In this briefing:

- SBS (2384) A Great Third Party Logistics Company Seeing Good Organic Growth as Well as Via M&A.

- Drill Results Confirm High-Grade Mineralisation (Flash Note)

- Mexican Banks – Near Term Relief on Fees from the ABM Convention; Thoughts on January’s Bank Data

- Viva Biotech (维亚生物) IPO: Warning Signs from 2018 Numbers (Part 2)

- Koolearn (新东方在线) Trading Update – A Wobbly Start

1. SBS (2384) A Great Third Party Logistics Company Seeing Good Organic Growth as Well as Via M&A.

It is seeing decent organic growth, led by a focus on third party logistics (3PL). This will carry on. The recently acquired Ricoh Logistics should eventually see margins improve as it is integrated into SBS. This year’s operating profit forecast of Y9bn (+10%) is conservative. An increase of Y1bn this year will come from Ricoh Logistics alone, and then we have organic growth. In our view operating profit will be at least Y10bn. There is the unrealised profit on land, which add some Y85bn to a company whose market cap is Y71bn. Despite the outperformance over the last 12 months, this remains a decent long-term domestic buy, and one in which foreigners still own only 12%. The shares trade on 13x 12/19 assuming an operating profit of Y10bn.

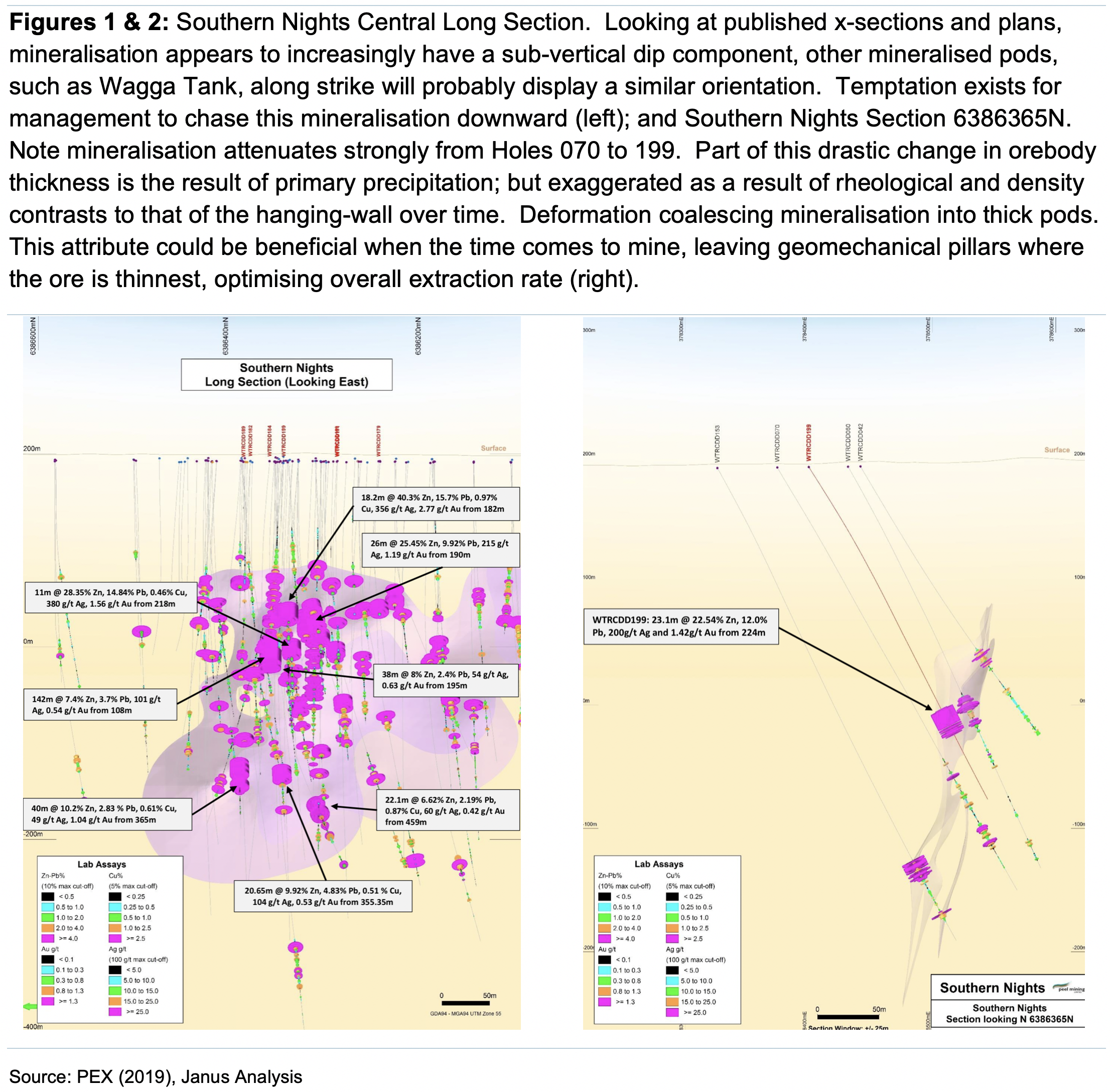

2. Drill Results Confirm High-Grade Mineralisation (Flash Note)

- Significant thick, high-grade Zn/Pb intersections with substantial by-products

- X-sections highlight ore thickness variability

- On schedule for maiden Resource mid-June incorporating both S. Nights and Wagga Tank

- Current drill programmes to be completed within a month

- Employing VMS structural and geochemical specialists for future exploration vectoring

- Maintain Speculative Buy Recommendation

3. Mexican Banks – Near Term Relief on Fees from the ABM Convention; Thoughts on January’s Bank Data

- The Mexican president Andres Manuel Lopez Obrador (AMLO) announced at the annual Mexican bank association (ABM) convention on the 22nd March that there would be no cap or regulatory-enforced reduction in Mexican banking fee and commission charges

- AMLO stated that he expects fees to decline going forward, as a result of increased competition between banks; in the ABM convention, it was also announced that banks will charge zero commissions on the planned platform for digital payments

- This seems a better outcome on fees than the market expected – at least in the near term, as fees are still on the political agenda – and there was greater emphasis at the convention on how to achieve increased financial inclusion, via digital banking initiatives

- Yet we still believe that bank fees could be a bone of contention over the medium term, and we show the FY 2018 ratio of fees to revenues and to assets for eight banks, in the charts below

- The January 2019 Mexican banks data implies slower system loan growth going forward, yet credit quality remains healthy and credit spreads are holding steady

- Despite the volatile global markets, in the short term banks like Grupo Financiero Banorte-O (GFNORTEO MM) could benefit from the “fee relief”; longer term, we would highlight Gentera SAB De CV (GENTERA* MM EQUITY) as an attractive fundamental pick in Mexican banks

4. Viva Biotech (维亚生物) IPO: Warning Signs from 2018 Numbers (Part 2)

Viva Biotechnology, a China-based drug discovery company, is seeking to raise USD 200m to list on the Hong Kong Stock Exchange. It has recently obtained approval for listing by the Hong Kong Stock Exchange. In our previous insight (link here), we discussed the company’s fundamentals, its unique business model, its shareholders, and our thoughts on its valuation.

In this insight, we look at its latest prospectus and review our valuation for Viva Biotech.

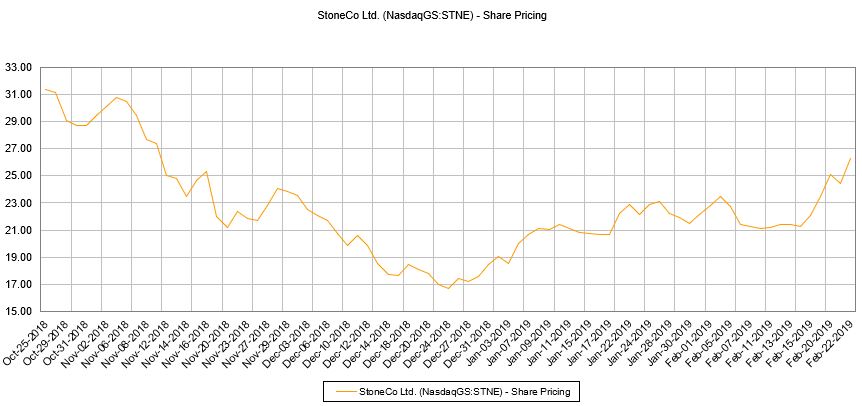

5. Koolearn (新东方在线) Trading Update – A Wobbly Start

Koolearn (1797 HK) raised about US$214m at HK$10.20 per share, the mid-point of its IPO price range. We have previously covered the IPO in:

- Koolearn (新东方在线) IPO Review – Yet to See Results from Increased Spending

- New Regulatory Tightening on Online Education Reads Badly on Koolearn IPO

- Koolearn (新东方在线) Pre-IPO – Profitable Online Edu Company but Poor Sentiment Weighs

In this insight, we will update on the deal dynamics, implied valuation, and include a valuation sensitivity table.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.