This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

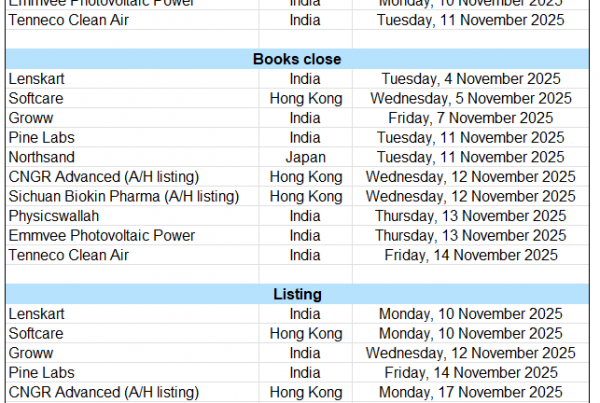

1. Sany Heavy Industry IPO Valuation Analysis

- Our base case valuation of Sany Heavy Industry is target price of CNY21.1 per share. This represents 7.6% lower than current price of CNY22.83 per share.

- IPO price of Sany Heavy is expected to be set between HKD20.30 and HKD21.30. Our valuation analysis suggests lack of a meaningful upside for Sany Heavy Industry listing in HK.

- There are still lack of a major turnaround of the property market in China and this could continue to negatively impact the overall construction equipment market in China.

2. SANY Heavy Industry H Share Listing (6031 HK): Valuation Insights

- Sany Heavy Industry (600031 CH), the world’s third-largest construction machinery company, has launched an H Share listing to raise US$1.6 billion.

- I discussed the H Share listing in SANY Heavy Industry H Share Listing: The Investment Case.

- The proposed AH discount of 17.2% to 13.1% (based on the 17 October A Share price) is attractive, and I would participate in the H Share listing.

3. WeRide Secondary HK Offering – Is Relatively Cheaper but Lacks Momentum

- WeRide (WRD US) plans to raise around US$350m in its secondary listing in Hong Kong.

- The company won HK listing approval and filed its PHIP on 19th October 2025. It will look to launch its secondary offering soon.

- In this note, we’ll take a look at the deal and talk about the impact of the raising.

4. Pony AI Secondary HK Offering – Stock Has Been Volatile, a Look at Possible Trading Setup

- Pony AI (PONY US) plans to raise around US$1bn in its secondary listing in Hong Kong.

- The company won HK listing approval and filed its PHIP on 17th October 2025. It will look to launch its secondary offering soon.

- In this note, we’ll take a look at the deal and talk about the impact of the raising.

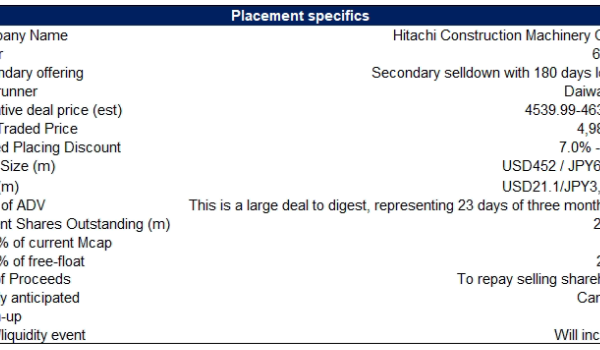

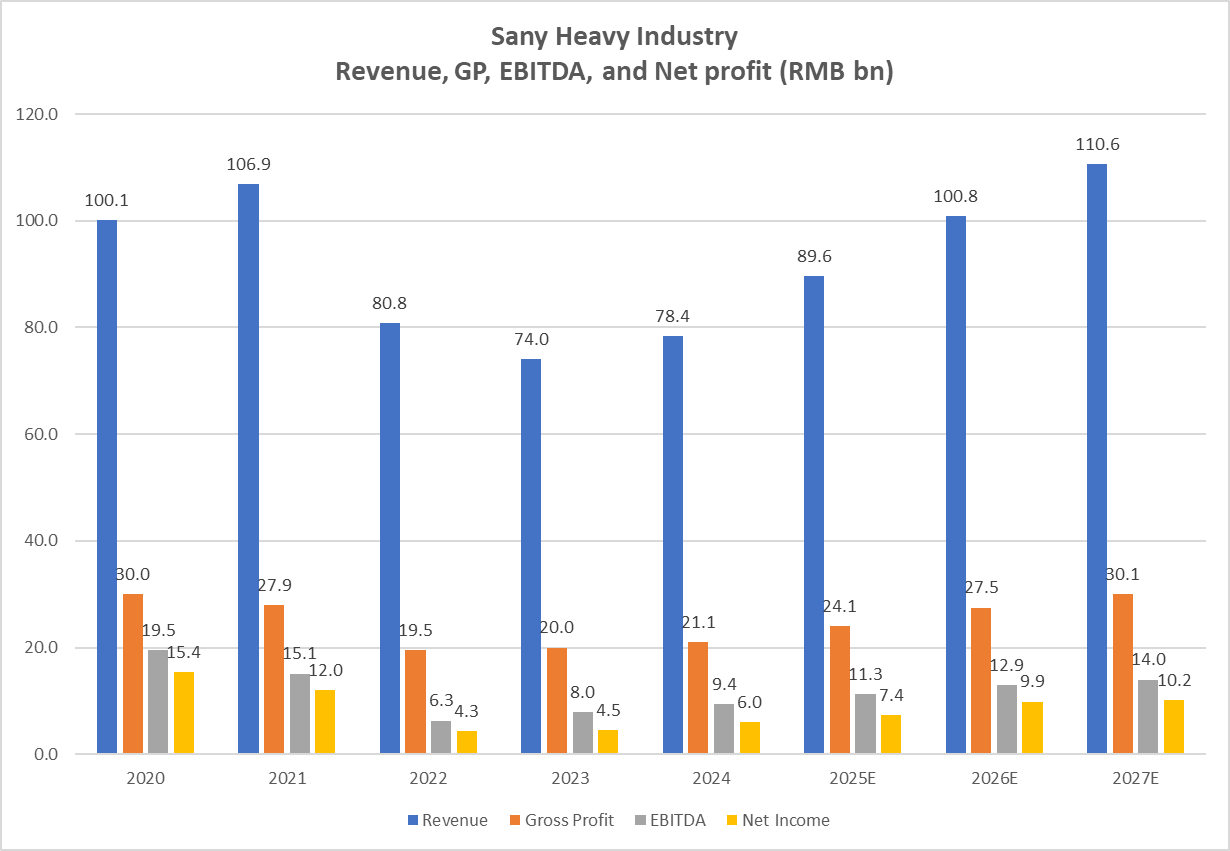

5. ECM Weekly (20 October 2025)- Sany, Seres, JST, Fibocom, Tekscend, FineToday, LG India, DIY, Duality

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, India saw a host of listing, while HK is gearing up a busy year end.

- On the placements front, we had a look at some of the IPO lockups. There weren’t any large placements this week.

6. CIG Shanghai A/H Listing: Smaller A/H Premium than Larger Peers, Expensive

- Cig Shanghai (603083 CH), telecommunications equipment company, is looking to raise up to US$594m in its upcoming Hong Kong IPO.

- It is a provider of critical infrastructure components for the development of AI.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

7. Sany Heavy Industries A/H IPO Pricing – Thoughts on Valuations

- Sany Heavy Industry (600031 CH) aims to raise around US$1.6bn in its H-share listing.

- Sany Heavy Industry was the world’s third largest and China’s largest construction machinery company in terms of construction machinery’s cumulative revenue from 2020 to 2024, according to Frost & Sullivan.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

8. Sany Heavy Industry IPO: Valuation Assessment

- Sany Heavy Industry (600031 CH)‘s IPO price range is set at HK$20.3-21.3, aiming at raising HK$11.9bn based on the mid-point IPO price.

- Key strengths are excellent growth potential globally, a leading market position, excellent R&D capability, and a solid financial track record.

- Sany Heavy’s fair valuation is a 5-10% discount to its A-share, in our view, implying an H-share price of HK$22.06-23.29, leaving limited upside from the IPO level.

9. Zijin Gold (2259 HK) 25Q3 – Updates on Forecast/Valuation and Potential Risks Behind

- Zijin Gold showed strong growth momentum in 25Q1-Q3, mainly driven by high gold prices and the two major acquisitions of the Ghana Akyem Gold Mine and Kazakhstan Raygorodok Gold Mine.

- Based on 25Q1-Q3 results, we updated our forecast of Zijin Gold, with net profit to reach US$1.5 billion/US$2.3 billion/US$3.5 billion in 2025/2026/2027, respectively.Theoretically speaking, valuation still has positive upside potential.

- However, our greatest concern is not the fundamental factors but the selling caused by liquidity crisis, which may lead to a synchronous correction of Zijin when the global market declines.

10. Pony AI HK Dual Primary Listing: The Investment Case

- Pony AI (PONY US) is a Chinese robotaxi operator and self-driving technology company. It is seeking to raise US$1 billion through a dual primary HKEx listing.

- It was listed on the Nasdaq on 27 November 2024, raising US$260 million at US$13.00 per ADS. Since listing, the shares are up 48%.

- The investment case centres around Pony’s accelerating revenue growth and progress towards positive unit economics. However, the path to profitability is long-dated and the valuation is full.