https://assets.smartkarma.com/sk-press/in-the-news/20160831_Pimcos_APAC-_trading-_head-_joins-_Smartkarma.pdf

http://www.straitstimes.com/opinion/the-moats-that-fintech-companies-must-cross

It has been postponed once, and now many firms worry MIFIDII could be further delayed by Brexit. The question on everyone’s minds is will Britain’s decision to leave the European Union throw Britain’s compliance with MIFIDII into a tailspin?

What does Brexit mean?

On June 23, Britain voted to leave the European Union in a nationwide referendum. The result sent a shock through financial markets. For most in Britain, the result was uncomfortably close. Leave won by 52% to 48%. The referendum turnout was 71.8%, with more than 30 million people voting.

Britain’s withdrawal from the European Union will not formally begin until Article 50 of the Lisbon Treaty is invoked. Triggering Article 50 gives the parties two years to agree to the terms of the split. Several European heads of state, including France’s François Hollande, hoped Article 50 would be triggered promptly in the event of UK’s leave vote. But Britain’s new Prime Minister, Theresa May, has publically stated that she will not trigger Article 50 before the end of 2016. This means that there will not be a clear idea of what kind of deal the UK will seek from the EU, on questions of trade and immigration, until 2017. From a legal standpoint, Britain remains under the jurisdiction of existing European laws for the next two years.

How will the implementation of MIFIDII be impacted?

Britain’s decision to leave the EU has fostered doubts about the implementation of MIFIDII. The ambitious set of trading rules laid out by the MIFIDII are subject to approval by the British parliament, and UK investors are questioning whether certain aspects of MIFIDII – namely, volume caps on dark pool trading, the ban on broker crossing networks, and the transparency regime for illiquid fixed income securities – are in Britain’s best interest.

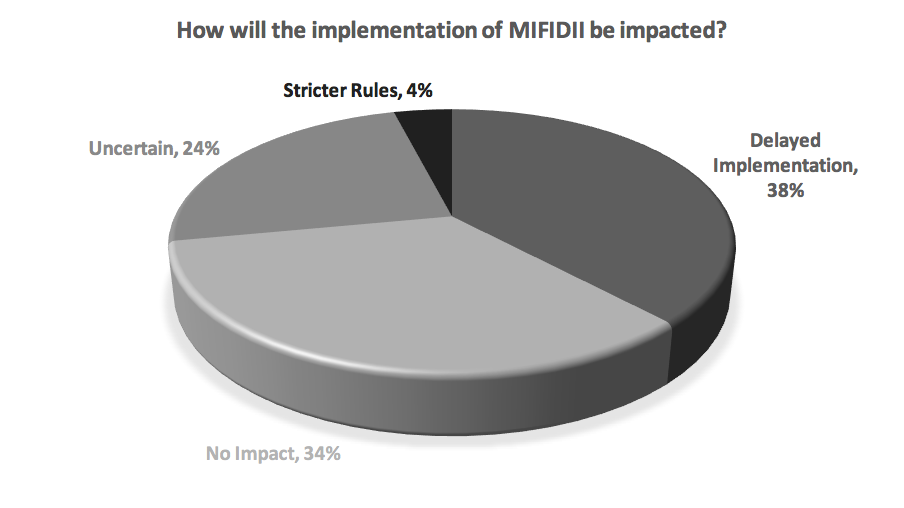

In a poll conducted in the two weeks following the vote, capital markets research firm Tabb Group polled over 300 market participants – including brokers, banks, vendors, exchanges, and prop trading firms – to gauge their views over the UK’s decision to leave the European Union.

Participants were asked to assess the impact of Brexit on the implementation of MIFIDII. The majority of respondents (38%) stated that Brexit will delay the rollout of the legislation, with 34% saying that they were uncertain as to its impact.

The report accompanying the survey reads:

“The banking and dealer community were somewhat optimistic about any potential delay, although they were only marginally more expectant than exchanges and the vendor community.”

But firms hoping for a delay will be disappointed by the Financial Conduct Authority’s (FCA) recent issue of a stark reminder that UK firms must continue to prepare for the new rules.

“Regardless of MIFIDII regulatory implementation, commercially the horse has bolted,” says Jon Foster, Co-Founder of Smartkarma. “At its core MIFID2 is about reducing conflicts of interest, and creating a new gold standard for transparency and the duty of care owed to investors. Leading global players are incentivised to adopt this new Gold standard as they compete for assets. This competitive tension will ensure widespread adoption; by participants, by countries and by innovators reshaping the industry for the better.”

Chris Aspinwall, CEO of British tech firm Fidessa said in an article recently published by Futures & Options World that while it is still too early to know all the implications of Brexit on financial markets he does not see “any impact on the changing regulatory environment.”

Tullet Prebon has become the second City firm to predict that British firms will have to comply with the European trading reforms irrespective of Brexit. Tullet said in a statement last week: “The uncertainty surrounding Brexit has raised questions about the implementation of MIFIDII but so far the message from regulators has been to carry on.”

The London-based broker added: “The implementation of MIFIDII has to take place at least a year before any expected Brexit event, and in most planning scenarios the UK will maintain the alignment with MIFIDII at least for the foreseeable future.”

Except in the event of any major changes, it seems that MIFIDII will roll out in January 2018 as expected.

For more on MIFIDII and how it will impact the way that investors buy and consume research, read our blog post here.

MIFIDII is one of the most ambitious pieces of European financial regulation to affect investors in recent years. It governs everything from measures to reduce market volatility to policing potential conflicts of interests among financial advisers. Buyers and sellers of research must be ready to alter their existing strategies if they are to meet the new regulatory standards.

What is MIFIDII, and why is it so important to investors?

MIFIDII has been commonly regarded as a victory for common sense. Since the 2008 financial crisis, there has been a tangible sense amongst investors and policymakers alike that the EU should do more to ensure the robustness of its financial markets.

Michel Barnier, EU Internal Market Commissioner from 2010 to 2014, set himself the task of creating a ‘single rule book’ for European financial services in 2011. The goal was to prevent excessively risky practices from occurring again at the scale of 2008. Barnier first proposed a draft of MIFIDII in October 2011. After nearly three years of negotiations, a deal on the final version of the law was approved by national governments and the EU Parliament in 2014, with a commencement date of January 3, 2017. This date has since been extended to January 2018 due to ongoing negotiations.

What has caused the delays in the roll out of MIFIDII?

It took three years for Barnier’s proposal to be agreed upon by national governments and by the EU Parliament. In simple terms, the reason was that the law does not cover the technical implementation standards required to put its measures into operation. This task was given to the European Securities and Markets Authority (Esma). Esma was required to draft the required technical implementation standards and then send them for review by the European Commission, governments and the EU Parliament.

This was intended to be a small task when compared to reaching an agreement on the law itself. However, it has proved anything but. The technical standards run to more than a thousand pages, and their preparation has been slowed by debates over technicality.

What are the impacts of MIFIDII on the ways investors buy and consume research?

MIFIDII will have a significant impact on the way that investors buy and consume research. For one, if a firm wishes to use client funds to pay for research, it will be required to separate execution costs from research payments. Fund managers will have to report on providers paid from the account, the total amount they were paid and over a timeframe, the services received and the amount spent from the research budget.

Some industry-insiders have regarded these regulations as an unwelcome increase to their already burdensome administrative workload.

However, the legislation is unavoidable. MIFIDII is a byproduct of a desire for greater transparency that had been steadily growing since 2008. While its implementation will cause investors to rethink their current research strategy, this could actually help revitalize the industry.

“Any focus on value for money inevitably brings an emphasis on efficiency,” says Jon Foster, Co-Founder of Smartkarma. “A fragmented research market cannot deliver this. We expect to see consolidation or better still, a platform approach, to bring about cost savings. We are already seeing moves afoot, most recently highlighted by the merger between independent research firms Lombard Street and Trusted Sources.”

Gilles Bazy-Sire (CEO at Equity GPS), in an article recently published by FT.com, said that from the moment MIFIDII comes into effect independent research producers will reap the benefits of generating creativity and innovation in the industry. MIFIDII will push institutional research providers to differentiate themselves and provide deep, valuable insights to buyers. This will benefit the industry overall, injecting a fresh dose of innovation into investment research on European markets.

http://www.reuters.com/article/wanda-properties-delisting-idUSL3N1AR06G

https://www.techinasia.com/talk/online-panel-fintech-sea

http://www.themalaymailonline.com/money/article/dbs-soured-loans-mask-something-even-more-disturbing

https://www.bloomberg.com/gadfly/articles/2016-08-08/dbs-soured-loans-mask-something-more-disturbing

http://www.icis.com/resources/news/2016/08/05/10022881/india-to-adopt-unified-gst-but-implementation-faces-hurdles/

https://assets.smartkarma.com/sk-press/in-the-news/20160805_SPH_Invest_Intelligently_With_Smartkarma.pdf