Summary

Earlier this year, I asked followers on Twitter whether they had trading access to Southeast Asian markets. 75% answered that they don’t.

So I thought I should help you identify brokers with the best access to these markets.

Here is my conclusion:

- If you’re looking for an online trading platform with access to most Asian markets, then I believe that Boom Securities is the best option for you.

- If you don’t mind trading over the phone and are looking for a Singapore-based broker with great market access, then I believe that either KGI Securities or Maybank will do the trick.

Just be aware that the transaction costs in Southeast Asian markets are high. For that reason, I recommend investing for the very long term only. Or at least make sure that the upside in each stock can justify the costs involved in purchasing it.

Who is eligible for Asian brokerage accounts?

Most brokers I have reviewed enable foreigners to open accounts with them. The only exception is if you’re a US citizen because the US SEC prohibits financial institutions that are not registered and regulated in the US from soliciting US clients. Americans will only be able to open accounts with brokers that already have a presence in the US.

Here are the major Asian brokers that accept Americans and non-Americans as customers:

Some brokers only accept those 21 years and older, including KGI Securities and OCBC Securities. So if you’re between 18 and 21 years old, you will have to exclude these from your shortlist.

Some brokers have additional requirements on minimum deposits, including OCBC Securities, Saxo and Phillip Securities. But I don’t think that should be a major hurdle for you.

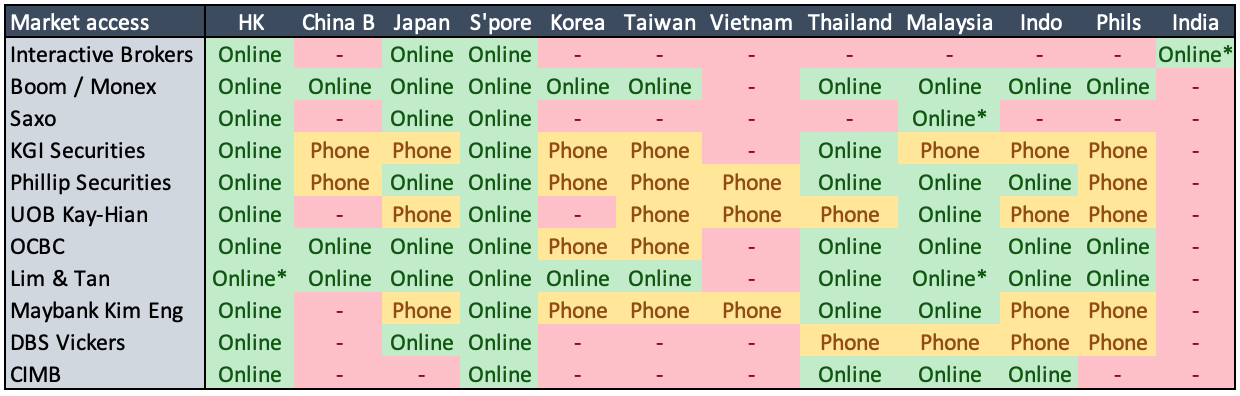

Market access

Here is the market access offered by the major brokerage companies in Asia.

Interactive Brokers is a popular option for retail investors, but unfortunately, it only offers access to Hong Kong, Japan, Singapore and India (with some restrictions). For Southeast Asian markets and Korea / Taiwan, you will need another broker.

Here are the brokers that offer the best access to these other countries:

Best market access:

The online trading platform that offers the access to the most Asian markets is Boom (Monex), with the only two exceptions being Vietnam and India.

Decent market access:

For Southeast Asian markets, OCBC Securities, Philip Securities, Lim & Tan’s online trading platforms offer decent access. Note that in Lim & Tan’s case, however, you will have to open separate trading accounts for Malaysia, Hong Kong and Singapore. CIMB’s access is not bad, but they do not offer access to the Philippines.

Trading over the phone:

If you’re fine with broker-assisted trading (over the phone / messages), then KGI Securities, Maybank and DBS Vickers could be options worth exploring.

To summarise: for HK, Japan, Singapore, you’ll be fine with Interactive Brokers and Saxo. For the Philippines, you can choose any of the Singaporean or Malaysian brokers or Boom except CIMB. For Korea / Taiwan, you can trade with any broker except UOB, DBS and CIMB. Just know that you’ll probably have to trade over the phone.

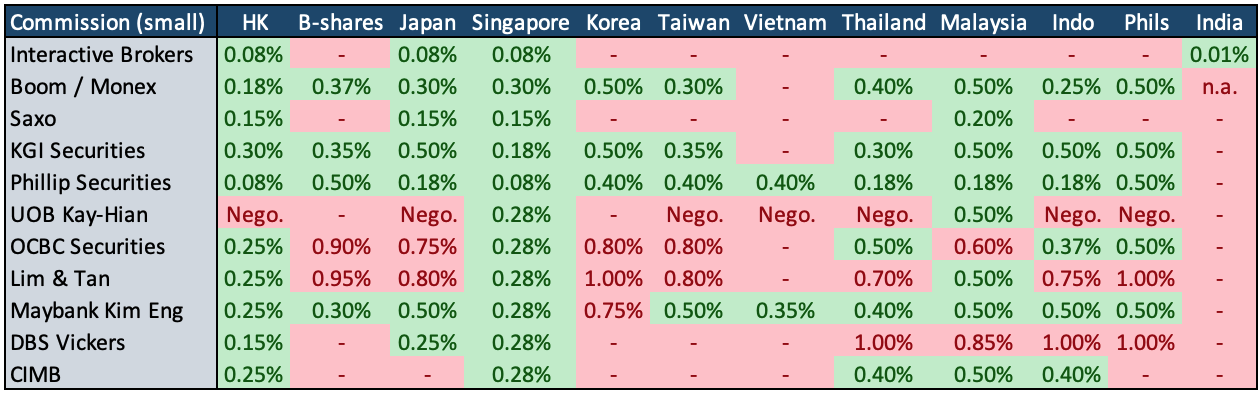

Commission rates

Here are the trading commissions for the major Asian brokerage companies.

Best commission rates:

Interactive Brokers’ commissions are probably the best in the entire industry with commission rates below 20bps. However, IBKR does not offer access to Southeast Asian emerging markets and not to Korea or Taiwan either. Almost the same for Saxo, also offers decent commision rates for developed markets but among Southeast Asian markets it only offers access to Malaysia (subject to further documentation).

The second tier:

Boom Securities (Monex), CGS-CIMB, Maybank, KGI Securities, OCBC Securities and Philip Securities offer commission rates of around 20-60bps.

The worst:

DBS Vickers and Lim & Tan charge closer to 1.0% in commission for each trade.

Note that these fees are per transaction, so for a buy-and-sell round-trip, expect at least double the fees. If you trade a lot, the fees will add up.

FX conversion rates

When a broker offers access to a local market but does not handle the local currency, the settlement will proceed in a base currency (e.g. SGD or USD), and an FX spread will then be added. These FX spreads can be very high.

Few brokers offer settlement in Southeast Asian currencies. KGI Securities does offer settlement in MYR, IDR, and I believe OCBC Securities does in MYR, IDR, PHP and THB, but the others do not. So as a customer of, say, KGI Securities, what you can do is pre-fund your account with your desired currency and then ask them to trade directly with that currency. A bit of a hassle as you’ll have to transfer money back and forth.

If your broker does not handle the local currency, prepare to pay up. The bid-ask spreads can be massive. I called up each of the brokers and asked them to provide indicative exchange rates.

The table below shows the bid-ask spread provided to me by their customer service reps: equivalent to what you would pay starting from USD or SGD, buy the local currency and then convert back again.

Either way, you’ll have to pay 1-5% round-trip for Thai Baht, Malaysian Ringgit, Indonesian Rupiah and Philippine Peso. These are very high numbers indeed.

Boom Securities would not give me an exact quote, simply stating that they outsource the business to HSBC Hong Kong and that the spread will typically be 1-2% per transaction (times two for a round-trip conversion). Phillip Securities Hong Kong has indicative rates on its website, but who knows what exchange rate they will actually use when settling in non-local currencies. The Singaporean banks UOB, OCBC and DBS, offer inferior rates, in my view. The Malaysian banks Maybank and CIMB’s rates are just slightly better.

But either way, if you add up commission rates x2 plus the bid-ask spread, you’ll end up paying somewhere around 2-5% in total transaction fees for Southeast Asian markets. So make sure that the upside in whatever stock you want to trade justifies the cost of purchasing it.

Other fees

Other transaction fees tend to be modest and not worth taking into account:

- Dividend handling fees are typically modest. 1% at UOB, DBS and Lim & Tan, 0.5% at KGI Securities and Boom. Many others such as CIMB, Boom and Phillip Securities charge US$3-5 for each dividend.

- Custody charges tend to be somewhere around 0.1% for Taiwanese shares. At the Singaporean brokers, custody charges for foreign shares tend to be SG$24/year. The only company that stands out in terms of custody charges is KGI Securities’, which charges 0.68% for Singaporean stocks and 0.70% for Taiwanese stocks.

- Boom charges an admin fee of ~US$25 per year. Lim & Tan charges a similar amount.

Customer reviews

Here are representative reviews for each of the brokers (most from broker research platform seedly.sg):

- KGI Securities (n.a.): “Overall they are quite good… might need a separate account for Vietnam and Philippines.”

- Boom / Monex (n.a.): “Load problem… the trades are executed fast… I love that they cover so many SE Asian countries… competitive fees except for that dividend charge which I hadn’t noticed.”

- CGS-CIMB (4.4/5.0): “Customer service is great… the staff are polite and patient when answering my questions… platform was also good to use… take forever to open an account.”

- Phillip Securities (4.2/5.0): “No frill and no platform fee… customer service is good and very helpful… [the user interface is] easy to understand and user friendly.”

- Interactive Brokers (4.1/5.0): “Really low rates… cheapest broker out there if you intend to invest >100k… the problem is it looks confusing… but the app is good… not intuitive and hard for beginners to use.”

- Lim & Tan (3.9/5.0): “Compared to new online brokers [the user experience] feels outdated and less intuitive… commission rates aren’t cheap… I find Lim and Tan’s website very user-unfriendly.”

- Saxo (3.8/5.0): “User interface is very intuitive with plenty of features… the platform was easy to navigate, but customer support was horrible… don’t depend on Saxo if you need the funds to be withdrawn promptly.”

- OCBC Securities (3.1/5.0): “Poor user interface on both web and mobile versions… old interface… customer service is average at best… not the cheapest commissions in the market, but I am assigned a dedicated trading rep who is responsive.”

- Maybank Kim Eng (2.7/5.0): “Like their customer service… when you buy a share, the portfolio is showing incorrect info and sometimes it does not even show out the units that you bought… website is a bit old fashioned but workable enough.”

- DBS Vickers (2.7/5.0): “Platform seems quite outdated and not user friendly… buying overseas stock can be expensive… the “live” streamed prices on the DBS Vickers website are not accurate.”

- UOB Kay-Hian (2.2/5.0): “Bad experience using their services… charges high fees as well, compared to its competitors…. user interface looks very old and outdated… the platform is really archaic, as compared to Phillip and CIMB… they keep fulfilling partial orders to profit from transaction fees.”

In brief, no one can match Interactive Brokers in terms of fees and execution. But CIMB’s and Phillip Securities’ apps are decent. UOB / DBS / OCBC / Maybank seem to be lagging in this respect. I have a decent experience with Boom (Monex) and have heard good things about KGI Securities.

Investor protection

Interactive Brokers’ American accounts (both residents and non-residents) are covered by Securities Investor Protection Corporation (SIPC) insurance for up to US$500,000 for securities and cash (cash only: US$250,000).

Singapore broker accounts are only covered by deposit insurance and not for securities. So if your broker goes bankrupt and stocks are held in the broker’s name, then you may not be able to receive any financial compensation. If you own local shares in Singapore, SGX’s Fidelity Fund will pay compensation of up to SG$50,000. There is another way you can protect yourself: by opening a so-called Central Depository (CDP) account, your stocks will be held in custody with Singapore Exchange instead – a company that’s unlikely ever to go bankrupt.

Hong Kong does have SIPC insurance, but it only covers HK stocks and up to HK$150,000. That’s a very modest amount of money.

So with limited SIPC protection, I recommend sticking with brokers that have strong financial backers. These are the parent groups of the brokers I mentioned above:

- Interactive Brokers: Interactive Brokers Group (IBKR US)

- Boom: Monex Group (8698 JP)

- Saxo: Zhejiang Geely Holding Group (private)

- KGI Securities: China Development Financial Holding Corporation (2883 TW)

- Phillip Securities: Philip Investment Corporation (private)

- UOB Kay-Hian: UOB Group (UOB SP)

- OCBC Securities: OCBC Bank (O39 SP)

- Lim & Tan: Lim & Tan Securities (private)

- Maybank Kim Eng: Malayan Banking (MAYBANK MK)

- DBS Vickers: DBS Group (backed by the Singapore government)

- CGS-CIMB: CIMB Bank (CIMB MK)

I feel comfortable with Interactive Brokers, Monex, China Development Financial (a Taiwanese company), UOB, OCBC, DBS, Maybank and CIMB. These are all major financial institutions.

Not putting all your eggs in one broker basket will also help.

Final ranking

Here is my final (subjective) ranking of the Asian brokers listed above. I exclude Interactive Brokers and Saxo since they do not offer sufficient market access to qualify as pan-Asian brokers.

- Boom Securities: Great market access on one single online trading platform. The commission rates are competitive, but there is not much transparency around their FX conversion rates. Backed by Monex, which is a major Japanese financial institution. Americans are eligible to become customers. Based in Hong Kong.

- KGI Securities: Great market access to all markets except Vietnam. Competitive commission rates. Southeast Asia trading is mostly done over the phone. Excellent customer service. Backed by a major Taiwanese financial institution with a market cap of US$7 billion. Americans are eligible to become customers. During COVID-19, they won’t accept new customers unless an existing customer can refer you to them. But I suspect that will change soon. KGI Securities is based in Singapore, which to me is a positive.

- Maybank Kim Eng: Great market access, including to Vietnam. Okay commission rates, poor platform user interface. Backed by a major Malaysian bank. The FX rates they quoted me seemed somewhat better than those offered by the Singaporean banks. Not open to Americans.

- CGS-CIMB: Decent commission rates, great app UI, access to most Asian markets except Philippines, Korea and Taiwan. Backed by major Malaysian bank CIMB. Americans are eligible to become customers.

- Phillip Securities: Low commission rates. Decent app and customer service (allegedly). Access to all Asian markets, including Vietnam. Not backed by a major financial group. Unfortunately not open to Americans.

- OCBC Securities: Great market access, but high fees for East Asian markets. The trading platform can be used for Southeast Asia. The user interface is allegedly not great. Responsive trading rep. Backed by a major financial institution. Americans are eligible to become customers.

- UOB Kay-Hian: Poor user interface. Not much transparency with regards to fees. Mostly trading over the phone. Backed by a major Singaporean financial institution. Americans are eligible to become customers.

- DBS Vickers: High fees for Southeast Asian emerging markets at close to 1%. Most trading is done over the phone. The upside is that it has implicit backing from the Singapore government via Temasek. Not open to Americans.

- Lim & Tan: Very high commission rates at 70-100bps. A lot of the trading is done via the platform, but you will need separate accounts for Malaysia, Singapore, Hong Kong and the US. Not backed by a major financial institution. They appear to trade via Boom Securities, so why not use Boom directly? Americans are eligible to become customers.

Begin your investment journey with Smartkarma Plus

Institutional-Level Investment Insight, Now for private accredited investors

Smartkarma has levelled the playing field. We bring you institutional-level Insight that moves markets, at a price-point that matches your needs.

Smartkarma Plus Welcome Offer

Just $1.99 for your first month

- ✓ Unlimited Research Summaries

- ✓ Personalised Alerts

- ✓ Custom Watchlists

- ✓ Company Data and News

- ✓ Events & Webinars