In this briefing:

- Bilibili Placement: Momentum Bodes Well

- Map Aktif Follow-On Offering – Lace up for a Potential Long Run

- Pan Pacific/Don Quijote: Bringing Joy into Shopping

- Mercari: Why Mercari Is Likely to Be a Winner in the Cashless Wars

- Last Week in GER Research: Lyft, Rakuten, Lynas, Yunji IPO, Xinyi IPO and Ruhnn IPO

1. Bilibili Placement: Momentum Bodes Well

Bilibili announced a USD 300 million share placement and a USD 300 million convertible note placement after market close on Monday. This is the first major placement since Bilibili’s IPO in March 2018. In this insight, we will provide our thoughts on the deal and score the deal in our ECM Framework.

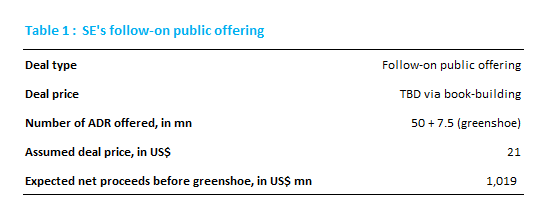

2. Map Aktif Follow-On Offering – Lace up for a Potential Long Run

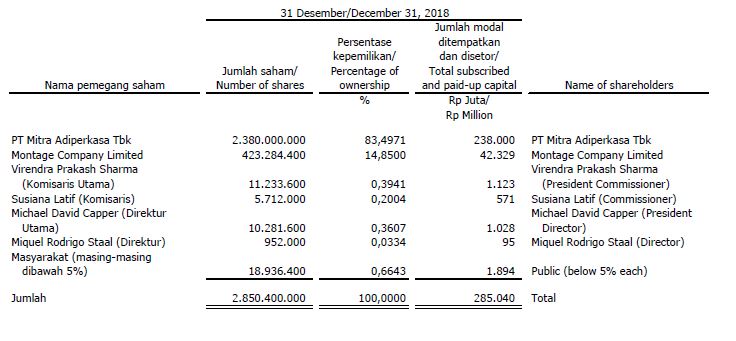

CVC is looking to raise about US$353m through the sale of about 648m Map Aktif Adiperkasa PT (MAPA IJ) shares in the follow-on offering.

Map Aktif (MAPA) is a sports, leisure, and kids retailer in Indonesia. It is a subsidiary of Mitra Adiperkasa (MAPI IJ). The selldown might not be totally unexpected as CVC planned to exit its investment by 2020. However, post this selldown it will still have 192m share left.

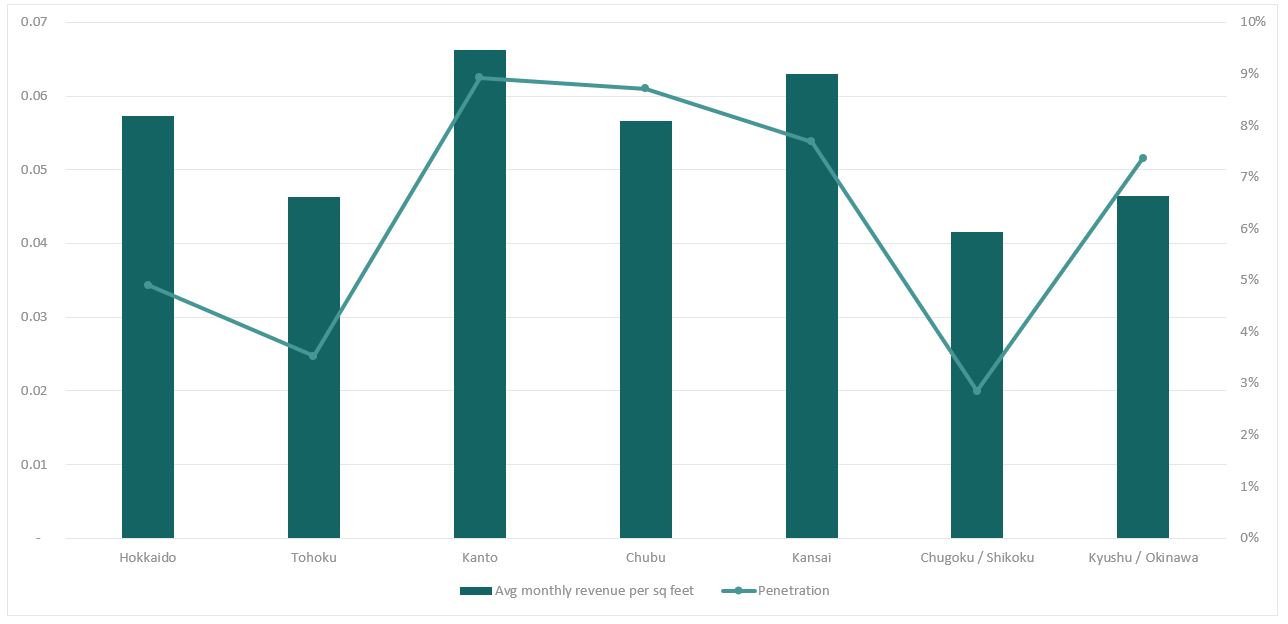

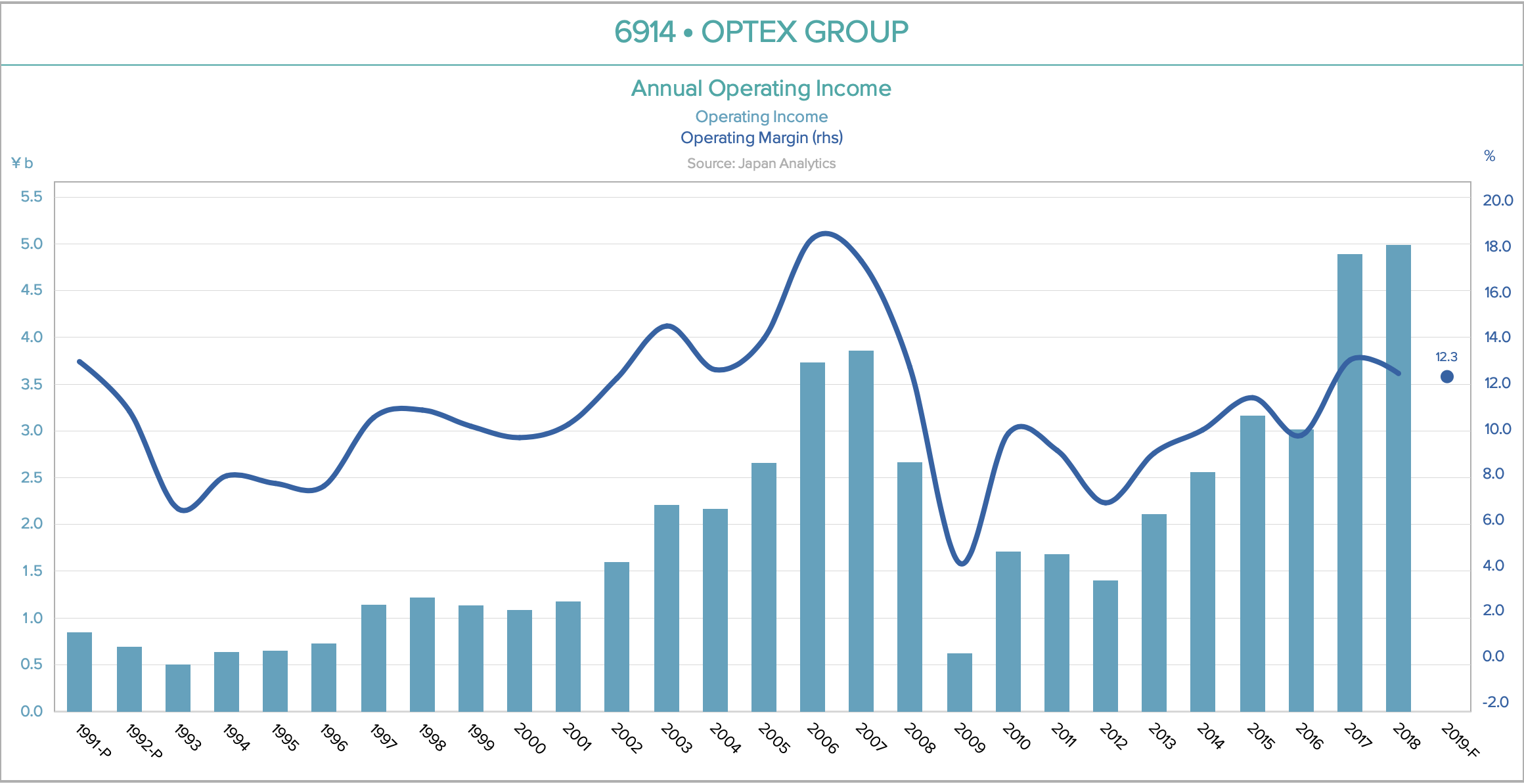

3. Pan Pacific/Don Quijote: Bringing Joy into Shopping

- Japanese Retail is in a secular decline: There are areas in retail that are worse affected than the rest

- Falling foot traffic: The biggest problem for Japanese retail

- Don Quijote’s recent history and growth potential

- Attracting shoppers from multiple store formats helps Don Quijote to expand its target market

- Don Quijote is least affected from slowdown in Chinese tourist spending

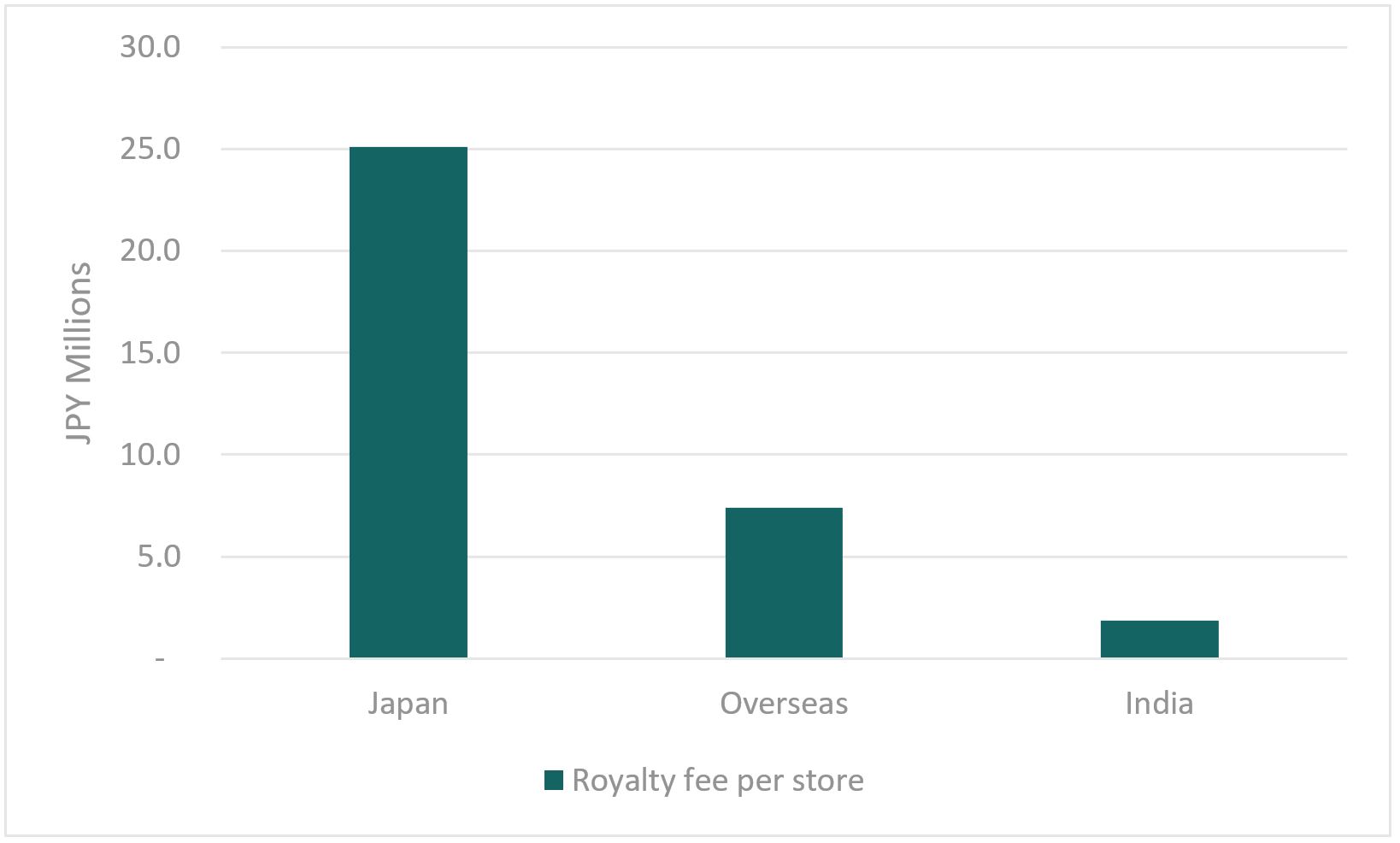

- FamilyMart UNY store conversions to contribute to revenue and EBIT growth over the next five years

- New store openings to cap at 25 per year because of UNY store conversions

- Valuation: Market unjustly penalized Don Quijote for the UNY acquisition

- Change in retail landscape to help make Don Quijote the “DON” in Japanese retail

4. Mercari: Why Mercari Is Likely to Be a Winner in the Cashless Wars

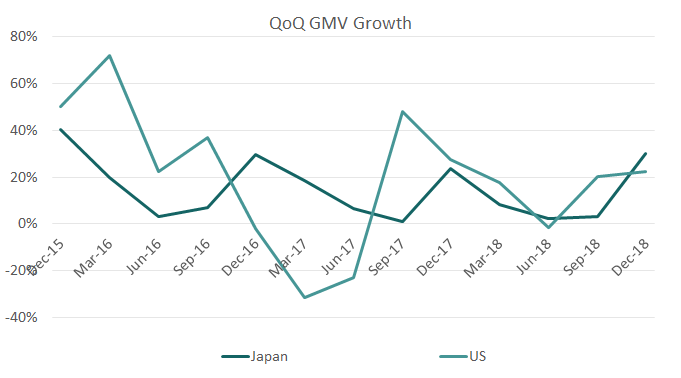

While we have been sceptical about Mercari Inc (4385 JP)‘s efforts in the US, we have always appreciated the domestic business and have only been put off by the rather demanding multiples. After speaking to the company, we continue to like the domestic business and feel that recent initiatives to broaden the user base are likely to be successful. In addition, while we still feel that there are numerous question marks about whether the business model can work in the US, we have come around to a more positive view on the company’s execution there. Lastly, we believe Merpay’s edge in the cashless wars is underappreciated and the fall in the share price is starting to make the stock attractive.

We discuss the details below.

5. Last Week in GER Research: Lyft, Rakuten, Lynas, Yunji IPO, Xinyi IPO and Ruhnn IPO

Below is a recap of the key analysis produced by the Global Equity Research team. This week, we update on Lyft Inc (LYFT US) now that it is below its IPO price and remind of the potentially muted impact for strategic holder Rakuten Inc (4755 JP). On the M&A front, Arun digs into the conditional deal for Lynas Corp Ltd (LYC AU) from Wesfarmers Ltd (WES AU). With regards to IPO research, we initiate on e-commerce player Yunji Inc. (YJ US) and solar company Xinyi Energy Holdings Ltd (1671746D HK) while we update on the IPO valuation of Ruhnn Holding Ltd (RUHN US).

In addition, we have provided an updated calendar of upcoming catalysts for EVENT driven names below.

Best of luck for the new week – Arun, Venkat and Rickin

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.