Receive this weekly newsletter keeping 45k+ investors in the loop

1. From Buyers to Builders: Assessing the U.S. Housing Market

- Market sentiment on rate cutting and its impact on the housing market in 2026 is largely optimistic

- Home prices are up two and a half percent through June but have been declining month-over-month

- Housing supply at a national level is back to pre-Covid levels, transitioning to a buyer’s market from a seller’s market with strong mortgage credit but affordability challenges due to higher rates

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. HEM: Oct-25 Views & Challenges

- Hawkish inflation and policy rate pricing shifts toward our UK/EA view did not stop US rates frontloading more cuts.

- We still see markets overpricing easing, with UK inflation expectations stuck above target, and neutral rates high.

- A break in activity data, especially unemployment, and underlying price/wage inflation, would threaten our view.

3. US Shutdown: A Means To An End

- The Democrats opted for a US government shutdown despite the Administration being well prepared for what it sees as an opportunity to promote its longer-term agenda.

- While they hold out, the president’s ‘grim reaper’, OMB Director Russell Vought, will have a free hand to cut the size of government and pursue his unitary executive vision.

- Some of his actions will undoubtedly be challenged in the courts, but the signs are that the Supreme Court will continue to side firmly with the Administration.

4. UK: Poor Productivity Paradigms

- The OBR looks likely to trim its productivity trend assumption to 1%, which would still be a bullish break from the current stagnation. Trends rarely break outside recessions.

- High taxes are squeezing the most productive and being transferred to the inactive. It should not be surprising that the UK’s political choices have stalled productivity.

- We see no reason to think the UK will pull off an internationally exceptional jobs-light boom from here. Ongoing stagnation would extend the UK’s rule for fiscal slippage.

5. EM Fixed Income: Is better growth worse for EM?

- Recent data has shown better-than-expected growth globally, leading to a shift in the macro landscape.

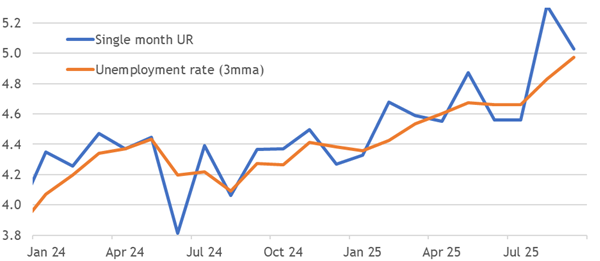

- The US economy has shown signs of weakness, particularly in the labor market, but overall growth forecasts have been revised upwards.

- Emerging markets have maintained a positive bias, with inflows steadily coming in, but there are concerns about potential vulnerability in EM currencies and local rates markets if the US growth environment remains strong.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

6. US: Steady As She Shuts

- The US government shutdown causes vital economic data to go dark, leaving the Fed facing market pressure to blindly cut rates as priced, creating risks of policy error.

- Both parties see strategic value in prolonging the shutdown, risking disruption that lasts well beyond historical norms. But levels will rebound when it inevitably ends.

- In the interim, private surveys signal weakness, and this picture is unlikely to improve significantly enough to block cuts in 2025, but that won’t drive more Fed cuts in 2026.

7. Beyond The Blue Chips: A Look At SGX’s iEdge Singapore Next 50

- SGX iEdge has launched the SGX iEdge Singapore Next 50 indices to track the 50 largest and most liquid SGX Mainboard companies beyond the 30 companies featured in the Straits Times Index (STI).

The Next 50 index has the highest weighting in the Real Estate sector, comprising ~47% of the index by weight. Other meaningful sectors are Financials, Industrials, and Consumer.

- By utilizing the new index in conjunction with the Straits Times Index (STI), investors and asset managers can more effectively construct tactical asset allocation strategies that aim to enhance portfolio performance.

8. Turning tides: a new dawn for capital flows

- Shift in capital flows and rise of domestic emerging market investors

- Discussion with experts in UAE and Singapore on their experiences and perspectives

- Impact of global events like financial crisis and COVID on emerging markets and expat communities

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

9. Q4 Outlook for Our Investment Themes Part 2 – Asian Equities

- How have our major investment themes performed so far in 2025?

- Review of the performance of the major markets and asset classes we focus on

- We revisit our outlook for each of those asset classes for Q4 25

10. RARE EARTH ELEMENTS: China Plays Its AI Trump Card!

- China has implemented extensive restrictions on its export of Rare Earth Elements, which will affect critical parts of the AI supply chain including semiconductor equipment and chips, and data centers.

- The restrictions were in response to recent actions by the U.S. to broaden restrictions on semiconductor equipment exports to China and Secretary Bessent’s comments regarding Argentina’s future relationship with China.

- President Trump responded with a social media post threatening a 100% increase in tariffs on Chinese imports and export controls on critical software.