In this briefing:

- GER Upcoming EVENTS Calendar

- Emart: Attractive Entry Point, Undervalued Real Estate Assets, & Homeplus REIT IPO

- Visit Note

- Bank Mandiri (BMRI IJ) – Shape Shifting and Millenial Mortgages – On the Ground in J-Town

- New Oriental (EDU): Educator License Not A Concern

1. GER Upcoming EVENTS Calendar

We have received requests to provide a calendar of upcoming catalysts for near-term M&A, stubs and erstwhile event-driven names. Below is a list of catalysts over the near-term for such names as below. If you are interested in importing this directly into Outlook or have any further requests, please let us know.

Kind regards, Rickin Arun and Venkat

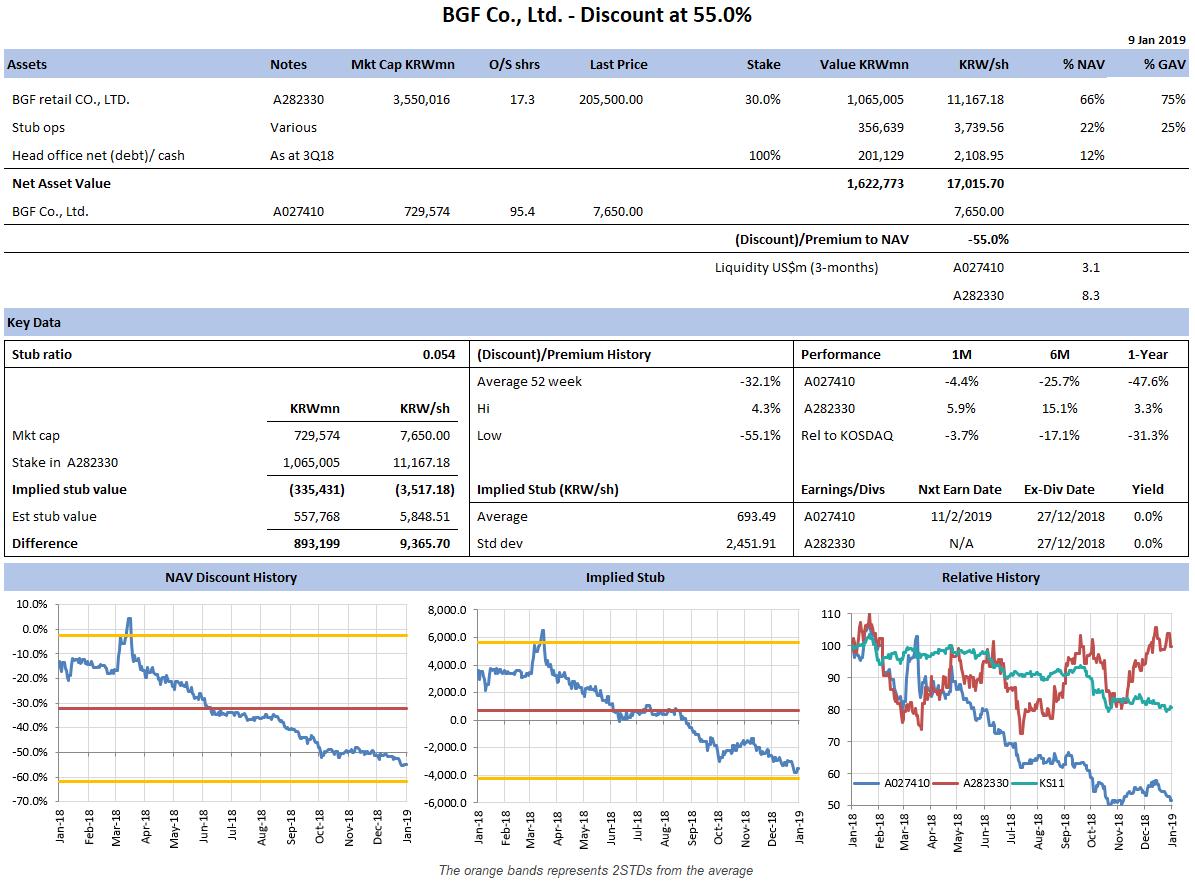

2. Emart: Attractive Entry Point, Undervalued Real Estate Assets, & Homeplus REIT IPO

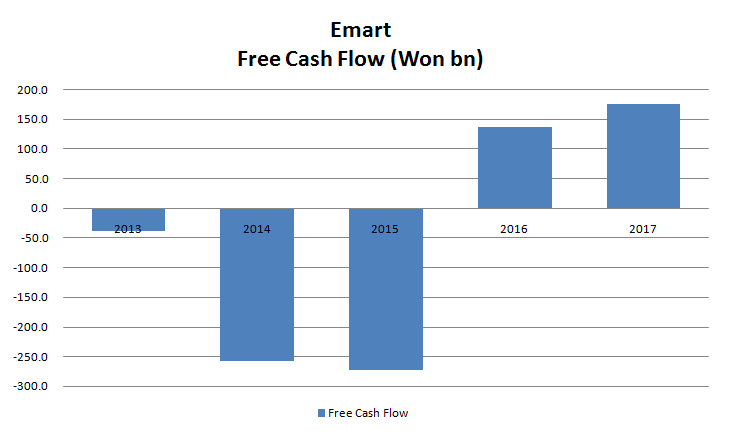

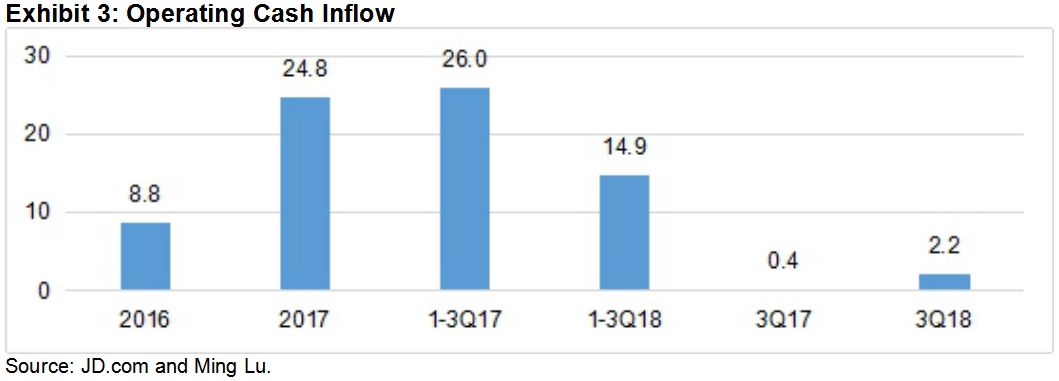

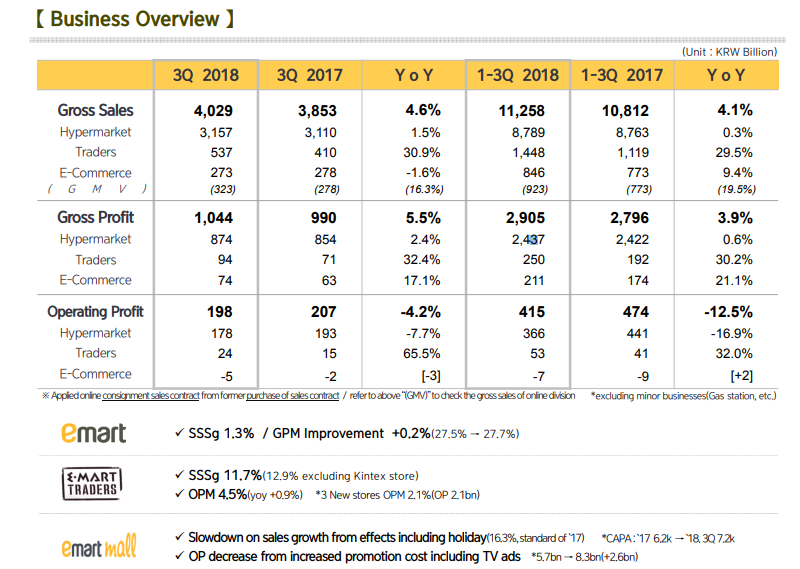

Shares of E Mart Inc (139480 KS) are down 40% from their highs in March 2018 and we think this decline has been excessive. We believe the stock has bottomed and we expect a 20-30% upside on this stock over the next six months to one year (current share price is 193,500 won). At end of 3Q18, the company had 157 Emart hypermarkets and Traders warehouse supermarkets, of which 90% of their assets were owned by the company and 10% were leased. The company has the highest number of hypermarkets and warehouse supermarkets in Korea. The following are the major catalysts that could boost Emart shares by 20-30%+ in the next 6-12 months.

- Renewed focus on the company’s real estate value

- Upcoming IPO of Homeplus REIT in 2019

- Push back against a steep increase in minimum wages

- Success of Pierrot Shopping and a gradual reduction of unprofitable hypermarkets

3. Visit Note

We recently visited Prataap Snacks (DIAMOND IN) in Indore, Madhya Pradesh. Our objective of interaction was to get some clarifications on standalone financials of the company. As of FY 2018, standalone revenue was at 10,309 mn vs 10,377 mn for consolidated entity. Contrary to management’s suggestion to look at consolidated financials, we prefer to look at standalone financials, since the parent company contributes to 99% of Sales as 100% of the assets. Some of the issues that warrant attention are highlighted in this insight. Consensus financial data indicate an expectation of 44% growth in EPS for FY 2020. Our checks indicate an increasing competitive environment where both regional and national (MNC brands) are fighting for market share. The company is entering new product categories like sweet snacks. However, looking at growth expectations and cost structures discussed in this insight, investors would be better off looking for an alternative which is leaner.

4. Bank Mandiri (BMRI IJ) – Shape Shifting and Millenial Mortgages – On the Ground in J-Town

A recent meeting with Bank Mandiri Persero (BMRI IJ) in Jakarta confirmed a positive outlook for loan growth and net interest margins for 2019, with continuing incremental improvements to credit quality, especially in the MidCap and SME space.

The bank is optimistic about loan growth in 2019 but with a shift in the shape of growth, with Midcap and SME loans moving into positive territory, a slight tempering of growth from large corporates.

Microlending continues to be a significant growth driver, especially salary-based loans, which have huge potential and are relatively low risk.

Mandiri is switching its focus on smaller sized mortgages and is even offering products specifically targeting millennials. It is also training staff in its branches to promote both mortgages and auto loans, which should help to boost growth in consumer loans.

The bank is investing heavily in growing both Mandiri Online mobile banking, as well as working closely with the major e-commerce players in Indonesia.

Management is optimistic about the outlook for net interest margins and comfortable with its funding requirements, with good visibility on credit quality.

Bank Mandiri Persero (BMRI IJ) remains a key proxy for the Indonesian banking sector, with an increasingly well-diversified portfolio and growing exposure to the potentially higher growth areas of microlending and consumer loans. The bank has fully embraced modern day banking with strong growth in Mandiri Online, which should help the bank grow its transactional business and its current and savings accounts (CASA). Its push to grow salary-based loans is another business with huge potential, given the low penetration of its corporate pay-roll accounts. According to Cap IQ consensus estimates, the bank trades on 12.5x FY19E PER and 11.0x FY20E PER, with forecast EPS growth of +16.5% and +11.8% for FY19E and FY20E. The bank trades on 1.9x FY18E PBV with an FY18E ROE of 13.9%, which is forecast to rise to 15.5% by FY20E. Given its higher growth profile and rising ROE, the bank looks relatively attractive compared to peers.

5. New Oriental (EDU): Educator License Not A Concern

- The Education Ministry of China promulgated Burden Relief Measures for Students in Primary and Secondary Schools (中小学生减负措施).

- The market is concerned about “Article 15” on the educator license.

- We note that a large number of teachers in part-time schools took the educator exam in November 2018.

- We expect that the incremental passers of the educator exam will be many more than the number of EDU’s vacancies, and that most of the passers will prefer to work for giants such as EDU or TAL (TAL) as opposed to other part-time schools.

Get Straight to the Source on Smartkarma

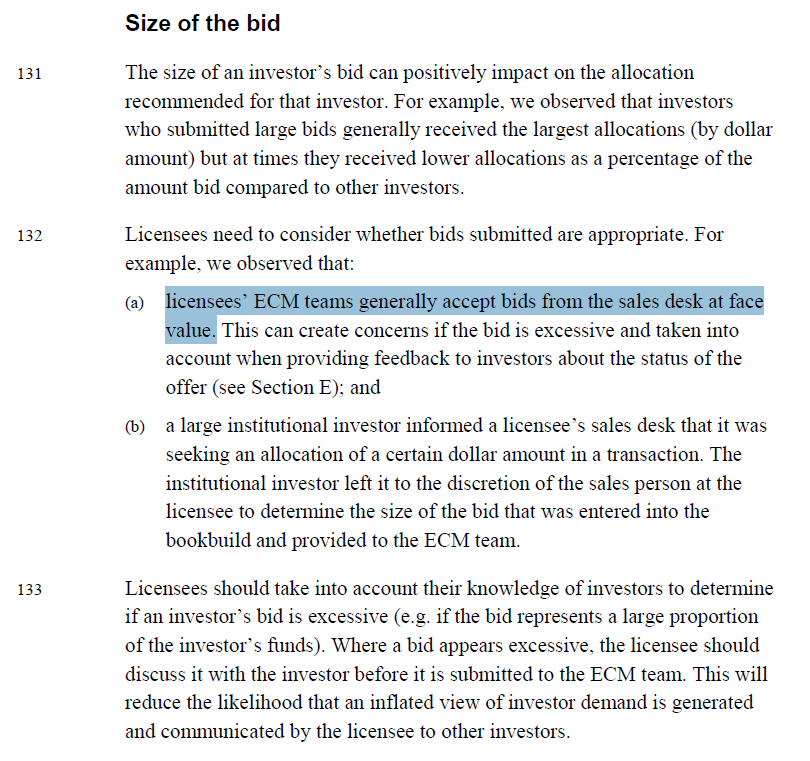

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.