ECM Weekly (12 January 2019) - Futu, China East Education, China Kepei Education, Viva Biotech

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Despite a shaky 2018 Q4 market and the disappointing Softbank Corp (9434 JP)'s IPO, we have been getting a steady stream of newsflow on upcoming IPOs.

Starting with upcoming IPOs, Chengdu Expressway Company Limited (1785 HK) and Weimob.com (2013 HK) will be listing next week on Tuesday, 15th January. Weimob was priced at the low end of its price range while Chengdu Expressway's IPO was at a fixed price of HK$2.20. We are bearish on both IPOs. Weimob is overly reliant on Tencent for its SaaS and Ads business and, at the same time, Tencent will only own less than 3% stake after listing. Whereas Chengdu Expressway has been a well-managed company but valuation implies limited upside. Trading liquidity will likely remain tepid as like Qilu Expressway Co Ltd (1576 HK) which listed mid last year.

In the pipeline, we are hearing that Kepei Education (KEPEI HK) will likely open its book next Monday. We will be following up with a note on valuation. In other IPOs that are coming in this quarter, Helenbergh China and Zhongliang, both property developers, are looking to IPO in this quarter. Viva Biotech Shanghai Ltd (1577881D HK) is also looking to list in Hong Kong Q2 while Urban Commons, a US property developer, is planning a US$500m REIT IPO in Singapore.

Activity seems healthy for the ECM space, but sentiment has not been the best as seen from Xiaomi's high profile IPO that took a hit just as its lockup expired. Its share price has corrected from a high of HK$22.20 to just above HK$10.34 this Friday. This should not have been a big surprise since many have already pointed out that its valuation should really have been closer to that of a hardware business and we pointed out that the IPO's trajectory would likely be similar to Razer.

This reminds us of a particular listing last year, Razer Inc (1337 HK) , and, in fact, both bear quite a handful of similarities. Strong portfolio of investors, hardware business with software capabilities, expensive valuations, and etc. The stock did well at first but has come back down to earth since then.

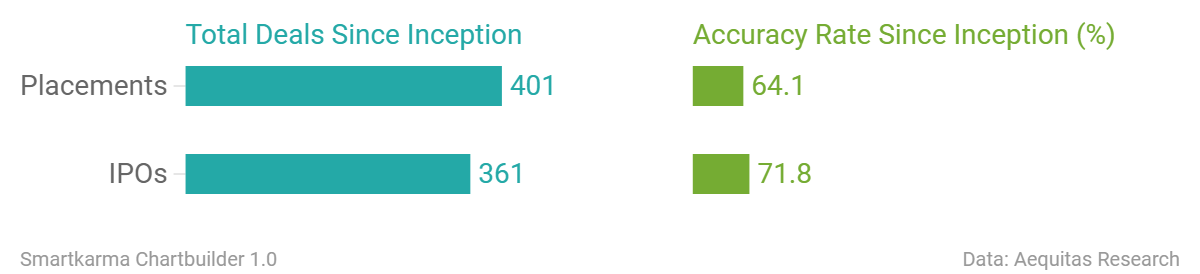

Accuracy Rate:

Our overall accuracy rate is 72% for IPOs and 64% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- China Tobacco International (Hong Kong, US$100m)

- China East Education (Hong Kong, US$400m)

- Ebang International (Hong Kong, re-filed)

- MicuRx Pharma (Hong Kong, re-filed)

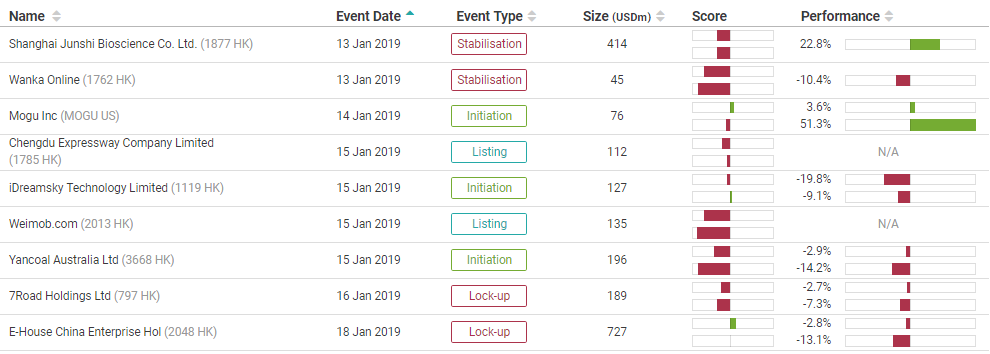

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Urban Commons plans IPO of up to US$500m at Q1-end

- Viva Biotech plans IPO in the second quarter

- CStone Pharma plans US$400m IPO in Feb

- Global Switch plans about US$1bn HK IPO

- China's Wanda files for US IPO of sports unit to raise up to US$500m

Smartkarma Community's this week Analysis on Upcoming IPO

- Futu Holdings IPO Preview: Running Out of Steam

- Futu Holdings Pre-IPO - Great Metrics but in a Commoditised Industry

- China Tobacco International (IPO): The Monopolist Will Not Recover

- China Tobacco International IPO: Heavy Regulation, Declining Margins – A Bit Late to IPO Party

- IPO Radar: AutoCorp, Honda's Avatar in Thailand

List of pre-IPO Coverage on Smartkarma

- Unlock all research summaries

- Follow top, independent analysts

- Receive personalised alerts and emails

- Access Briefings, Analytics, and Events

Upgrade anytime to our paid plans for full-length research, real-time analyst discussions, and more.

Join a thriving community of 45,000+ investors, including the top global asset managers managing over $13trn in assets.

- Mrs. Bectors Food Specialities Pre-IPO Quick Take - Sales for Its Main Segment Have Been Stagnant16 Jan 2019

- Chengdu Expressway (成都高速) Post-IPO - Low Liquidity and Tiny Adjusted Free Float15 Jan 2019

- Weimob IPO Trading Update - Existing Shareholders to the Rescue15 Jan 2019

- ECM Weekly (12 January 2019) - Futu, China East Education, China Kepei Education, Viva Biotech12 Jan 2019

- China East Education (中国东方教育) Pre-IPO - The Company Known for Its Culinary School09 Jan 2019

- Futu Holdings Pre-IPO - Great Metrics but in a Commoditised Industry09 Jan 2019

- ECM Weekly (15 December 2018) - Wanka, Alpha Smart, CMGE Tech, Junshi Science, Xinyi Energy.15 Dec 2018