In this briefing:

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Relaunched at Lower Price

- Gold May Rise on Lower Real Ylds; Canada Leads Fall in Real Ylds; Aust Inflation Expectations Slump

- RRG Weekly – Fed Highlights Headwinds – Greece Greases Growth – Thai Election Sun Too Close to Call

- Is There Still a Bright Future for FutureBright?

- Up Fintech (Tiger Brokers) IPO Trading Update – First Day Volume Was Higher than Futu, Close to QTT

1. Dongzheng Auto Finance (东正汽车金融) IPO Review – Relaunched at Lower Price

Dongzheng Automotive Finance (2718 HK) (DAF) re-launched its IPO at a lower fixed price of HK$3.06 per share, expecting to raise about US$208m. We have covered the fundamentals and valuation of the company in:

- Dongzheng Auto Finance (东正汽车金融) Pre-IPO Review – Dependent on Dealership Network for Growth

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Better off Buying the Parent

In this insight, we will only look at the company’s updated valuation and re-run the deal through IPO framework.

2. Gold May Rise on Lower Real Ylds; Canada Leads Fall in Real Ylds; Aust Inflation Expectations Slump

- The broad decline in global bond yields and curve flattening suggest that the market has become more concerned about weak global economic growth.

- The fall in yields is at odds with the rise in equity and commodity prices this year, but the later may have lost upward momentum.

- Safe haven currencies, gold and JPY, have strengthened this week and are likely to perform well if yields remain low.

- US real yields have fallen more than nominal yields this year, with a partial recovery in inflation expectations from their fall in Q4 last year. Lower real yields point to weaker fundamental support for the USD, and further support safe havens like gold.

- Canadian real long term yields have fallen more abruptly than in the USA, into negative territory, suggesting the outlook for the Canadian economy has deteriorated more than most. This may relate to concern over a peaking in the Canadian housing market. The fall in real yields suggests further downside risk for the CAD.

- Long term inflation breakevens have fallen in Australia sharply since September last year to now well below the RBA’s 2.5% inflation target.

- Australian leading indicators of the labour market have turned lower, albeit from solid levels, and may be enough, combined with broader evidence of weaker growth, for the RBA to announce an easing bias as soon as April.

- Asian trade data and flash PMI data for major countries point to ongoing and significant weakness in global trade.

3. RRG Weekly – Fed Highlights Headwinds – Greece Greases Growth – Thai Election Sun Too Close to Call

- US: Fed Sees Tailwinds from Global Growth Shifting to Headwinds from China and Europe.

- Greece: Growth supported by ‘Golden Visa’ (5-year visa for investing 250,000 Euro) and strong tourism arrivals. 2.3% GDP in 2020.

- Thailand: Sunday election between Shinawatra-linked Pheu Thai Party and military backed Palang Pracharat Party. Too close to call.

- Brazil: Former Brazilian President Michel Temer has been arrested in São Paulo as part of the Car Wash corruption investigation. Brazil stocks fell on the news.

4. Is There Still a Bright Future for FutureBright?

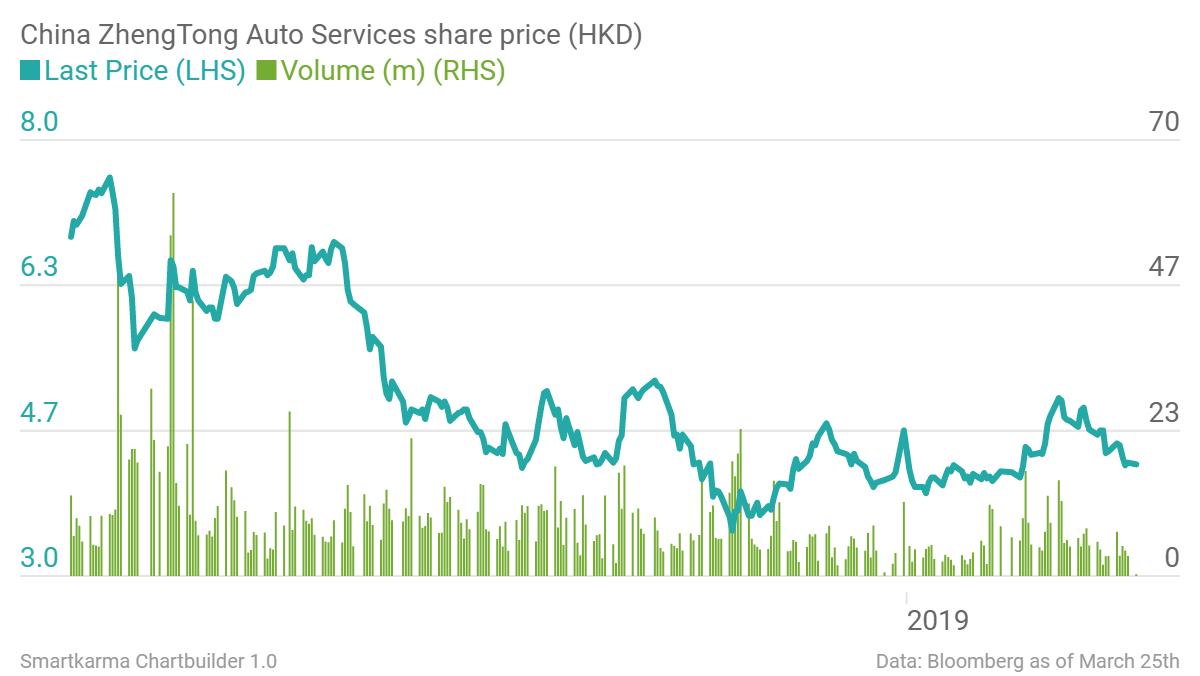

Almost 12 months after posting our initial thesis on Future Bright Holdings (703 HK)Gambling on a Bright Future, we review FutureBright’s most recent results, raising questions on whether stalling improvement in the core restaurant business performance warrants taking chips off the table while waiting for key catalysts to materialise.

5. Up Fintech (Tiger Brokers) IPO Trading Update – First Day Volume Was Higher than Futu, Close to QTT

Up Fintech (TIGR US)‘s IPO was priced at US$8/share, above its range of US$5-7/ADS raising at total of US$111m, including the proceeds from the private placement with Interactive Brokers Group, Inc (IBKR US).

In my earlier insights, I looked at the company’s background, past financial performance, scored the deal on our IPO framework and compared it to Futu Holdings Ltd (FHL US):

- Futu Holdings IPO Quick Note – Comparison with Tiger Brokers – Same Market, Different Economics

- Up Fintech (Tiger Brokers) Pre-IPO Quick Note – Much Too Reliant on IBKR

- Up Fintech (Tiger Brokers) IPO Quick Take – It’s Not like Futu, Won’t Perform like It Either

In this insight, I will re-visit some of the deal dynamics, comment on share price drivers and provide a table with implied valuations.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.