This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. BoE: Policy Mistake Diagnosis

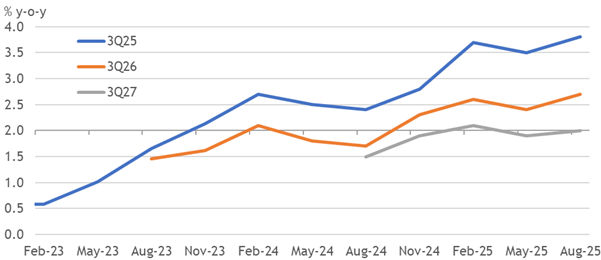

- Inflation expectations have been persistently too high, while productivity trends poorly, driving wage and price inflation forecasts to grind higher in recent years.

- The BoE’s cutting cycle contributed to reversing the trend decline in expectations, and in turning a slight overshoot into a massive one, with a 3.2pp revision since Feb-23.

- We forecasted this excess for these reasons, so it was predictable and therefore a policy mistake to cut so soon. Further surprise should prevent the MPC from cutting again.

2. US Inflation Skips Several Months

- July’s US inflation print reversed all of the increase built in from tariffs over the past several months, despite matching expectations prevailing into the release.

- Core goods inflation eased slightly, suggesting ongoing corporate success in avoiding the tariff shock. But service inflation is stuck too high to be consistent with the target.

- Anti-avoidance measures and belated pass-through will drive further rises. We doubt they will be as severe as many fear, yet still not create much space to cut rates.

3. UK: Slowdown Softened In Q2

- June’s remarkable rebound compounded the resilience revealed by April’s upwards revision, which also broke flimsy fundamental stories blaming tariffs for a slowdown.

- IP no longer declined in April, but the broader growth profile still matches the residual seasonality that spuriously drives GDP dynamics in our forecast. H2 will be weaker.

- The BoE discounts headline GDP volatility without blaming seasonality, so another surprisingly strong quarter will be hard for hawks to ignore, reducing the rate cut risk.

4. US/Taiwan: Xi Calls The Shots

- In stark contrast to its dealings with other trade partners, Washington is firmly in the position of supplicant in its dealings with Beijing.

- This reflects not only Xi Jinping’s carefully prepared and strong hand but also Donald Trump’s seeming determination to strike a deal with China at more or less any cost.

- Increasingly, therefore, Taiwan stands to be “a pawn in a bigger game”.

5. UK Jobs Suggest Summer Stabilisation

- Unemployment broke a four-month streak of increases at 4.66%, with favourable cohort effects risking a fall soon. Payrolls may also be revised to grow again from July.

- The structural hit from tax increases is matched by the cumulative fall in payrolls so far. Fundamental explanations for its divergence from the LFS aren’t supported yet.

- Ongoing resilience in wage growth stokes unit labour cost pressures alongside taxes that are beyond the target. We still expect the MPC to resist cutting rates again.

6. Tradesmen’s Collective: Fixing the Trades with Tech, Transparency & Boots-on-the-Ground

- Discussion between Jonathan, CEO of Tradesmen Collective, and Ed, Director of Investor Relations, on tech startups and market trends

- TTC USA’s integrated platform addresses industry inefficiencies with cutting edge software, escrow services, and legal support

- Insight on leading assets like gold, Bitcoin, and Nvidia; mentions of success stories like MicroStrategy integrating Bitcoin and Nvidia integrating software for business growth

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

7. Poised for a Volatility Spike

- We remain long-term bullish on equities. In the short run, realized volatility declined since the “Liberation Day” panic, but conditions are setting up for a near-term volatility spike.

- Uncertainty over Fed policy and government credibility are possible catalysts for a disorderly increase in volatility and market correction.

- As well, the signs of narrow leadership, weak breadth and stretched risk sentiment elevates the risks of a pullback.

8. Another View of American Exceptionalism

- We believe global equity investors should adopt a barbell strategy of overweighting U.S. large cap growth and non-U.S. value stocks in their global equity portfolios

- The trend is your friend: Both are undergoing multi-year uptrends in relative performance.

- The key question is the length and sustainability of U.S. AI leadership.

9. HONG KONG ALPHA PORTFOLIO (July 2025)

- The Hong Kong Alpha portfolio outperformed its benchmark and all Hong Kong indexes in July. The portfolio achieved these results while increasing its Sharpe ratio and reducing beta and volatility.

- The shift to the healthcare and materials sectors since Liberation Day in April has aided the portfolio’s performance. The consumer staples sector lost momentum, and we exited some positions there.

- The HSI now trades above its long-term resistance levels for the first time since 2022. This signals a good time to rotate back into market leaders in tech.

10. HEW: Wrong Policy Turnings

- As soon as a data point calms nerves around a theme, a hawkish challenge seems to appear. This week, that was US CPI into PPI and UK unemployment into GDP.

- A bias to ease, triggered by a one-touch round of bad news, has consequences when not sustained. The BoE’s early start to its easing cycle has proved to be a policy mistake.

- Next week is a prime opportunity for Chair Powell to calm dovish excitement about Fed easing. UK inflation seems set to rise by another tenth, while the EA rate sticks at 2%.