Corporates want to increase shareholder interest and target new investors.

Two ways investors learn about a company and conduct their due diligence

- The obvious route – investor meetings via brokerages and corporate access firms with a company.

- The not-so-obvious, but important route – investors rely on analysts and their knowledge of the company, sector, and industry, either before or after meeting with a corporate.

In a Post-MiFID II World, How Does This Pan Out?

Buy-side Interaction with Corporates

The introduction of MiFID II has made it harder for the buy-side to reach corporates. In many ways, investors are still adjusting to the change in their status quo. In a pre-MiFID II environment, brokers would typically arrange for meetings between investors and corporates at no additional cost.

Instead, they would factor the cost into brokerage commissions as part of the existing broking relationship. Now, if investors need to access corporates, they need to pay brokers to arrange for this specific service.

According to the Wall Street Journal, US institutional investors paid about US$6 billion in commissions to brokers in 2016. Corporate access-related services accounted for about US$2 billion of that. However, the lack of a clear demarcation for Corporate Access fees is creating potential regulatory challenges for investors.

At the same time, investors are possibly still getting used to a new state of things, where corporate accessibility is done through unbiased third parties with no ties to specific corporates.

A Financial Times survey found that 92 percent of respondents viewed Corporate Access as important or critical to their investment process. However, they found it challenging to price and pay for such an interaction.

Buy-Side Interaction with Independent Analysts

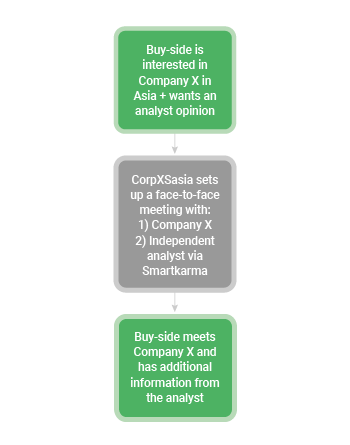

When the buy-side engages in reverse, thematic, or even non-deal roadshows, they are also interested in meeting with analysts who have covered the company and sector in question.

This can take place prior to or after their meeting with company management. It happens outside of their own internal research and is part of their investment inquiry. This is not always possible for a couple of reasons:

- A combined Research and Corporate Access model: Outside of a bank, this model doesn’t really exist and can be quite fragmented. The buy-side would have to arrange for these services using their own resources.

- Independent Research Providers: Connecting with analysts of insightful independent research across a region or sector can be time-consuming and unstructured. An additional, yet important problem, is how one pays for this interaction.

What Is Smartkarma Doing to Address This?

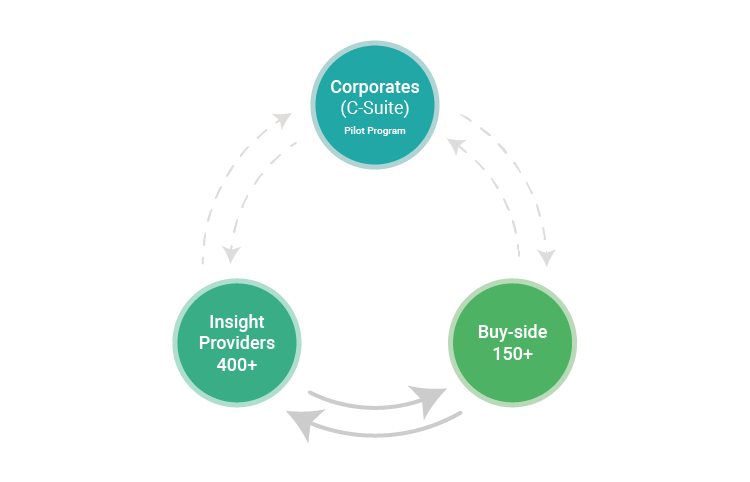

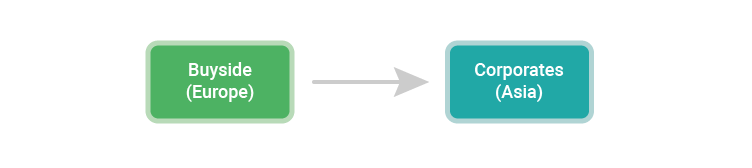

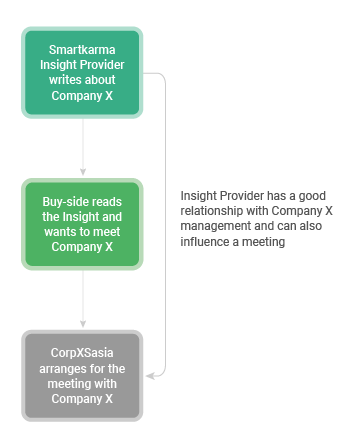

Smartkarma partnered with leading Corporate Access provider CorpXSasia. The latter arranges unconflicted and regulatory-compliant meetings between global institutional investors and listed corporates in Asia.

Smartkarma – the global investment research network

CorpXSasia – corporate access firm

Through this partnership, the institutional buy-side availing of CorpXSasia’s services can also arrange for meetings with Smartkarma Independent Research Providers seamlessly and gain insight into companies or sectors of interest.

Smartkarma and CorpXSasia – a unique partnership

There are several ways that this partnership can work. A couple are illustrated below:

Corporates: How Does This Impact You?

Investor Relations and company management can proactively engage, interact, and manage relationships with investors and analysts. Equally important to corporates is having seamless offline communication with investors and analysts – which can impact potential investment in their company.

This can be fairly specific and contextual, especially during a roadshow. Corporates will now see investors at their doorstep as this unbundled approach makes it possible.

Investor Relations can be at ease knowing that the “behind-the-scenes” is taken care of so they can focus on the “main act”.

For more details on the Smartkarma and CorpXSasia partnership, read the press release here.