This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

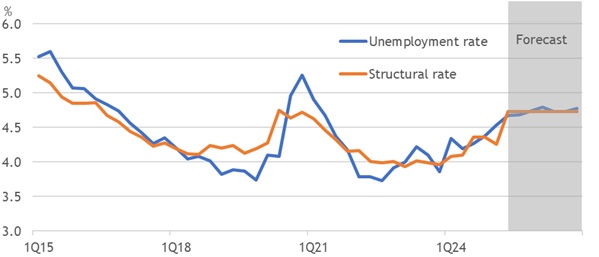

1. UK Structurally Unemployed

- Higher employment taxes can entirely explain the fall in payrolls as the tax wedge hits its highest since 1987, raising our structural unemployment rate estimate by 0.48pp.

- That could understate the structural shift amid a substantial drop in the threshold, rise in the minimum wage (jobs ban) and benefit rates. Some will go ‘inactive’ on disability.

- The unemployment rate must rise more than its natural rate to deliver disinflationary pressure sustainably. Our structural estimates suggest it won’t break excess inflation.

2. UK Fiscal Slippage Rules

- The UK’s de facto fiscal rule is slippage, with a £50bn to £100bn increase in borrowing between initial official forecasts and outcomes. 2025-26 made another slippery start.

- Politicians spend any space in the OBR forecasts, skewing surprises to higher spending. Yet tax hikes keep failing to raise the hoped revenue, motivating further increases.

- Investors should not be fooled by forecasts for consolidation when the failed strategy driving the fiscal slippage rule survives. Issuance may stay near £300bn in 2029-30.

3. US Politics: ‘As Ye Sow…’

- The Epstein files row has intensified deep splits in the MAGA movement and triggered persistent demands for accountability.

- Trump’s recent pivot towards supporting Ukraine and critical foreign policy shifts have fuelled further rifts among his traditional base.

- Despite controversies, the key midterm factor remains Trump’s economic agenda, as tariffs and fiscal changes may hit his core supporters hardest.

4. ECB: Watching the Good Place

- The ECB kept its description of the policy setting as in a good place, and wants to watch the news in the next few months. Lagarde refused to emphasise September’s meeting.

- Euro strength is depressing inflation below target in the near-term forecasts, but the ECB remains relaxed about this. It sees the outlook as broadly unchanged since June.

- We still see rolling resilience in the economy and doubt US trade policy will break it. More rate cuts are inappropriate without demand destruction, so we don’t expect any.

5. The Trade War Is Dead! Long Live the Trade War!

- Despite all of the dire headlines about tariffs on Canada, Mexico and the European Union, the only trade war that matters is effectively over. China has won.

- In the short run, economic policy uncertainty is receding but it’s not fully normalized. It’s time to adopt a risk-on posture.

- In the long run, equity investors should not expect the S&P 500, which trades at forward P/E of 22, to continue to outperform global stocks in the next expansion cycle.

6. New Barbarians Podcast | Episode #029 | Recap & Reset: Macro Shifts, Ethereum’s Spike, MicroStrat…

- Podcast has been running for almost seven months with recent guest episodes

- Discussion on recent global asset trends and market news, including inflation, Fed rate cuts, and Trump’s tariff threats

- Mention of interns from CUNY City Tech helping with macro database analysis and highlighting Ethereum’s strong performance in the market.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

7. Potential Change in Capital Gains on Stocks & Securities Transaction Taxes: Impact on Korean Stocks

- The capital gains tax on stock sale gains and securities transaction taxes could be raised in 2H 2025, which could negatively impact the Korean stock market, especially small caps.

- Combination of higher securities transaction tax and capital gains on stock sales could result in local retail investors selling their shares in 4Q 2025, before these changes come into effect.

- Although many small caps in Korea have performed well this year, the potential changes on these two important taxes could put some damper on the recent excellent share price performances.

8. HEW: Trade Deals & Fiscal Slippage

- Market narratives were driven by US trade pacts, critically with Japan, the ECB watching data from a good place, and further evidence of UK fiscal problems.

- Tariff uncertainty eased slightly, but it is still fierce ahead of the 1 August deadline. PMIs remained resilient, and UK retail sales rebounded into growth again for Q2.

- Next week brings Fed, BoC and BoJ meetings (broadly on hold), US and euro-area GDP growth for Q2, US payrolls, euro-area unemployment and slower flash HICP data.

9. BUY/SELL/HOLD: Hong Kong Market Update (JULY 21)

- HSI poised to break 25k for first time since 2022. Next resistance 27100. Hong Kong market outperforming global markets by wide margin since our BUY was initiated in March 2024.

- Financial, materials and healthcare sectors leading the market higher as tech sector consolidates. China shares still offer the best valuation metrics in Asia.

- Alibaba Pictures (1060 HK) , renamed Damai Entertainment has seen increased analyst attention as the company becomes the Live Nation Entertainment, Inc (LYV US) of China.

10. Stay Overweight Japanese Equities

- Despite the Upper House election result we are overweight Japanese equities and a buyer of the yen.

- Business cycle indicators are positive; the profit and investment cycles in upswing. Companies are highly diversified – foreign sales account for 40% of sales and 37% of production is abroad.

- They are hedging their bets by expanding in the US and India while scaling back in China. These factors contribute to the resilience of corporate earnings growth.