This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

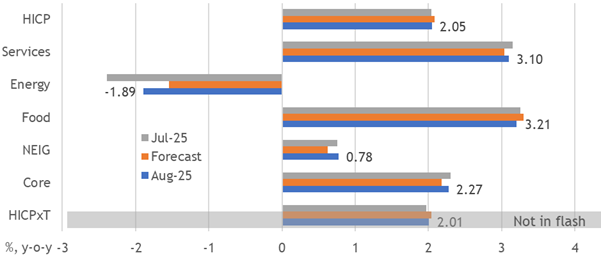

1. EA: Defying Disinflationary Narratives

- Dovish hopes for EA disinflation continue to be disappointed by resilient outcomes. The rise to 2.1% in August amid sticky core pressures is opposite to the dovish narrative.

- Euro appreciation’s disinflationary shock is being offset by domestic resilience, which was most surprising in Northern Europe. Our errors were relatively small and balanced.

- Ongoing upside surprises have defied recent consensus expectations of a drift down to 1.8%. The ECB faces broad upside news that should reassure it against cutting again.

2. Cutting After Pauses

- The BoE and Fed rarely resume cutting cycles after a pause, yet the Fed seems set to break its hold with a cut just as the BoE and ECB enter their own pauses.

- 2002-03 is the best historical parallel for the Fed, which signals potential cuts should be shallow and are likely to be reversed. Politics is no match for the fundamental need.

- Persistently excessive UK pressures should prevent the BoE from cutting in November or beyond, with a quarterly pause historically unlikely to resolve in another rate cut.

3. HEW: Pauses On And Off

- Another disappointing payroll release provides the fundamental cover needed for the Fed to end its pause with a rate cut on 17 September without being too political.

- The BoE is starting its own pause, and if it goes a quarter without cutting, historically, it’s not resumed the cycle. Its DMP survey confirmed inflation’s persistent problem.

- Another upside inflation surprise seems set to keep the ECB on hold amid record low unemployment. We also expect it to preserve its view that policy is in a good place.

4. Liz Truss on the ‘Doom Loop’ Engulfing the UK Economy

- Legacy systems can’t handle usage-based billing, slowing down product launches

- Metronome allows for quick roll out of new pricing models in minutes

- Guest interview with Liz Truss discussing economic challenges and the need for policy shifts

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. BoE Survey Says Inflation Persists

- CFOs are telling the BoE that they plan to keep raising prices by more than 3% in 2026. The BoE should take notice, as this survey’s previous warnings have proven accurate.

- Expected increases reflect the passthrough of further wage increases beyond a pace consistent with the target. They exceed even our already hawkish forecasts.

- The BoE is unlikely to realise the sharp drop in wage growth it expects by year’s end, without a shock to break the current regime, bolstering our call for no more rate cuts.

6. HEM: Politicised Policy Pricing

- Persistent inflationary pressures pared dovish guidance and pricing for the BoE and ECB, but Fed pricing is stuck.

- Blocking a rare resumption of Fed easing looks unlikely, but history suggests cuts would be shallow and reversed.

- Peer pressure is weak during a policy mistake. The BoE faces domestic problems that prevent further easing.

7. HONG KONG ALPHA PORTFOLIO (August 2025)

- Hong Kong Alpha portfolio gained 11.34% in October outperforming its benchmark and HK indexes. The portfolio’s Sharpe ratio increased to 2.91 and the beta and correlation to its benchmark decreased.

- The Hong Kong Alpha portfolio is generating significant alpha (idiosyncratic) returns since launch, with 40% of returns represented by superior stock selection, with the remaining due to sector weighting.

- At the end of August, we bought Luk Fook Holdings Intl (590 HK) for the portfolio as retail demand for gold products in mainland China increases.

8. 182: Private Credit: Hype, Hazard, or the Next Big Thing in Long-Term Growth? With Huw Van Steeni…

- Private assets, gold, and real estate are recommended for investment to recreate what our parents had financially

- Private credit is reshaping wealth portfolios, with a shift towards insurance companies funding the majority of assets in private credit

- The role of private credit has grown significantly post-financial crisis, with a focus on higher quality, lower risk assets and loans to hard assets such as infrastructure.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

9. Everything is a bit Brown

- We often talk of people wanting things to be Black and White and being disconcerted when they realise that they are in fact always Grey, but we would extend that metaphor to the full colour spectrum.

- We want things to be clear and bright and in vivid colour, but in fact everything is, well, basically a bit brown, the colour you get when all the other paints are mixed together and thus, to us at least, it represents the current and pervading sense of muddle and confusion.

- Politically, we see Red socialists embracing Green issues as their central policy, while Greens are pursuing Red Marxism (the author James Delingpole wrote a great book about this called ‘Watermelons’ as in Green on the outside, Red on the inside. But we would just merge the two colours and get brown.)

10. We Know More Than We Can Say Precisely

- The current and expected deterioration of the underlying fiscal trend is troubling

- But the empirical and theoretical relationships between fiscal variables and longer-term interest rates are complex

- My decomposition of longer-term rates and econometric estimates can potentially add to the available research on this