This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

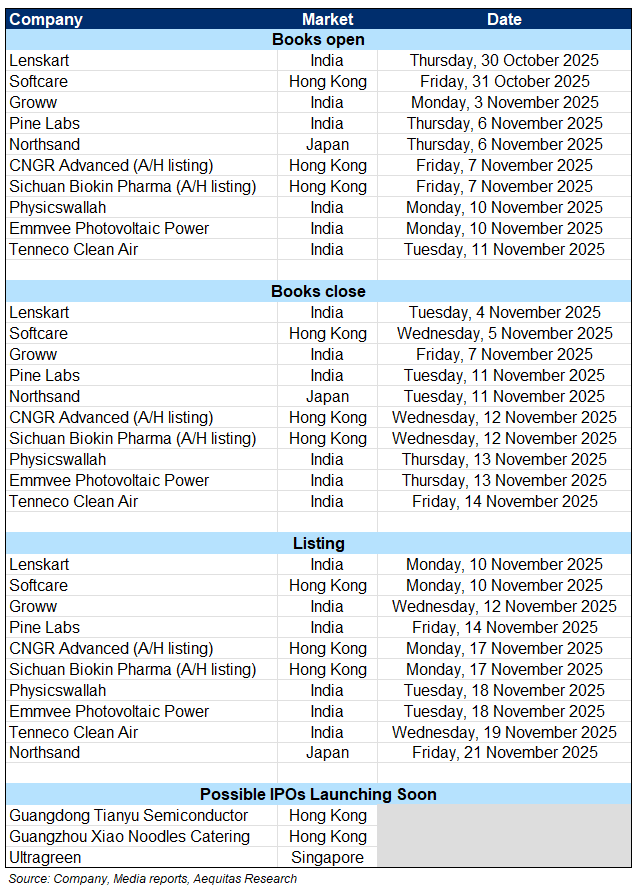

1. ECM Weekly (10 November 2025) – Seres, Pony, WeRide, Joyson, DIY, Maynilad, Northsand, Softcare

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, the deal flow continues unabated, although a lot of listing in Hong Kong didn’t do to well last week.

- On the placements front, there were a number of deals, with a few right at lockup expiry.

2. Groww IPO Trading – Decent Overall Demand

- Groww (1573648D IN) raised around US$747m in its India IPO. Groww, officially called Billionbrains Garage Ventures, is a direct-to-customer digital investment platform providing multiple financial products and services.

- With Groww, customers can invest and trade in stocks (including via IPOs), derivatives, bonds, mutual funds and other products. Customers can also avail margin trading facility and personal loans.

- We have looked at the company’s past performance and valuations in our previous notes. In this note, we will talk about the trading dynamics.

3. CNGR Advanced Material H Share Listing (2579 HK): Valuation Insights

- CNGR Advanced Material (2579 HK), a new energy materials company, has launched an H Share listing to raise US$507 million.

- I discussed the H Share listing in CNGR Advanced Material H Share Listing: The Investment Case.

- The proposed AH discount range of 36.9% to 29.9% (based on the 7 November A Share price) is attractive, and I would participate in the H Share listing.

4. Human Made Pre-IPO: A Bathing Ape, Reborn

- Human Made (456A JP) aims to raise around US$116m in its Japan IPO.

- Human Made Inc. is a Japan-based apparel and lifestyle company. Its business model centers on producing high-value, limited-supply apparel and goods.

- In this note, we look at the company’s past performance.

5. CNGR A/H Listing: Healthy A/H Premium and Cheap Valuation

- CNGR Advanced Material (300919 CH) is looking to raise up to US$500m in its upcoming Hong Kong IPO.

- CNGR is a Chinese battery-component producer and a new energy materials company. It is the global leader of nickel-based and cobalt-based pCAM (cathode) for lithium-ion batteries.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

6. Sichuan Biokin Pharmaceutical IPO: Well-Positioned to Ride Oncology Focused Global ADC Wave

- Sichuan Biokin Pharmaceutical has launched HK IPO to raise ~$430M by offering 8.6M shares at HK$389 per share. Subscriptions will close on November 12, with expected listing on November 17.

- Lead candidate, iza-bren is the world’s first and only EGFR × HER3 bispecific ADC to have entered Phase 3 trial. Biokin has co-development and co-commercialization agreement with BMS for iza-bren.

- The company is already listed on China’s A-share market in Shanghai. Biokin shares have been a strong performer since it went public and rose 77% over the last one year.

7. Lenskart Solutions IPO Trading – Very Strong Anchor Facing Weak Markets

- Lenskart Solutions raised around US$825m in its India IPO, with a very strong anchor book.

- Lenskart Solutions Limited (LSL) is a technology-driven eyewear company with integrated operations spanning designing, manufacturing, branding and retailing of eyewear products.

- We have looked at the past performance in our previous note. In this note, we talk about the trading dynamics.

8. Physicswallah IPO – RHP Updates and Thoughts on Valuation

- Physicswallah Is looking to raise about US$434m in its upcoming India IPO.

- Physicswallah Ltd (PWL) offers test preparation courses for competitive examinations, and other courses such as for upskilling, across 13 education categories, including JEE, NEET, and UPSC, among others.

- We have looked at the company’s past performance in our earlier notes. In this note we talk about the RHP updates and provide our thoughts on valuations.

9. Pine Labs IPO Trading – Low/No Demand

- Pine Labs raised around US$450m in its India IPO. Overall demand was weak.

- Pine Labs (PL) is a fintech firm focused on digitizing commerce through digital payments and issuing solutions for merchants, consumer brands and enterprises, and financial institutions.

- We have looked at the past performance in our previous note. In this note, we talk about the trading dynamics.

10. Klook Pre-IPO – The Positives – Growth Has Been Very Strong

- Klook (KLK US), a pan-regional experiences platform in Asia-Pacific, aims to raise around US$500m in its US listing.

- Klook connects travelers with merchants providing a vast array of activities, tours, attractions and other travel services across the globe.

- In this note, we talk about the positive aspects of the deal.