Huifu Payment IPO Preview: Pros & Cons

Huifu Payment (Huifu) is the first third-party payment service provider to build an independent sales organisations (ISO) network, to distribute its point-of-sale (POS) services in 2012. It is backed by Bain Capital (22.5% shareholder) and Fidelity International (12.3% shareholder). Huifu is raising about US$200M in the upcoming IPO.

- Listing Date: 15 June 2018

- Stabilisation End: 5 July 2018

- Broker Initiation: 25 July 2018

- Lock-up Expiry: 14 December 2018

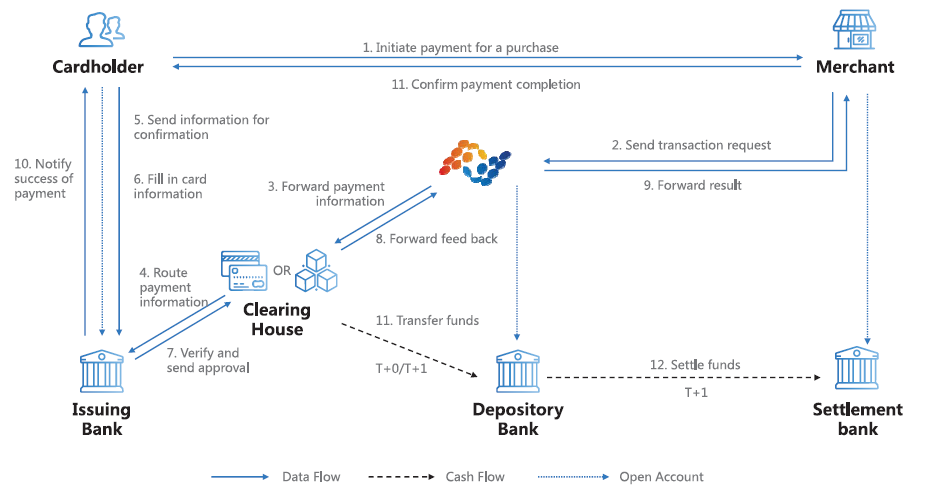

China’s Payments Process & Where Huifu Stands (Source: Huifu Prospectus)

Aggregate Sentiment from Smartkarma Insight Providers

Smartkarma Insight Providers who have covered the IPO are generally bearish on it.

- Overall Growth has been Impressive

Huifu’s revenue has grown by 76% CAGR from FY2015 to FY2017, more than tripling it. After two years of burning cash, Huifu generated a positive FCF in 2017. The growth has been mainly driven by strong growth in mobile POS, mobile payments, and internet payments. - Stagnated Market Share under a Fast Growing Market

Huifu is set to ride the strong growth in the third-party payments market in China, mobile POS and mobile payments have grown from accounting just 4.8% of total payment volume to over 60% in 2017. However, Huifu’s market share of independent third-party payments volume has constantly declined from 2015 to 2017. The acceleration in Huifu’s payment volume growth in 2017 was a result of overall market growth rather than market share gains. - Unique Value Proposition

How does Huifu compete against other third-party payment services providers such as Tenpay and Alipay that have dominated this space for a long time? The value proposition of Huifu Payment is “Independence, Aggregation, Convenience”. It provides a centralized payment system that accepts all modes of payment, while Alipay and Tenpay are considered non-independent third-party payment service providers. - Relatively Cheap Valuation Estimate

In terms of ROE (Return on Equity), Huifu is operated at a much lower ROE compared to the global peers (Paypal Holdings Inc (PYPL US) , Wirecard AG (WDI GR), Visa Inc Class A Shares (V US), and Mastercard Inc Class A (MA US), reflecting intense competition in China. Since Huifu does not have a global reach and it is just a small player in China, it should be valued at a discount to these peers.

Key Contributors

Toh Zhen Zhou

IPOs Placements & Holding Companies, Smartkarma

1 (Huifu)/ 293 (In Total)

Bearish View

Zhen Zhou suggested avoiding this deal in his recent insight. He had a negative outlook because “There is not enough upside even from the bottom end of the price range to consider buying this IPO on the basis of cheap valuations” .

See all insights from Toh Zhen Zhou starting with Huifu Payment IPO Review – Regulation May Take Away a Major Source of Income.

Arun George

IPOs & Technology analyst, Global Equity Research Ltd

1 (Huifu)/ 52 (In Total)

Bearish View

Arun has posted 1 insight on Huifu Payment’s upcoming IPO and holds a bullish view on this deal. From a valuation perspective, he believes that “the proposed IPO price range is undemanding”.

See all insights from Arun George starting with Huifu Payment IPO Preview: Peel Back the Layers to Unearth the True Picture.