This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Gold: Reviewing Five Decades of Bull Markets Against an Overextended Backdrop

- Gold’s rally shows signs of overextension but the volatility footprint differs from prior rallies.

- We exam major bull markets over the past 50 years to assess how the current move stacks up.

- Fund flows and the sources of buying pressure are analyzed to gauge the rally’s sustainability.

2. BYD (1211 HK) And JD.com (9618 HK) Lead Expected Swings as 27% of HSI Reports Before Month-End

- Context: Several of Hong Kong’s largest companies will report in the coming days, representing 27% of the Hang Seng Index (HSI).

- Highlight: This Insight identifies which stocks have option-implied swings deviating from historical averages.

- Why Read: Prepare for earnings season by understanding where single-stock and broader market volatility may be elevated.

3. Gold Part 2: Implied Volatility Dynamics Offer Insight into the Tone of This Bull Market

- Gold’s latest surge shows rising implied volatility but little sign of market stress, suggesting limited parallels with the explosive 1980 bull market.

- Tuesday’s correction was the largest selloff in 12 years and marked the end of a series of successively larger positive moves.

- Rising implied vols and strong Call demand reveal active trading but not the manic levels typically seen near a major blowoff.

4. Nintendo and the Switch 2: An Options Menu

- Nintendo is poised for a significant growth phase, driven by its new console and an expansive intellectual property ecosystem, promising sustained financial performance.

- Strategic capacity expansion and a robust balance sheet position Nintendo to capitalize on strong demand, mitigating risks and reinforcing its market leadership.

- Despite potential market volatility and competitive pressures, aggressive production targets and a strong financial foundation suggest a compelling investment opportunity.

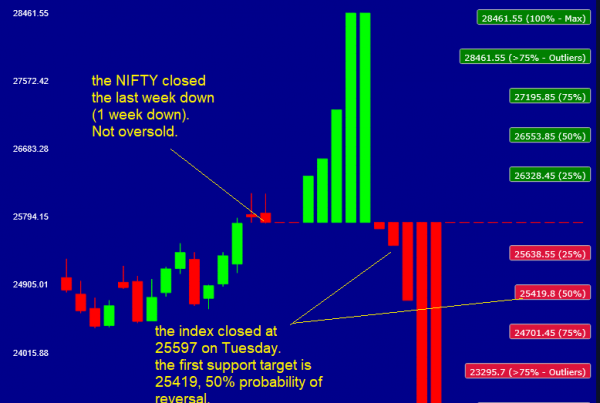

5. Cross-Market Outlook: US Vs Asia — Who’s Overbought, Who’s Oversold?

- A look at our probabilistic tactical models for US and Asian Equities: comparing which stocks are overbought and which ones are oversold.

- Between the US Stocks we track, all seems to have room to rally, short-term, and Amazon (AMZN US) is actually oversold (buy opportunity).

- The Asian Stocks we track instead show a less homogeneous picture, but several Asian stocks are incredibly overbought. Same as Gold.

6. Toyota Motor (7203 JP) Tactical Outlook: Awaiting Imminent Pullback

- Toyota Motor (7203 JP) has been going nowhere since July 2025 and before that it dropped from its highest peak. Long-term bullish, but short term we expect a pullback.

- Our model shows that the current trend pattern for Toyota Motor (7203 JP) is not bullish, usually the stock pulls back after 2 weeks up, i.e. end of this week.

- We propose this analysis of the pullback as an opportunity to buy at higher prices, or otherwise to hedge your holdings, if you want to tactically optimize returns.

7. BYD (1211 HK) Earnings on 30 Oct: Options Price in Larger-Than-Usual Move

- Context:BYD (1211 HK) reports Q3 2025 results on 30 October after market close.

- Options markets imply a ±4.7% move, notably larger than the historical ±3.0% average. The stock has shown asymmetric reactions, with fewer but stronger upside moves.

- Why Read: Understand how implied swings compare with history and how the earnings-linked volatility peak offers tactical opportunities around BYD’s 31 Oct weekly expiry.

8. HDFC Bank (HDFCB IN) Tactical Outlook: Time to Lock In Gains

- Despite good earnings results, HDFC Bank (HDFCB IN) does not seem to be going anywhere. The stock did rally for the past 3 weeks but after the earnings stayed flat.

- Our quantitative probabilistic model indicates HDFC Bank usually does not rally for more than 4 weeks when this pattern is encountered (we are in the 4th week, this week).

- From a price perspective, our model shows a mildly overbought stock, confirming the slow pace. The pullback should be short-lived (1-2 weeks), but it’s imminent.

9. Toyota (7203 JP) Up 3.2% Today: Tactical Bearish Option Strategies as Pullback Looms

- Context: Toyota Motor (7203 JP) rallied 3.2% in Wednesday’s morning session. Quantitative models highlight potential for a short-term pull-back.

- Trade Idea: Three actionable option strategies with a bearish tilt are presented, taking advantage of current implied volatility levels and skew.

- Why Read: This Insight combines directional analysis with volatility signals, highlighting a tactical options strategy where high implied volatility and bearish probabilities align, offering investors defined risk/reward.

10. Otsuka, Hirose Electric, Screen, Advantest: The Value Seeker Portfolio and NK Options

- A compelling investment strategy focused on high-quality Japanese equities, selected for strong financial health and growth prospects. This approach targets companies offering stability and long-term appreciation.

- The portfolio emphasizes industrial, automation, pharma, and technology hardware sectors, balanced with a tactical volatility trading approach. This strategy aims to enhance returns while managing short-term market fluctuations.

- Otsuka Holdings is highlighted as a core pharma pick. Screen and Hirose Electric are strong value picks in manufacturing and electronic tech, contributing to the portfolio’s quality and value focus.