This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. A/H Premiums & Recent Listings Performance-Changing Trends but Quality Matters More than the Premium

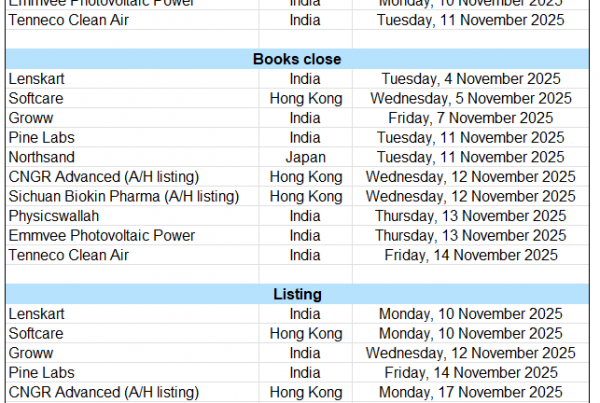

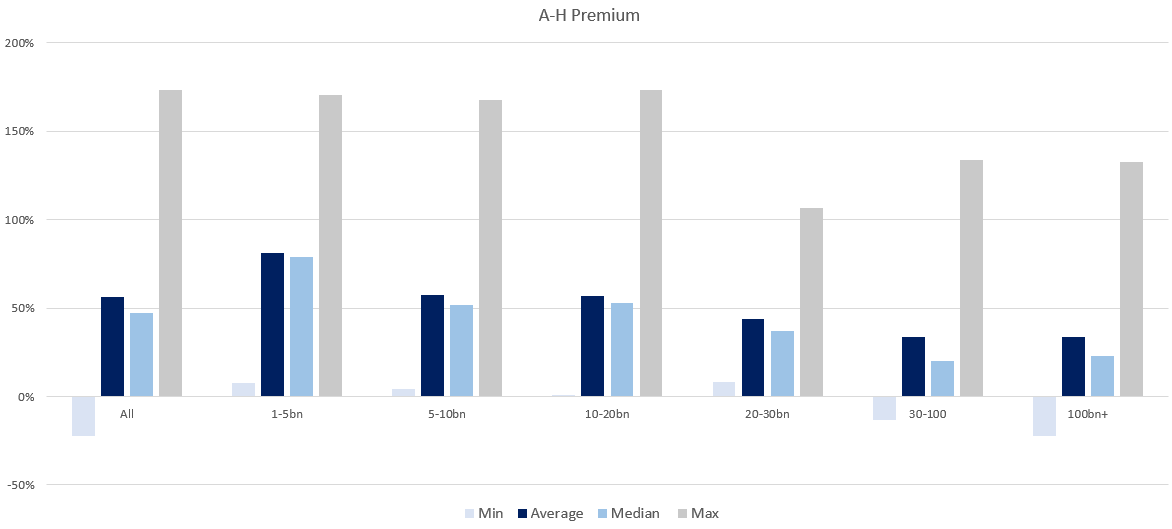

- With a spate of A/H listings already done in the first half and a lot more in the pipeline, we look at some of the trends from the recent listings.

- In this note, we will also talk about how the A/H premiums have moved since our last note in March 2025.

- Overall, recent A/H listings have somewhat reversed the trend of past A/H listings not doing much in the near term, with a few exceptions.

2. GNI Placement: Easy to Digest but Not Without Small Cap Pharma Risks

- GNI Group (2160 JP) is looking to raise around US$100m from a primary placement (after upsize).

- The deal is a small one, representing 2.4 days of the stock’s three month ADV, despite being 9.0% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

3. Everest Medicine Placement – Third Deal in the Year, Previous Ones Didn’t Do Well

- Everest Medicines (1952 HK) aims to raise around US$200m via a top-up placement.

- This will be the third placement this year for the stock, the previous two deals didn’t do well. Although the stock has bounced back a lot since.

- In this note, we comment on the deal dynamics and run the deal through our ECM framework.

4. Figma Inc (FIG): High Profile Software IPO Sets Terms, Expecting Major Attention Next Week

- Figma is offering 36.9mm shares at $25.00-$28.00 equating to a market cap of $12.2bn-$13.65b and is scheduled to debut on July 31st.

- They estimate their total revenue to increase by 39% to 41% for the three months ended June 30, 2025 compared to the three months ended June 30, 2024.

- This company is highly regarded in the software sector and we believe that there will be ample interest in this IPO.

5. Leads Biolabs (维立志生物) Trading Update

- Leads Biolabs raised HKD 1290m (USD 166m) from its global offering and will list on the Hong Kong Stock Exchange on Friday, July 24th.

- In our previous note, we looked at the company’s operation, management track records and discussed the IPO valuation.

- In this note, we provide an update for the IPO before trading debut.

6. DH (Daehan) Shipbuilding IPO Book Building Results Analysis

- DH Shipbuilding reported a solid IPO book building results analysis. The IPO price has been finalized at 50,000 won per share (high end of the IPO price range).

- At the IPO price of 50,000 won, the expected market cap will be 1.9 trillion won. DH Shipbuilding will start trading on 1 August.

- Our base case valuation of DH Shipbuilding is target price of 67,576 won per share, which represents a 35% upside to the IPO price.

7. OSL Group Placement: Momentum Is Strong but Is Opportunistic

- BC Technology Group (863 HK) is looking to raise around US$157m from a primary placement.

- The deal is a large one to digest, representing 20.2 days of the stock’s three month ADV, and 11.3% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. Pine Labs Pre-IPO – The Negatives – …some Segments Slowing, Lots Unexplained

- Pine Labs is looking to raise up to US$1bn in its upcoming India IPO.

- Pine Labs (PL) is a fintech firm focused on digitizing commerce through digital payments and issuing solutions for merchants, consumer brands and enterprises, and financial institutions.

- In this note, we talk about the not-so-positive aspects of the deal.

9. ECM Weekly (21 July 2025) – Muyuan, Unisplendour, NTT, Kasumigaseki, Anthem, Leads, SBI, Ascentage

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, filings and listings have cooled off going into the general summer lull.

- On the placements front, State Bank Of India (SBIN IN) pulled the trigger on its long touted QIP.

10. Pine Labs Pre-IPO – The Positives – Some Segments Growing..

- Pine Labs is looking to raise up to US$1bn in its upcoming India IPO.

- Pine Labs (PL) is a fintech firm focused on digitizing commerce through digital payments and issuing solutions for merchants, consumer brands and enterprises, and financial institutions.

- In this note, we talk about the positive aspects of the deal.