This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

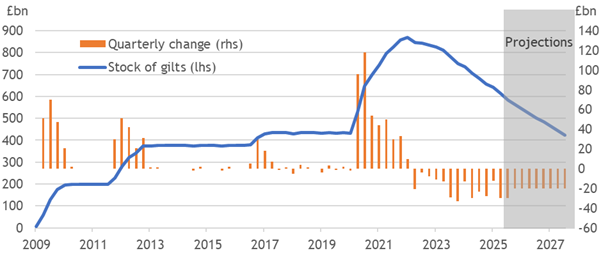

1. BoE QT: Pruning A Bad Policy

- The BoE’s annual Quantitative Tightening announcement in September should see it prune the targeted size, we expect by £20bn to £80bn, concentrated in the long-end.

- Fewer maturities in the year ahead would otherwise put too much pressure on active sales into a market that lacks appetite, especially with LDI demand disappearing.

- Pruning the size and duration delays costs crystallising by several billion a year, which the Chancellor will welcome, yet QT’s poor design remains an expensive fiscal disaster.

2. Fed: Politics Vs Fundamentals

- President Trump’s current preference for rate cuts is not unconditional. Higher-order logic suggests this would not override fundamental resilience or fairly prove “TACO”.

- Political pressure is state-dependent, with the messenger mattering more than the objective truth beneath any message. Trump’s Chair will have a stronger hand.

- Brazil suffered President Lula’s pressure, but he still supported his “Golden Boy’s” turn from dovish dissent to forceful rate hikes. Fed pricing ignores the potential for change.

3. France: Déjà Vu?

- Despite the near certainty that the Bayrou government will fall on 8 September, investors are wary, rather than spooked, reckoning that they have seen all this before.

- They are likely correct to judge that compromises will then be found, allowing the 2026 budget to be passed by a new centrist government.

- However, this would again only be putting off the day when a real crisis point is reached.

4. HEW: Crystalising Policy Divergence

- Spreads between ECB and Fed expectations widened again this week as the ECB held rates with a neutral bias while disappointing US labour market data drive dovish hopes.

- Underlying US services inflation was soft, and initial jobless claims spiked, albeit over Labor Day. We think US pricing has gone too far, and political pressure won’t dominate.

- Guidance with the Fed’s upcoming cut could start to correct that. The BoE will hold rates, after more hawkish macro news next week, and should trim its QT plan this year.

5. The Heat Is On: News Flow and Sentiment in CHINA / HONG KONG (September 11)

- HSTECH index is showing increasing strength as Hong Kong continues it Secular Bull Market. Continued strong market breadth indicates both rotational buying and new investors entering the market.

- Southbound buying from mainland investors remains strong after the “Liberation Day announcement. Mainland investor volume is now 20% of total volume in the Hong Kong market.

- China Biotech and Drug sectors were hit as the U.S. administration indicated it may begin restricting import of Chinese-made drugs and to cut off the pipeline of Chinese-invented experimental drugs.

6. Technically Speaking Breakouts & Breakdowns – HONG KONG (September 10)

- The Hong Kong secular bull market continues to broaden and has broken all long term resistance levels. The HSCEI has beaten Asian and global peers over the last 18 months.

- Growth and Momentum factors have been the best performers in the HSCI year to date. The Materials and Healthcare sectors continue to show increasing strength in their relative returns.

- Cloud Village (9899 HK) had a breakout pattern from a continuation triangle after reporting a deal to stream Korean drama series to Chinese market. The company’s profits grew in 1H25.

7. ECB: Balanced In The Good Place

- Staying in the ECB’s “good place” encouraged a neutral bias around its unanimous decision for no change, while being appropriately open to tackling future shocks.

- Staff inflation forecasts still undershoot the target, with recent upside news seemingly postponing passthrough rather than trimming the extent into something like our view.

- President Lagarde sounded relaxed about France’s spread widening, and the ECB did not discuss the TPI. We still expect no ECB easing against this, or further rate cuts.

8. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 12 September 2025

US producer prices softened in August, but structural factors keep inflation pressures elevated despite Fed rate cuts.

Labour market revisions show weaker US job growth, raising doubts on monthly payroll data reliability.

Japan’s GDP growth headline looks strong, but weak domestic demand and lower business spending reveal fragile fundamentals.

9. Seasonal Weakness Ahead?

- We are seeing fundamental headwinds in the form of elevated valuations and earnings uncertainty from tariffs, which won’t be visible until Q3 earnings season.

- On the other hand, the technical outlook appears relatively benign.

- Our base case calls for some choppiness ahead. We are near-term cautious, but not bearish.

10. Waller’s Gambit

- Fed Governor Chris Waller is a leading candidate to be the next Fed Chair, and the issue of Fed independence is paramount.

- Our evaluation of his economic case for rate cuts should be whether the decisions are based on sound data, theory and solid judgment.

- He has shown solid thinking on employment, but his justification for rate cuts based on the Fed’s inflation mandate is weaker and shows signs of wishful thinking.