In this briefing:

- Hopewell’s Egregiously Bad Offer, But What Can You Do?

- Yincheng Intl (银城国际) IPO Quick Note: A Highly Levered Nanjing Developer Bet

- Another US LNG Project Goes Ahead: Positive for the Contractors; Negative for Others Looking to FID

- NextDecade’s Oil-Linked Contract Offering Signals More Hurdles Ahead for US LNG Project Developers

- ECM Weekly (23 February 2019) – Futu, CStone, Dexin, New Century, AB InBev, MabPharma

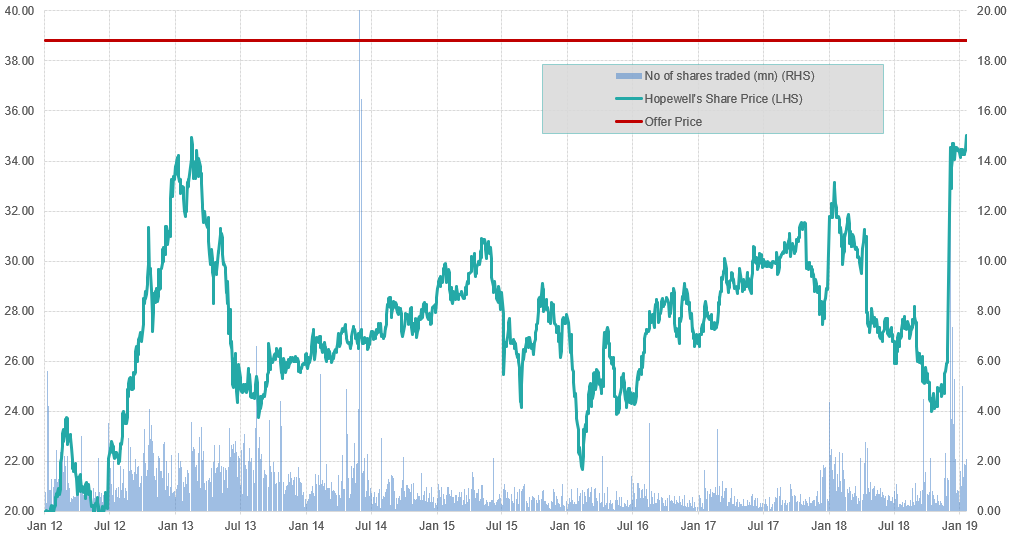

1. Hopewell’s Egregiously Bad Offer, But What Can You Do?

The Scheme Document for the privatisation of Hopewell Holdings (54 HK) has been dispatched. The court meeting will be held on the 21 March. The consideration will be paid (on or before) the 14 May. The IFA (China Tonghai Capital) considers the $38.80/share Offer to be fair & reasonable. The Scheme is conditional on ≥75% for, ≤10% against from disinterested shareholders. As Hopewell is HK-incorporated, there is no “head count ” test. The full timetable is as follows:

Date | Data in the Date |

6-Dec-18 | Announcement |

24-Feb-19 | Scheme document |

13-Mar-19 | Last time for lodging shares to qualify to vote |

15-Mar-19 | Meeting record date |

19-Mar-19 | Court/EGM meeting |

2-May-19 | Effective date |

14-May-19 | Cheques dispatched |

Substantial Shareholders | Mn | % |

The Wu family & concert parties | 320.7 | 36.93 |

Non-consortium Offeror concert parties | 31.7 | 3.65 |

Total | 352.5 | 40.48 |

Disinterested Shareholders | 516.1 | 59.42 |

After hearing conflicting opinions on what constitutes a blocking stake, a chat with the banker confirmed the blocking stake, as per the Companies Ordinance, is tied to 63.07% of shares out (i.e. Scheme shareholders – see page 95); whereas the Takeovers Code is tied to 59.42% of shares out. Effectively there are two assessments on the blocking stake and the more stringent (the 59.42% out in this case) prevails.

With the Offer Price representing a 43% discount to NAV, wider than the largest discount precedent in past nine years (the Glorious Property (845 HK) offer, which incidentally was voted down), the IFA creatively argues that extenuating factors such as the premium to historical price needs to also be taken into account. Hardly original, but that is where investors must decide whether this is as good as it’s going to get – given the Wu family’s control, there will not be a competing offer – or to hold out for a superior price longer term. This is a final offer and it will not be increased.

What the IFA fails to discuss is that the widest successful discount to NAV privatisation was 29.4% for New World China Land (917 HK) in 2016. And all precedent transactions (successful or otherwise) are PRC (mainly) property development related; except for Wheelock which operated property in Hong Kong (like Hopewell) and in Singapore, which was privatised at a 12.1% discount to NAV.

Therein lies the dilemma – what is a fair and reasonable discount to NAV for a Hong Kong investment property play? With limited precedents, it is challenging to categorically reach an opinion. And that is the disingenuous conclusion from the IFA that the premium to last close and with reference to historical pricing, is in effect the overriding reason to conclude the Offer is reasonable. I would argue the Wu family has made a low-ball offer for what is essentially an investment property play with quantifiable asset value.

A blocking sake is 5.9% or 51.6mn shares. First Eagle, which recently voted down the Guoco Group Ltd (53 HK) privatisation that was pitched at a ~25% discount to NAV, holds 2.7% (according to CapIQ).

Trading at a wide gross/annualised return of 7%/37.5%, reflecting the risk to completion, and the significant downside should the scheme be voted down. Tough one – the premium to last close and with reference to the 10-year price performance, should be sufficient to get it over the line, and the basis for this “bullish” insight. But only for the brave.

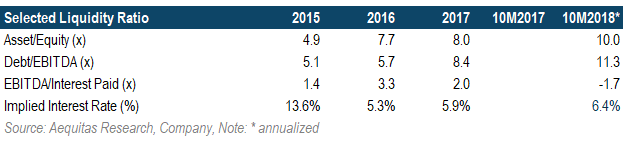

2. Yincheng Intl (银城国际) IPO Quick Note: A Highly Levered Nanjing Developer Bet

Yincheng International, a China Yangtze delta focused property developer, is raising up to USD 110 million to list on the Hong Kong Stock Exchange. In this note, we will cover the following topics:

- The company’s property portfolio

- Financial performance that concerns us

- Shareholders and use of proceeds

- Our view on the deal

3. Another US LNG Project Goes Ahead: Positive for the Contractors; Negative for Others Looking to FID

US private LNG company Venture Global is starting construction on its 10 million ton per annum (mtpa) US LNG export facility in Louisiana after gaining approval from the US Federal Energy Regulatory Commission (FERC). This is positive for the LNG contractor market and we discuss the companies involved in the project.

This follows final investment decision taken on Golden Pass (Exxon and Qatar Proceed with US$10bn Golden Pass LNG Terminal: Positive for Chiyoda and MDR US) and supports our thesis of a large wave of new projects that will be sanctioned in the coming months (A Huge Wave of New LNG Projects Coming in the Next 18 Months: Positive for The E&C Companies). This was viewed as a relatively speculative project and with aggressively low cost and timing estimates.

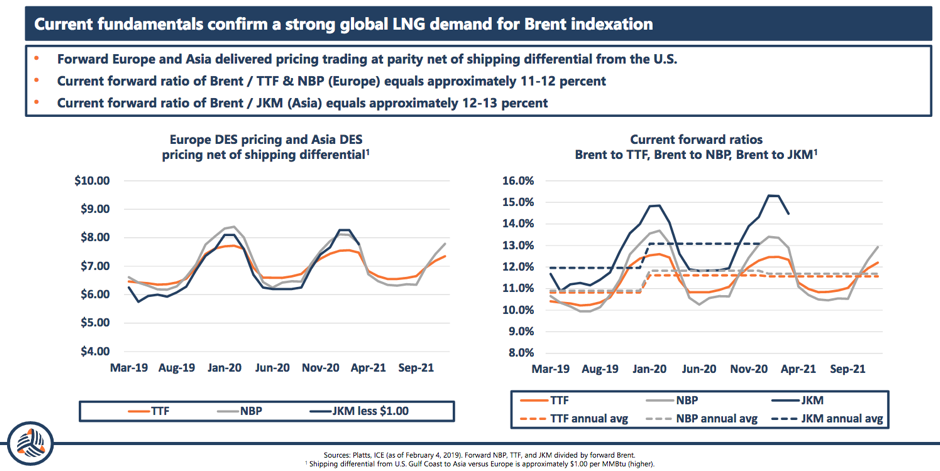

4. NextDecade’s Oil-Linked Contract Offering Signals More Hurdles Ahead for US LNG Project Developers

NextDecade Corp (NEXT US) recently announced that it started offering long-term contracts indexed to the crude Brent in order to attract more LNG buyers. This follows the agreement reached by Tellurian Inc (TELL US) with Vitol back in December to index a long term contract with the Asian LNG price benchmark JKM. While typically US LNG projects are indexed to the Henry Hub, declining crude oil and LNG prices seem to have diminished the appeal of the Henry Hub pricing compared to the oil indexation. This insight takes a look at the latest trends in the LNG markets to assess which companies are taking the lead in the race to bring to FID in 2019 their proposed LNG projects.

Exhibit 1: NextDecade adds Brent indexation to its commercial offering

5. ECM Weekly (23 February 2019) – Futu, CStone, Dexin, New Century, AB InBev, MabPharma

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Starting with listings in Hong Kong next week, CStone Pharma (2616 HK) and Dexin China Holdings (2019 HK) will list on the 26th of February. Dexin is said to have priced at the mid-point of its price range while CStone is priced above its mid-point.

We also heard that Haitong Unitrust International Leasing was given the green light by CSRC for its Hong Kong IPO. The company had previously re-filed its draft prospectus in September last year. Shanghai Dongzheng Automotive Finance has also received approval from CSRC for its IPO.

There had also been a small property developer, YinCheng, that had launched its US$100m IPO. Jinxin Fertility had also just filed its draft prospectus with the HKEX.

Back in the US, we are hearing that Futu Holdings Ltd (FHL US) could be starting its bookbuild as early as next week. Sumeet Singh had previously analyzed the company in his insight, Futu Holdings Pre-IPO – Great Metrics but in a Commoditised Industry, and he will be following up with another insight next week.

In Japan, there is an Aruhi Corp (7198 JP) placement in which Carlyle looking to sell their entire stake in the company. Sumeet Singh had covered in Aruhi Placement – Bigger than the IPO but Good Track Record and Price Performance Should Help. The placement would be more attractive if it corrects down over the next few days but the removal of overhang from Carlyle seemed to be very well received by the market and the share price had even traded up 13% on Wednesday this week.

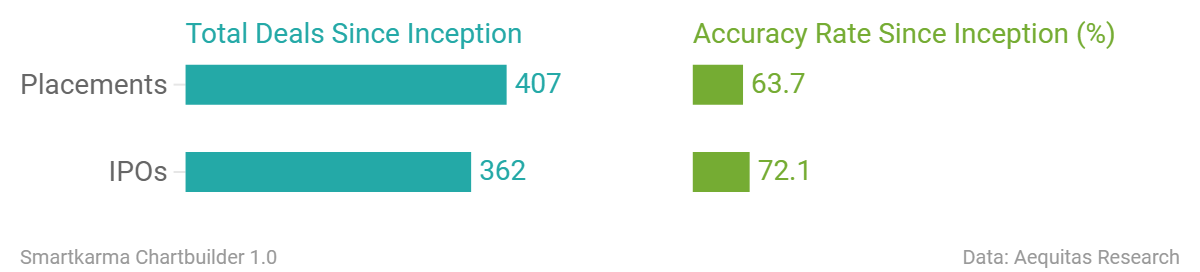

Accuracy Rate:

Our overall accuracy rate is 72.1% for IPOs and 63.7% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- Jinxin Fertility Group (US$600m, Hong Kong)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Fund Companies Ask Hong Kong to Relax IPO Investment Rules

- Chinese Tech Giants Seek Further IPO Rule Changes in Hong Kong

- Sembcorp could delay India energy IPO due to market conditions

- PNB Metlife IPO likely next fiscal

Smartkarma Community’s this week Analysis on Upcoming IPO

- New Century Hotel Mgmt IPO Preview: Two-Speed Businesses

- New Century Hotel (浙江開元酒店) Pre-IPO – Improved Profitability Not Driven by Underlying Operations

- Ab InBev Asia Pre-IPO – Quick Note – More like CR Beer Rather than Tsingtao

- MabPharma (迈博医药) IPO: Assembled for a Trade?

- Hyundai Autoever IPO Preview

- Hyundai Autoever IPO Pricing: Likely to Be a Dull Event Given No Growth Story & Glovis Merger

- HLX02: Innovation Could Overtake

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.