In this briefing:

- UK Trip – Wake up to Deflation Risk

- Confluence of Politics – China Bans Australian Coal Imports (Flash Note)

- Foldable Smartphones to Debut in 2019; Will It Aid an Industry Turnaround?

- Repsol, Petronas & Mitsui Make Massive Gas Find in Indonesia

- Free Money Has Flown

1. UK Trip – Wake up to Deflation Risk

By Bo Zhuang, Chief China Economist

- London-based investors are turning cautiously optimistic on China’s growth outlook amid the latest easing measures in January

- There is still little awareness about the rising deflation risk

- Interest in the trade war has subsided

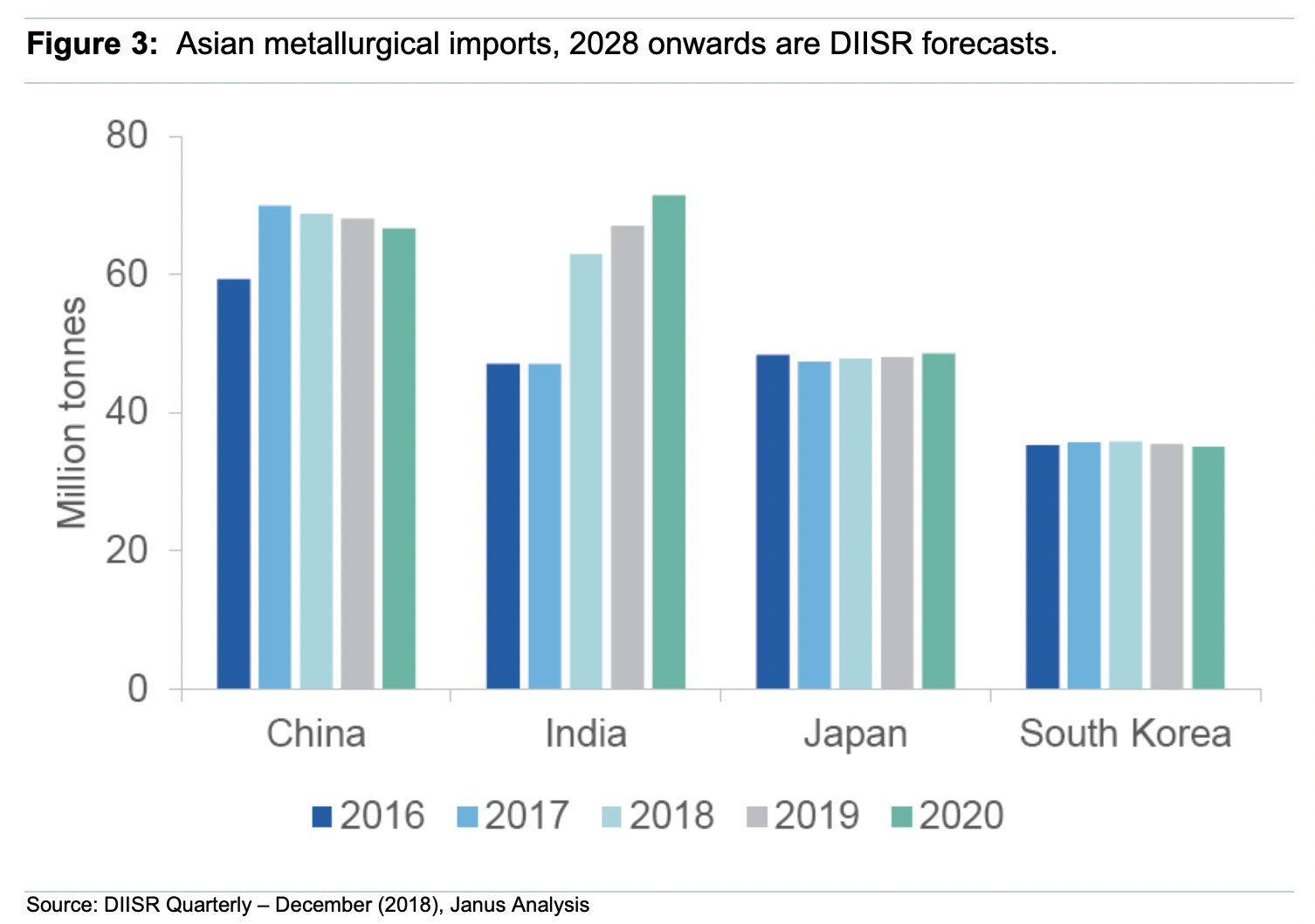

2. Confluence of Politics – China Bans Australian Coal Imports (Flash Note)

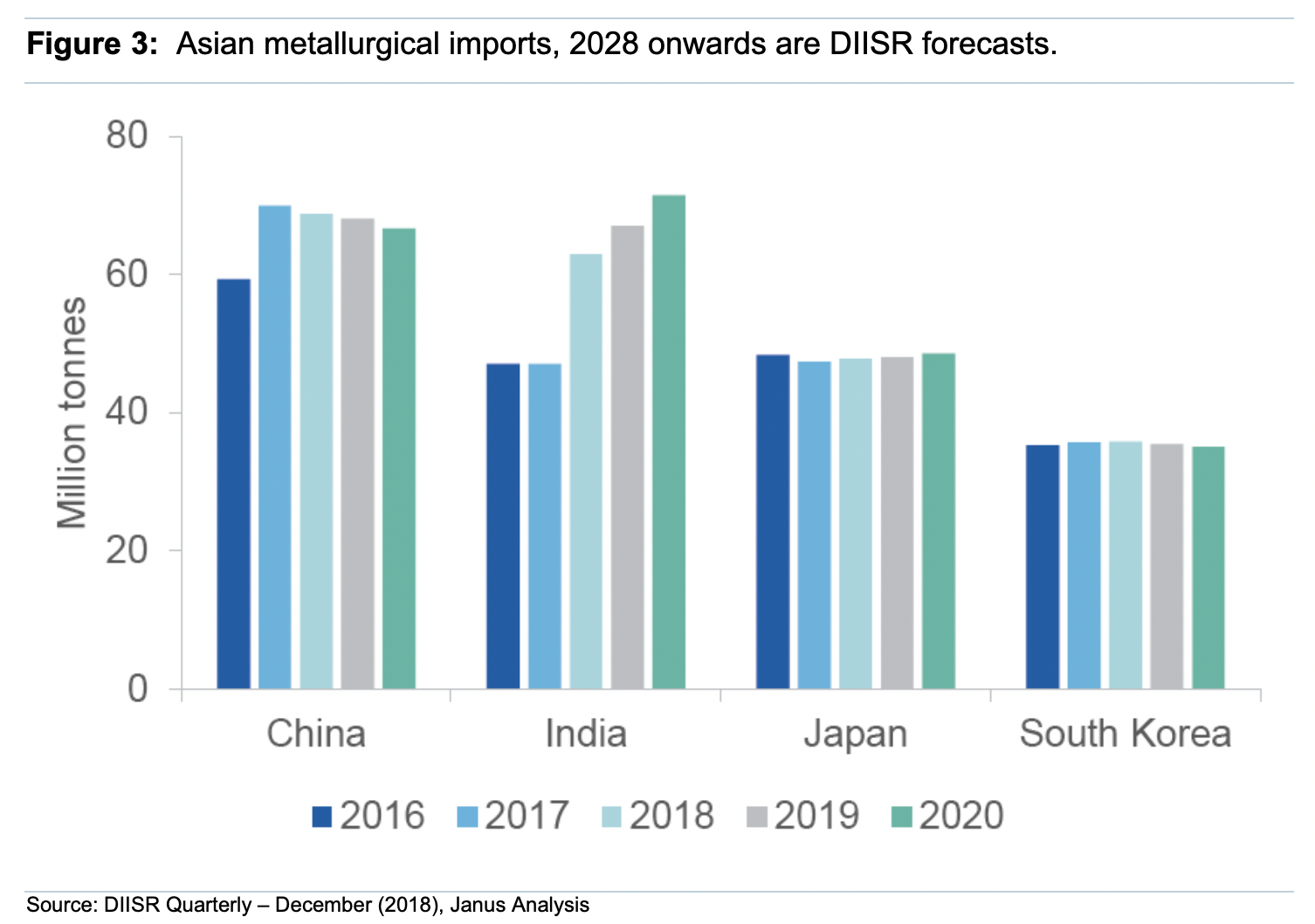

- China implements coal import caps specifically targeting Australian producers

- Unclear as to how widespread these restrictions will eventually be

- Thermal and metallurgical coal exports affected

- Impacting ~A$8.4Bn of metallurgical coal exports; or 4.4% of national income

- Thermal coal exports affected worth ~A$3.8Bn; or an additional 2% of national income

- Collectively, thermal and metallurgical exports equate to ~0.9% of Australian annual GDP

- Actions appear to be a response to blocking Huawei bidding for the 5G network

- Recent Chinese cyber-attacks harden Australian Government’s resolve

- Expect similar Chinese measures (in time) to be applied to other commodities and industries

3. Foldable Smartphones to Debut in 2019; Will It Aid an Industry Turnaround?

Plans regarding Samsung and Huawei’s foldable smartphones are out. The companies, which happen to be two of the largest contenders in the smartphone landscape are expected to unveil their foldable smartphone prototypes this month. In 4Q2018, Samsung, coming in first place, held a market share of 18.7% while Huawei, in third place, held a market share of 16.1%. Both companies are following different strategies when it comes to their foldable phone models.

The concept of foldable phones revolves around devices that can be folded into the size of a smartphone or opened up in to the size of a tablet. Huawei is said to be planning to introduce their foldable smartphone with 5G compatibility while Samsung is planning to release their foldable model with 4G compatibility. The market leader aims to leverage the expertise it has gained on its display technologies in its foldable smartphones.

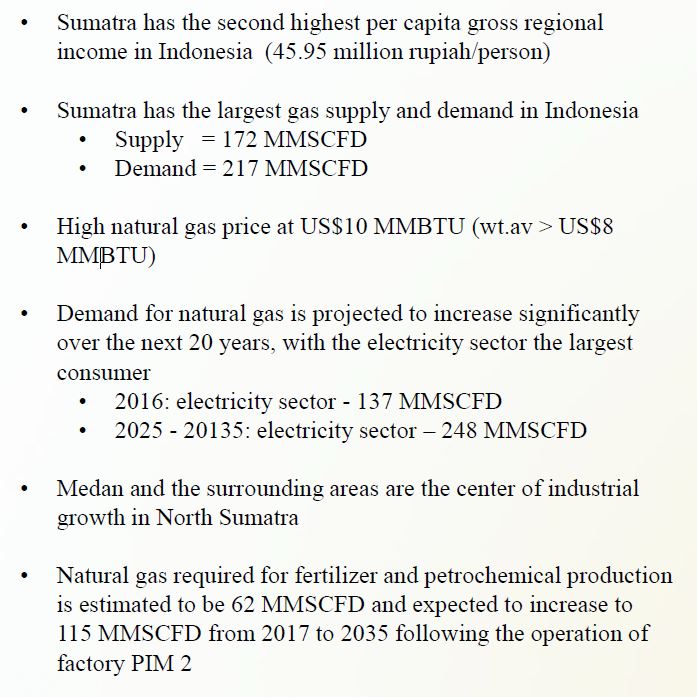

4. Repsol, Petronas & Mitsui Make Massive Gas Find in Indonesia

Repsol SA (REP SM)‘s discovery is very significant for the companies involved and others around the area, which we discuss in detail below. It is also important for Indonesia, which requires more gas to supply domestic and export demand. It is also positive for exploration sentiment globally, to see a material discovery (Oil Exploration: We Expect a Resurgence in 2019 Pointing to Strong Performance for E&Ps) and this may encourage further M&A in Indonesia such as this deal: (Indonesia Upstream Gas Asset Sale: Positive Read-Through to Other SE Asia Gas Companies).

5. Free Money Has Flown

The world will soon discover that debt matters.

The announcement of each round of QE increased asset prices, but the effect on Treasury bond prices began to fade when central bank purchases began. This unexpected behaviour revealed a little-known fact: asset prices react more to the expectation of changes in liquidity than to the experience of greater liquidity in financial markets. By contrast, economic growth is subject to the fluctuating standards of commercial bank lending, which follow variations in the demand for credit. Consequently, financial markets lead the economy. Meanwhile, central banks focus on lagging indicators, so they’re followers, not leaders. Bond markets usually predict more accurately than stock markets. To work, central bank easing policies require real risk-adjusted interest rates. However, with those rates below zero in many countries, further reductions would penalise lenders without helping borrowers. Thus, only rising inflation can save stressed debtors.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.