In this briefing:

- Nissan Governance Structure Report Out: Fog Dissipating Slowly. Sunny in Summer. Storms Next Winter?

- A Reality Check for Money Forward (3994 JP): Key Takeaways from Our Recent Visit

- Small Cap Diary: Rajthanee Hospital, CAZ

- New J Hutton – Exploration Report (Weeks Ending 22/03/22)

- Cupid Ltd: Attractive Valuation Post Significant Correction

1. Nissan Governance Structure Report Out: Fog Dissipating Slowly. Sunny in Summer. Storms Next Winter?

Six weeks ago I wrote that Nissan’s governance outlook was “Foggy Now, Sunny Later.” I said “Governance changes are afoot, with a steady flow of developments likely coming in March, April, May, and June.”

The last couple of months have seen numerous media articles about the process of Nissan Motor (7201 JP) and Renault SA (RNO FP) rebuilding their relationship. There have been visits to Tokyo by Renault’s new chairman of the board of directors Jean-Dominique Senard, and visits to Paris and Amsterdam by the CEOs of Nissan and Mitsubishi Motors (7211 JP).

There have been many suggestions in French and European newspapers in the interim that Jean-Dominique Senard would be the obvious choice as a representative director of Nissan. There have been other articles out there in the Japanese press suggesting what conclusions the committee might come to as to what outcomes should result. The difference is notable. The French side still wants control. The Japanese/Nissan/committee side sees the need to fix governance.

Today there was a report in the FT suggesting that Renault “wants” to restart merger talks with Nissan and “aims to restart merger talks with Nissan within 12 months.” It should be noted that these two sentences are not exactly the same. It may still be that France wants Renault to do so, and therefore Renault aims to do so. The same article revealed past talks on Renault merging with FCA but France putting a stop to it and a current desire to acquire another automaker – perhaps FCA – after dealing with Nissan.

Also today, the long-awaited Nissan Special Committee for Improving Governance (SCIG) report was released. It outlines some of the issues of governance which existed under Ghosn- both the ones which got him the boot, and the structural governance issues which were “discovered” after he got the boot.

There are clear patches in the fog. Two things shine through immediately.

- Governance weaknesses under Ghosn were inexcusably bad. Worse than previously reported.

- The recommendations to the board now are, on the whole, pretty decent. Some are sine qua non changes – formation of nomination and compensation committees, whistleblower reporting to the audit committee and not the CEO, and greater checks and balances. Some are stronger in terms of the independence of Nissan from Renault: the committee recommends a majority of independent board members, an independent chairman, and no representative directors from Renault, Mitsubishi, or principal shareholders.

There are, however, other issues which were not addressed, which for Nissan’s sake probably should be addressed. Yesterday was a first step on what will be a 3-month procession of news about the way Nissan will address the SCIG report’s recommendations, the process by which it will choose new directors when it does not have an official nomination committee, and the AGM in June to propose and confirm new directors. Then they will start their jobs in July.

The fog looks to lift slowly. And one may anticipate some better weather beyond. But business concerns remain a threat, and while relations appear to be getting better after the departure of Carlos Ghosn and the arrival of Jean-Dominique Senard, it is not clear that a Franco-Japanese storm is not brewing in the distance.

More below.

2. A Reality Check for Money Forward (3994 JP): Key Takeaways from Our Recent Visit

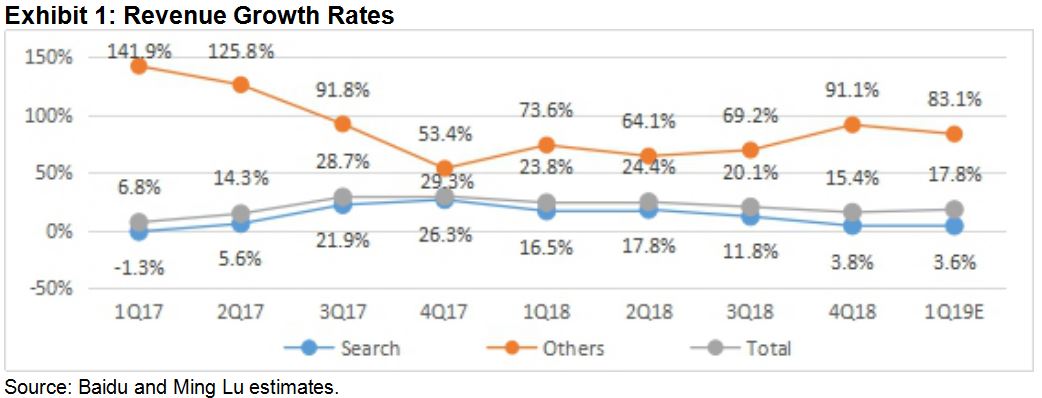

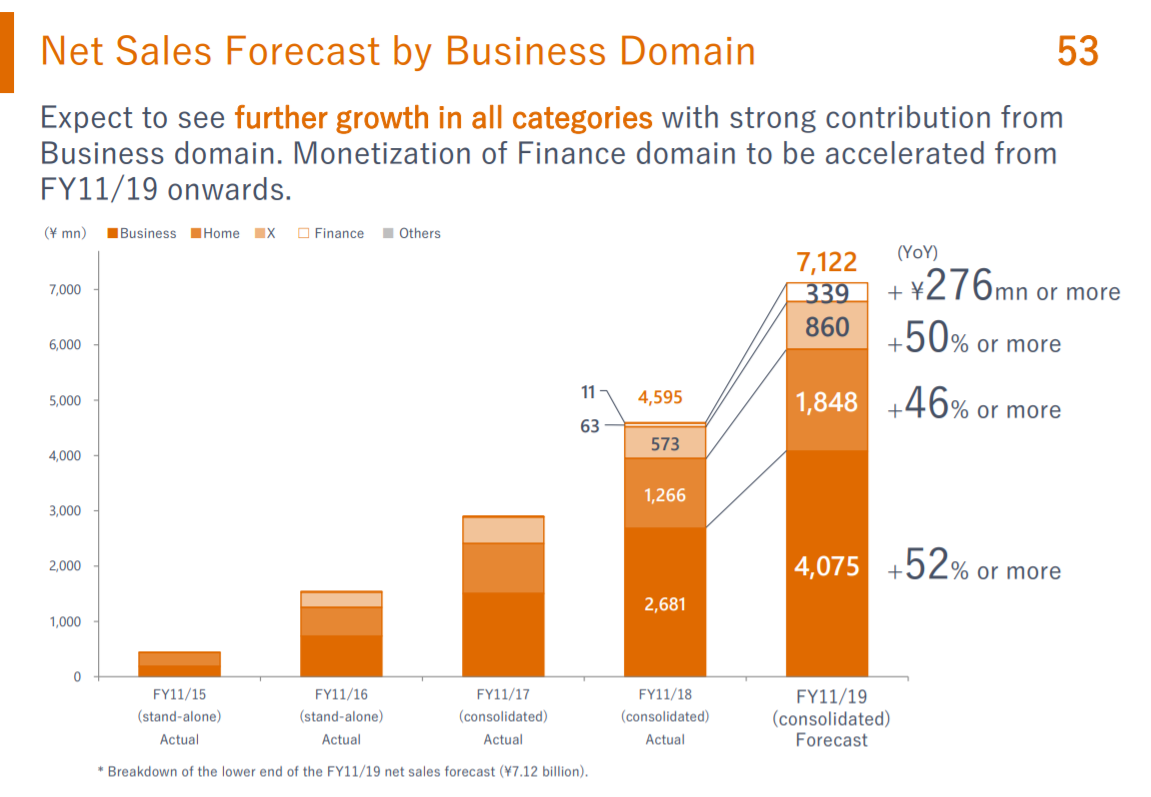

In our previous note, Money Forward (3994 JP): Solid Mid-Term Prospects for the Fintech Pro, but Overvalued, published July last year (2018), we suggested that Money Forward (3994 JP) (MF) was overvalued despite its strong growth profile. MF’s share price, which was at an all-time high (close to JPY6,000) around this time, fell below its IPO price (JPY3,000) in December, reinforcing our bearish view.

Since then, Money Forward’s share price has picked up (closing at JPY4,400 on 26th March 2019), on the back of strong topline guidance for FY11/19E (+55%-65% YoY growth) and “aggressive” medium-term profit targets (positive EBITDA by FY11/21E).

However, following our recent conversation with MF’s IR team, we believe that the above guidance needs to be slightly toned down.

3. Small Cap Diary: Rajthanee Hospital, CAZ

We visited two small-cap companies from totally different industries today. These are the key highlights.

- Rajthanee Hospital, a small hospital chain based in Ayuthya, achieved 15.7% revenue growth CAGR since 2016 on the back of its proximity to industrial estates.

- CAZ has seen its backlog double to Bt2.5bn largely due to its good relations with major clients (PTT) and partners (Samsung and other Korean chaebol), which dole out projects in the oil & gas sector to it.

- Internally, CAZ follows a sophisticated cost control method sporting bar codes and GPS to track materials and dedicated cost-control staff.

4. New J Hutton – Exploration Report (Weeks Ending 22/03/22)

- Uranium Price has fallen 7% over the past two months

- Actively looking for uranium short positions

- Provide summarised watch list

- Wisdom from Samuel Longhorne Clemens

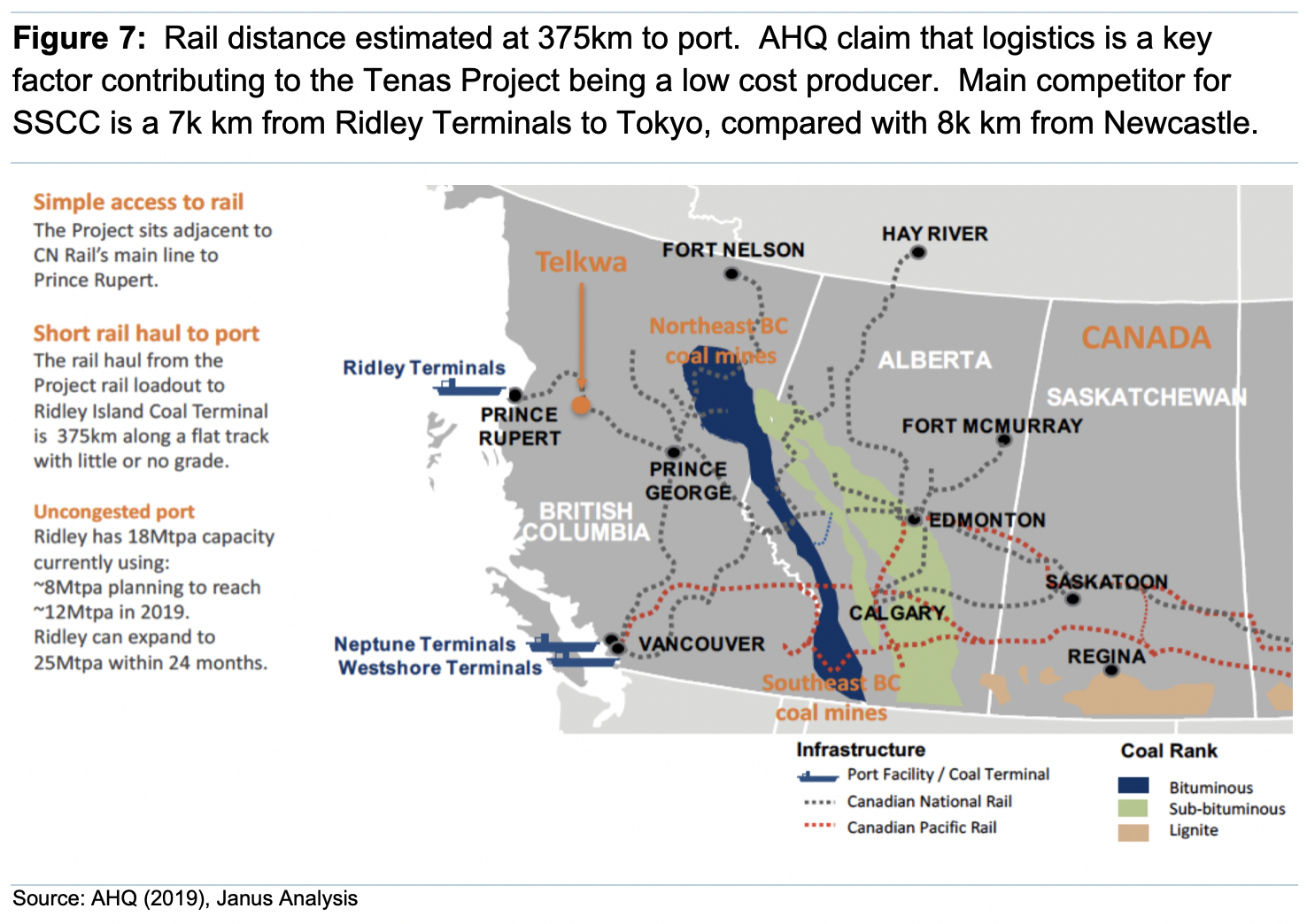

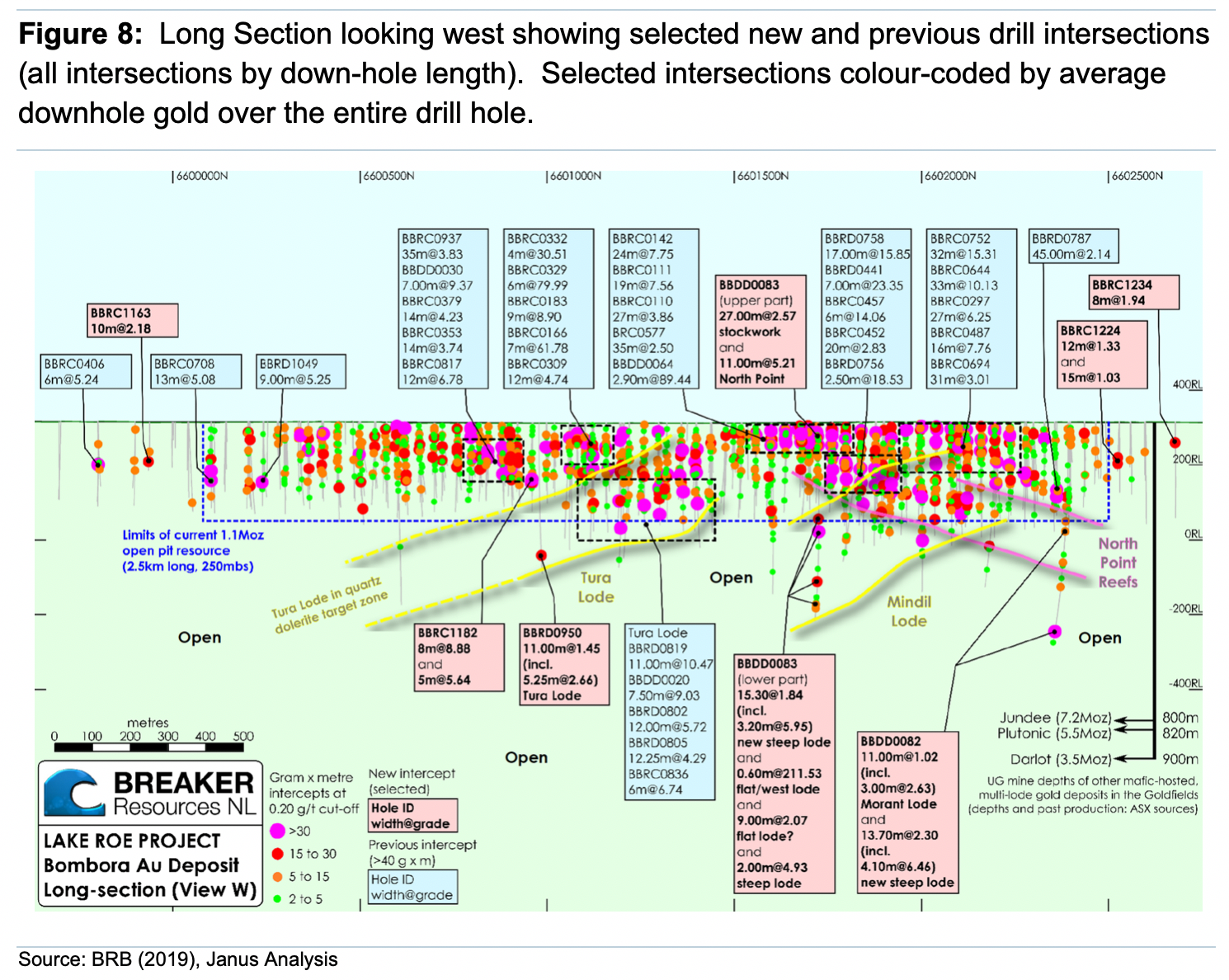

- Yellow Cake PLC (YCA LN), Berkeley Energy (BKY AU), Cameco Corp (CCO CN), Kazatomprom Natsionalnaya At (KZAP KZ), Jangada Mines PLC (JAN LN), Europa Metals Ltd (EUZ LN), Buxton Resources (BUX AU), Musgrave Minerals (MGV AU), Myanmar Metals (MYL AU), Archer Exploration (AXE AU), Canyon Resources (CAY AU), Catalyst Metals (CYL AU), Core Exploration (CXO AU), Exore Resources (ASX: ERX), Stavely Minerals (SVY AU), Tietto Minerals Ltd (TIE AU), Horizonte Minerals PLC (HZM LN), Bellevue Gold (ASX: BGL), Allegiance Coal (AHQ AU), First Au (ASX: FAU), Base Resources (BSE AU), Breaker Resources Nl (BRB AU)

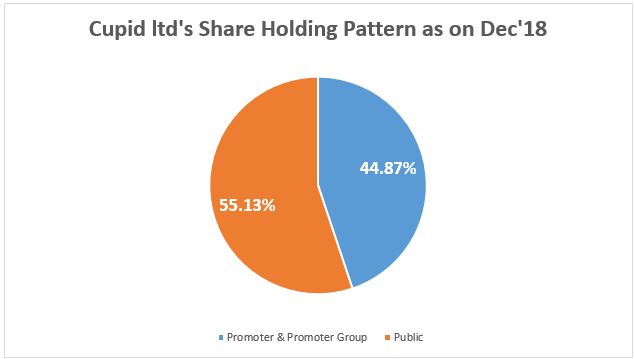

5. Cupid Ltd: Attractive Valuation Post Significant Correction

Cupid Ltd one of the largest manufacturers of condoms in India 9MFY19 revenue was largely as per our expectations, as there was some order slippages. As forecasted in our initiation report Cupid Ltd: Protecting the Needy, the company reported a 20% decline in revenue at Rs 505mn, which also resulted in lower profitability both at the operating as well as net level. EBITDA stood at INR 161.6 mn declining by 32.53% with EBITDA margin at 31.95%. PAT was INR 108.5 mn declining by 24.58% with PAT margin at 21.46%.

Despite this below-par performance in the 9MFY19, we are fairly positive on the future growth prospects of the company. As of March 2019, it has a healthy order book of INR 1300 m with Book to Bill ratio of 1.99 times on its TTM sales. We expect revenues to grow at 15% over FY18-19 and margins to improve in medium to long term horizon.

Having corrected by 67% from its peak, the stock currently trades at 10.20x its FY19 EPS and 8.34x its FY20 EPS; we believe that this provides a good entry point for this niche high margin healthcare company with attractive long term growth possibilities.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.