This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. HDFC Bank (HDFCB IN): Tactical Outlook Post–NIFTY Bank Index Overhaul

- Brian Freitas has discussed in a recent insight the methodology changes for the NSE Nifty Bank Index that will be implemented starting from December 30.

- HDFC Bank (HDFCB IN) is one of the two stocks that passive trackers need to sell (the other is ICICI Bank Ltd).

- HDFC Bank (HDFCB IN) is falling this week, so we analyze our model’s WEEKLY support entry zones, to evaluate how much HDFC Bank can fall, for hedging or re-entry purpose.

2. [2026 High Conviction] Korean Mega Cap Investment: Samsung’s $310B Tech Spend, the AI-Momentum Trade

- Samsung is positioned as a global hub for the AI Supercycle, driven by a pivot to memory technology, and evidenced by a KRW 450T ($310 billion) local investment plan.

- The Device Solutions division’s Q3 2025 rebound (sales +19% sequentially) and an estimated 43.4% Fwd 2-Yr EPS CAGR support potential upside for the stock

- The company has demonstrated a commitment to enhancing shareholder value by completing its 10T share repurchase program ahead of schedule and maintaining a consistent annual dividend payout through 2026.

3. 2026 High Conviction – Japan’s Triple Play: How PBR Reform, AI, and Banks Unlock Alpha

- Sustained pressure from the JPX initiative targeting firms trading below P/B is forcing enhanced capital returns (buybacks and dividends), creating opportunity across both indices.

- BoJ’s shift to a positive rate environment is fundamentally restoring Net Interest Income and profitability to the Financials sector, positioning the TOPIX, in particular, for outperformance.

- AI/Tech Sector Dominance: The Nikkei 225 is driven by high-tech firms. This concentration, led by high-priced high weighted stocks like Advantest and Softbank Group, provides high-beta AI exposure

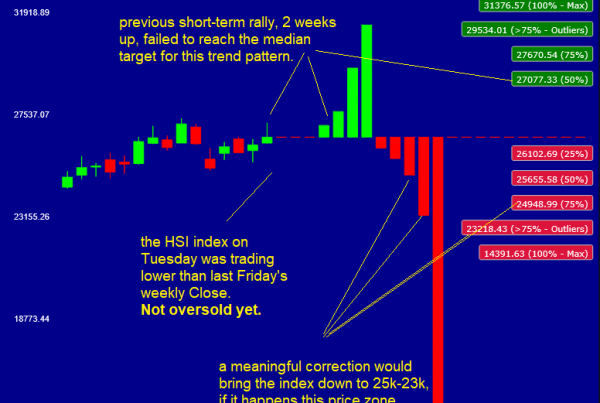

4. Hong Kong December 2025 Monthly Covered Call Report

- Top Hong Kong Stock Exchange listed covered call candidates for the month of December.

- The top 10 provide an average ~6.9% premium with a potential ~8.4% upside P&L if exercised.

- Investors with a neutral 1-month view on the underlying can seek to generate income.

5. NVDA Tactical Outlook: Time to BUY?

- NVIDIA Corp (NVDA US) started correcting at the end of October 2025. At the same time, in early November, SoftBank Group announced it was unloading all its NVDA stake.

- SoftBank founder Masayoshi Son, speaking at an investment forum in Tokyo Monday, revealed he was reluctant to sell SoftBank’s Nvidia stake, but needed to raise cash for new AI investments.

- Both companies are very oversold according to our models, NVDA has reached a point where is a good BUY, we present here a new analytics tool, to support this theory.

6. Bitcoin Tactical Outlook After The -35% Drop

- Bitcoin has been selling off since early October 2025 and reached a -35% loss around November 20, then bounced back, the rally is currently ongoing.

- Our focus is always short-term and in this insight we will try to analyze how far the current BTC-USD spot rally can go before a new sell-off begins.

- The alternate hypothesis is that the current downturn is merely a sharp, tactical correction within a larger secular bull market. Under this interpretation, the pullback could be a buying opportunity.

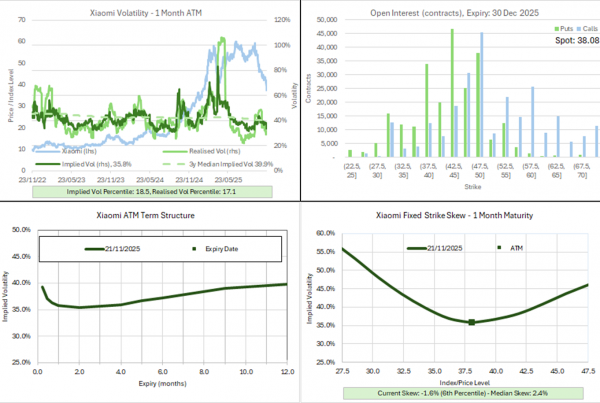

7. Hong Kong Single Stock Options Weekly (Dec 01 – 05): Narrow Range, Low Vols and Weaker Put Flow

- Quiet trade across Hong Kong Single Stock this week with HSI’s weekly range near the lows of the year.

- Implied vols were mixed and are still clinging to the lowest levels of the year.

- Options activity lower week over week, led by declines in Put trading.

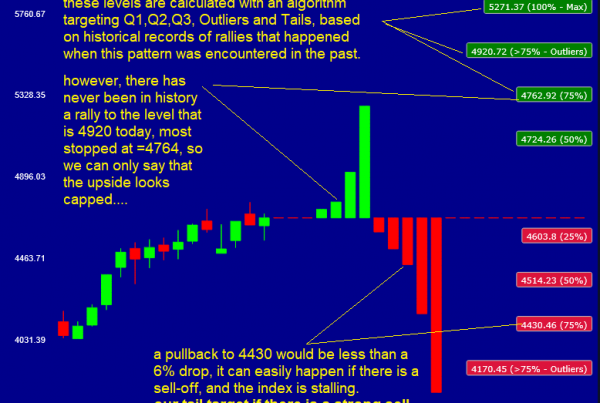

8. Macro Monthly (December): Seasonal Strength, Vol Selling Edges and a Notable Nifty Setup

- December seasonals across major markets show a generally positive profile, but the path is uneven, with most gains clustering in the final days of the month.

- Several markets offer appealing vol selling setups, particularly those with consistently positive December vol premiums and elevated implied levels relative to past outcomes.

- Nifty vol appears attractively priced, but its tendency not to monetize in December requires traders to think differently about how they extract value.

9. Australia Single Stock Options (Dec 01 – 05): Narrow Range and Mixed Implieds

- Very quiet trading this week with a weekly closing range near the lows for the year.

- Breadth deteriorated from last week’s elevated readings as the market tries to push higher.

- Quiet earnings calendar with only six companies issuing earnings reports in the coming week.