This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. HEM: Dec-25 Views & Challenges

- Volatile markets and policy guidance washed out, with pricing and forecasts little changed on the month.

- Bailey is biased to ease, but the BoE is awakening to its inflation problem. It should cut less than dovishly priced.

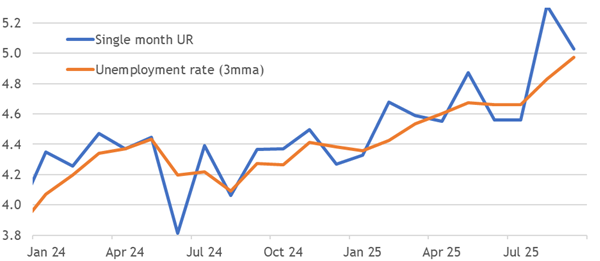

- Higher unemployment could move beyond a structural shift from policy to signal a less elevated neutral rate.

2. BoE Survey Says Stagflation Survives

- CFOs keep telling the BoE their prices will rise by 3.5% in 2026, with wage increases similarly substantial. There has been no significant break lower in over 18 months.

- Employment plans have also deteriorated, lending some support to the dovish case as well. But this side is an unreliable signal, while inflation has proved brutally accurate.

- Doves need the employment aspect to be true, but the transmission to prices not to be. This survey signals upside inflation risks that should discourage rate cuts in 2026.

3. HONG KONG ALPHA PORTFOLIO: (November 2025)

- The Hong Kong Alpha portfolio returned -2.89% in November versus +1.72% for its benchmark index. The HK Alpha portfolio has outperformed Hong Kong indexes by 33% to 45% since inception.

- The portfolio continues to generate 57% of its returns from alpha (idiosyncratic returns) while maintaining a Sharpe ratio of 2.19 YTD.

- We have sold positions in the materials and industrials sectors and added positions in telecom, gold, and insurance industries at the end of November.

4. HEW: Easing Before The Festive Storm

- The BoE FPC cut capital requirements in a surprise macroprudential easing that adds to the less-tight fiscal policy to lessen the need for BoE rate cuts, but one is coming.

- UK CFOs reveal no progress in breaking excessive inflation expectations for 18 months, EA inflation surprisingly rose, and the worst PMIs improved as resilience broadened.

- Another Fed cut is firmly priced, setting it up to be delivered, but members are likely to dissent against it and remain cautious in only forecasting one more cut in 2026.

5. Activity Thaws Into Winter

- The worst services PMIs thawed in November, broadening growth even as averages held steady. Activity in the US services ISM has trended up to exceed the PMI data now.

- A slight fading of stagflationary pressures in the latest US surveys probably balances out in the Fed’s policy trade-off. We still fear that it is easing excessively.

- Rising unemployment rates in the US and UK are concerns not experienced in most of the world. This theme feeds their recent divergence from the global surprise tendency.

6. Likely Increase In Mandatory Tender Offer from the Current 50% + 1 Share Requirement

- Korean government is likely to increase the mandatory tender offer from current 50% + 1 share requirement (minimum majority stake) to much higher levels (but below the maximum 100% requirement).

- There is an increasing probability that indeed the Korean government is likely to increase the minimum majority stake requirement to 60% to 75% of total shares in 1H26.

- If the minimum maximum stake rises to 60%-75% of outstanding shares, this would have a further beneficial impact on the minority shareholders.

7. Asian Equities: Southbound Zeal Dips; Some Established Themes Looking Tired, Others Rejuvenated.

- From the superlative September (US$24.2 bn net buy), onshore investors’ net Southbound buying dipped in October (US$11.9 bn) and November (US$15.7 bn). Xiaomi, Alibaba, PopMart and Meituan were bought most.

- The most sold stocks during October-November were SMIC, Hua Hong Semi, Innovent Biologics. Enthusiasm for semiconductor and biotech seems to be cooling off, though we believe biotech focus should revive.

- Investors’ sustained preference is for stocks catering to domestic consumption that are able to adopt AI to improve productivity and expand their cash-generating businesses. Internet platforms fall in this silo.

8. Late-Cycle Tension: Rising Volatility Signals a Critical Market Inflection into 2026

- US equities triggered key reversal signals as market breadth deteriorated, crowded AI leaders unwound, and indexes broke trend support, elevating near-term downside risk.

- Macro uncertainty, tighter liquidity, and shifting investor psychology are pressuring high-liquidity growth assets, while gold and quality balance-sheet exposures provide relative resilience.

- Multiple late-cycle timing models align into early 2026, raising the probability of episodic volatility and making disciplined positioning, selective risk-taking, and tactical hedging essential.

9. Asian Equities: Stupendous FII Selling in November; Long-Term Study Foreshadows Structural Recovery.

- In November, FIIs sold a stupendous US$22 bn Asian equities, the second highest in the past 6 years. Bulk of it was in Korea (US$9.7 bn) and Taiwan (US$12 bn).

- Concerns about sustainability of AI capex and doubts about Fed rate trajectory were the key drivers of FIIs’ worries. The latter also depressed the Asian currencies.

- Study of last 6 years cumulative buying/selling reveals massive selling in Taiwan/Korea. Flows in these markets should recover the most as FIIs play catch-up. India is a more difficult call.

10. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 5 Dec 2025

United States shows deepening slowdown with weak ISM manufacturing, falling employment, and declining private payrolls, signaling rising recession risk.

India and China exhibit relatively constructive economic prospects, contrasting with softness in advanced economies.

Asian indicators are mixed, with Indonesia struggling on trade and Hong Kong retail sales recovering gradually but remaining below pre-COVID levels.