In this briefing:

- Yunji (云集) Pre-IPO Review – Poor Disclosure on Data

- China Zheshang Bank – A Look Beyond Doubling Impairment Costs

- Xinyi Energy IPO Preview: Second Time Lucky?

- HK Connect Discovery Weekly: Mainland Investors Buying WH Group (2019-03-22)

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Relaunched at Lower Price

1. Yunji (云集) Pre-IPO Review – Poor Disclosure on Data

Yunji Inc. (YJ US) is looking to raise about US$200m in its upcoming IPO.

YJ is a membership-based social e-commerce platform. Growth from FY2016 to FY2018 has been stupendous. Revenue has grown at a 218% CAGR while gross profit grew at 175% CAGR. Losses have been shrinking as a percentage of revenue and the company seems to be close to break even.

However, the disclosure of data is poor. There is no clear explanation how the company has achieved such strong growth in FY2018 without having to provide a proportionately larger incentive in the same period.

2. China Zheshang Bank – A Look Beyond Doubling Impairment Costs

It should be no surprise to see China Zheshang Bank (2016 HK; “CZB”) reveal a dramatic rise of impairment costs in 4Q18. It is one of only few China banks to yet announced quarterly results, and here it reported profit at -12% YoY in 4Q18. The doubling of impairment costs in the period goes to our long-standing concerns of continued credit tdeterioration in China and well more than headline figures suggest. This is partly based on our China corporate analysis of interest cover and debt/ebitda, which remain weak. It is also notable that CZB has been one of the faster growing banks in the country, putting its ‘unseasoned’ loans higher than many others; where we believe these banks are more likely to see higher impairment costs. Perhaps that is now coming through? And with RMB250bn of write-offs in December 2018 for China’s bank system, this suggests there will have to sizeable impairment costs to replenish balance sheet provisions.

3. Xinyi Energy IPO Preview: Second Time Lucky?

Xinyi Energy Holdings Ltd (1671746D HK) has filed IPO prospectus once again to list its solar generation business that was spun-off from its parent company Xinyi Solar Holding Ltd. Xinyi Energy has 9 operational solar farms with a total capacity of ~950MW.

The company is set to acquire additional solar farms of 540MW capacity from its parent company in a separate transaction post IPO.

Xinyi Energy has not indicated the size and pricing of its offer, however, according to various media reports the company is expected to raise nearly HK$570M (around 12% of the previous offering of HK$4.5B). A significant portion of IPO proceeds is expected to be utilised towards upfront payment of 50% for acquiring solar farms from its parent company and the remainder for working capital and debt repayment. Although we have a positive view of the solar energy sector, the IPO pricing will determine our overall view of the company.

4. HK Connect Discovery Weekly: Mainland Investors Buying WH Group (2019-03-22)

In our Discover HK Connect series, we aim to help our investors understand the flow of southbound trades via the Hong Kong Connect, as analyzed by our proprietary data engine. We will discuss the stocks that experienced the most inflow and outflow by mainland investors in the past seven days.

We split the stocks eligible for the Hong Kong Connect trade into three groups: component stocks in the HSCEI index, stocks with a market capitalization between USD 1 billion and USD 5 billion, and stocks with a market capitalization between USD 500 million and USD 1 billion.

In this insight, we highlight the WH Group, which led the inflows last week.

5. Dongzheng Auto Finance (东正汽车金融) IPO Review – Relaunched at Lower Price

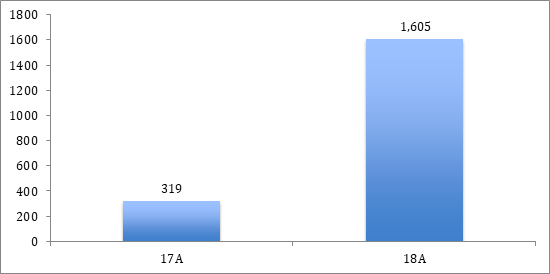

Dongzheng Automotive Finance (2718 HK) (DAF) re-launched its IPO at a lower fixed price of HK$3.06 per share, expecting to raise about US$208m. We have covered the fundamentals and valuation of the company in:

- Dongzheng Auto Finance (东正汽车金融) Pre-IPO Review – Dependent on Dealership Network for Growth

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Better off Buying the Parent

In this insight, we will only look at the company’s updated valuation and re-run the deal through IPO framework.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.