This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Hong Kong 2025 Placements – Year so Far and Trends for Potential Primary Placements

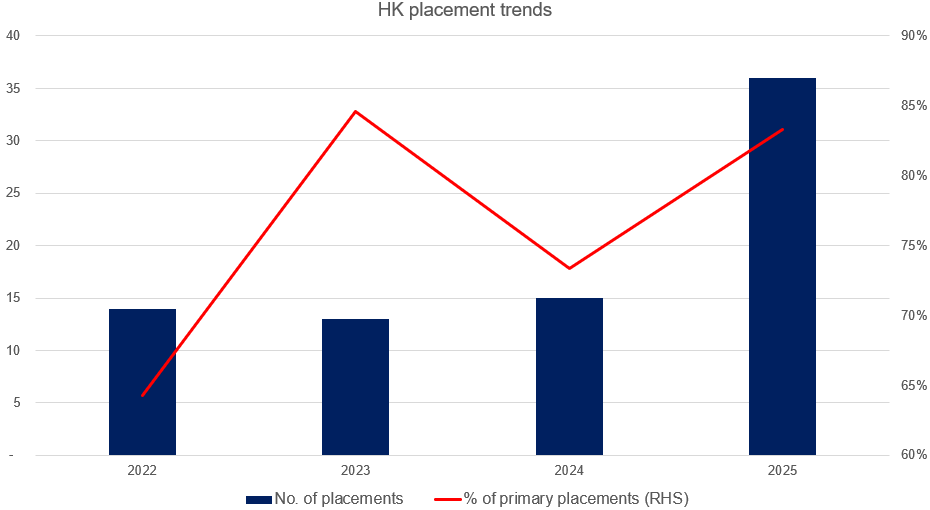

- 2025 has seen a sharp turnaround in HK placements, with 36 US$100m+ deals so far. This compares to only 14 in 2022, 13 in 2023, and 15 in 2024.

- Most of the 2025 placements have been primary raising and have come from a handful of sectors/backdrops.

- In this note, we try to identify the possible primary placements that could take place over the rest of the year.

2. HKEx Consultation Paper (Conclusion) – What Matters for ECM Investors

- The SEHK recently issued an update in response to its consultation paper in December 2025, with new mechanisms proposed for the IPO in the future.

- In this note, we summarize the conclusion by HKEx and the rules to be implemented.

- We are of the view that overall, the changes will benefit ECM investors with greater certainty in allocations.

3. ECM Weekly (4 August 2025)-Meituan, LG CNS, Wuxi AppTec, SICC, NSDL, Aditya Info, GigaDevice, WeWork

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, India deal flow remains strong, with HK A/H listing starting to flow in again.

- On the placements front, WuXi AppTec (2359 HK) undertook a mega raising, while Prosus NV (PRX NA) has begun to pare its stake in Meituan (3690 HK).

4. Eternal (Zomato) Placement – Second Clean-Up by Antfin This Week, Will Lift the Overhang

- Antfin (Netherlands) Holding B.V. is looking to raise up to US$612m via a cleanup of its remaining ~2% stake in Eternal (ETERNAL IN) .

- Antfin has been selling off parts of its ~14% stake in the firm since the IPO. The company last sold a 2% stake to raise upto US$400m in Aug 2024.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

5. Bullish US LLC (BLSH): Global Digital Asset Platform Sets Terms Seeking up to $4.2b IPO Valuation

- Bullish US will offer 20.3 million shares at $28-$31 and is scheduled to debut on Wednesday (8/13).

- BlackRock, Inc., and ARK Investment Management, LLC and/or its affiliated entitiesindicated an interest in purchasing up to an aggregate of $200 million in this offering.

- A combination of highly-notable existing shareholder base, anchor orders and tailwinds from the industry will likely have this IPO in high demand.

6. PayTM Block – US$434m Clean-Up by Antfin

- Antfin (Netherlands) Holding B.V. (Antfin) is looking to raise up to US$434 via a cleanup of its remaining 5.8% stake in Paytm (PAYTM IN).

- Antfin has been selling off its stake in PayTM since it pared around 12% in Nov 2021 IPO. It last sold a 4% stake to raise upto US$242m in May2025.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

7. Pre-IPO Guangzhou Innogen Pharmaceutical Group (PHIP Updates) – Some Points Worth the Attention

- Compared to competitors, the competitive advantage of Efsubaglutide Alfa is not obvious.The weight loss effect of single target mechanism could be weaker than that of competing dual and triple agonists

- Before Innogen filed for listing, some pre-IPO investors chose to transfer the Company’s equity they held at a discount, indicating that these investors lack confidence in the Company’s prospects.

- Under the double pressure of a single pipeline and lagging commercialization, pre-IPO valuation of RMB4.65bn is more like a dangerous bubble game.We shared our views on valuation and post-IPO performance.

8. Boston Dynamics – Rights Offering of 1.2 Trillion Won Expected; Potential IPO in 2027/2028 in NASDAQ

- There has been an increasing probability that Boston Dynamics (BD) announces a fourth rights offering capital raise worth about 1.2 trillion won (US$870 million) in the next several weeks.

- All the Hyundai Motor Group related entities are expected to increase their ownership stakes in Boston Dynamics whereas it is expected to decline for Softbank post the capital raise.

- The current valuation estimates of Boston Dynamics (post capital raise) vary widely from about 4 trillion won to 10 trillion won.

9. Curator’s Cut: China Healthcare Rally, Financial Market Infra Moves, and Korea’s Equity Upswing

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,200+ insights published in the past two weeks on Smartkarma

- In this cut, we review the rally in Chinese healthcare in 2025, track some updates in financial markets infrastructure companies, and see how Korean equities have done since end-May

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

10. SICC A/H Listing – PHIP Updates and Thoughts on A/H Premium

- SICC (688234 CH), a manufacturer of high-quality SiC substrates, aims to raise up to US$250m in its H-share listing.

- In terms of market share, as per Frost & Sullivan, based on 2024 sales, its market share was at 16.7%.

- In this note, we look at the PHIP updates and talk about the likely A/H premium.