In this briefing:

- Notes from the Silk Road: Xtep Int’l Holdings (1368 HK): Time to Run (Away) For Now

- Sony Trading Low Just Above Higher Conviction Intermediate Buy Support

- QTT Placement: Liquidity Warrants a Quick Trade

- Zhongliang (中梁地产) Pre-IPO Review – Incredible Growth Bogged Down by Related Party Transactions

- Optex (6914 JP): Factory Automation Slowdown in the Price

1. Notes from the Silk Road: Xtep Int’l Holdings (1368 HK): Time to Run (Away) For Now

Xtep International (1368 HK) has announced a placing and top-up subscription of new shares event, creating a capital base which is 9% larger.

XTEP states that they have considered various ways of raising funds and consider that it would be in their best interests to raise equity funding through the placing and the subscription.

With the share price down 16% since the placement, we examine what this means for the company’s fundamentals and shareholders. We believe the results will prove to be mixed for management and shareholders alike. We highlight how we expect the stock ranking to react, given we the placement was only a few days back and this is yet to reflect. This special situation analysis may surprise you with the conclusions.

2. Sony Trading Low Just Above Higher Conviction Intermediate Buy Support

Sony Corp (6758 JP) is forming a bullish descending wedge/channel that once mature will chisel out an intermediate low with scope to clear medium term breakout resistance. The tactical low near 4,400 lies just above more strategic support.

Clear pivot points will help manage positioning within the bull wedge that is in the final innings.

The tactical buy level is not that far from strategic support with a more bullish macro lean.

MACD bull divergence is not only supportive into near term weakness but also points to a breakout above medium resistance. Risk lies with Sony not looking back after hitting our tactical low target.

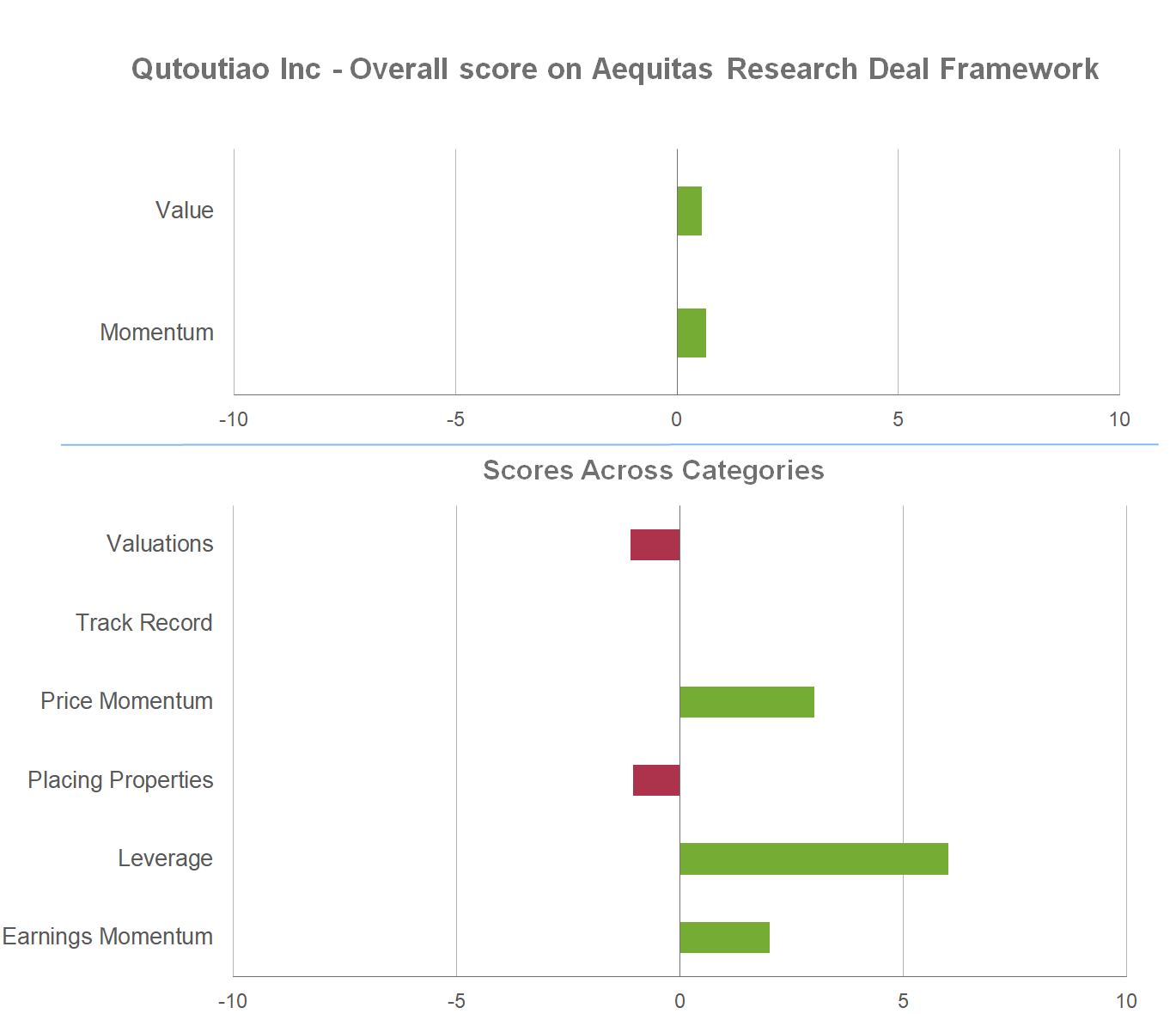

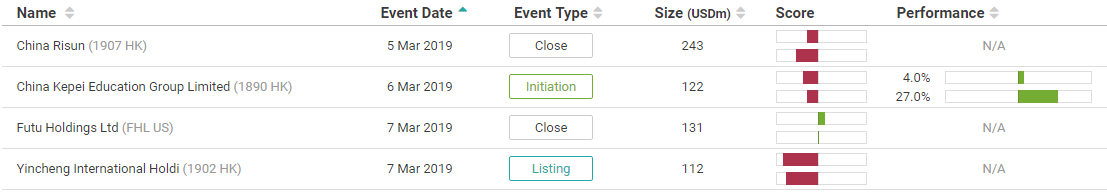

3. QTT Placement: Liquidity Warrants a Quick Trade

Qutoutiao Inc (QTT US) announced a USD 100 million share sales by the company and its shareholders, slightly more than two weeks after the lock-up expiration on March 13th. In this insight, we will provide our quick thought on the deal.

4. Zhongliang (中梁地产) Pre-IPO Review – Incredible Growth Bogged Down by Related Party Transactions

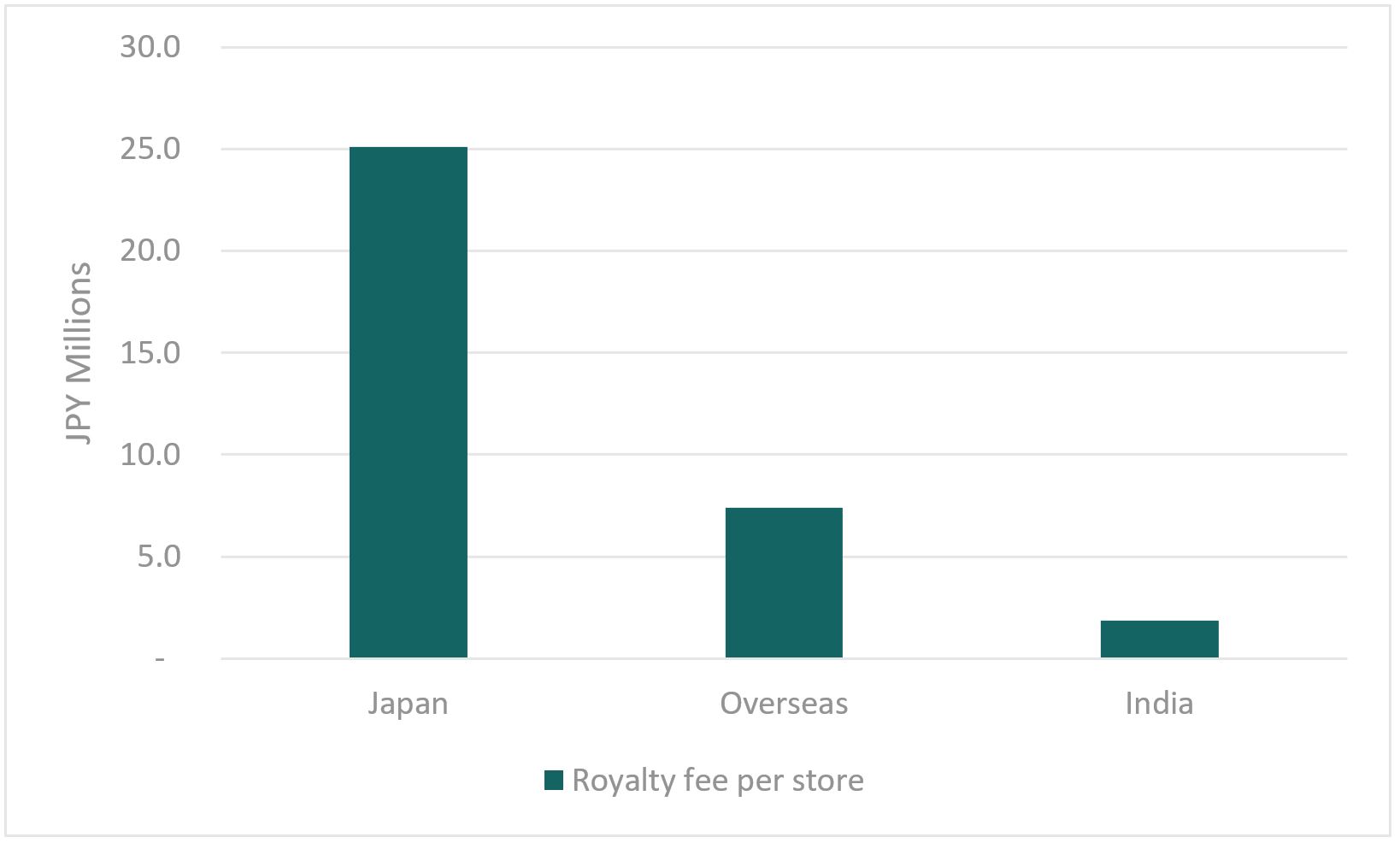

Zhongliang Holdings (ZLH HK) is looking to raise about US$800m in its upcoming IPO.

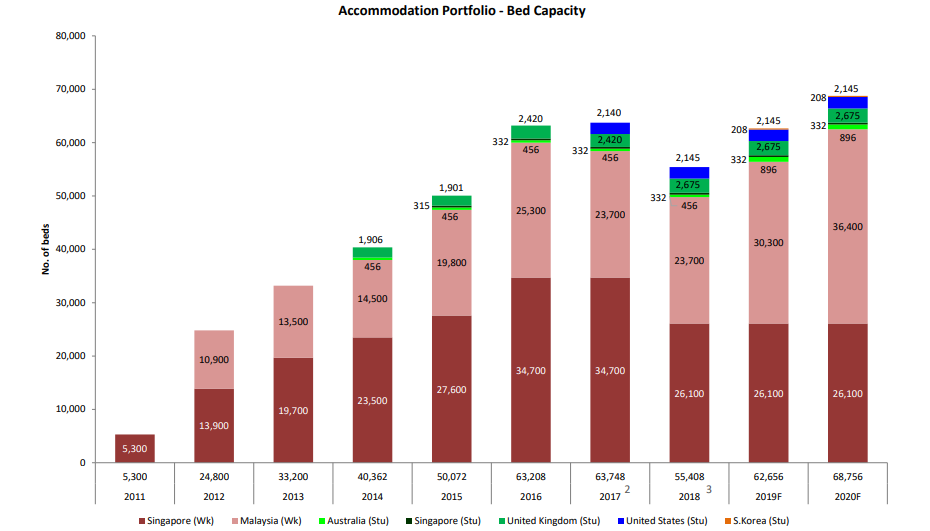

ZLH is a fast-growing real estate developer in China. Its completed projects are mostly in the Zhejiang Province but its projects under development are spread across the country.

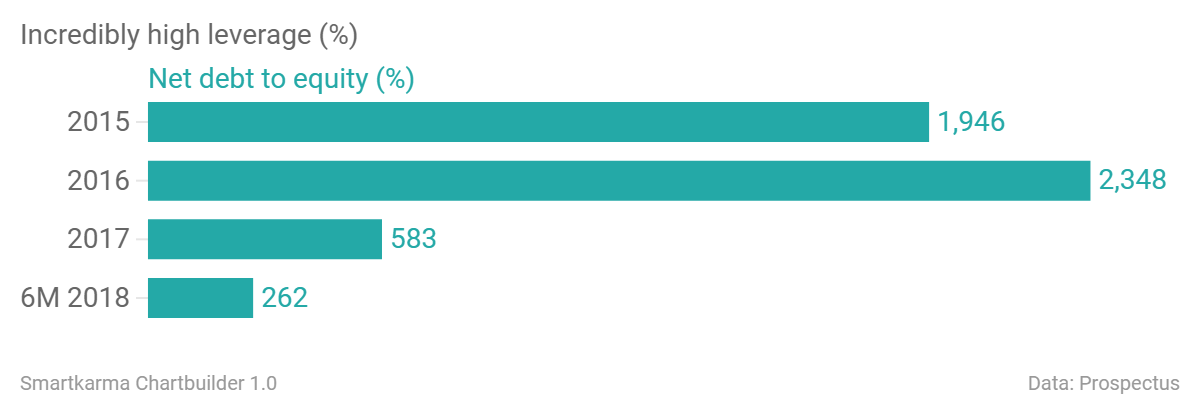

It was highly leveraged in FY2016 as it ramped up its expansion efforts but had been able to reduce it significantly to about 260% net debt to equity levels while effective interest rates on debt has been falling every year.

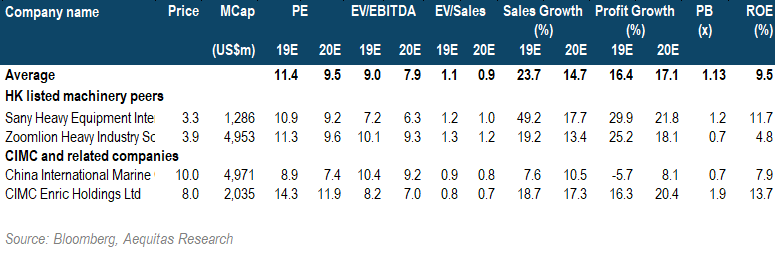

In this insight, we will look at the company’s operations and financials, identify key corporate governance issues, and share our thoughts on peer valuation.

5. Optex (6914 JP): Factory Automation Slowdown in the Price

According to management, weak demand for factory automation sensors had a significant negative impact on sales and profits in 1Q of FY Dec-19. Also, in our estimation, it is likely to cause 1H results to fall short of guidance. But this should be in the share price, which has dropped by nearly 50% from its 52-week high.

In the year to December 2018, operating profit was up only 2.1% on a 7.0% increase in sales, largely due to an increase in machine vision marketing expenses. In January and February 2019, factory automation orders and sales dropped abruptly as customers sought to reduce excess inventories. In March, some new orders were received for delivery in May, indicating that the situation may stabilize in 2H. Demand for security and automatic door sensors continues to grow at low single-digit rates.

For FY Dec-19 as a whole, management is guiding for a 6.2% increase in operating profit on a 7.2% increase in sales. Our forecast is for flat operating profit on a 2% increase in sales. Sales and profit growth should pick up over the following two years, in our estimation, but remain in single digits.

At ¥1,765 (Friday, March 29, closing price), Optex is selling at 18x our EPS estimate for FY Dec-19 and 17x our estimate for FY Dec-20. Over the past 5 years, the P/E has ranged from 13x to 36x. On a trailing 12-month basis, Japan Analytics calculates 5% upside to a no-growth valuation, which is in line with our forecast for this fiscal year. This suggests: buy either for the bounce or for the long term.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.