In this briefing:

- Prabhat Dairy Ltd – Update: Revenues and Margins Continues to Increase in Line with Our Expectations

- Swaraj Engines: Positive Outlook But Growth Is Slowing and Valuation Is Rich

- GMO Internet (9447 JP) – Grossly or Modestly Overrated?

- Halla Holdings Stub Trade: Downwardly Mean Reversion in Favor of Mando

- GUNKUL (GUNKUL TB): Solar to Drive Top-Line Growth

1. Prabhat Dairy Ltd – Update: Revenues and Margins Continues to Increase in Line with Our Expectations

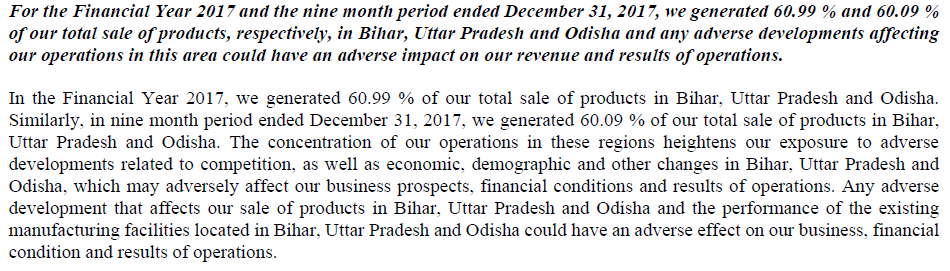

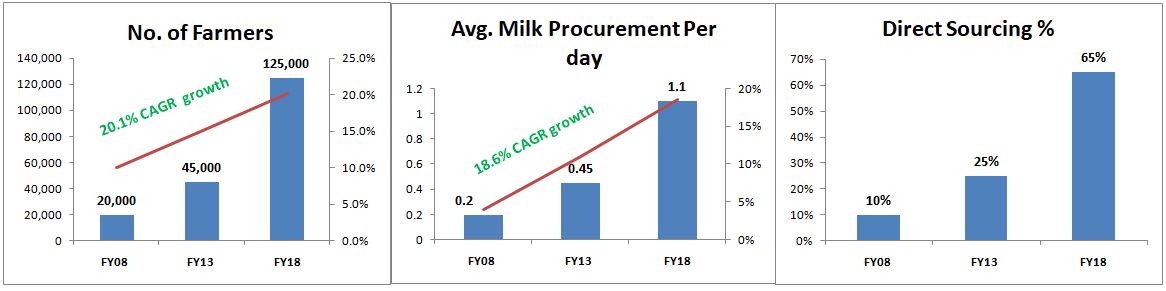

Prabhat Dairy Ltd’s quarterly result is in line with our expectation. In Q2 FY19, the company registered a growth of 8.53% YoY, EBITDA margin was 9.4% improving by 119 bps since the same period last year, EBITDA grew by 24.2% YOY; the profit margin was at 2.95% improving by 60 bps YoY, Net Income grew by 35.86% YOY. For more details about the company, please refer to our initiation report Prabhat Dairy Ltd – An Emerging Star in the Indian Milky Way. B2B business contributed to 70% of revenue and the remaining 30% was driven by B2C business. Value Added Products contributed to 25% of revenue in Q2FY19.

The stock is trading at 16.3x its TTM EPS, 13.8x its FY19F EPS. Margins have improved over the past quarters due to lower cost of raw materials, we expect raw materials to continue to be lower than their historic average in short term. Lower cost of raw material along with the improving contribution from B2C will lead to higher margins in medium to long term. The company also wants to increase its B2C contribution aggressively from the current 30% to 50% by 2020.

We will monitor the stock closely to firm up our views further, albeit we remain positive on the long-term prospects of the company.

2. Swaraj Engines: Positive Outlook But Growth Is Slowing and Valuation Is Rich

Swaraj Engines (SWE IN) (SEL)is primarily manufacturing diesel engines for fitment into Swaraj tractors manufactured by Mahindra & Mahindra Ltd. (M&M). The Company is also supplying engine components to SML Isuzu Ltd used in the assembly of commercial vehicle engines. SEL was started as a joint venture between Punjab Tractor Ltd (now acquired by M&M Ltd) and Kirloskar Oil Engines Ltd. M&M holds 33.3% stake in SEL and is its key client.

We are positive about the business because:

- SEL’s growth is correlated with M&M’s tractor business growth. SEL supplies engines to the Swaraj division of M&M. M&M expects tractor growth to be around 12% YoY in FY19E. We forecast SEL’s tractor engine volumes will grow at a CAGR of 12% for FY18-21E.

- The growth of the company is dependent on the monsoon and rural sentiments. We expect the profitability to improve with normal rainfall and government initiatives towards the rural sector. We expect the revenue/ EBITDA/ PAT CAGR for FY18-21E to be 14%/ 15%/ 14% respectively.

- SEL is debt free and a cash generating company. It has a healthy and stable ROCE and ROE. SEL has increased its capacity from 75,000 engines in FY16 to 120,000 engines in FY18. We expect the capacity utilisation to reach 97% by FY20E from 90% in 1HFY19. SEL funds its capex through internal accruals. We forecast a capex of Rs 600 mn for FY19E to FY21E considering the requirement of the additional capacity, R&D and testing costs for new and higher HP engines & for upgradation of engines according to the TREM IV emission norms for >50 HP engines.

We initiate coverage on SEL with a fair value objective of Rs 1,655/- over the next 12 months. This represents a potential upside of 15% from the closing price of Rs 1,435/- (as on 26-12-2018). We arrive at the fair value by applying PE multiple of 18x to EPS of Rs 87/- to the year ending December-20E and add cash of Rs 82/- per share. While the business outlook is good, we think the upside in the share price is limited due to rich valuation.

Particulars (Rs mn) (Y/E March) | FY18 | FY19E | FY20E | FY21E |

Revenue | 7,712 | 9,210 | 10,478 | 11,525 |

PAT | 801 | 906 | 1,063 | 1,190 |

EPS (Rs) | 64.5 | 74.8 | 87.6 | 98.1 |

PE (x) | 22.3 | 19.2 | 16.4 | 14.6 |

Note: E= Estimates

3. GMO Internet (9447 JP) – Grossly or Modestly Overrated?

Source: Japan Analytics

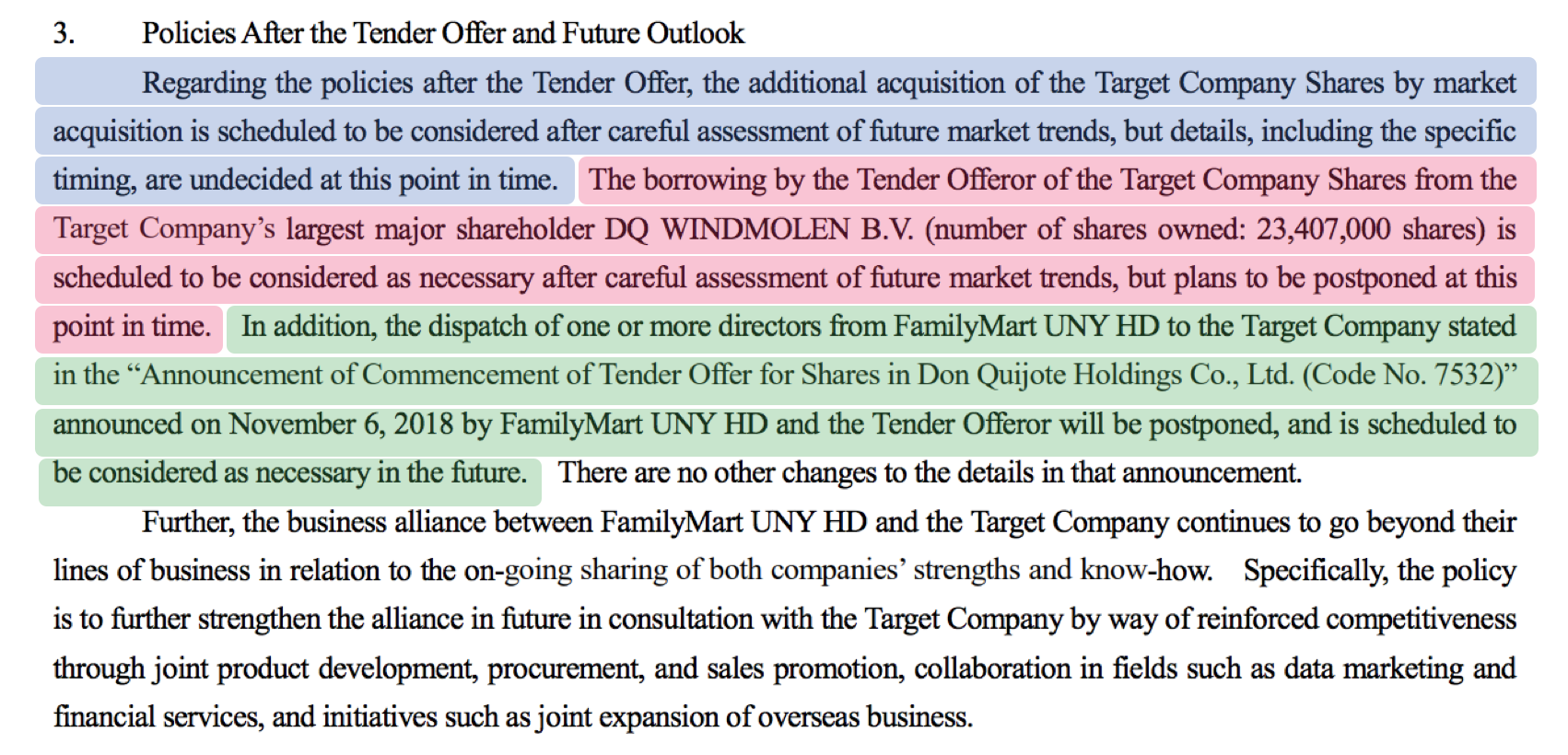

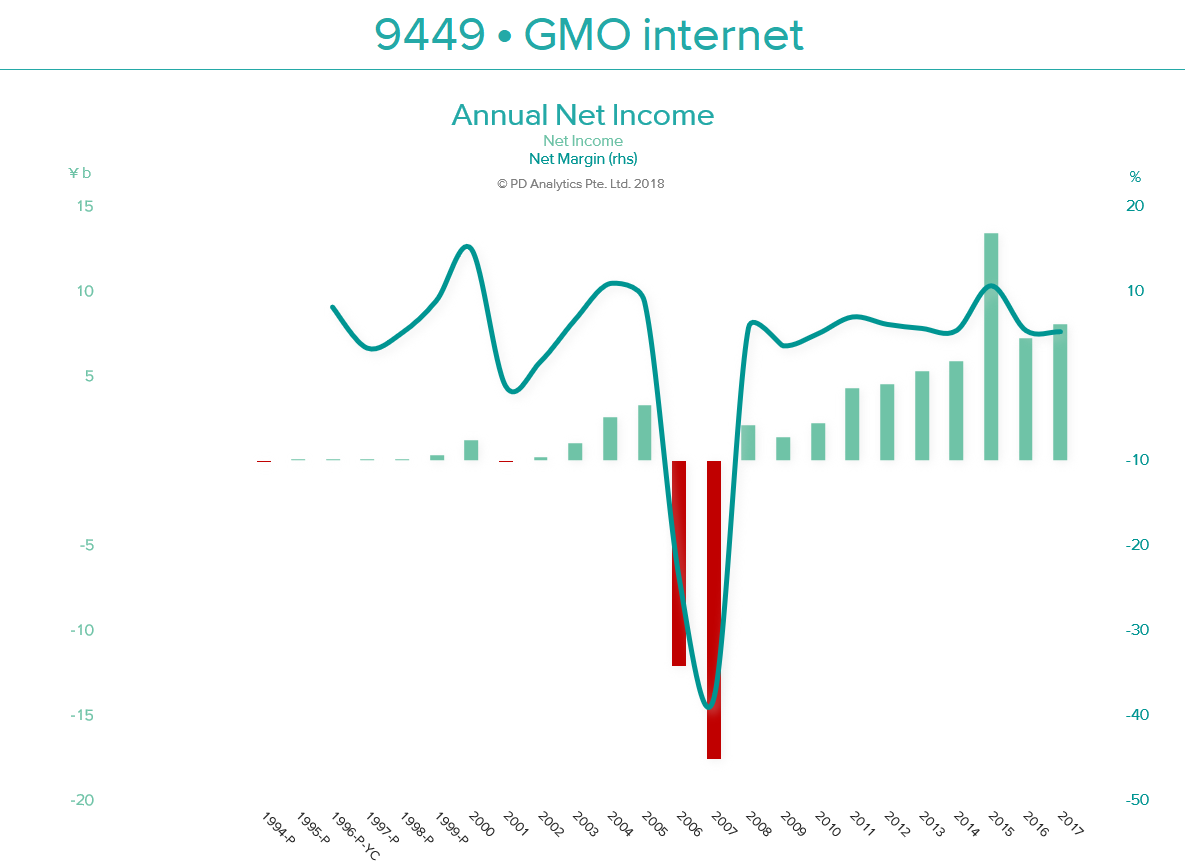

THE GMO INTERNET (9449 JP) STORY – GMO internet (GMO-i) has attracted much attention in the last eighteen months from an unusual trinity of value, activist and ‘cryptocurrency’ equity investors.

- VALUE– Many traditional, but mostly foreign, value investors have seen the persistent negative difference between GMO-i’s market capitalisation and the value of the company’s holdings in its eight listed consolidated subsidiaries as an opportunity to invest in GMO-i with a considerable ‘margin of safety’.

- ACTIVIST – Since July 2017, the activist investor, Oasis, has waged a so-far-unsuccessful campaign with the aim of improving GMO’s corporate governance, removing takeover defences, addressing a ‘secularly undervalued stock price we are not able to tolerate’ (sic), and redefining the role and influence of the company’s Chairman, President, Representative Director and largest shareholder, Masatoshi Kumagai.

- ‘CRYPTO!’ – In December 2017, GMO-i committed to spending more than ¥35b or 10% of non-current assets. The aim was threefold: to set up a bitcoin ‘mining’ headquarters in Switzerland (with the ‘mining’ operations being carried out at an undisclosed location in Scandinavia), to develop proprietary state-of-the-art 7nm-node ‘mining chips’, and, in due course, to sell GMO-branded and developed ‘mining’ machines. The move was hailed in the ‘crypto’ fraternity as GMO-i became the largest non-Chinese and the first well-established Internet conglomerate to make a major investment in ‘cryptocurrency’ infrastructure.

OUTSTANDING – Following the December 2017 announcement, trading volumes spiked into ‘Overtraded’ territory – as measured by our Volume Score. Many investors saw GMO-i shares as a safer way of gaining exposure to ‘cryptocurrencies’, even as the price of bitcoin began to subside. By early June 2018, GMO-i’s shares had reached a closing price of ¥3,020: up 157% from the low of the prior year and outperforming TOPIX by 135%. Whatever the primary driver of this outstanding performance, each of our trio of investor groups no doubt felt vindicated in their approach to the stock.

CRYPTO CLOSURE – On December 25th 2018, GMO-i’s shares reached a new 52-week low of ¥1,325, a decline of 56% from the June high. Year to date, GMO-i shares have now declined by 31%, underperforming TOPIX by nine percentage points. On the same day, GMO-i announced that the company would post an extraordinary ¥35.5b loss for the fourth quarter, incurring an impairment loss of ¥11.5b in relation to the closure of the Swiss ‘mining’ headquarters and a loss of ¥24b to cover the closure of the ‘mining chip’ and ‘mining machine’ development, manufacturing and sales businesses. GMO-i will continue to ‘mine’ bitcoin from its Tokyo headquarters and intends to relocate the ‘mining’ centre from Scandinavia to (sic) ‘a region that will allow us to secure cleaner and less expensive power supply, but we have not yet decided the details’. Unlisted subsidiary GMO Coin’s ‘cryptocurrency’ exchange will also continue to operate, and the previously-announced plans to launch a ¥-based ‘stablecoin’ in 2019 will proceed. In the two trading days following this announcement, the shares have recovered 13% to ¥1,505.

RAIDING THE LISTCO PIGGY BANK – As we shall relate, this is the second time since listing that GMO-i has written off a significant new business venture which the company had commenced only a short time before. In both cases, the company was forced to sell stakes in its listed consolidated subsidiaries to offset the resulting losses. On this occasion, the sale of shares in GMO Financial (7177 JP) (GMO-F) on September 25 2018, and GMO Payment Gateway (3769 JP) (GMO-PG) on December 17 2018, raised a combined ¥55.6b and, after the deduction of the yet-to-be-determined tax on the realised gains, should more than offset the ‘crypto’ losses. According to CFO Yasuda, any surplus from this exercise will be used to pay down debt. Also discussed below and in keeping with this GMO-i ‘MO’, in 2015, the company twice sold shares in its listed subsidiaries to ‘smooth out’ less-than-desirable operating results.

In the DETAIL section below we will cover the following topics:-

I: THE GMO-i TRACK RECORD – TOP-DOWN v. BOTTOM UP

- BOTTOM LINE No. 1: NET INCOME

- BOTTOM LINE No.2 – COMPREHENSIVE INCOME

II: THE GMO-i BUSINESS MODEL – THROWING JELLY AT THE WALL

III: THE GMO-i BALANCE SHEET – NOT SO HAPPY RETURNS

IV: THE GMO-i CASH FLOW – DEBT-FUNDED CASH PILE

V: THE GMO-i VALUATION – TWO METHODS > SAME RESULT

- VALUATION METHOD No.1 – THE ‘LISTCO DISCOUNT’

- VALUATION METHOD No.2 – RESIDUAL INCOME

CONCLUSION – For those unable or unwilling to read further, we conclude that GMO-i ‘rump’ is a grossly-overrated business. Despite having started and spun off several valuable GMO Group entities, CEO Kumagai bears responsibility for two decades of serial and very poorly-timed ‘mal-investments’. As a result, the stock market has, except for the ‘cryptocurrency’-induced frenzy of the first six months of 2018, historically not accorded GMO-i any premium for future growth, and has correctly looked beyond the ‘siren song’ of the ‘HoldCo discount’. According to the two valuation methodologies described below, the company is, however, fairly valued at the current share price of ¥1,460. Investors looking for a return to the market-implied 3% perpetual growth rate of mid–2018 are likely to be as disappointed as those wishing for BTC to triple from here.

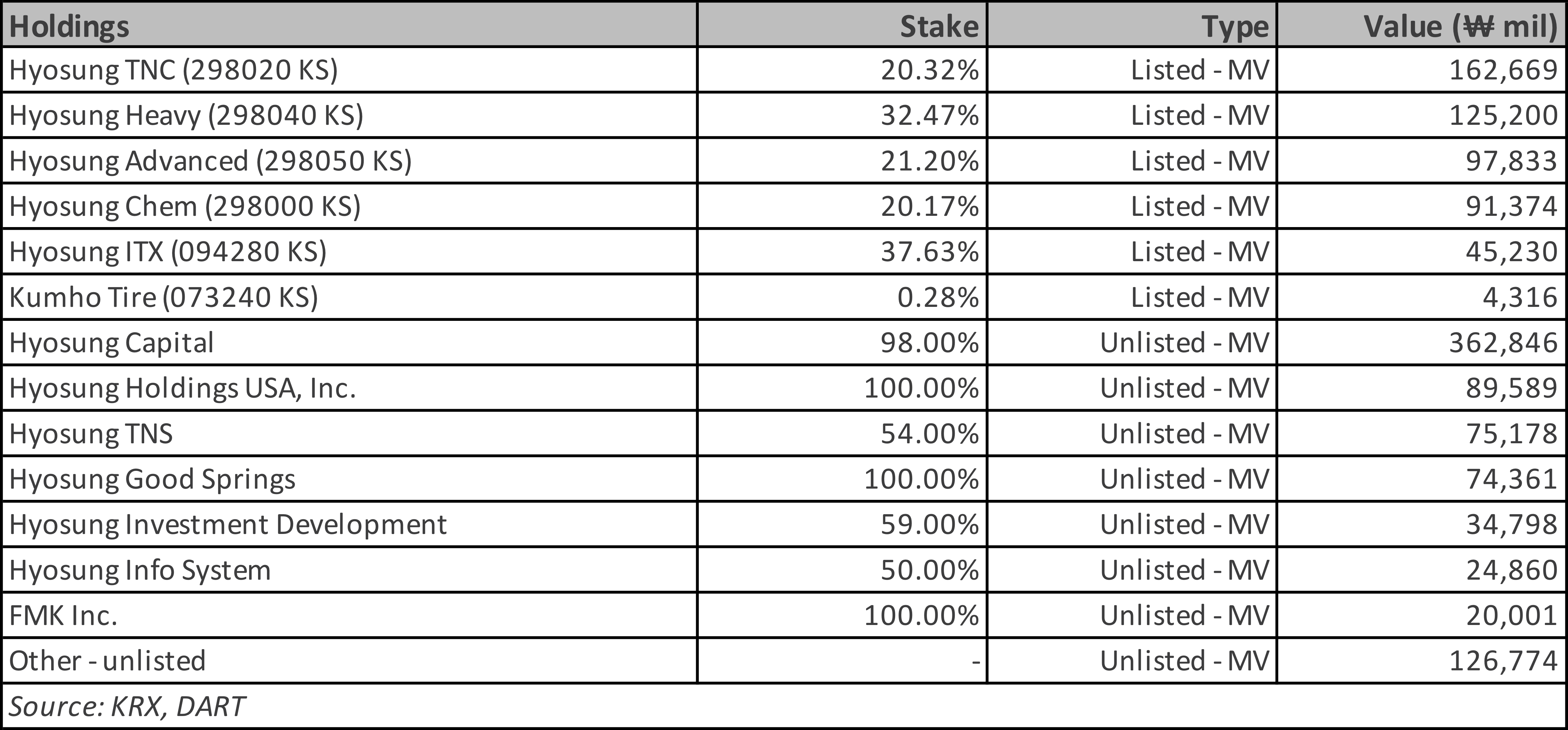

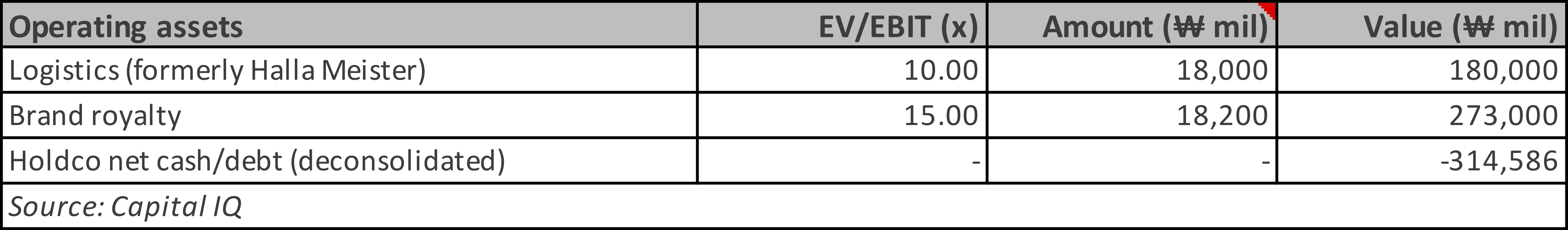

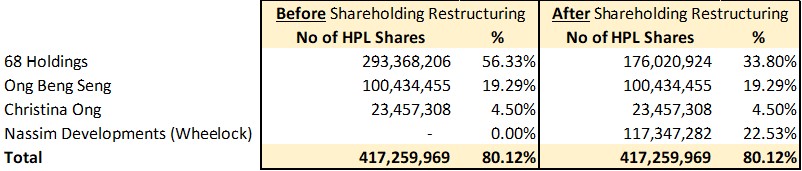

4. Halla Holdings Stub Trade: Downwardly Mean Reversion in Favor of Mando

- Halla Holdings is falling nearly 5% today. Holdco said it’d give a ₩2,000 div per share. This is about 4.5% div yield at yesterday’s closing price. 5% drop today shouldn’t be much as an ex-dividend date price drop. Mando fell 5%. Mando was oversold relative to the other local auto stocks, particularly to Halla Holdings. They are still close to +1 σ on a 20D MA.

- Mando-Hella Elec has been another reason behind Holdco’s valuation divergence against Mando lately. I believe Mando-Hella is being overhyped. Mando-Hella-caused divergence should no longer be effective. I expect ‘downwardly’ mean reversion from now on. I’d go short Holdco and long Mando at this point.

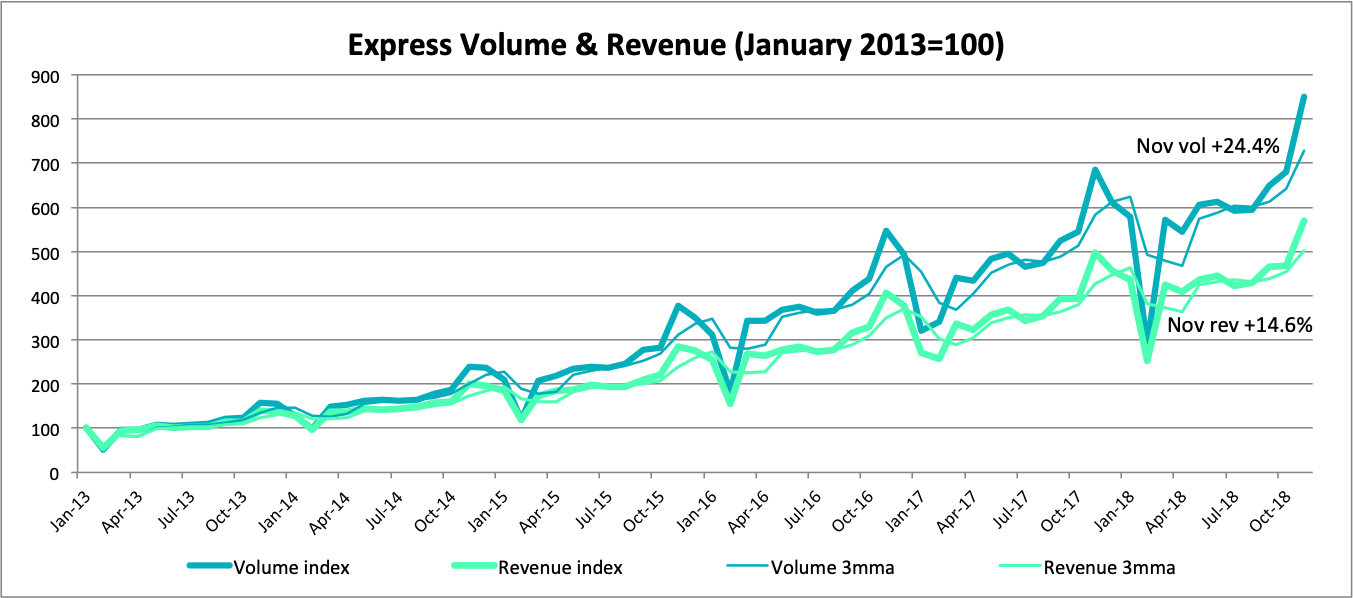

5. GUNKUL (GUNKUL TB): Solar to Drive Top-Line Growth

- Good payout ratio, good growth in core profit, and strong long-term sales growth relative to its sector

- Acquisition of 49% stake in a 30MW solar farm in Malaysia with a commercial operation date (COD) set for 1Q20 to support revenue growth

- High volume of solar rooftop installation projects planned for Charoen Pokphand Foods Pub (CPF TB) and other private firms to boost GUNKUL’s construction revenue

- Attractive at 19CE* PEG ratio of 0.5 relative to ASEAN Industry at 1.6

- Risk: Lower than expected electricity demand, unfavorable weather conditions

* Consensus Estimates