In this briefing:

- NIO’s (蔚来) Guidance Makes Selling upon Lock-Expiry More Compelling

- Ctrip (CTRP): Overcame Two Difficulties in Q4, But Market Over-Reacted to “Global No. 1”

- Polycab IPO: Largest Cables Player, Asset-Heavy Low ROE Model = Vulnerable to Govt Capex Slowdown

1. NIO’s (蔚来) Guidance Makes Selling upon Lock-Expiry More Compelling

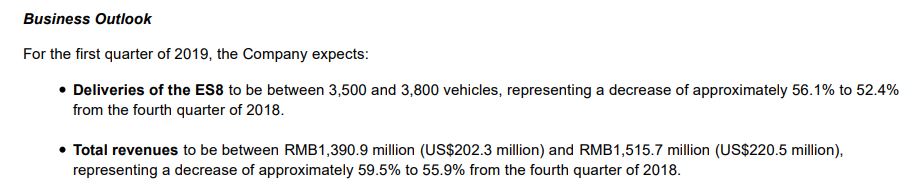

NIO Inc (NIO US) fell 17% in its after-hour trading session post announcement of its Q4 results. The company turned a gross profit in Q4 while the number of cars delivered in the full year 2018 was 11,348 has beaten their own 10,000 cars target. The company is currently trading 62% above its IPO price.

However, the worrying part lies in its guidance which could mean that pre-IPO investors have more compelling reasons to lock-in some profits upon lock-up expiry.

2. Ctrip (CTRP): Overcame Two Difficulties in Q4, But Market Over-Reacted to “Global No. 1”

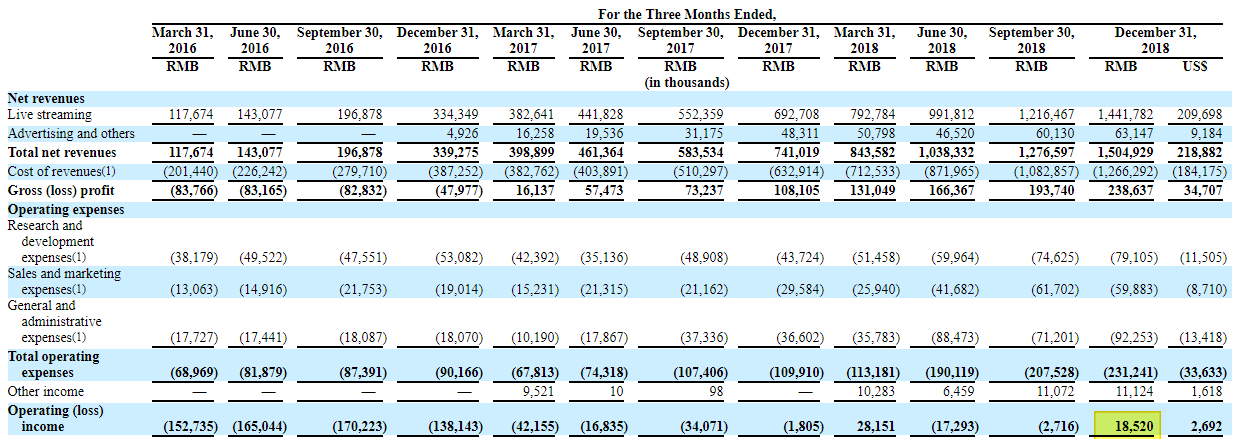

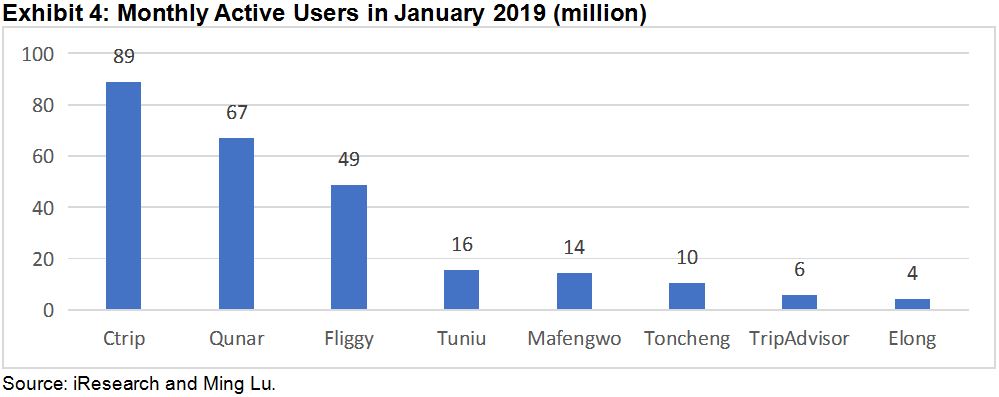

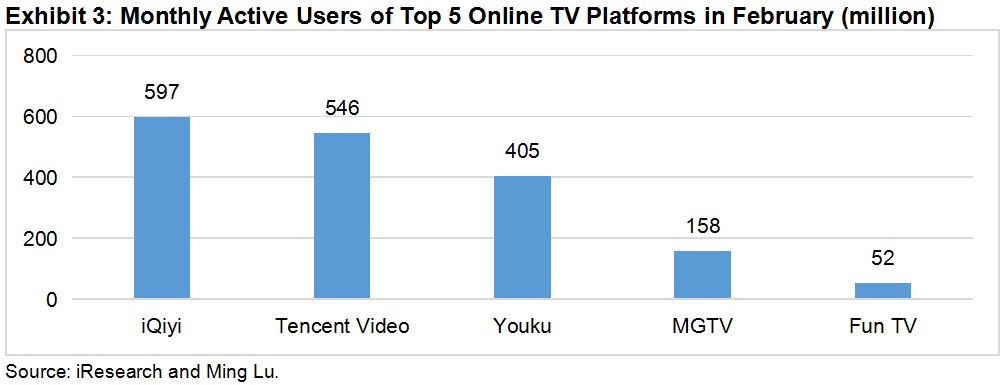

* The recovery in 4Q2018 shows that CTRP has already survived the new law and the new competitor in 2018.

* We believe EPS will grow 12% in 2019.

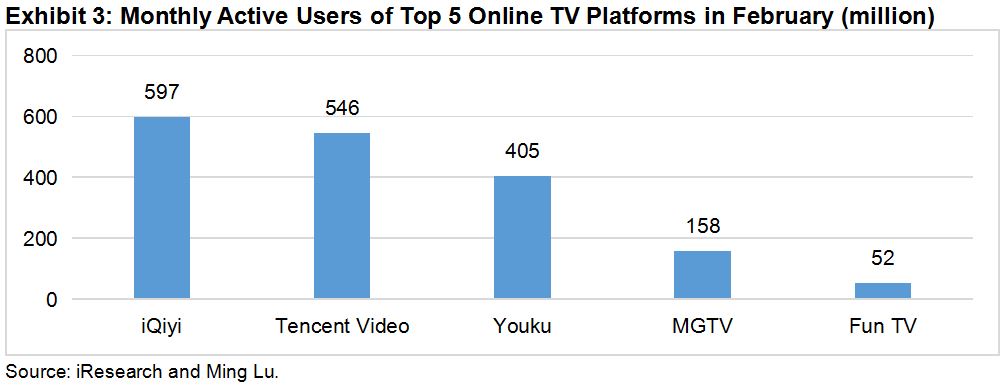

* However, we believe the market has already over-reacted to the news last November that CTRP became the largest online travel agency.

* We set a target price of USD23.80, which is 32% below the market price.

3. Polycab IPO: Largest Cables Player, Asset-Heavy Low ROE Model = Vulnerable to Govt Capex Slowdown

- Polycab India (POLY IN) is the largest wires and cables manufacturer in India almost 2x the size of its next largest competitor. It is also present in electrical consumer durables and EPC projects.

- Company’s 14% revenue Cagr over FY14-18 was aided by government’s increased capex in rural and railway electrification.

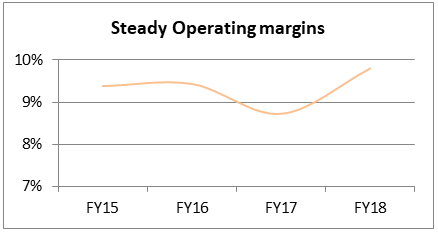

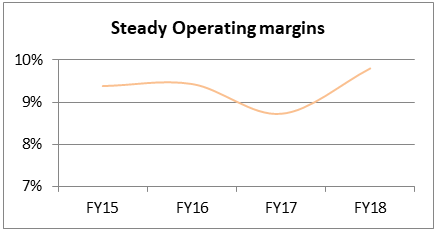

- Despite large B2B exposure, company managed to defend gross margins over FY15-18 by passing on input cost variations to its customers. Operating margins have also been steady on the back of improving margins in the key wires and cables segment.

- High B2B nature of business results in 90+days of working capital cycle. Business is capex heavy (annual run rate Rs2.4bn over FY15-18). Company has the lowest asset turnover among its listed peers. It also generates the lowest amount of free cashflows among its peers.

- Investing most of the operating cash in the business would have been great if company was generating healthy ROE. But company’s ROE is in the sub 15% range and it would fall further after the planned Rs5bn primary issue.

- The asset-heavy and low ROE model makes Polycab more dependent on earnings growth to drive stock performance. This, in turn, makes it more vulnerable to any slowdown in government capex in electrification compared to peers.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.