This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. HONG KONG ALPHA PORTFOLIO: (September 2025)

- Hong Kong Alpha portfolio gained 8.45% in September and 60.89% and 62.80% YTD and since launch one year ago. The portfolio has outperformed Hong Kong indexes by more than 40%.

- The portfolio has a Sharpe ratio of 3.23 YTD and has generated more than 40% of its returns from stock-picking (alpha). Its beta is low at only 1.17.

- At the end of September, we increased exposure to AI and robotics and sold positions in the consumer and finance sectors.

2. UK: Lending Looks Stimulated

- Lending activity is sustaining beyond the levels prevailing before the stamp duty tax hike distortion. Only housing transaction volumes are down, but by less than before.

- New loan rates have fallen by 23bp since then, for a 110bp cumulative fall. New rates are close to the outstanding stock. Many borrowers are refinancing for similar deals.

- Past tightening has broadly passed through, but the strength in broad money growth signals that monetary conditions are settling at a slightly stimulative setting.

3. EA: Core Excess Revealed In Sep-25

- Inflation’s break above target to 2.23%, within 1bp of our forecast, came as past energy price falls dropped out to reveal the more resilient underlying pressures.

- Small upside surprises in large countries, like Germany and Italy, were balanced in number and contribution by larger surprises in small ones, like Greece and Estonia.

- We expect less negative payback in October and January, preventing our profile from languishing below the target through 2026, like the consensus view does.

4. UK: Government Leads Imbalances

- Household saving and inflation have eroded their debt burden while corporates remain prudent. A lack of imbalances to correct starves the UK of fuel for a recession fire.

- Persistent fiscal and current account deficits highlight where the UK’s primary risk lies. If the market regime focuses on fiscal issues, the corrective pressures could be fierce.

- We don’t expect that correction to occur, but the Chancellor should tread carefully, while doves need not worry about a recession arising from healthier other UK sectors.

5. Australian Equities: Where are we now, and what’s next?

- Australian economy remains sluggish, but some positives include recovery in small caps and resilience of Australian consumers

- Market volatility and narrow leadership driving unhappiness among active investors

- Resilience of Aussie consumer and strong retail results stood out in recent reporting season, with small caps and US housing exposure also notable themes

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

6. HEW: Watching What Didn’t Happen

- The US government shutdown removes the potential for official statistics to damp dovish concern, raising the likelihood of October’s cut, especially with other weak data.

- EA unemployment’s rise reflected rounding rather than substance. UK national accounts revealed healthy balance sheets, aside from the government, and bullish lending stats.

- Next week’s calendar stays thin with US releases suspended and Europe’s cycle focusing on the following week. The RBNZ, BoT, BSP and Peru announce rates next week.

7. Gold Mania, Niobium Dreams, and Antimony Nightmares (Datt)

- US monetary policy is accommodative and markets are buoyant, especially in commodities

- Investors need to be cautious about being overly bullish in current environment

- Similarities seen with 2006-2007 period, particularly in disruptions in copper supply and new technologies in metal recovery; investors should be wary of hype and potential risks involved

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

8. Get Ready to Buy the Dip, But Not Yet

- We remain intermediate-term bullish on stocks, but the market is at risk of a correction.

- If last week’s weakness is the start of a pullback, short-term trading indicators point to further downside potential.

- Investors should be prepared to buy the dip, but not yet.

9. Indian Market: WANT TO BUY THE DIP, THINK AGAIN !!

- India’s markets continue to underperform Asia since our insight last November recommending investors to “Fade the Market”.

- Foreign investors continue to exit the market this year with the largest net outflow since COVID.

- The Trump administration is pressuring India in trade negotiations with reciprocal tariffs (25%), additional tariffs for importing Russian oil (25%), pharma tariffs (100%), and new restrictions on H-1B visas.

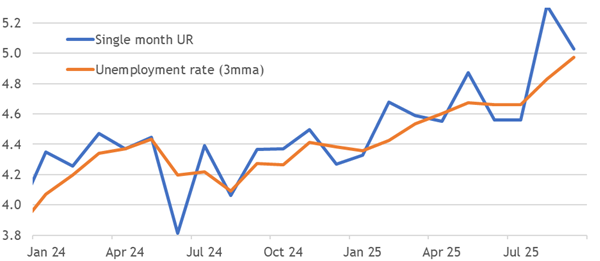

10. EA: Rounding Jobs For Migrants

- A surprise rise in EA unemployment reflects rounding rather than alarming weakness, with labour supply and demand still surging. Finland’s woes are more idiosyncratic.

- Supply has trended much faster post-pandemic, sustaining demand at its old trend without extreme capacity constraints. Migration has more than accounted for the rise.

- Ukrainians are dominating the flow and complicating the read through to disinflationary spare capacity. Wage growth is an even more critical signal when supply is uncertain.