This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Tekscend Photomask IPO Trading – Priced at the Top, but Still Relatively Cheap

- Tekscend Photomask (429A JP), a manufacturer and distributor of semiconductor photomasks, raised around US$900m in its Japan IPO.

- TP is a global provider of photomasks and related support services. It has been the leader in the merchant photomask market in terms of sales since 2016.

- In our previous note, we looked at its past performance and valuations. In this note, we will talk about the trading dynamics.

2. Tekscend Photomask (429A JP) IPO: Trading Debut

- Tekscend Photomask (429A JP) is a global leader in semiconductor photomasks. At the IPO price, Tekscend will raise JPY138 billion (US$910 million). The shares will be listed on 16 October.

- I previously discussed the IPO in Tekscend Photomask (429A JP) IPO: The Bull Case, Tekscend Photomask (429A JP) IPO: The Bear Case and Tekscend Photomask (429A JP) IPO: Valuation Insights.

- The peers have re-rated since the release of the prospectus. My analysis suggests that Tekscend is attractively valued at the IPO price.

3. ECM Weekly (13 October 2025)- LG India, Tata Capital, Rubicon, Canara, FineToday, Maynilad, Kokusai

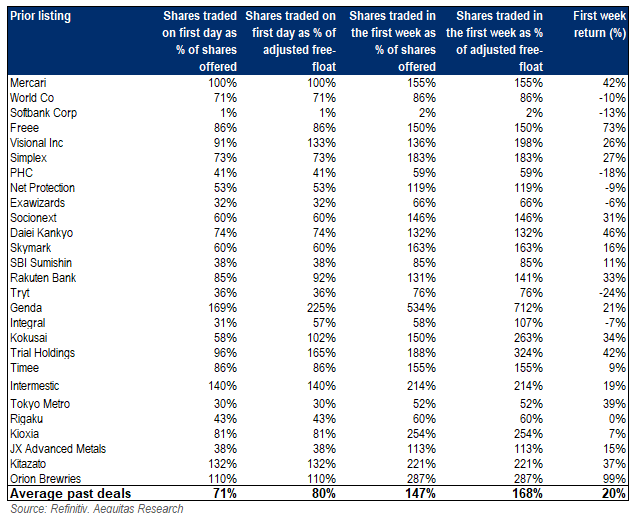

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, the year end looks set to see a flurry of listings, with the pace already starting to pick up again.

- On the placements front, markets were back where they left of prior to the October holidays.

4. Top Toy IPO Preview

- Top Toy International is getting ready to complete its IPO in Hong Kong in the next several months.

- Top Toy was last valued at US$1.3 billion in July 2025 when it received a US$59.4 million Series A financing (of which Temasek contributed US$40 million for a 3.2% stake).

- Top Toy is trading at P/E of 32x (2024 net profit) (valuation of US$1.3 billion) versus Pop Mart (P/E of 103x based on its 2024 net profit).

5. FineToday Holdings (420A JP) IPO: Valuation Insights

- FineToday Holdings (420A JP), a Japanese personal care business, is seeking to raise US$280 million. It previously pulled an IPO to raise US$500 million in December 2024.

- I previously discussed the investment thesis in FineToday Holdings (420A JP) IPO: The Investment Case.

- In this note, I present my forecasts and valuation. My analysis suggests that FineToday is fully valued at the IPO price.

6. Fibocom A/H Listing: Strong Revenue Growth, Some Margin Pressures

- Fibocom Wireless (300638 CH) a wireless communication modules provider, aims to raise up to US$400m in its H-share listing.

- Fibocom was founded in Nov 1999, and is a leading wireless communication module provider. The firm’s module products include i) data transmission modules, ii) smart modules, and iii) AI modules.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

7. Sany Heavy Industries A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Sany Heavy Industry (600031 CH), aims to raise around US$1.5bn in its H-share listing.

- Sany Heavy Industry was the world’s third largest and China’s largest construction machinery company in terms of construction machinery’s cumulative revenue from 2020 to 2024, according to Frost & Sullivan.

- We have looked at the company’s past performance in our earlier note. In this note, we talk about the updates and likely A/H premium.

8. LG Electronics India IPO Trading – Very Strong Subscription, Won’t Be Chasing if It Pops Too High

- LG Electronics (066570 KS) raised around US$1.3bn via selling 15% of its stake in LG Electronics India IPO.

- LG Electronics India (LGEI) was the market leader in India in major home appliances and consumer electronics (excluding mobile phones) in terms of volume, as per Redseer Report.

- We have looked at the company’s past performance and undertaken a peer comparison in our previous note. In this note, we talk about the trading dynamics.

9. JST Group (6687 HK): Valuation Insights

- JST Group (6687 HK) is China’s largest e-commerce SaaS ERP provider. It is seeking to raise HK$2,086 million (US$268 million).

- I previously discussed the IPO in JST Group IPO: The Investment Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price is attractive in the context of the revenue growth.

10. Seres Group A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Seres Group (601127 CH), a Chinese NEV manufacturer, aims to raise around US$2bn in its H-share listing.

- Seres Group (SG) is principally engaged in the research and development, manufacturing, sales and services of new energy vehicles (NEV) as well as core NEV components.

- In our previous note we had looked at its past performance. In this note, we talk about the recent updates and likely A/H premium.