In this briefing:

- Golden Agri: Reduced Risk of El Niño Pushes Out CPO Price Recovery into 2020

- Propertylink – CNI Shareholders To Vote On ESR’s Final Offer

- M1 Ltd (M1 SG): A Clever Ploy to Put the Ball Firmly in Axiata’s Court

- Maoyan Entertainment (猫眼娱乐) IPO: Turning Profitable, Thoughts on Valuation

- Itochu Confirms Intent to Deepen Hold over Descente

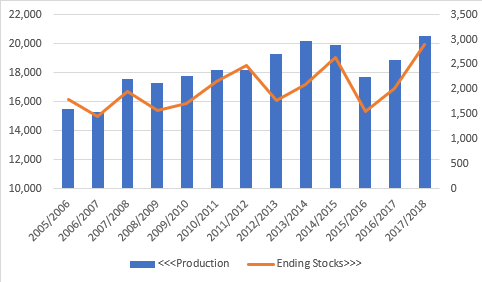

1. Golden Agri: Reduced Risk of El Niño Pushes Out CPO Price Recovery into 2020

INVESTMENT VIEW:

The Australian Bureau of Meteorology has just downgraded its risk of El Niño from ‘Alert’ to ‘Watch’, and as a result, we temper our optimism for a near-term rally in CPO prices. Longer-term, we remain bullish on Golden Agri Resources (GGR SP), but higher CPO prices remain a key catalyst for our bullish call on the shares.

2. Propertylink – CNI Shareholders To Vote On ESR’s Final Offer

ESR has now declared its Offer for Propertylink Group (PLG AU) “to be best and final“, and the Offer has been extended until the 28 February (unless further extended).

After adjusting for the interim distribution of A$0.036/share (ex-date 28 December; payment 31 January), the amount payable by ESR under the Offer is A$1.164/share, cash.

The Target Statement issued back on the 20 November included a “fair and reasonable” opinion from KPMG, together with unanimous PLG board support.

To recap: after PLG rebuffed an offer from Centuria Capital (CNI AU) in September, followed by PLG making an offer for Centuria Industrial Reit (CIP AU) – in which both CNI (23.5%) and PLG (17.3%) have sizeable stakes – ESR launched its offer for PLG. Adding to the cross-holdings, ESR also acquired major positions in both PLG (18.06% initially, now up to 19.9%) and CNI (14.9%).

ESR’s Offer is conditional on a minimum acceptance condition of 50.1%. CNI has a 19.5% stake and Vinva Investment Management 5%.

The next key event is CNI’s shareholder vote on the 31 January. This is not a vote to decide on tendering the shares held by CNI in PLG into ESR’s offer; but to give CNI’s board the authorisation to tender (or not to tender) those PLG shares.

Although no definitive decision has been made public by CNI, calling the EGM to get shareholder approval and attaching a “fair & reasonable” opinion from an independent expert (Deloitte) to CNI’s EGM notice, can be construed as sending a strong signal CNI’s board will ultimately tender in its shares. According to the AFR (paywalled), CNI’s John Mcbain said: “We want to make sure when we do decide to vote, if we get shareholder approval, the timing is with us“.

Assuming the resolution passes, CNI’s board decision on PLG shares will take place shortly afterwards. My bet is this turns unconditional the first week of Feb. The consideration under the Offer would then be paid 20 business days after the Offer becomes unconditional. Now trading with completion in mind at a gross/annualised spread of 0.8%/6.7%, assuming payment the first week of March.

3. M1 Ltd (M1 SG): A Clever Ploy to Put the Ball Firmly in Axiata’s Court

M1 Ltd (M1 SP), the third largest telecom operator in Singapore, is subject to a voluntary conditional offer (VGO) at S$2.06 cash per share from Keppel Corp Ltd (KEP SP) and Singapore Press Holdings (SPH SP) (KCL-SPH). KCL-SPH said on Tuesday that they wouldn’t increase their S$2.06 offer price “under any circumstances whatsoever.”

KCL-SPH’s stance not to increase their S$2.06 offer price is a clever ploy to the put the ball in Axiata Group (AXIATA MK)’s court. Axiata has three options, in our view. We believe that the probability of a material bid to KCL-SPH’s offer is low with Axiata most likely to retain its stake as a minority shareholder.

4. Maoyan Entertainment (猫眼娱乐) IPO: Turning Profitable, Thoughts on Valuation

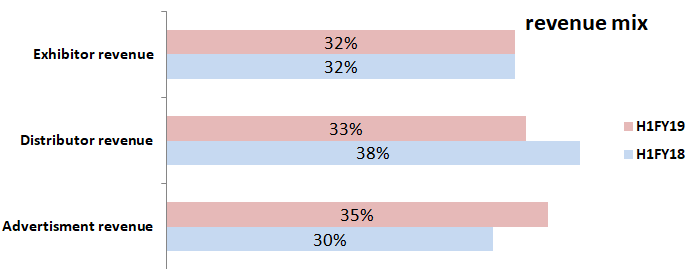

Maoyan Entertainment (formerly Entertainment Plus) launched its institutional book building last Friday. We covered the company’s background, industry backdrop, financials, shareholders and the regulatory overhang in our previous two notes.

In this note, we will look at the recent development of the company, based on the data from the prospectus and our channel checks. We will also discuss the valuation of the company.

Our Previous Insight on Maoyan Entertainment:

- Entertainment Plus (猫眼娱乐) IPO: The Engineered Movie Ticketing Leader that Runs Out of Steam (Part 1)

- Entertainment Plus (猫眼娱乐) IPO: The Coming Regulatory Bang Isn’t That Bad (Part 2)

5. Itochu Confirms Intent to Deepen Hold over Descente

Itochu (8001 JP) continues a battle of words and equity as it attempts to gain more control over sports firm Descente (8114 JP).

Meanwhile, Descente has brought in Wacoal (3591 JP) as a white knight and made a splash in the business media about its recent success.

Itochu insists that Descente needs Itochu’s management skills, particularly to build a stronger business in China and other overseas markets, and says the only way to make Descente listen is to buy more stock – more than its current nearly 30%.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.