In this briefing:

- Baidu (BIDU): Stagnant in 4Q18, Wrong Change Feeds a 24% User Increase to Google

- Continuing Positive Outlook for Last Mile Industrial Real Estate Supports New Financings Globally

- Jcontentree (2nd Largest Korean Drama Production Firm): Three Key Catalysts

- IQiyi (IQ): In 4Q18, Baidu’s Growth Engine Lost Control Over Content Cost

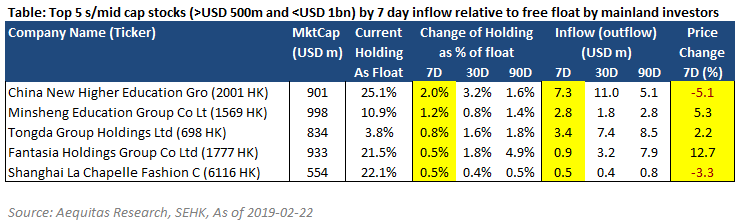

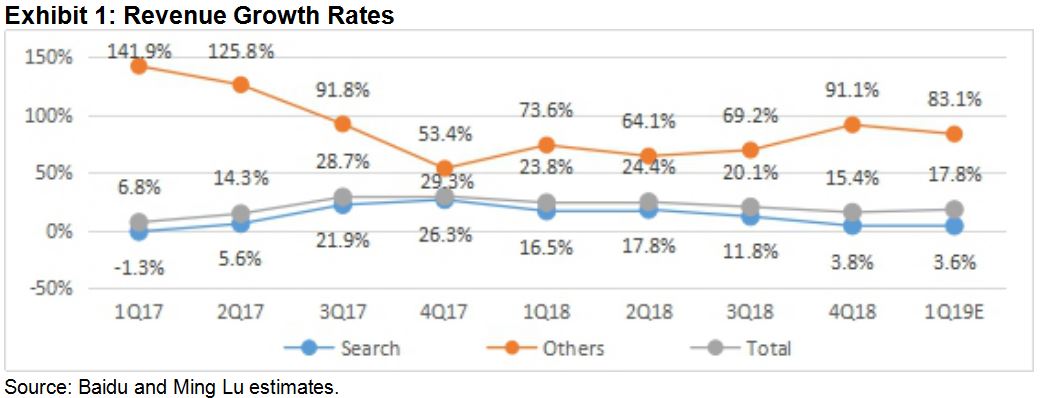

1. Baidu (BIDU): Stagnant in 4Q18, Wrong Change Feeds a 24% User Increase to Google

- Baidu posted a weak result for 4Q2018.

- We believe it is a wrong decision to change Baidu into an in-house search engine.

- Alphabet Inc Cl C (GOOG US) ’s monthly active users in mainland China increased 24% QoQ in January 2019.

- We believe Baidu’s stock price has been fairly impacted.

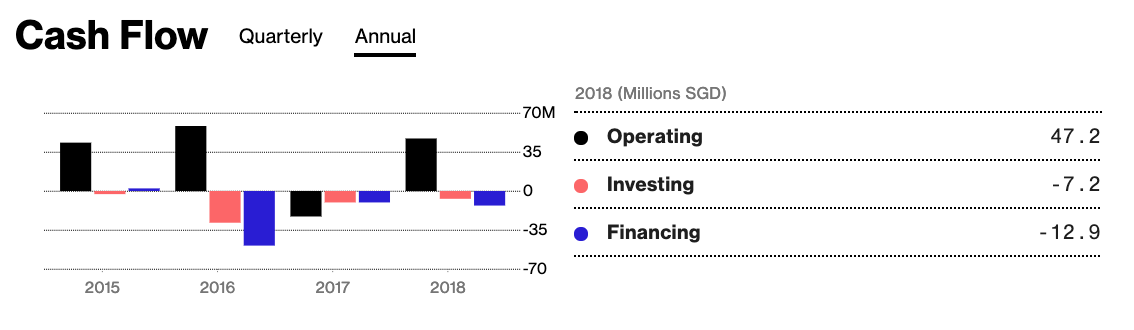

2. Continuing Positive Outlook for Last Mile Industrial Real Estate Supports New Financings Globally

- We published a series of Insights explaining our positive outlook for the industrial segment of the global Real Estate sector.

- Currently, companies in this segment are capitalizing on strong fundamentals to raise new equity capital. They are using the proceeds from these deals to fund property acquisitions and developments, and to deleverage their balance sheets, thereby setting the stage for continuing growth.

- This trend is especially notable because it is taking place in a range of geographic locations, around the world.

3. Jcontentree (2nd Largest Korean Drama Production Firm): Three Key Catalysts

Jcontentree Corp (036420 KS) is the second largest drama production firm in Korea after Studio Dragon (253450 KS). The company has three key catalysts that could positively impact its share price in the next 6-12 months:

- Expansion of OTT Service by the Global Giants – One of the most favorable investment themes in the next several years is the tremendous growth of the global OTT services by global giants such as Netflix, Disney, and Amazon. These giants want to provide the very best contents that could be popular on a global basis and the Korean dramas have been becoming increasingly popular all over the world and Jcontentree should also be one of the key beneficiaries of this trend.

- IPO of Megabox – The company also has a controlling stake in Megabox Joongang, which is the third largest movie theater chain in Korea. On February 19th, 2019, Jcontentree sent a RFP to eight securities firms for the IPO of Megabox. The company will soon finalize the securities firms for the IPO and plans to complete the IPO in 1H 2021. Various media have estimated the value of Megabox to be around 700 billion won or more.

- Korean dramas may be re-aired in China in 2019 – The Korean dramas were blocked in China in the past two years but there are some cautious optimism that the Chinese regulators will allow some of the Korean dramas to air in 2019.

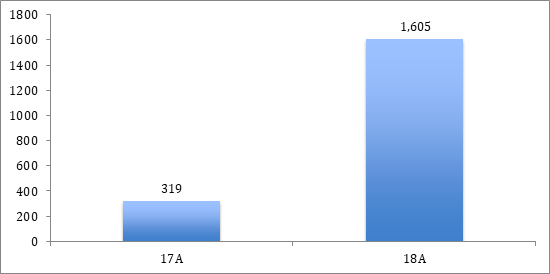

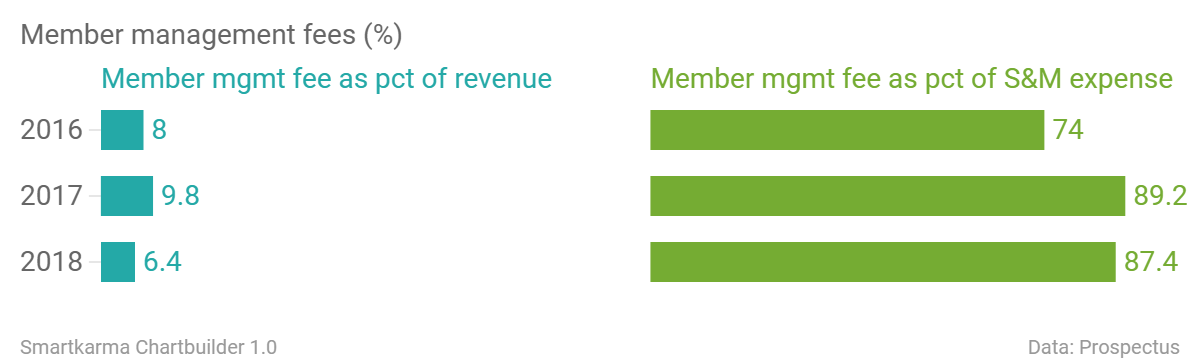

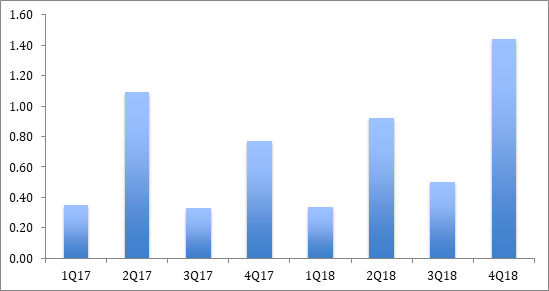

4. IQiyi (IQ): In 4Q18, Baidu’s Growth Engine Lost Control Over Content Cost

- We notice that the growth rate of cost of revenues exceeded the growth rate of membership revenues.

- We believe that the margins will continue to decline even if the advertising business recovers.

- IQ has the largest monthly active users in the video market, but it does not have an obvious advantage over Tencent Holdings (700 HK) .

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.