This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

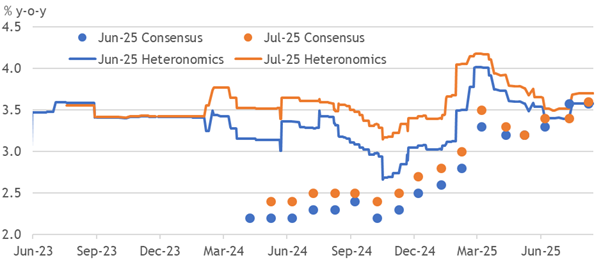

1. UK Excess Inflation Expectations

- The upwards trend in consensus inflation forecasts reflects persistent excess effective expectations supporting wages amid policymakers’ failure to re-anchor at the target.

- Easing on the assumption of success predictably negated the required conditions, so we forecasted the problem. Nonetheless, expectations were also stickier than we assumed.

- Without renewed progress, wage growth should keep trending above the BoE’s forecast, discouraging further rate cuts. Hikes may even be needed in 2026 to break excesses.

2. UK CPI Trend Extends Excess In July

- Another upside surprise in UK CPI inflation extended the accumulated drift to 1.3pp over the past year, yet was only 0.2pp above our old call.

- This outcome matched the BoE’s latest call, with airfares driving the rise, and median pressures holding slightly above a target-consistent pace, so there is less policy impact.

- The MPC was finely balanced in its support for August’s cut, and this rise will not lead dissenters to support past action, let alone another cut, which we still doubt occurs.

3. EA: Sticky Inflation Survives Euro’s Surge

- Inflation’s surprise stickiness at 2% was confirmed in the Euro area’s final print, with pressures broad based and slightly above a target-consistent pace in most countries.

- There has been little progress in inflation’s latent trend or our persistence-weighted measure, despite the Euro’s substantial and sustained appreciation.

- Without dovish second-round effects, the ECB can look through a potential slowing in headline inflation to a tight labour market and persistent pressures, then not cut rates.

4. India-China Economic Relations: Navigating Massive Imbalances and Strategic Dependencies

- India’s $101B trade deficit with China highlights strategic economic vulnerabilities across key sectors.

- Regulatory barriers since April 2020 sharply limited Chinese FDI, leading to negligible investments and shelved deals.

- India’s import dependency is profound, spanning pharmaceuticals, electronics, chemicals, and railway components, exposing multiple strategic sectors to supply risks.

5. India Economics: Choppier Waters Ahead?

- After a strong showing in the first quarter of 2025, the Indian economy is likely to see growth normalise. Key drivers of demand are showing mixed performance.

- Across consumption and investment, performance remains uneven across key sectors, leading to signs of softening momentum based on non-GDP demand indicators.

- Trump’s latest tariff threat against India poses tough questions on the long-term outlook. With its “China+1” strategy in doubt, the economy needs a new playbook to fortify growth.

6. EA: Re-Balance Of Payments

- An end to the Euro’s bullish trend is now revealed to have coincided with a reversal of two critical supports. Frontloaded export levels have normalised without payback.

- International portfolio investment into the EA during April fully unwound between May and June, revealing no investor appetite to hold higher allocations to EA assets.

- The Euro is not benefiting from a structural shift towards it, so we doubt the bullish trend will resume. Belated payback in goods inventories could also eventually weigh.

7. HEW: Dovish Bias Dominates

- The evidential hurdle formally shifted in support of a Fed rate cut in September. Still, the data may yet discourage it, or embolden the market to price it as mistaken.

- Flash PMIs broadly reinforced the resilience narrative, while another upside UK inflation surprise sets the BoE up to resist cutting amid persistently excessive expectations.

- A quieter, bank holiday-shortened week leaves the BOK and BSP decisions as monetary policy highlights. Euro area M3 and some national flash HICP prints are our data focus.

8. Asian Equities: FIIs Selling Asia in August; Only Taiwan Still Being Bought

- After buying Asian equities for three months, FIIs sold Asia in the three weeks of August: notably India (-$2.53bn) and Korea (-$298m). Taiwan (+1.6bn) was the only large market bought.

- It’s too early to call a trend change. Our FII gauge of 6-month cumulative buying as percentage of the market’s capitalization indicates that most markets are neither overbought nor oversold.

- Even though FIIs have bought the large Asian markets lately, none of them are overbought. Taiwan’s FII gauge is relatively closer to the upper limit. Indonesia is unequivocally oversold.

9. Separate Dividend Tax Plan in Korea: A Push for a 25% Rate for Top Bracket

- Democratic Party lawmaker Kim Hyun-jung has introduced a revised Income Tax Act that would lower the top tax rate on dividend income from 35% to 25%.

- Given that this proposal is coming from the ruling Democratic Party, there is a fairly high probability that this could be passed into law in 3Q 2025.

- We provide a list of 28 mid-cap/large cap stocks in Korea with more than 35% dividend payout and 3% or more dividend yield that could benefit from this new proposal.

10. Asian Equity: As the Result Season Nears Its End, Asian EPS Estimates Suffer a Surprising Downgrade

- As the earnings reporting season nears completion, our EPS estimate tracker reveals a downgrade to Asian EPS. AxJ EPS declined only 0.5%-0.8%. But several constituent markets’ EPS declined much more.

- Asian EPS estimates were supported by China and somewhat surprisingly, Thailand. Indian estimates continued to decline. Even Korea and Taiwan, the recent earnings outperformers, were downgraded during this season.

- Unlike Asia, US EPS estimates rose during this season. Japan’s and Europe’s declined. In a subsequent note we shall track the estimates of all the sectors in each Asian Market.