This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

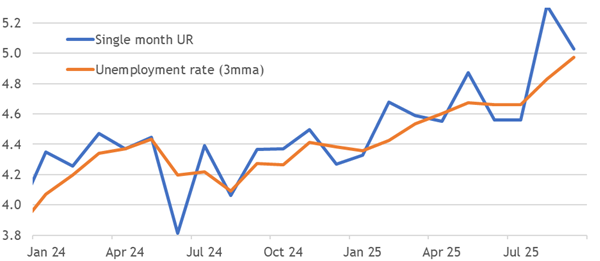

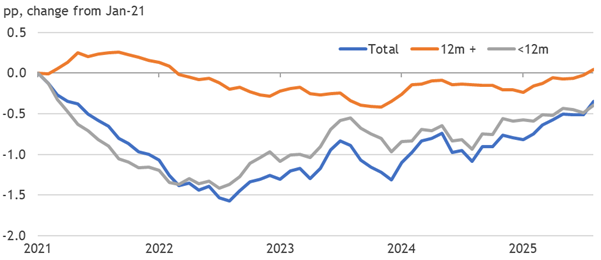

1. UK: Mixed Messages On Labour Market

- Most narratives can find some support in the latest labour market report, preserving uncertainty that should keep the BoE on hold at least until some clarity emerges.

- Unemployment has increased (LFS) or stabilised (payrolls), while pay is shockingly resurgent (inc-bonuses), slowing as expected (ex-bonus) or stagnating (private pay).

- Weakness isn’t as clear as the consensus and press sometimes make out, but concerns aren’t invalidated. We still expect resilience to preserve excess inflation hawkishly.

2. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 17 October 2025

- China: Monetary & Trade Indicators Strengthen: September data show broad-based monetary growth

- Korea: Early Signs of Trade Softness: The first 10 days of October show exports down 15% YoY, imports down 22.8%.

- India: Inflation Trends Favor Rate Cuts: Wholesale prices up just 0.1% YoY in September — a stark contrast to >10% in 2022 and flat in 2023.

3. UK: Unseasonably Resilient In Q3

- Slight growth in August sustains an above trend level of activity and is tracking to a 0.2% q-o-q pace for Q3, matching our forecast and the consensus, but disappointing the BoE.

- The ongoing slowdown in service sector activity repeats residual seasonality that would leave a trough in two months, but there is slightly more resilience this year.

- Policymakers shouldn’t react to statistical noise, and are unlikely to amid ongoing excesses in underlying inflation that a stabilising labour market wouldn’t break.

4. The Art of the Trade War: PAIN THRESHOLD FOR THE TACO TRADE!!

- Tensions between China and the U.S. have increased. Last week’s tit-for-tat exchanges culminated with President Trump threatening China with higher tariff rates and a cancellation of his meeting with Xi.

- Trump’s Friday post on social media immediately caused U.S. markets to swoon with the S&P breaking support levels. In a TACO trade moment, Trump reversed his harsh rhetoric on Sunday.

- Anyone can speculate on what the next few weeks will look like for markets, but we believe the market may start pricing in more long-term risk.

5. HEW: Cockroaches Startle Pricing

- Losses on bad and fraudulent US loans raise the risk that more cockroaches will emerge, nourished by monetary policy stimulating asset prices outside of recessionary regimes.

- Market rates fell on this, while macro data didn’t offer direction as UK Q3 GDP kept tracking 0.2%, EA inflation was confirmed, and UK labour market data were mixed.

- Next week’s UK inflation data should reveal a rise, with the CPI reaching 4%. Delayed US CPI data will provide a rare signal more relevant to the Fed’s likely decision to cut.

6. EA: Inflation Rises Briefly In The Fall

- Inflation’s rise to a high 2.3% in September was confirmed in the final print, although some payback remains likely in October. We doubt it goes fully back to the target then.

- Underlying inflation metrics were broadly stable again at about 2.5%, with little progress in most statistical measures for over a year.

- There is little cause for alarm at this stage, so the ECB can keep waiting in a good place, but we still see a greater risk of hikes than cuts in 2026.

7. The Return of Tariff Man

- We’ve been warning forweeks that the U.S. equity market advance was extended and it could pull back at any time.

- President Trump’s threat to impose high tariffs on China seems to be the bearish trigger.

- Our base case calls for a 5-10% pullback, and we regard any correction as a welcome pause and opportunity to add to equity positions at lower prices.

8. The AI Bubble Debate

- Are we in an AI bubble? Probably, but much depends on what stage we are in the bubble.

- On one hand, headline M&A deals like the one concluded with AMD is supportive of further gains.

- On the other hand, the recent Oracle earnings report casts doubt about the profitability of AI cloud computing sustaining elevated valuations.

9. US Equities: Maintaining Elevated Leadership Valuations Will Require Upside Surprises

- Hype surrounding the benefits of artificial intelligence (AI) has increased in 2025, despite a slowing economy. While new economy sectors have contributed to growth, not all is AI-related.

- There are valid comparisons between the current environment and the late 1990s surrounding hype about the beneficial impact of technological innovation on corporate performance. S&P500 leadership is priced to perfection.

- Current US equity leadership valuations are exposed to threats over the next 9 months, including stress in credit markets due to high bond issuance by companies in AI-related activity.

10. Asia Cross Asset Podcast: Japan – The New LDP Leader: Implications for policy and markets

- Ayako Takashi advocates for responsible expansionary fiscal policy, focusing on income distribution rather than aggressive fiscal expansion.

- Takashi’s comments on the relationship between the government and the Bank of Japan do not necessarily indicate clear intervention, but may put pressure on the central bank.

- The BOJ may need to deliver rate hikes every six months to combat elevated inflation, with market expectations of a terminal rate around 1%. Timing of rate hikes may be tricky, especially with fluctuating exchange rates.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.