This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

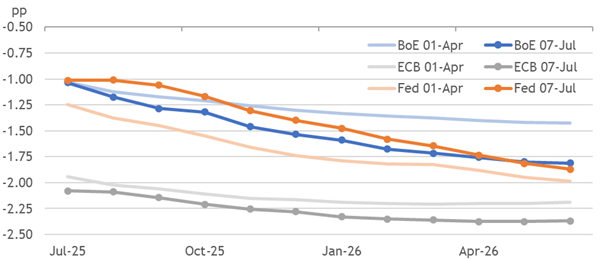

1. Inconsistently Dovish Pricing

- Dovish market fears from April have unwound for the Fed, yet deepened for the BoE, despite broadly resilient data and cautious guidance from policymakers reluctant to cut.

- Equity prices have relied on this resilience to recover, yet expectations for extended rate-cutting cycles imply it breaks. Payrolls only forced half of the gap to close.

- We expect ongoing resilience to keep rolling market pricing for rate cuts later, with the unnecessary easing ultimately never being delivered by the BoE, Fed, or ECB.

2. Labour’s Collapsing Credibility

- Labour failed to campaign on a platform up to the UK’s structural problems, depriving it of the support to deliver change in its first year. Reform UK now lead most polls.

- Spending cut U-turns compound the fiscal hole exposed by the slippage of optimistic assumptions, making further tax hikes and more persistent deficits seem inevitable.

- Far-centrism has been rejected, but challenges to Labour’s right and left break its ability to triangulate back towards success. Investors may not stay so forgiving.

3. Can a New Bull Begin at a Forward P/E of 22?

- It’s official, our long-term market timing model has confirmed a buy signal at the end of June.

- The S&P 500 is trading at a forward P/E of 22. Can a new bull truly begin at such elevated valuations?

- We interpret the buy signal from our long-term market timing model as a buy signal for global equities, and not just the U.S. market.

4. HEM: Rolling Resilience

- Economic activity is robust with a tight labour market.

- Price and wage inflation are generally above 2%.

- Despite predictions of a downturn, the current economic regime remains stable.

5. Why America’s Manufacturing Dreams Might Be Economic Nightmares

- Germany’s GDP declined 0.2% in 2024, Japan’s industrial production contracted 1.1%. Meanwhile, America’s service-focused economy outperforms manufacturing-heavy competitors consistently.

- Tooling costs are 10x higher in America than China. Even 145% tariffs insufficient—need 350% tariffs to make domestic manufacturing viable.

- US services exports surpass lost manufacturing profits. Services employ 84% of private sector, pay more than manufacturing ($36 vs $35/hour).

6. De-Dollarisation Debate : Unmasking USD Over-Valuation

- Despite headlines about BRICS alternatives, gold hoarding, and China’s reduced U.S. Treasury holdings, the data shows no structural shift away from the dollar.

- A 10% decline in the DXY under six months is not an uncommon occurence from a longer term perspective.

- The dollar’s weakness is driven by a historically overvalued real effective exchange rate (REER) and falling oil prices, not a structural decline.

7. HEW: Kicked Can Lands Steady

- Trump kicked the tariff can a few weeks to 1 August, leaving other policymakers and markets in a wait-and-see mode. Pricing was little changed amid little news elsewhere.

- We thematically explored the market implications of resilience rolling cuts later, how healthy the US labour market data is, and dug into the UK’s political problems.

- Next week’s UK labour market and inflation data are critical ahead of an August BoE decision we believe remains finely balanced. US and EA inflation are other highlights.

8. US Claims Continue To Cruise Calmly

- Rising continuing claims in recent months have been heralded as a canary warning of belated suffering in the labour market. But the problem is ending before it ever began.

- US employment growth is still aligned with its long-run average, and the unemployment rate is unchanged on the year. Openings and quits are also steady with averages.

- The Fed needs excess disinflation to cut, and we believe this won’t materialise. That also avoids demand and policy pressure on the BoE and ECB, helping them hold rates.

9. Barbarians with Bandwidth: Why Christina Qi Left the Hedge Fund World to Reinvent Data

- Recap of last week’s events including good inflation news, pressure on Fed to cut interest rates, tensions between Israel and Iran escalating, and market outcomes

- Factors showing risk-on sentiment with sales growth up, EPS growth strong, volatility and quality return on equity fluctuating

- Discussion on factors influencing return on equity and quality, with insights into market trends and data analysis techniques

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

10. Systematic Global Macro: Data, AI, and Models Are Reshaping Investing | New Barbarians AI Agent #05

- The podcast episode discusses the shift towards systematic global macro investing and the advantages of using quantitative models and algorithms.

- The sources highlight the importance of technology and data in driving this shift, but also emphasize the value of human judgment in certain situations.

- Listeners are encouraged to explore the freely available Google Colab Jupyter notebook for replicating sector performance analysis discussed in the episode.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.