This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

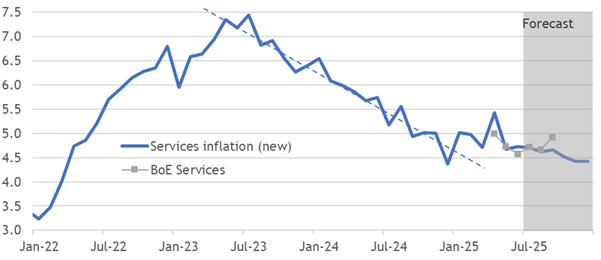

1. UK CPI Lifts Hawkish Case in June

- UK inflation surged 0.2pp beyond the consensus again in June, with underlying inflation measures broadly inconsistent with the target and headlines moving the wrong way.

- The consensus is failing to learn the lesson of intense underlying pressures. The CPI rate rose 0.6pp since Jan instead of falling 0.4pp and is 1.4pp higher than called a year ago.

- Policymakers seem infected with dovish fear about the labour market ahead of August’s meeting. CPI is 0.9pp higher in our year-ahead forecast, and we were right a year ago.

2. UK Jobs Data And The Muddled MPC

- UK payroll revisions removed most of May’s weakness, while wage and price inflation is too fast, yet the BoE probably won’t back down from an August cut as the UR rises.

- Fewer payroll inflows explain its downtrend, with <24yo suffering sustained pain, but the 25-64yo endure the taxation hit, structurally raising unemployment by ~0.5pp.

- Wage growth isn’t showing signs of new disinflationary demand pressures, so we expect excessive underlying wage and price trends to persist, not helped by an August BoE cut.

3. Asia Cross Asset: Liberation Day 2.0 and Asia

- Not surprised by recent events in the equity market, as it aligns with forecasted growth trends in Asia

- Transitory factors such as front loading and transshipment contributing to expected decline in H2 growth

- Expectation for central banks in the region to potentially ease rates in response to current economic conditions

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

4. US Inflation Creeps In Quietly

- Rebounding headline and core US inflation in June understated the underlying growth, with shelter rising at its slowest pace since August 2021. Tariff pain crept in belatedly.

- Commodities, less food, energy and car prices grew by 0.3% m-o-m, the fastest since Feb-23, and services (ex-shelter) hit 0.4% m-o-m, both inconsistent with the target.

- Less than half of the post-election surge in expectations has survived so far. Further rises remain likely, even if sustained avoidance smooths and reduces the full impact.

5. HEW: Inflation Persists, But Cuts Loom

- Persistent upside inflation surprises and sticky wage growth are lifting hawkish market narratives, defying central bank and consensus hopes for a quick return to target.

- UK inflation jumped well above forecast in June, strengthening the hawkish case, while US core inflation shows tariffs adding to excessive underlying price pressures.

- Next week, attention turns to the ECB decision, July flash PMIs, and UK public finances, as markets weigh central banks’ willingness to ignore resurgent inflation.

6. The Bullish Elephant in the Room

- We have been fairly cautious on equities in the past, but that’s changing. There is a bullish elephant in the room that is becoming evident and can’t be ignored.

- Market psychology had panicked and became overly concerned about left-tail risk. . Better, or less bad, news emerged and price momentum became dominant.

- Our base case scenario calls for the rally to continue into the August–September time frame.

7. Tuning Tariff Impact Estimates

- President Trump’s tariff policy seemingly follows a random walk with a drift towards deals. Path dependency raises risks and uncertainty around his volatile whims.

- Corporate avoidance measures have spared their customers from most of the pain, but Vietnam’s deal as a template could belatedly bring more of the pain to bear.

- We assume most countries stay at 10%. The impact of others rising to 20% may be smaller than the anti-avoidance hit, with the total now worth less than 0.4% to UK GDP.

8. Hong Kong Alpha Portfolio (June 2025)

- The Hong Kong Alpha portfolio has significantly outperformed the Hong Kong indexes in June and since inception. Outperformance range is 17% to 23% since inception.

- At the end of June, we sold positions in the tech sector after substantial gains. The portfolio’s exposure to the consumption sector was also trimmed, both discretionary and staples.

- The portfolio added exposure to the metals refining sector and initiated positions in conglomerates Shanghai Industrial Holdings (363 HK) and Citic Ltd (267 HK) .

9. Korea: Short Selling Data Analysis: 3Q 2025

- We are introducing a new regular series called “Korea: Short Selling Data Analysis.” We will try to provide this insight on a quarterly basis.

- Net short balance ratio for top 20 stocks in KOSPI averaged about 1.7% three months ago, much lower than current levels (3%).

- The average short interest ratio of these top 20 stocks in KOSPI with the highest short balance ratio was 2.6x as of 10 July 2025.

10. Korean Government’s New Task Force for Inclusion in a Major Global Index + IBKR Korea Trading Signal

- In this insight, we discuss Korean government’s new task force for Korea to be included in a major global index.

- Prior to this major market moving event, there will be some important signals.

- One of the most important signals could be major global securities companies (such as IBKR/TD Ameritrade) allowing trading of Korean stocks to customers world-wide.