This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

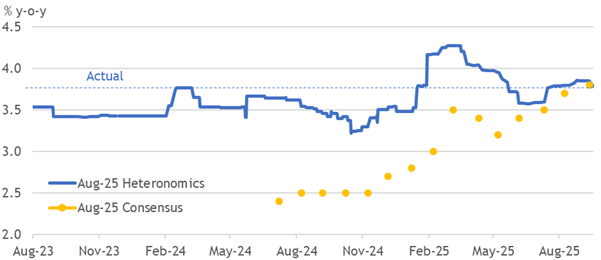

1. UK CPI Stickier For Longer

- UK inflation data confirmed the substantial upwards drift in the consensus, worth 0.6pp since May and 1.1pp over the past year, while matching final forecasts for August.

- The consensus has shifted further than usual over the past month. It now aligns with our hawkish forecast until April, when hope again dominates in dragging inflation down.

- Although the MPC won’t be shocked by this outcome, the persistent excess in underlying inflation still seems set to keep it holding rates. We do not expect cuts to resume.

2. UK Jobs Find Their Floor

- Stability in unemployment at 4.66%, while payrolls only marginally decline, suggests the labour market has found its floor before disinflationary pressures accumulate.

- A narrative-breaking improvement could occur next month. Tax rises structurally explain the scale of the previous shock, with weakness seemingly not going beyond that.

- Excess supply is needed to break wage growth to a target-consistent trend. Without that, the MPC should hold rates before potentially reversing by raising them in 2026.

3. Emerging Markets Outlook and Strategy for September 2025

- Global growth has been better than expected, particularly in emerging markets, due to strong export performance and tech cycle strength

- China’s growth is expected to slip below 3% in the second half, with domestic demand slowing sharply

- Despite the growth resilience in EM, central banks are expected to continue their gradual cutting cycle due to weak domestic demand and disinflation trends

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

4. Generative AI in Investment Mgmt: Value Investor’s Perspective w/ Ehsan Ehsani | New Barbarians #035

- Ehsan Ehsani, executive director at Crescendo Partners and adjunct professor at Columbia Business School, joins the discussion with Harmonic Insights and will be organizing the Generative AI and Investment Management Conference at Columbia.

- Futures markets are predicting a 25 basis point cut with more cuts in the future, while volatility and factor returns continue to be influenced by macro factors.

- Quantitative investors typically do not make significant changes to their portfolios based on short-term data, instead focusing on longer-term trends and statistically significant moves.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. BoE Trims QT To Hold Policy Steady

- The MPC unsurprisingly held rates while seeking an answer to its key question around inflation risks amid elevated expectations and a possible structural shift.

- It also trimmed QT by £30bn to £70bn, keeping active sales of long gilts steady in the next three quarterly auctions while skewing QT towards short and medium gilts.

- We still expect the MPC’s presumption of rate cuts resuming to fade out in early 2026 as hawkish pressures persist. Some offsetting fiscal space arises from QT being trimmed.

6. Japan Macro: Restarting Coverage

- Bank of Japan likely to remain on hold till January 2026 with risk of further delay

- Once BoJ resumes hiking cycle, it will likely follow twice a year pace till 1.5%

- With the Fed cutting rates, the long end of the JGB curve is firmly anchored

7. HEW: Cautious Cuts Through The West

- Economic data releases revealed more resilience in labour markets than feared, while inflation remained high. Yet Western central banks broadly cut rates, albeit cautiously.

- The BoE’s caution left only two dovish dissents to its on-hold decision, while it cut QT by £30bn to £70bn to reduce the likelihood of gilt market indigestion.

- Next week’s SNB and Riksbank decisions should join the BoE in holding steady, although they have already cut much further. Flash PMIs are the data focus in a thin calendar.

8. US: You Ain’t Seen Nothin’ yet on the Impact of the Trump Tariffs

- China’s share of US imports will halve in 2025 from Mar’18 peak of 21.8%, and ASEAN’s share (led by Vietnam) will rise to 14%. India, Korea, Taiwan’s shares gain too.

- There was a big surge in Asian exports to the US in Jun-Jul’25 to beat tariffs, but tariffs will alter patterns in 4Q2025, cutting export growth and reducing US disinflation.

- The rebound in US steel production (+4.6%YoY in Jun-Jul’25) and ISM manufacturing new orders suggests select American industries (metals, automobiles, electronics) will gain but downstream users will suffer steadily more.

9. Twilight of the AI Bull?

- The leadership of AI-driven stocks is starting to stumble from bubbly valuation levels, which brings up the warning from Bob Farrell’s Rule #4.

- The debate is ongoing as to whether the AI bull is evolving from hyperscaler leadership to the next phase of companies that can better exploit the technology.

- The lack of cyclical market leadership is concerning from a technical perspective. We are therefore tactically cautious about the short-term outlook for U.S. equities.

10. Dialling down the Noise

- Traders, Quants and Passive Investors have steadily crowded out most earnings signals for long term investors.

- Quarterly reports won’t be missed, and ironically their ending may help restore the role of fundamental analysis.

- However, narrative trading will simply go elsewhere and developments in AI, options and meme stocks are already creating a new asset class we might call ‘Equity as Crypto’.