In this briefing:

- PLANB: Solid Outlook for Music Marketing Business Under BNK48 Office

- Titan Co Ltd (TTAN IN)

- SCMA (SCMA IJ) – Biting the Digital Bullet – On the Ground in J-Town

- Macq Media In The Crosshairs As Fairfax Merger Completes

- IPO Trading Strategy: A Deep-Dive on Early Trade of Chinese Companies Listing in the US

1. PLANB: Solid Outlook for Music Marketing Business Under BNK48 Office

We maintain Plan B Media (PLANB TB) with a BUY rating, and the new target price of Bt8.30 derived from 1.5xPEG’2019E, which is the average of Thailand’s consumer discretionary sector or equivalent to 32xPE’19E

The story:

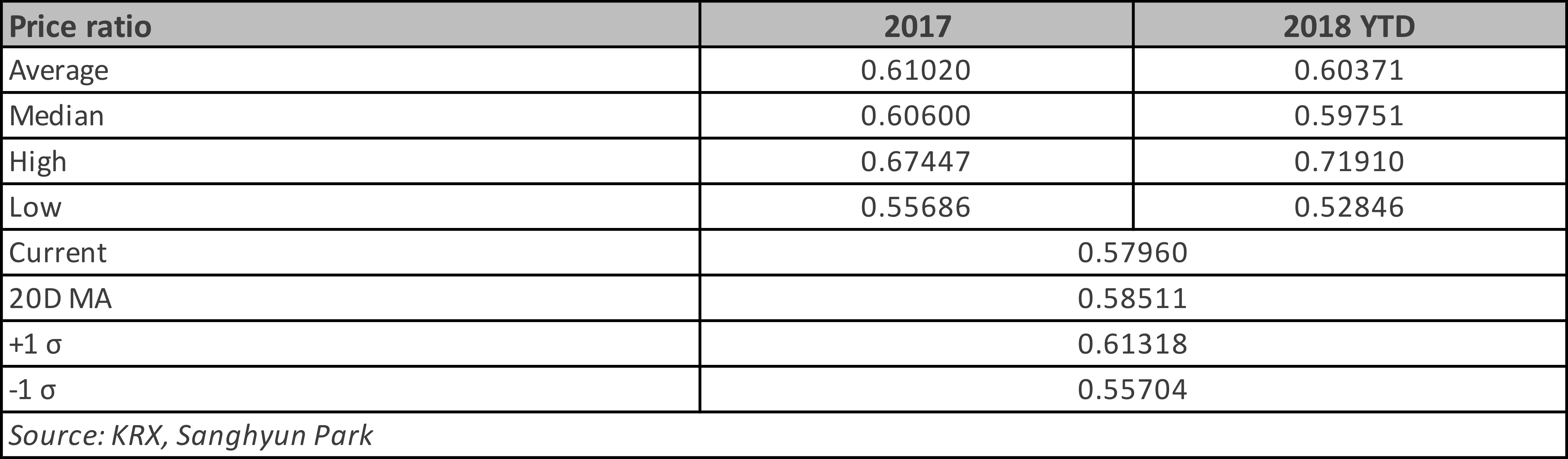

- Revising up net profit in 2018-20E by 2-11% mainly from BNK office

- Music and sports marketing drive earnings momentum north

- Plenty of opportunities to monetize underutilized capacity

Risks: Obstacles for renewing concession contracts with state-owned enterprises along with falling consumer spending and a share-price dilution effect on the back of then generally mandated raise in capital.

2. Titan Co Ltd (TTAN IN)

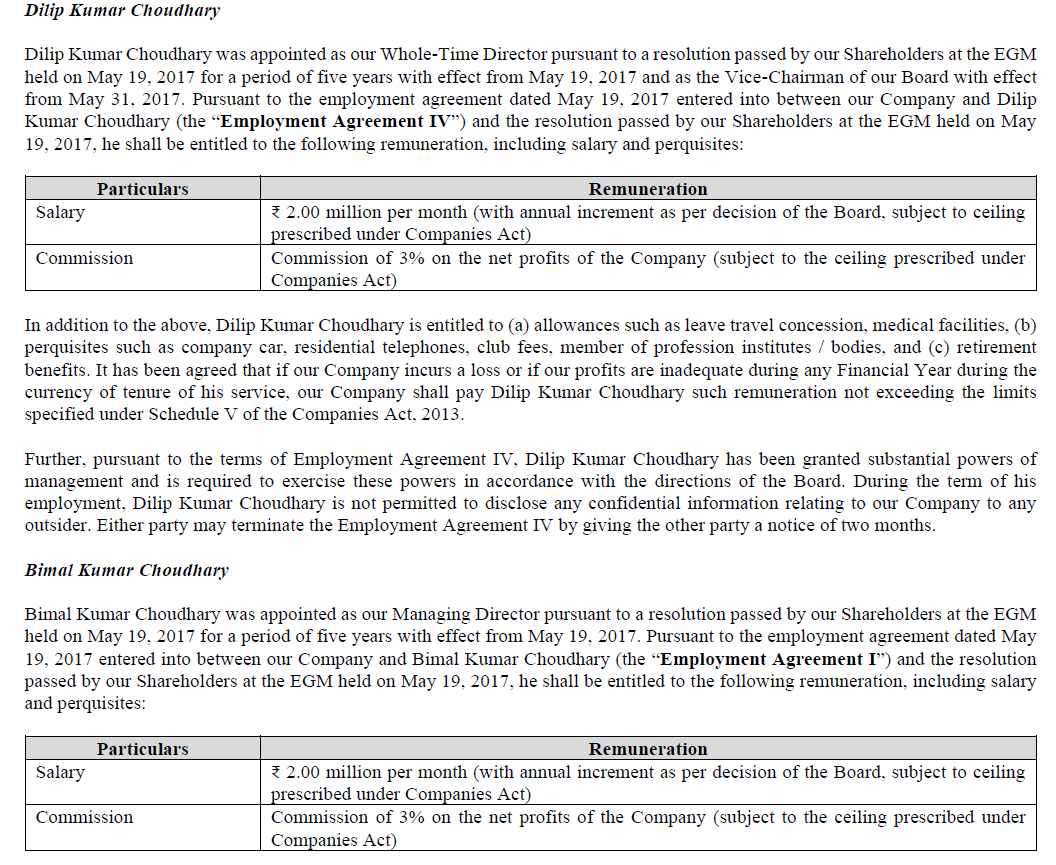

Titan Company Limited manufactures and sells watches, jewellery, eyewear, and other accessories and products in India and internationally. The company operates through four segments: Watches, Jewellery, Eyewear, and others. It is one of the few companies operating in organised jewellery retail industry of India. We visit stores & markets in Kochi (Kerela) and Chennai (Tamil Nadu), the biggest consumption markets to understand structural changes that have taken place in the industry, with an objective to tweak our revenue and margin estimates. We believe consensus might be underestimating growth from the jewellery segment which is the largest contributor with 81.60% of Sales as of FY2018. Our revenue estimates for FY19 and FY20 are 5.8% & 2.98% higher than consensus, primarily based on higher than expected market share gains from unorganised players. Our EBITDA margins for FY 19 & FY20 are 1% & 1.30% higher than consensus estimates primarily based on product mix which is in favour of studded jewellery and operating leverage as sales across stores pick up. Our EPS for FY19 & FY20 is estimated at INR 18.60 and INR 24.26 per share which is higher than consensus by INR 2.47 and 4.05 per share for FY 19 and FY 20. Based on an average forward multiple of 49x we arrive at a target price of INR 1187, representing a 30% potential return from current market price.

3. SCMA (SCMA IJ) – Biting the Digital Bullet – On the Ground in J-Town

The conclusion from a recent meeting with the management of Surya Citra Media Pt Tbk (SCMA IJ) in Jakarta was that the company is ready to grasp the nettle of moving a significant focus towards the digital space. That said, it is clear that Free-to-Air business is still very much alive and kicking and will be the core driver for some time to come.

Media Partners Asia suggests that the advertising revenues for the Free-to-Air TV industry in Indonesia can grow +5.6% CAGR between 2017-2023.

Internet companies are driving growth at the margin but also make-up 2/3rds of the 15% of total spend on digital advertising, which suggests only 5% lost from TV.

Surya Citra Media Pt Tbk (SCMA IJ) is on the cusp of a significant move into the digital advertising and content space through Vidio.com, Kapanlagi.com, as well as its payments gateway Dana.

The company will also enter a new advertising medium of outdoor billboards, where it will seek to consolidate the industry through acquisitions, with the aim of controlling 50% of this market.

Surya Citra Media Pt Tbk (SCMA IJ) remains the best media proxy for advertising in Indonesia. It has seen its two main Free-to-Air stations SCTV and Indosiar command number 1 & 2 audience share positions over the last two months, giving an overall prime-time audience share YTD of 35%. The company estimates that the core business can probably achieve growth of +10% over the next two years. The real kicker to growth for the company will come from its significant move into the digital and content space through a series of acquisitions, mainly from its parent Elang Mahkota Teknologi Tbk (EMTK IJ). These transactions are will be done at arm’s length so as to avoid any corporate governance concerns. According to CapIQ consensus, the company is trading on 16.7x FY19E PER and 15.1x FY20E PER, with forecast EPS growth of 8.6% and 10.6% for FY19E and FY20E respectively. The company also has a dividend yield of 3.9% for FY19E and generates an ROE of 32%.

4. Macq Media In The Crosshairs As Fairfax Merger Completes

Late last week, Australian media reported that preliminary discussions were underway between Nine Entertainment Co Holdings (NEC AU) and Macquarie Radio Network (MRN AU)’s second-largest shareholder, John Singleton. This development is not entirely unsurprising, just that formal discussions were deferred until the Nine/Fairfax Media (FXJ AU) merger was formally completed.

In July, Nine and Fairfax entered into a Scheme Implementation Agreement in which the two companies would merge (albeit a Nine takeover) via a cash/scrip structure, in an A$4bn deal, creating Australia’s largest integrated media player. This included the acquisition of Fairfax’s 54.5% stake in MRN. The scheme was implemented on the 7 December. I discussed the merger in my insight Nine & Fairfax – Integrated Advertising.

In an interview with The Daily Telegraph last month (paywalled), John Singleton confirmed that he was ready to sell his 32% stake in MRN as he was not interested in being a small player in a big operation.

The Australian (paywalled) is reporting that Nine has offered $2/share (a 9.3% premium to the closing price of A$1.83 on December 4th), with Singleton believed to be holding out for $2.15/share. In a further twist, Alan Jones, with 1.27% of MRN, is understood to have certain conditions/clauses attached to that stake should Singleton sell, which may make an offer tabled by Nine potentially untenable.

For its part, Nine has confirmed it has held preliminary discussions regarding the outstanding shares, and further announcements will be made by Nine should these discussions progress to a transaction. MRN is currently trading at ~$1.90/share.

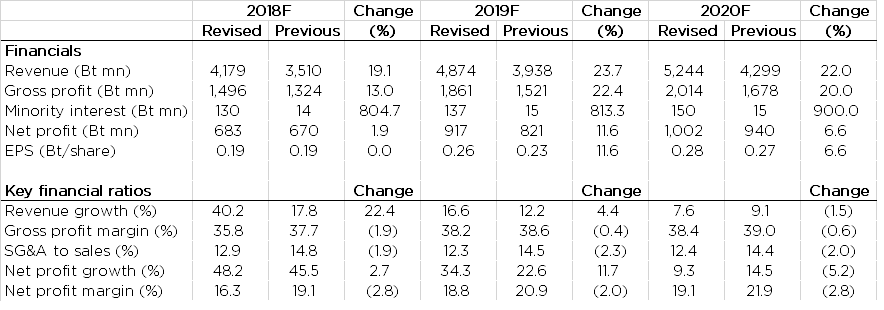

5. IPO Trading Strategy: A Deep-Dive on Early Trade of Chinese Companies Listing in the US

Ahead of Tencent Music (TME US)‘s IPO today , we have done a deep-dive analysis on the past 28 major Chinese IPOs that have listed in the US. We note the following points

A higher pop associated with a lower free float?

If it starts weak , we wouldn’t assume disaster – historically shares have broken above IPO price at some point during day one trade

Day one moves by pricing range – pops across the board

GER pricing view for Tencent music

Companies assessed in this report: X Financial (XYF US) , Qudian Inc (QD US) , Pinduoduo (PDD US) , Qutoutiao Inc (QTT US) , HUYA Inc (HUYA US) , Pintec Technology Holdings L (PT US) , 111 Inc (YI US) , Uxin Ltd (UXIN US) , BEST Inc (BSTI US) , Sunlands Online Education Gr (STG US) , Cango Inc (CANG US) , Huami Corp (HMI US) , Sea Ltd (SE US) , Aurora Mobile Ltd (JG US) , Viomi Technology Co Ltd (VIOT US) , Weidai Ltd (WEI US) , Jianpu Technology (JT US) , Greentree Hospitality (GHG US) , iQIYI Inc (IQ US), Sogou Inc (SOGO US) , Onesmart Education (ONE US) , CNFinance Holdings Ltd (1640496D US) , TuanChe Ltd (TC US) , NIO Inc (NIO US) , CooTek Cayman Inc (CTK US) , Niu Technologies (NIU US) , Mogu (MOGU US) , and Bilibili Inc (BILI US)

More details below