AFC Vietnam Fund Dec 2020 Report

Dear Research Team,

Market Developments

During this time of the year, most stock brokers and banks publish their year-end review and outlook for the next year. We would argue, similar to what was written in a recent article by The New York Times, that these forecasts are often wrong, similar to long-term weather forecasts. In December 2019 for example, the median analyst consensus on Wall Street was that the S&P 500 would rise a mere 2.7 percent in the 2020 calendar year, while the stock market marked strong gains of +15.5% as of 30th December. Not to mention of a change in forecaster’s sentiment after the market tanked sharply on COVID-19 news when a full year decline of 11% was expected – of course exactly at the time when the market hit the low for the year. That doesn’t mean that we want our readers to stop reading economic and market news and outlooks, but we merely would like to highlight that these are just an interesting source of information – nothing more. We believe that instead of trying to predict market or economic numbers, it is wiser and more efficient in terms of performance to go along with positive developments in the economy, society and politics.

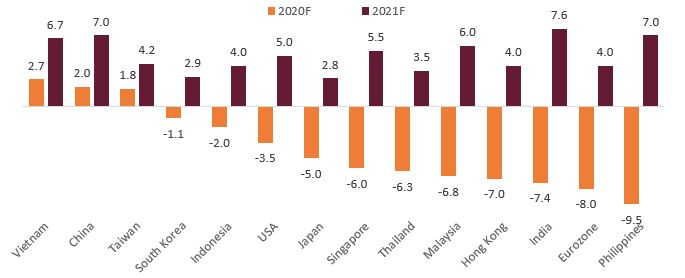

After so many years of being bullish on these aspects in Vietnam, we are watching closely if there are any changes to be noticed in this respect. 2020 proved once again that Vietnam was not only able to continue its positive upward trajectory, but it actually outperformed most other countries in the world in terms of economic growth and the handling of the COVID-19 pandemic. No wonder the Vietnamese are proud of these achievements and are optimistic about the future (as they always are!), unlike frustrated and persistently “locked down” people in most other parts of the world.

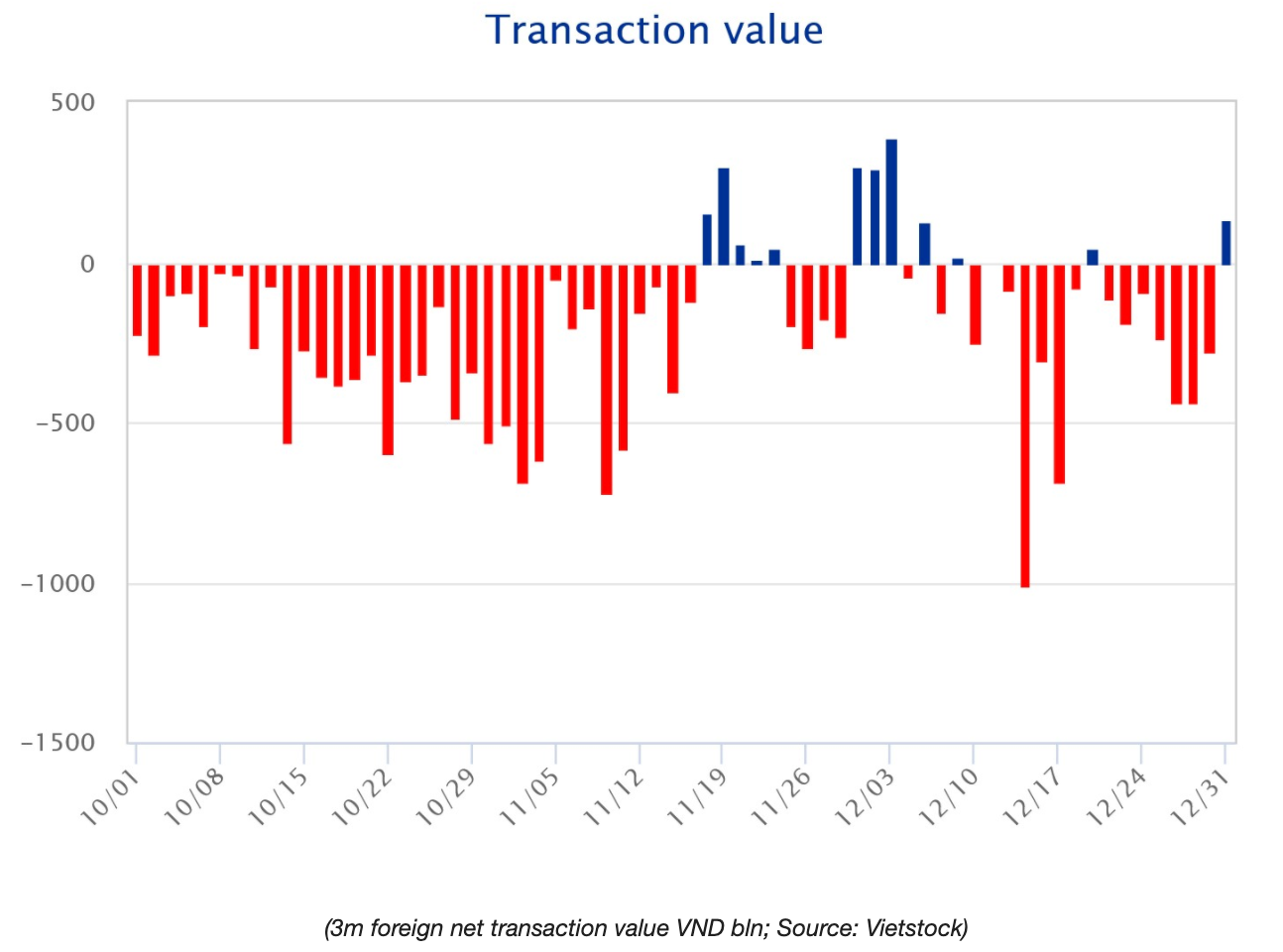

Therefore, the stock market was able to shrug off strong selling from foreign investors in 2020. We never looked too much at those foreign inflow/outflow numbers as locals are driving the market in Vietnam, but a return of foreign investors next year would add to local demand which would certainly be positive.

It is worth mentioning that in recent months and years more and more companies have delisted from the UPCOM and Hanoi exchanges in order to list their shares on the much larger HCMC exchange. UPCOM was always a kind of third market with less regulations which was, and still is, used for new listings (IPO’s), even for big companies. Hanoi, as the capital of Vietnam, always tried to compete with the exchange in HCMC but has lost the battle over time in terms of market turnover and market capitalization. Recently, even the formerly highest weighted company of the Hanoi Stock Exchange, Asia Commercial Bank, has changed its listing to HCMC. Meanwhile, the difference between the two markets in terms of size is huge (HCMC market capitalization USD 181 bln vs. Hanoi USD 9 bln), and even the UPCOM market currently has a market capitalization of USD 86 bln. The price movement of the Hanoi index has recently become so erratic that we have decided to follow only the main index HSX in HCMC for future comparisons, as this is also the stock market index followed by the media. We therefore will discontinue reporting price changes of the Hanoi index on a regular basis, but will continue to report important and interesting events from the exchange if and when they occur.

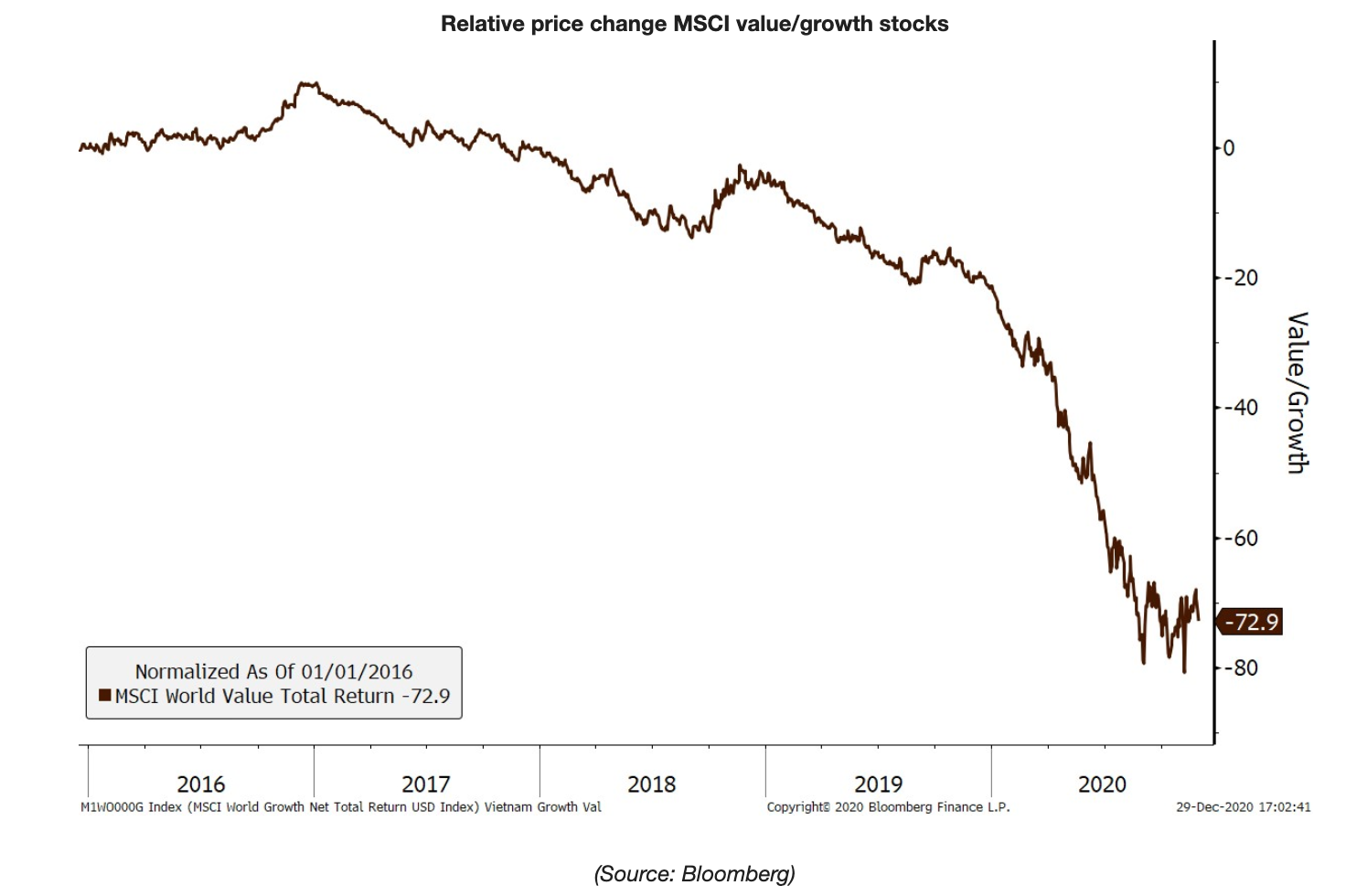

A second major trend which we have written about many times is the change of leadership from growth to value stocks, which finally seems to be underway. As can be seen from the chart below, after an acceleration in the weakness of value stocks earlier this year, it looks like a long-term bottom could be in place which would be an important gamechanger for the next few years. Like any other fund, we are looking for growing companies and to maximize profits for our investors, but at the same time we like to sleep well with the positions we hold. When the stock market environment went sour during the spring and valuations of our stocks went from “cheap” to “super-cheap”, we re-evaluated the risks in our positions, but otherwise were pretty relaxed given the attractive valuations. We would have had a much harder time being optimistic if we would have been invested in loss-making or highly priced stocks which were the favorite investments of many funds around the world. Of course, we enjoyed seeing the sharp rebound in stock prices in recent months and our valuations recovered as well, but even with the strong gains since the low in March our average harmonic P/E is currently only at 8.7x.

With so many undervalued stocks in our portfolio, the NAV of the fund would need to increase 100% from today for the fund valuations to be in line with the market average, which itself is not expensive compared to other markets. We are well positioned with our holdings to participate in a further “catch-up” with the small- and mid-cap segments where indices already reached a new all-time high whereas the VN-Index is still 9% belowits high reached in April 2018.

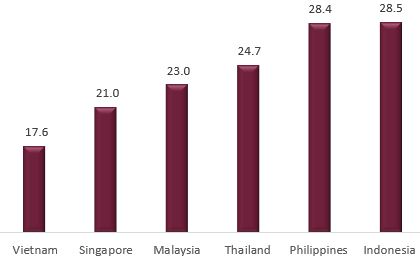

The valuation of the Vietnamese market is still quite attractive with a PER of 17.6x compared to other countries such as Thailand (24.7x), Indonesia (28.5x), Malaysia (23.0x), Singapore (21.0x) or Philippines (28.4x).

Asian valuations – PER

(Source: Bloomberg)

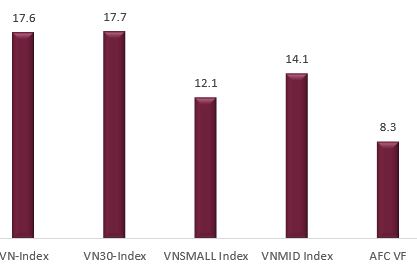

Although the whole market valuation in Vietnam is currently around 17.6x, we see significant differences among various segments, with for example PER’s of small- and mid-cap stocks only averaging at around 12.1x and 14.1x respectively, against 8.3x for our fund.

Vietnam valuation by segments – PER

(Source: HSX, AFC research)

This is why small- and mid-cap indices both performed strongly in 2020 versus the HCMC index (VNI). (small-caps +37.8%, mid-caps +36.3% and VNI +14.9%). This lured a record number of new local investors into the market and according to SSI Securities, the largest stock broker in Vietnam, the total number of new brokerage accounts opened in the first eleven months of 2020 reached more than 328,000.

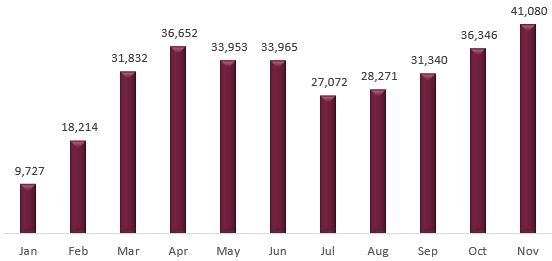

New opened accounts by month in 2020

(Source: SSI, VSD, AFC Research)

With the help of these new local investors, the market growth momentum and liquidity improved significantly.

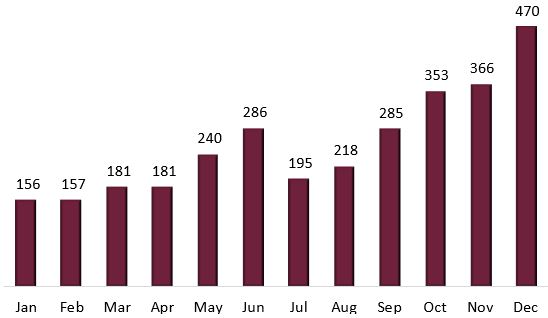

Vietnam average daily trading volume (USD mln)

(Source: HSX, AFC Research)

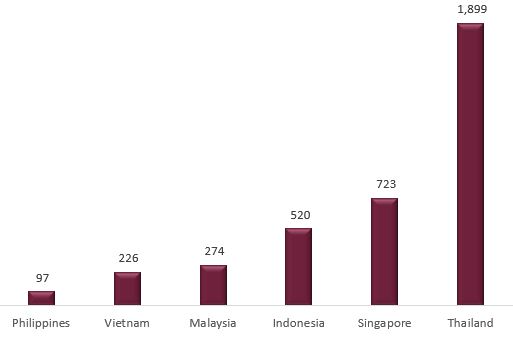

In December, the market liquidity improved further and reached an average of USD 470 mln per day which is on par with other ASEAN markets such as Thailand, Indonesia, Malaysia or Philippines.

Average daily trading value by markets (USD mln)

(Source: Bloomberg)

While the above developments will hopefully benefit the Vietnamese stock market’s performance in 2021, another long-term positive development can be seen from investments being driven by social and environmental forces.

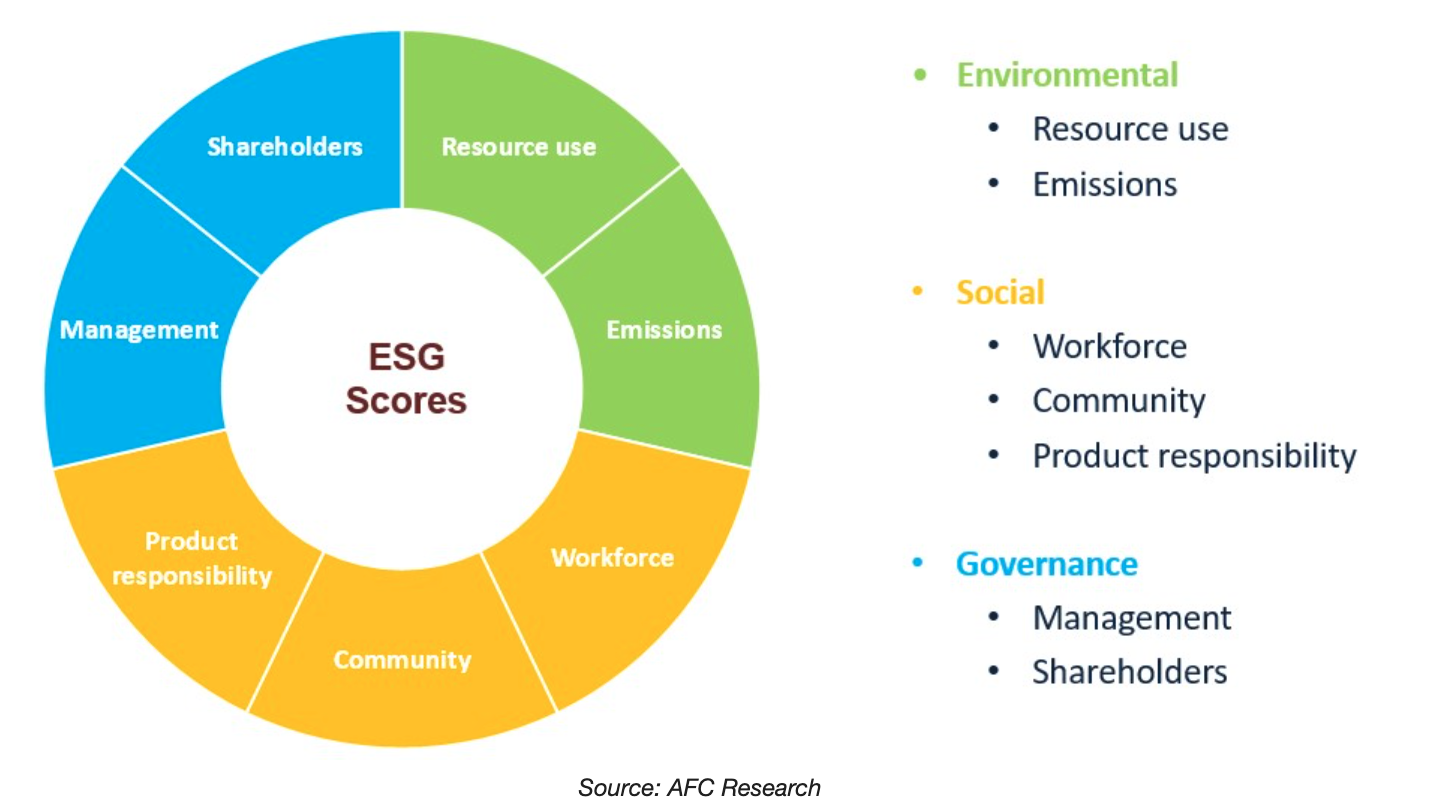

ESG - Environmental / Social / Governance

There appears to be a growing opinion in the investment industry, mainly in the US and Europe, that companies that fit ESG criteria are well equipped to manage risk and operate in a sustainable manner in the future, so therefore are attractive investments in their own right. But this ESG topic is only just starting to gain attention in frontier and emerging markets, and because we think that long term benefits for the country and its people are substantial, we decided, as mentioned in our last report, to start integrating environmental, social and governance (ESG) factors into our investment process.

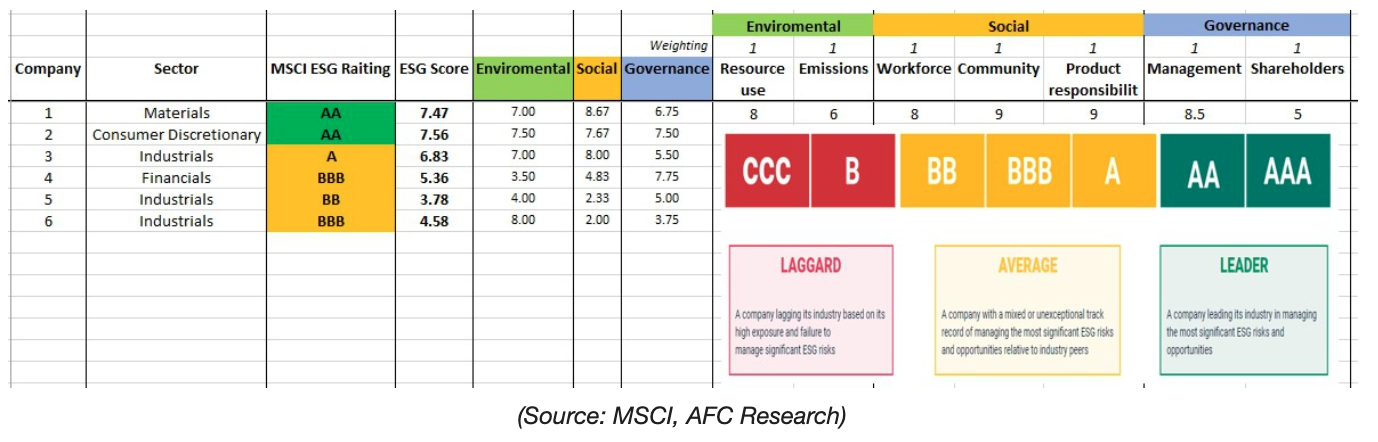

We are focusing on the above mentioned 8 factors and score each company between 0-10 (10 being the best and 0 the worst score).

- Resource use- reflects the performance and capacity to reduce the use of materials, energy or water, and to find more eco-efficient solutions by improving supply chain management.

- Emissions - measures the commitment and effectiveness towards reducing environmental emissions in its production and operational processes.

- Workforce - measures the effectiveness of job satisfaction, human rights, a healthy & safe workplace, competitive compensation, diversity and equal (gender) opportunities and development opportunities for its workforce.

- Community - measures the commitment to contribute to charities, infrastructure and education projects and support of under privileged members in the society.

- Product responsibility - reflects the capacity to produce quality goods and services, integrating the customer’s health and safety, integrity and data privacy.

- Management - measures the commitment and effectiveness towards following best practice corporate governance principles.

- Shareholders - reflects the effectiveness towards equal treatment of shareholders and the use of anti-takeover measures.

We are then using a rating methodology from MSCI in order to translate these scores into ratings between CCC to AAA (AAA being the best and CCC the worst value).

After our initial rating, companies are contacted and sent a self-assessment form in order to value and score their achievements in each of these 8 ESG factors. Where we see big differences between their and our score, we adjust the numbers according to the discussion with the respective management of these companies. We think this an important step, since these companies will realize that ESG is important, especially for international investors and we hopefully can motivate them to adapt and improve in these segments.

It is great to see that there are a few companies already making a great effort to improve their behavior in regards to ESG, but there are of course other companies which have still lots of room for improvement, to say the least.

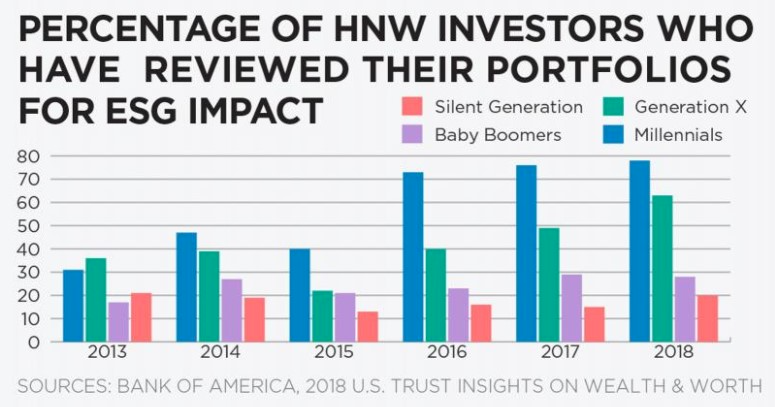

Vietnam is certainly in a very early stage of ESG awareness compared to the developed world, but we see that more and more companies are starting to report on ESG, along with the government who implements rules in their Stock Exchange guidelines. As this theme is gaining traction, we feel that early movers are rewarded in their performances, not to speak of the positive impact on society and environment. Especially the younger generation of investors is increasingly looking into these topics as well.

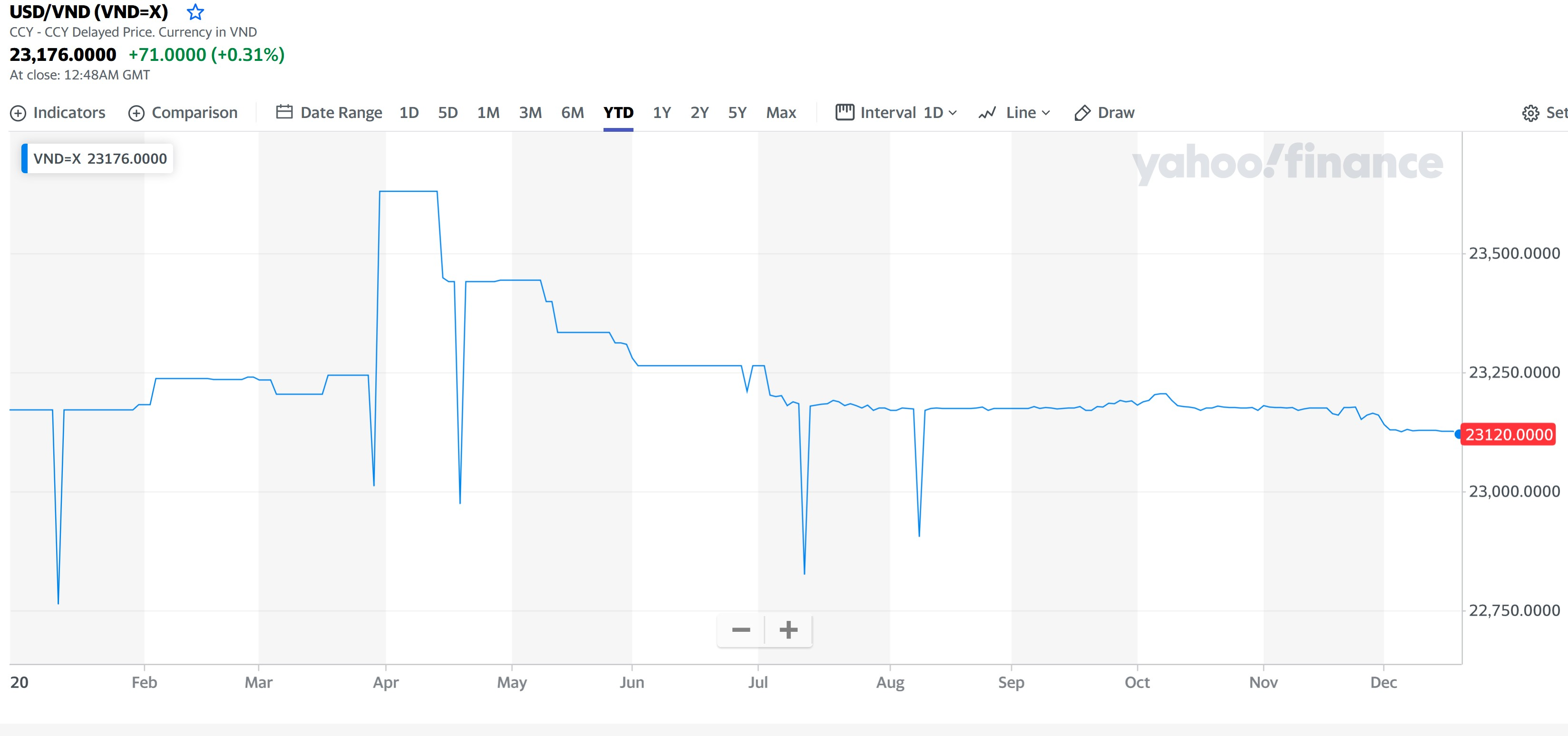

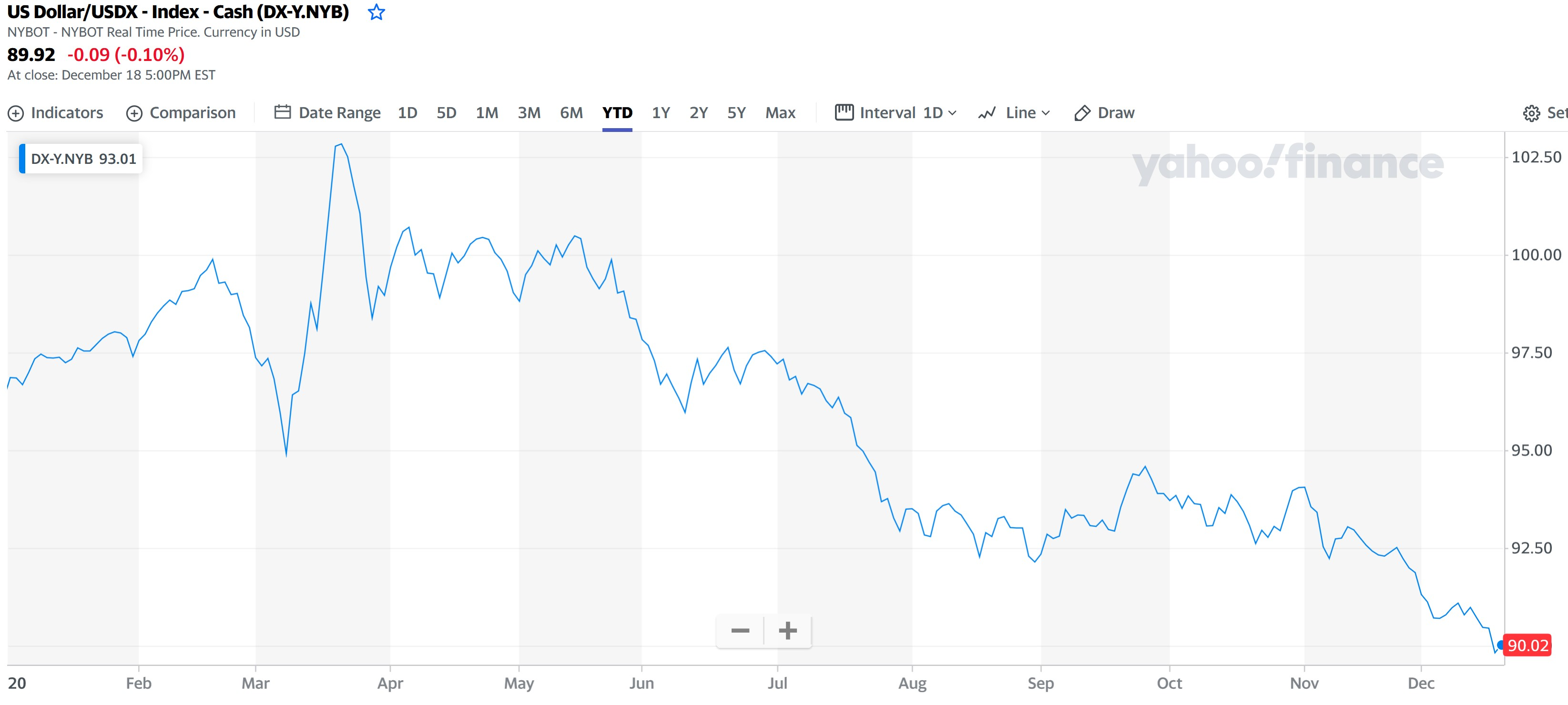

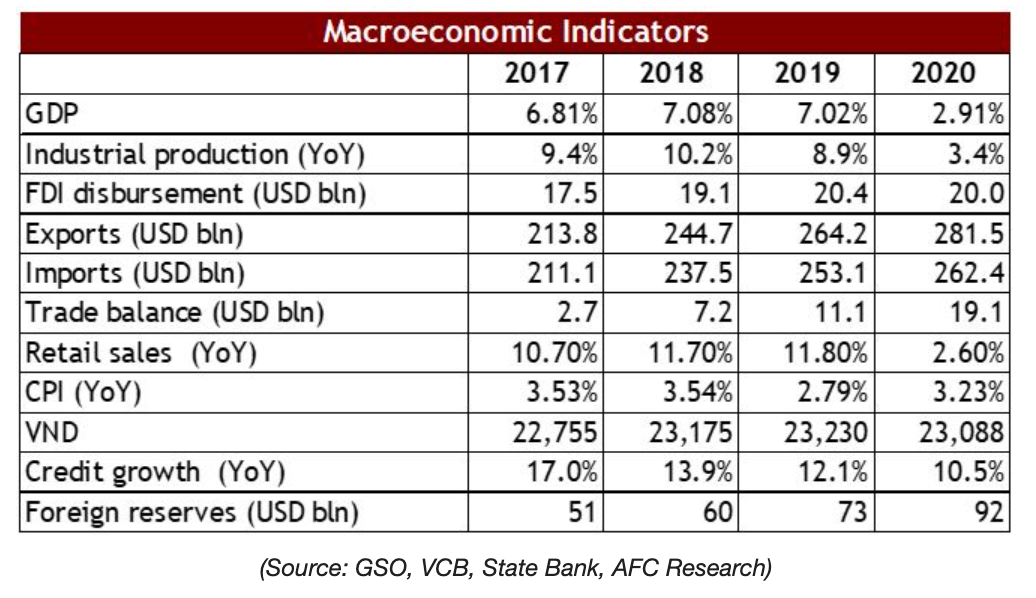

Is Vietnam a currency manipulator?

The most recent declaration from the US Treasury department that Vietnam, along with Switzerland, is now classified as a currency manipulator is in reality just further proof of the strong performance of the Vietnamese economy. As a developing country, with an inflation rate of 3%-4%, the Trump administration cannot seriously expect strong appreciation of the currency from Vietnam, especially when its currency is one of the most stable in the world against the USD. The three points which led the US Treasury Department to this conclusion were 1) a high trade surplus (that is always the initial goal of low income economies), 2) high accumulation of foreign reserves (that has been true for Vietnam over the past 1-2 years, but from it is occurring from a low base and is mainly a result of high FDI – foreign direct investments), and 3) a high Vietnamese current account surplus (which is usually a sign of a economically successful country, as one can also see this for example in Germany, Switzerland or previously Thailand). Vietnam (with its border to China) is becoming an important political partner for the US in the region, while at the same time the relationship between the US and the Philippines is fading. The new Biden administration is more likely to find an agreement with Asian economies instead of isolating the US even more in this important part of the world. Nevertheless, this discussion will continue for some time and will further support the stability of the currency, especially in a weak USD environment globally.

(2020 USD/VND; Source: Yahoo!finance-Verizon Media)

(2020 USD-Index; Source: Yahoo!finance-Verizon Media)

Brexit

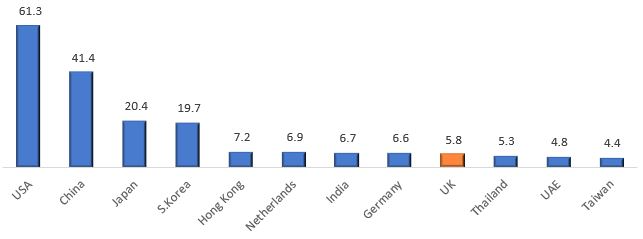

Vietnam once again showed its ability to proactively adjust its economic policy when needed and act completely different to what people often expect from a communist country. Vietnam and the UK successfully negotiated an FTA (free trade agreement) which will eliminate 99% of tariffs between the two countries after 7 years from the current level of 65%. Key export items may benefit from the deal including electronic products, textile and footwear, machinery, wood and wood products and fishery products. Together with EVFTA the agreement with the UK will enable Vietnam to increase trade with Europe considerably. Currently, the UK is one of the largest export markets for Vietnam, behind the USA, China and the EU.

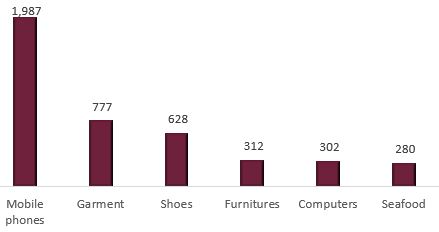

Top export products to the UK (USD bln)

(Source: GSO, AFC Research)

With the successful handling of the COVID-19 crisis, Vietnam is on track to become the second largest manufacturing country in the world after China. A large number of enterprises, such as for example Apple, Uniqlo, Hangzhou Ciec Group, Foxconn, Pegatron or Lotte etc. are looking for business partners in Vietnam in order to lower production costs of their products. Furthermore, Vietnam’s local consumer demand is recovering strongly while most other countries in the world are likely to continue to struggle with COVID-19 for the foreseeable future.

GDP growth by country in 2020 and 2021 (%)

(Source: DBS)

Conclusion for 2021

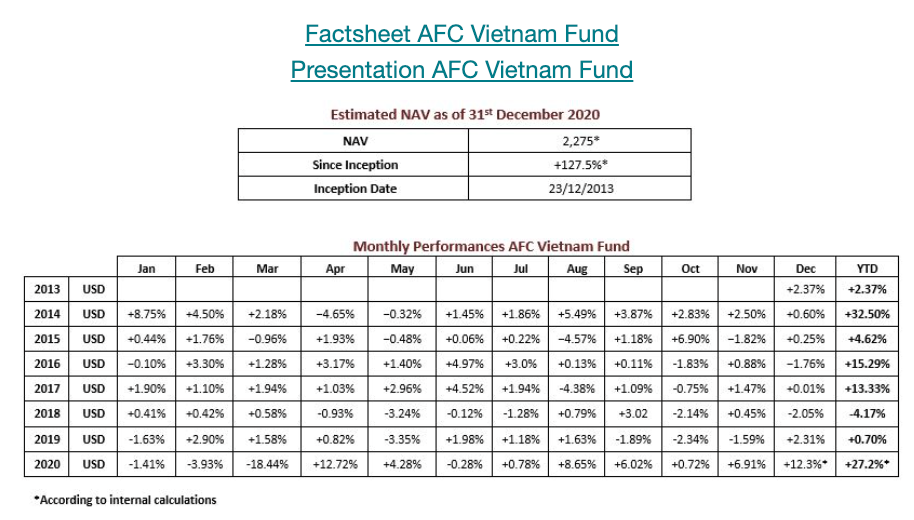

While we refrain from any forecasts and always want to remind our investors to expect the unexpected (just think back to January 2020!), we have remained consistent with our positive stance towards Vietnam being the single best investment idea since our inception in December 2013. While diversification should always be a major investment criterion within a portfolio and especially within emerging and frontier markets, we are now maybe even more convinced for the next 7 years than we have been for Vietnam in the past 7 years.

Economy

Subscription

The next subscription deadline will be 25th January 2021. If you would like any assistance with the subscription process please be in touch with Andreas Vogelsanger.

We are wishing you all a happy, healthy and prosperous New Year!

Best regards,

AFC Vietnam Fund

- Unlock research summaries

- Follow top, independent analysts

- Receive personalised alerts

- Access Analytics, Events and more

Join 55,000+ investors, including top global asset managers overseeing $13+ trillion.

Upgrade later to our paid plans for full-access.

- Loading...