This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

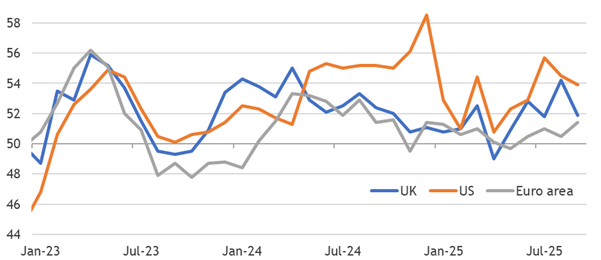

1. Broadly Slower Services PMIs

- PMIs broadly disappointed and declined relative to August, but absolute levels mostly remain robust or at least expansionary. We are not concerned by these noisy moves.

- Such broad slowing seems shocking relative to the past few months, but it is historically a regular occurrence. Five of the previous twelve were at least as broadly bad.

- The labour market remains tight in the euro area, softened in the UK, and steady in the US. Slower activity does not mean disinflationary slack. We stay relatively hawkish.

2. EM Fixed Income: (EM) Credit where credit’s due

- Despite a mixed Fed meeting, EM markets continue to rally in FX and rates

- EM local markets still in a good place with upside potential in growth and improving flow picture

- Sovereign credit markets have had a strong performance year to date, with investors feeling optimistic but also acknowledging the need to be humble in assessing macro risks and valuations.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

3. HEW: Resilience Reminders Roil Doves

- Bullish GDP revisions and jobless claims provided further reminders that the economy is much more resilient than market pricing has dovishly assumed, causing a hawkish shift.

- Nonetheless, the Riksbank surprised with a 25bp rate cut, but projected that as the terminal rate before hikes start reversing the stimulative setting in 2026.

- Next week’s US payrolls data dominates the calendar, given the potential to break market conviction in an October Fed cut. EA inflation should rise back above the target.

4. Asian Equity: Relative Valuations Have Mostly Converged; Korea the Only Large Rerating Candidate

- Most large Asian markets’ forward PE multiples are significantly higher than their long-term averages. But their valuations relative to Asia-ex-Japan are mostly at the averages, only Korea’s is significantly lower.

- HK/China’s relative PE is slightly lower than average, Taiwan’s is slightly higher. ASEAN markets’ relative PE are sharply lower than their averages, but we think most lack rerating catalysts.

- We think Korea and Philippines deserve to get rerated. India’s relative PE, though at its long-term average, could decline slightly further, to reach its recent bottoms.

5. Will AI save the US Economy?

- European policymakers and investors see Donald Trump’s economic policies harming Republican prospects in the 2026 midterms and the 2028 general election.

- The Trump Administration is placing a good deal of faith in AI as a panacea. But the US may not have the skilled labour or the power-generating capacity to fuel an AI boom.

- Nor is it clear whether the current Administration is preparing for the related socio-economic disruption from which the MAGA faithful would be far from immune.

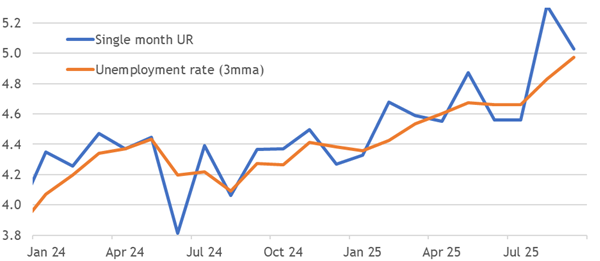

6. Resilience Is Reinstating

- Falling US jobless claims and bullish GDP revisions are reinstating evidence of ongoing resilience. Underlying GDP only slowed by about 0.1pp in H1, or 15% of 2024’s average.

- Risk management rate cuts to balance the higher costs of being wrong on the downside raise the probability that easing proves premature and swiftly ends.

- The ECB already sees the transmission of its past cuts trending loan growth higher. It may reach pressures consistent with hikes next year, and it already clashes with easing.

7. Asian Equities: Foreign Flows Come Roaring Back in September; India, ASEAN Still Getting Sold

- Fed’s “risk management cut” and a dovish outlook of 2 more cuts in 2025 are driving foreign flows back to Asia. US$11.5bn inflows in September till date underscores the sentiment.

- Korea (US$4.94bn) and Taiwan (US$7.5bn) grabbed the Asian flows entirely, driven by the rejuvenated AI capex theme. India (-US$904m) continues to be sold, though the selling pace has diminished.

- FIIs bought Indonesia (US$672m) in August and sold almost identical amount in Thailand. Philippines, despite being cheap and having a few sectors with upward earnings inflection, continues to be sold.

8. US Tariff Policy: A.K.A. WHACK A MOLE!

- The U.S. continues to play “Whack-A-Mole” using tariffs to threaten and/or negotiate on many economic and geopolitical issues.

- The Trump tariff policy, which may be declared illegal by the Supreme Court next month, has caused manufacturers to hold off on hiring and expansion plans.

- Although tariff revenue for the U.S. government is at an all-time high, the U.S. will still record its highest trade deficit in history this year.

9. SLBs in 2025: Where Step-Ups Create Event-Driven Alpha

- Set-Up and scale: 245 SLBs face 2025 KPI tests; applying a 19% 2024 miss rate implies ~50 step-ups of ~25 bps, worth ~20–60 bps PV. >$80bn notional, heaviest in Q4.

- Trade design, credit and equity: Pre-position where slippage exists and no pre-test calls; run structure pairs; trade post-print drift; for equities, SLB misses flag delivery shortfalls and funding-cost creep.

- Why the market is inefficient: ESG KPIs hide in footnotes and annexes, overlooked by analysts. Verification lags and slow vendor updates delay repricing, so step-up structures stay mis-weighted and mispriced.

10. Indonesia : Sri Mulyani’s Exit Compounds Fiscal Risks

- The exit of Indonesia’s veteran Finance Minister, Sri Mulyani Indrawati, marks a turning point in the country’s fiscal regime.

- With her out of the picture, it is only a matter of time before the government revises the 3% deficit ceiling higher to accommodate Prabowo’s large spending plans.

- This is a slippery slope and an indiscriminate push for spending, without concomitant tax reforms, could put debt on an unsustainable path.