This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Don’t Swim Naked: TIME TO PUT YOUR SHORTS ON!

- The bear market rally in the US stock market continues as investors try to justify the tariffication of global trade and ignore its economic consequences. A FREE LUNCH.

- Soft and hard economic indicators in the US are falling, with some alarming numbers in the travel industry.

- US companies face potential blowback from Chinese consumers that provide 7% of S&P revenue.

2. HEM: Dovish Prices Deranged

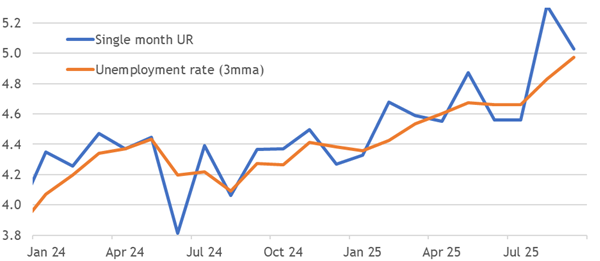

- Despite concerns, activity continues to be robust with stable manufacturing and tight labour markets.

- There is a persistent issue of high underlying price and wage inflation.

- The Bank of England’s rate cut ahead of the Federal Reserve is seen as highly irrational, as rates do not reflect the rebounding risk sentiment.

3. HEW: Doves Disappointed By Patience

- The BoE and Fed decisions disappointed dovish hopes for action by sensibly waiting to see some signs that easing is appropriate. Caution reduces the risk of a policy mistake.

- Inflation in the US, plus unemployment and GDP in the UK, are the scheduled economic highlights for us next week. The UK data may prove more resilient than feared again.

- An absence of bad news can allow the good vibes to keep flowing from recent resilient data and trade policy progress, but investors seeking to sleep easy may wish to hedge.

4. BoE Closer To Slowing Cuts

- The shockingly divided MPC’s offsetting votes weren’t the most hawkish signal alongside its 25bp rate cut. Most of the five backing it were only recently convinced.

- Maintained guidance for a gradual and careful approach not only disappoints dovish hopes, but signals a 5:2:2 bias between a slower, constant and faster pace of cuts.

- We still expect this gradualism to help the BoE resist cutting in August (and June) while waiting for dovish evidence that never emerges, making this the last cut.

5. The Coming Global Trade Re-Ordering

- China’s exports to the US dropped $7bn in April from March as the impact of tariffs kicked in.

- But its overall exports were barely impacted due to a jump in shipments to the rest of the world.

- This should ring a few alarm bells as to how the world will absorb the coming flood of Chinese imports, given Beijing’s struggles to lift consumption at home.

6. Steno Signals #195 – Wait, what? Did China just start buying Treasuries again?

- Morning from a sunny Copenhagen! Many pundits have (rightfully) struggled to find a coherent logic behind the Trump administration’s trade policy.

- However, quietly—but increasingly noticeably—the administration is beginning to make progress on a few of the core objectives outlined in the so-called “Mar-a-Lago Accord.” This accord seeks to leverage the U.S. defense umbrella to compel major trade partners to accept:a weaker USD, and increased purchases of U.S. Treasuries (USTs) in exchange for continued security guarantees— with tariffs serving as the primary tool in this negotiation strategy.

- While this approach has clearly sparked outrage globally—and while one can certainly question the strategic coherence and execution—the first signs are emerging that suggest it might be achieving some of its intended effects.

7. Assessing Trump’s Shock and Awe Move in Apr 2025

- April 2025 saw extreme market volatility after President Trump announced sweeping reciprocal tariffs, mainly aimed at China.

- Subsequent delays and complex exemptions fueled market swings, sparking fears of recession and inflation. First quarter 2025 US GDP contraction is not a trend.

- Despite headline risks, deeper analysis suggests a more balanced global economy over the longer term. Both China and the US will do whatever it takes to avoid a recession

8. Trust the Thrust, or Sell in May?

- We are seeing a resurgence of buy signals, or at least constructive signs for stock prices.

- Against that, the stock market is also facing a number of bearish headwinds, such as the “Sell in May” negative seasonality influence.

- We believe the intermediate path of equity prices is down. However, the reflex rally is a much-hated one and the short-term pain trade may be up.

9. HONG KONG ALPHA PORTFOLIO (April 2025)

- The Hong Kong Alpha portfolio underperformed its benchmark index during April by 1.1%. Since its inception last year, the portfolio has outperformed its benchmark by 18%.

- Although the tech sector was hit after April 2nd, the portfolio made 2% in its tech exposure for the month. We reduced the portfolio’s volatility & increased its Sharpe ratio.

- At the end of April, sold positions that are at risk from the tariff uncertainty and increased our exposure to China domestic consumption.

10. The Drill – The Gold(en) Era Continues!

- Greetings from Copenhagen.

- There’s plenty of geopolitical tension to unpack this week, with three major developments over just the past few days: 1) an Indian attack on Pakistan, 2) new events in the Middle East, and 3) the launch of U.S.–China trade talks.

- India attacked Pakistan in the Kashmir region overnight, and Pakistan swiftly retaliated.