatory approvals that include the U.S. and the EU. Financing is not a condition. The companies expect the complete the deal in the third calendar quarter of 2019.

2. ECM Weekly (12 January 2019) – Futu, China East Education, China Kepei Education, Viva Biotech

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Despite a shaky 2018 Q4 market and the disappointing Softbank Corp (9434 JP)‘s IPO, we have been getting a steady stream of newsflow on upcoming IPOs.

Starting with upcoming IPOs, Chengdu Expressway Company Limited (1785 HK) and Weimob.com (2013 HK) will be listing next week on Tuesday, 15th January. Weimob was priced at the low end of its price range while Chengdu Expressway’s IPO was at a fixed price of HK$2.20. We are bearish on both IPOs. Weimob is overly reliant on Tencent for its SaaS and Ads business and, at the same time, Tencent will only own less than 3% stake after listing. Whereas Chengdu Expressway has been a well-managed company but valuation implies limited upside. Trading liquidity will likely remain tepid as like Qilu Expressway Co Ltd (1576 HK) which listed mid last year.

In the pipeline, we are hearing that Kepei Education (KEPEI HK) will likely open its book next Monday. We will be following up with a note on valuation. In other IPOs that are coming in this quarter, Helenbergh China and Zhongliang, both property developers, are looking to IPO in this quarter. Viva Biotech Shanghai Ltd (1577881D HK) is also looking to list in Hong Kong Q2 while Urban Commons, a US property developer, is planning a US$500m REIT IPO in Singapore.

Activity seems healthy for the ECM space, but sentiment has not been the best as seen from Xiaomi’s high profile IPO that took a hit just as its lockup expired. Its share price has corrected from a high of HK$22.20 to just above HK$10.34 this Friday. This should not have been a big surprise since many have already pointed out that its valuation should really have been closer to that of a hardware business and we pointed out that the IPO’s trajectory would likely be similar to Razer.

This reminds us of a particular listing last year, Razer Inc (1337 HK) , and, in fact, both bear quite a handful of similarities. Strong portfolio of investors, hardware business with software capabilities, expensive valuations, and etc. The stock did well at first but has come back down to earth since then.

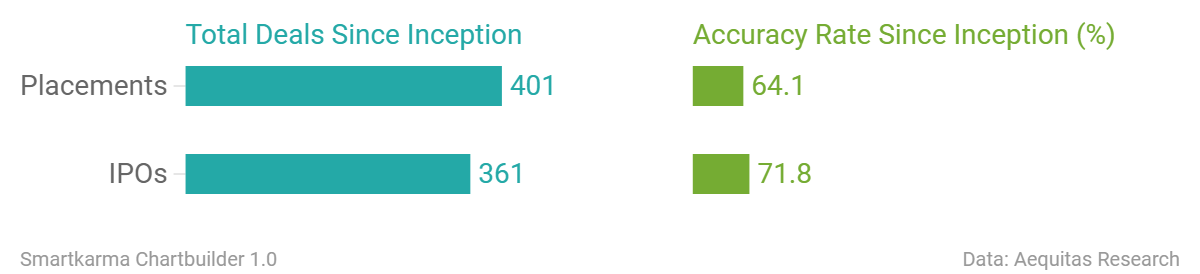

Accuracy Rate:

Our overall accuracy rate is 72% for IPOs and 64% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- China Tobacco International (Hong Kong, US$100m)

- China East Education (Hong Kong, US$400m)

- Ebang International (Hong Kong, re-filed)

- MicuRx Pharma (Hong Kong, re-filed)

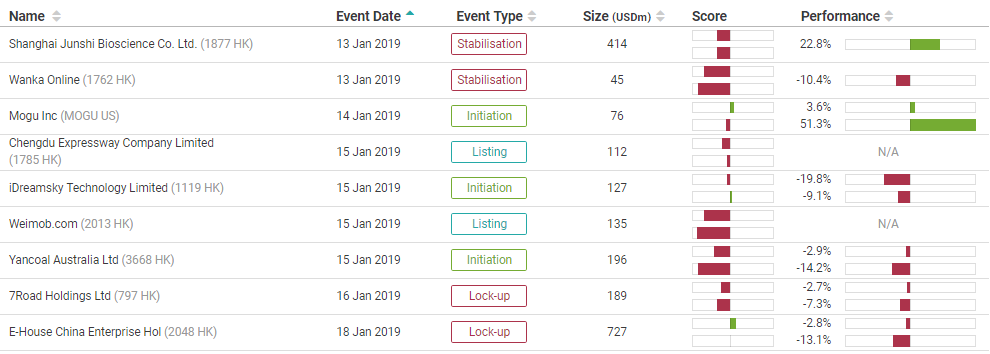

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Urban Commons plans IPO of up to US$500m at Q1-end

- Viva Biotech plans IPO in the second quarter

- CStone Pharma plans US$400m IPO in Feb

- Global Switch plans about US$1bn HK IPO

- China’s Wanda files for US IPO of sports unit to raise up to US$500m

Smartkarma Community’s this week Analysis on Upcoming IPO

- Futu Holdings IPO Preview: Running Out of Steam

- Futu Holdings Pre-IPO – Great Metrics but in a Commoditised Industry

- China Tobacco International (IPO): The Monopolist Will Not Recover

- China Tobacco International IPO: Heavy Regulation, Declining Margins – A Bit Late to IPO Party

- IPO Radar: AutoCorp, Honda’s Avatar in Thailand

List of pre-IPO Coverage on Smartkarma

3. Toshiba Buyback: Proceeding Apace, But That’s Slow

In November 2017, Toshiba Corp (6502 JP) bowed to the inevitable and issued shares in order to shore up shareholder equity ahead of the 31 March 2018 deadline where if the company had not announced a positive shareholder equity number, it would have been delisted according to the Enforcement Rules of the Tokyo Stock Exchange.

So it issued ¥600 billion of equity in an accelerated privately-negotiated placement to hedge funds. There was some jawboning later from domestic institutions who had not gotten the show on the deal, but they would do well to remember that when Toshiba was in dire straits earlier that year, and continued listing was not guaranteed because of accounting issues which were later overcome (before the equity issuance), it was the hedge funds who bought dozens of percent of the company – not domestic financial institutions. In any case, the equity was predictably needed, but as a way of making it clear that it would not be forever, the release accompanying the financing said the company would accelerate returns to shareholders once the sale of Toshiba Memory Corporation was complete.

That return of capital to shareholders was announced in June 2018 after the closing of the TMC transaction had been confirmed. Toshiba would buy back ¥700 billion of shares. At the time, that was up to 40% of shares outstanding, but the shares rose as the shares of companies with large buyback plans do, and it took until November to dot the “i”s and cross the “t”s on making sure that the cash in the bank account was deemed distributable capital surplus. On November 8th, a year after announcing the sale of equity, Toshiba announced the start of a Very Large Buyback. A few days later the company announced a large ToSTNeT-3 buyback, offering to buy back all ¥700 billion of shares the following morning at that day’s close. A week later the company had bought back ¥243 billion or more than 35% of the total buyback then announced further purchases would be made in the market.

That’s when the fun began.

For previous recent treatment on the Toshiba buyback, see the following:

Toshiba: King Street’s Buyback Proposals Lack Required Detail (5 Oct 2018)

Toshiba’s Buyback – How It Might Work (9 Nov 2018)

Toshiba’s ToSTNeT-3 Buyback: Unwinding? Another Game of 🐓? (12 Nov 2018)

Toshiba ToSTNeT-3: Round 2 (¥579bn To Go) (14 Nov 2018)

Toshiba ToSTNeT-3 Buyback Means 1/3 Done. Off To Buy In The Market Now! (21 Nov 2018)

Toshiba Buyback Update – Not Banging Down Doors To Get Stock Yet (3 Dec 2018)

4. Are Chip Oligopolies Real?

In the semiconductor industry, particularly in the DRAM sector, there has been significant consolidation leading some to hypothesize that there’s now an oligopoly that will cause prices to normalize and thus end the business’ notorious revenue cycles. Here we will take a critical look at this argument to explain its fallacy.

5. Global Banks: Some New Year Pointers

Here is a look at how regions fare regarding key indicators.

- PH Score = value-quality (10 variables)

- FV=Franchise Valuation

- RSI

- TRR= Dividend-adjusted PEG factor

- ROE

- EY=Earnings Yield

We have created a model that incorporates these components into a system that covers>1500 banks.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.