In this briefing:

- Brazilian Payments Report: Cielo on the Defensive Against Disruptive Challengers

- India’s Military Strikes on Pakistan: No War in the Offing from Either Side

- New J. Hutton Exploration Report (Week Ending 22/02/19)

- SYNEX: New Smartphone Launches Help Drive Earnings Momentum in 2019

1. Brazilian Payments Report: Cielo on the Defensive Against Disruptive Challengers

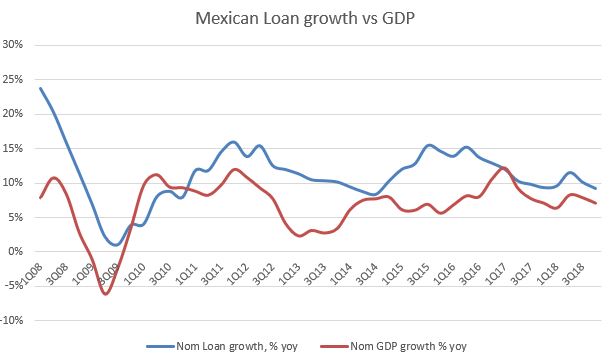

- The non-cash payments market continues to grow at a double-digit rate in Brazil, driven primarily by growing usage of credit and debit cards

- De-regulation and new entrants have brought challenges for the incumbents, especially for the largest player Cielo SA (CIEL3 BZ), with the challengers taking market share, squeezing margins and promoting better service for SME merchants in particular

- Competitive pressures continue in the Brazil payments market, reflected in the declining merchant discount rate (MDR), lower rental rates and sale prices for POS terminals, as well as pressure on the commissions for early payment of merchant receivables; the near-term prospects for Cielo remain challenging in our view

- Due to the ongoing headwinds, we expect Cielo to show negative earnings growth to 2021; management has announced that Cielo will defend its market share against the challengers; we see further downside risk to consensus earnings and the real risk of a greater than consensus 2019 DPS cut

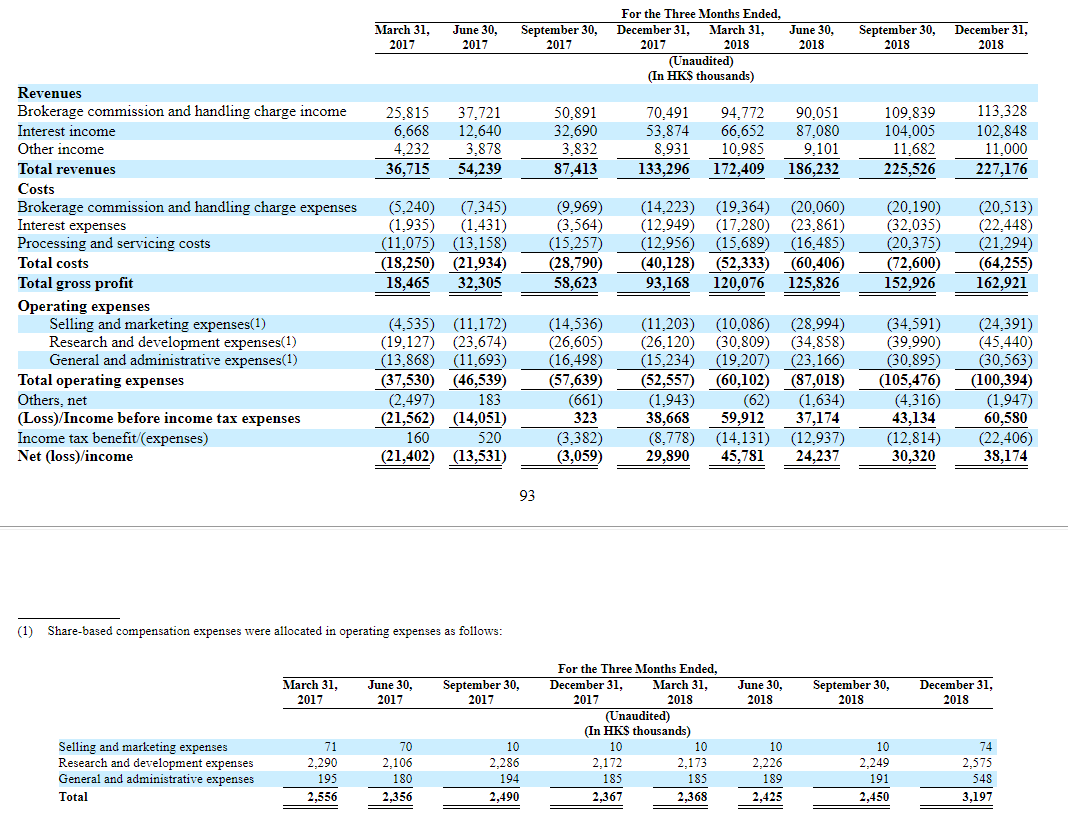

- StoneCo Ltd (STNE US)and Pagseguro Digital Ltd (PAGS US) are two of the payment challengers in this de-regulated market, growing faster than the Brazilian non-cash transactions market and taking incumbents’ market share; we see StoneCo to be the preferred entity to PagSeguro, based on StoneCo’s higher revenue yielding SME segment of focus and on its more attractive PEG ratio valuation

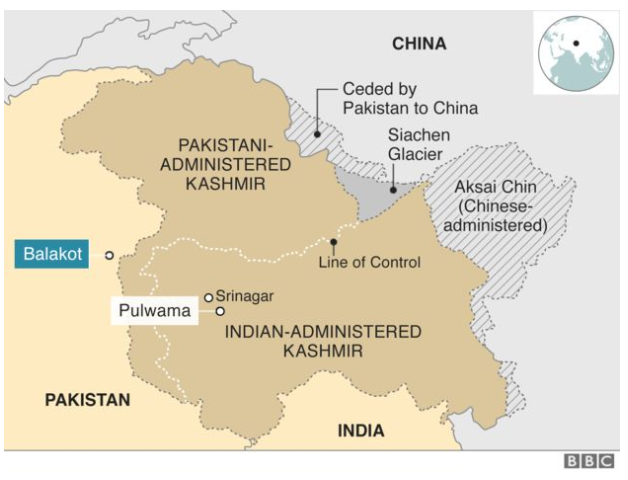

2. India’s Military Strikes on Pakistan: No War in the Offing from Either Side

The air strikes launched by the Indian Air Force on Jaba Top in Balakot, in the Khyber Pakhtunkhwa province of Pakistan, have raised the stakes in the escalation of conflict between the two nuclear-armed neighbours in South Asia. The stock market reaction on the morning of February 26 was negative with the Nifty-50 down nearly 146 points (1.3%), but thereafter it recovered to close at 10,835, only 45 points down (0.4%) from the previous close. The central issue for the Indian market remains whether this will result in another war or a military retaliation by Pakistan as India targeted a venue in Pakistan proper and outside Pakistan-administered Kashmir (PAK), unlike the earlier ‘surgical strike’ wherein Indian army units attacked a camp in PAK. A war will be prohibitively expensive for both countries, but more so for Pakistan. It would have a material impact on the fiscal deficits of both countries, and it is also unlikely that America would want an escalation of conflict in this heavily militarised region. Hence, while the Pakistani government may make appropriate noises to satisfy their public, their response may be non-military, through an escalation in low intensity conflict targeting the Indian military and para-military in Indian-administered Kashmir (IAK). Hence, while the casualties may rise, the possibility of another India-Pakistan war may be remote.

At the same time, there is an indirect fall-out of the present conflict. Since voters may perceive Prime Minister as a more credible war leader than his opponents, a war atmosphere may strengthen the prospects of the ruling party. If the market comes to this conclusion, the recent military strikes may in fact boost the market. However, that ‘war’ effect may wear off before the elections.

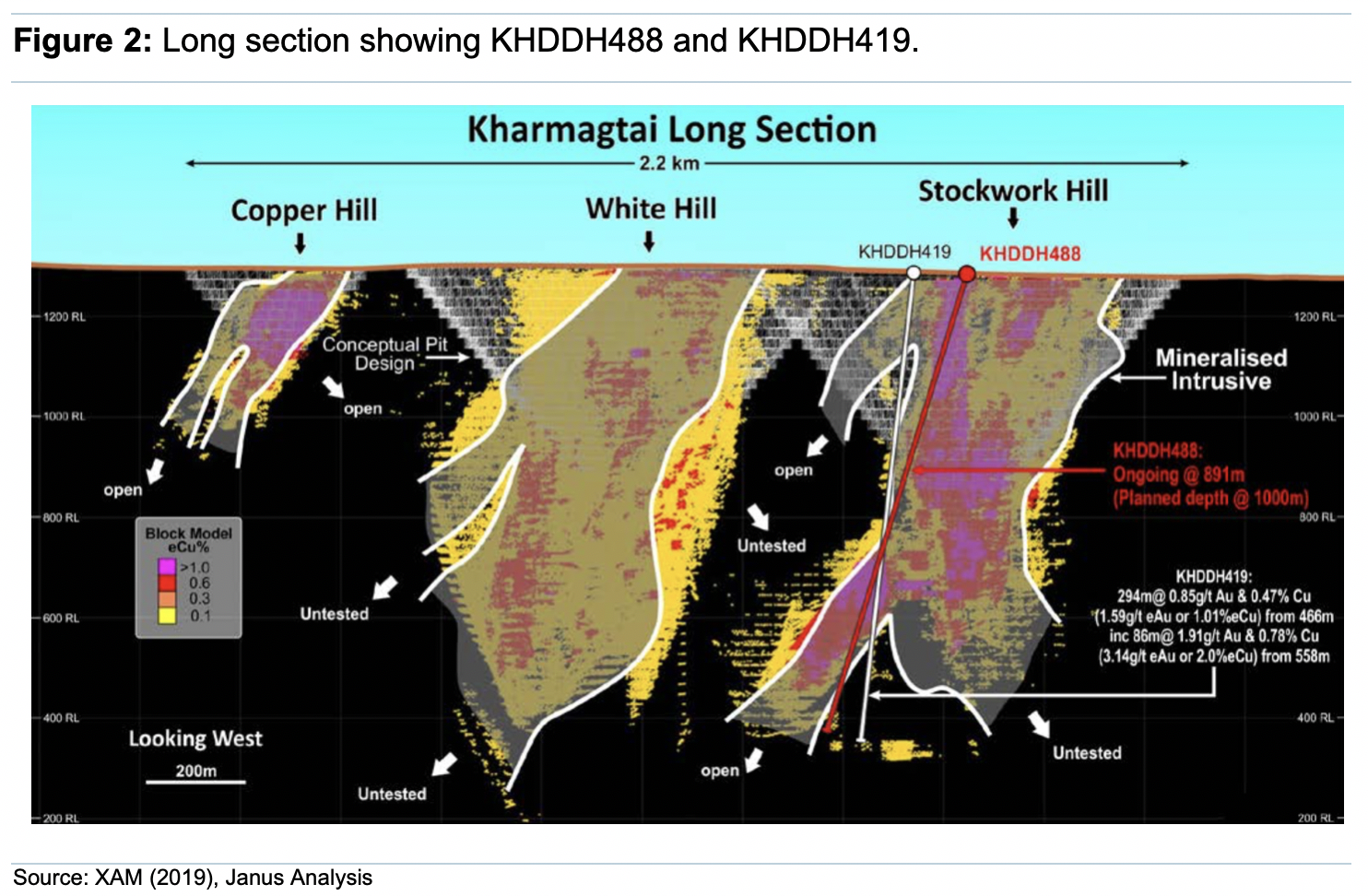

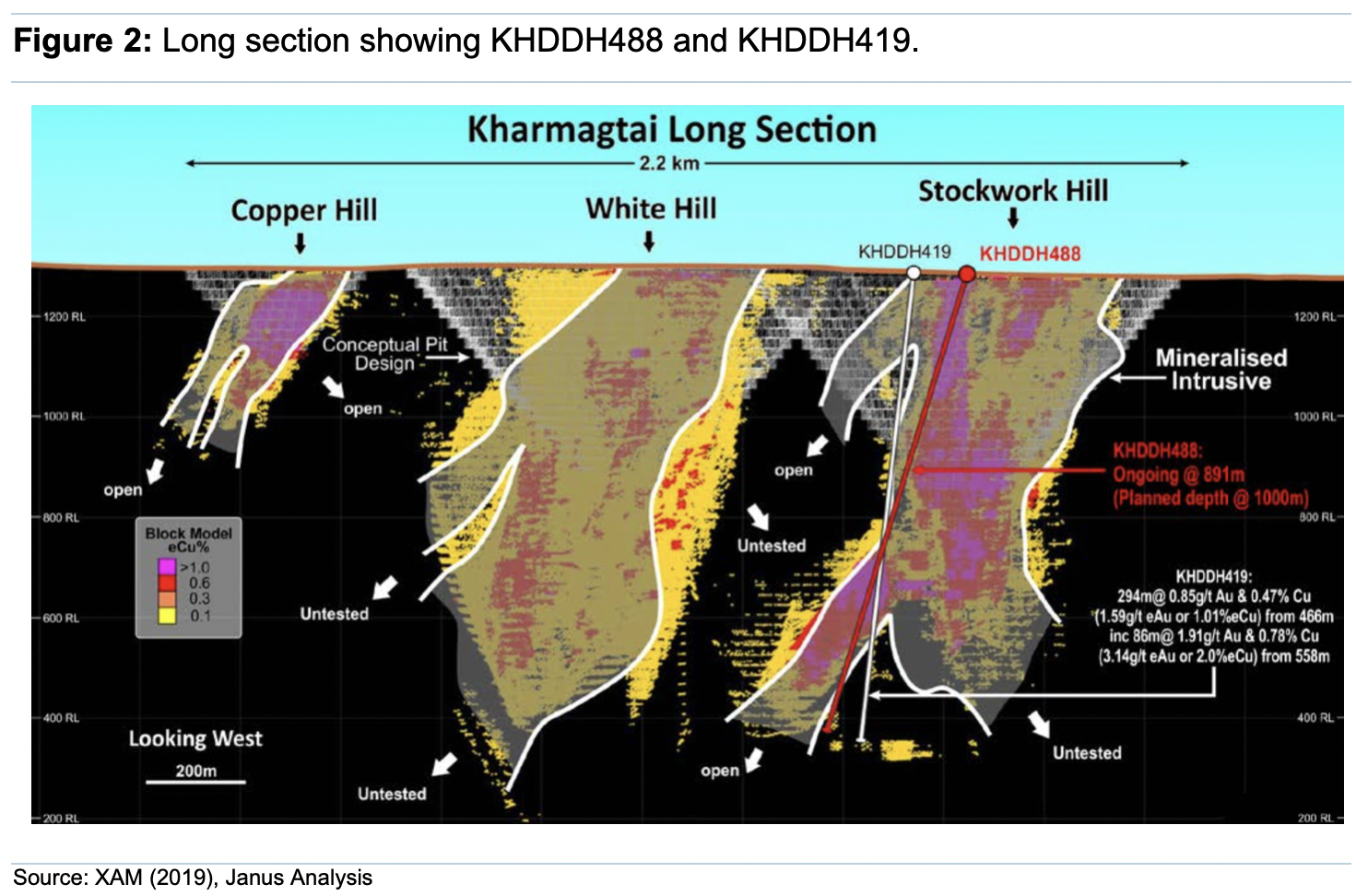

3. New J. Hutton Exploration Report (Week Ending 22/02/19)

- Azumah Resources (AZM AU) rated a Speculative BUY

- 99.5m at 2.2g/t Au complements ‘discovery hole’ (75m above) – 93.1m at 2.3g/t Au

- DDHs from current programme targeting down-dip from existing intercepts

- Key drill results expected over next few weeks

- 1Moz Reserve, 2.5Moz Resource

- US$1,77M NPV5%, 1.6yr payback.

- US$886/oz AISC (all-in sustaining cost)

- Azumah Resources (AZM AU) , Emmerson Resources (ERM AU), Xanadu Mines (XAM AU), Kingston Resources (KSN AU), Oklo Resources (OKU AU), Blackham Resources (BLK AU), Dacian Gold Ltd (DCN AU), De Grey Mining (DEG AU), Austar Gold (AUL AU), Strategic Minerals PLC (SML LN), Asiamet Resources Ltd (ARS LN), Landore Resources Ltd (LND LN)

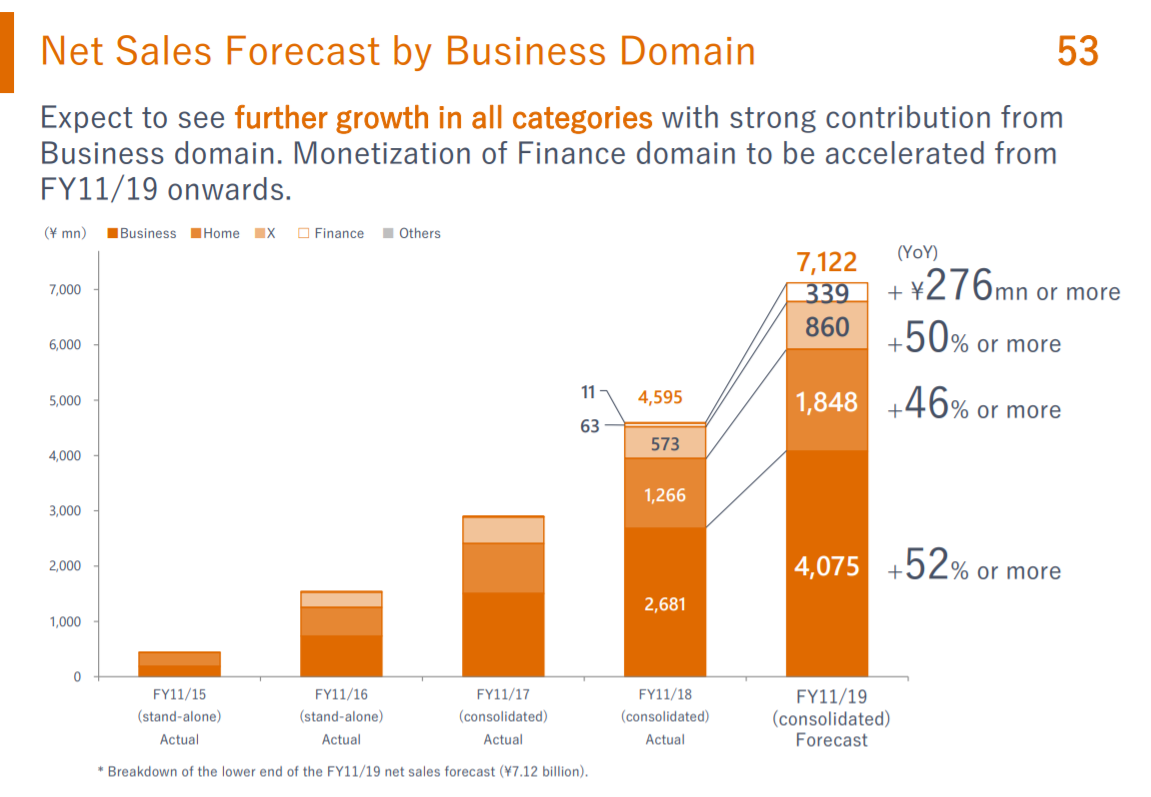

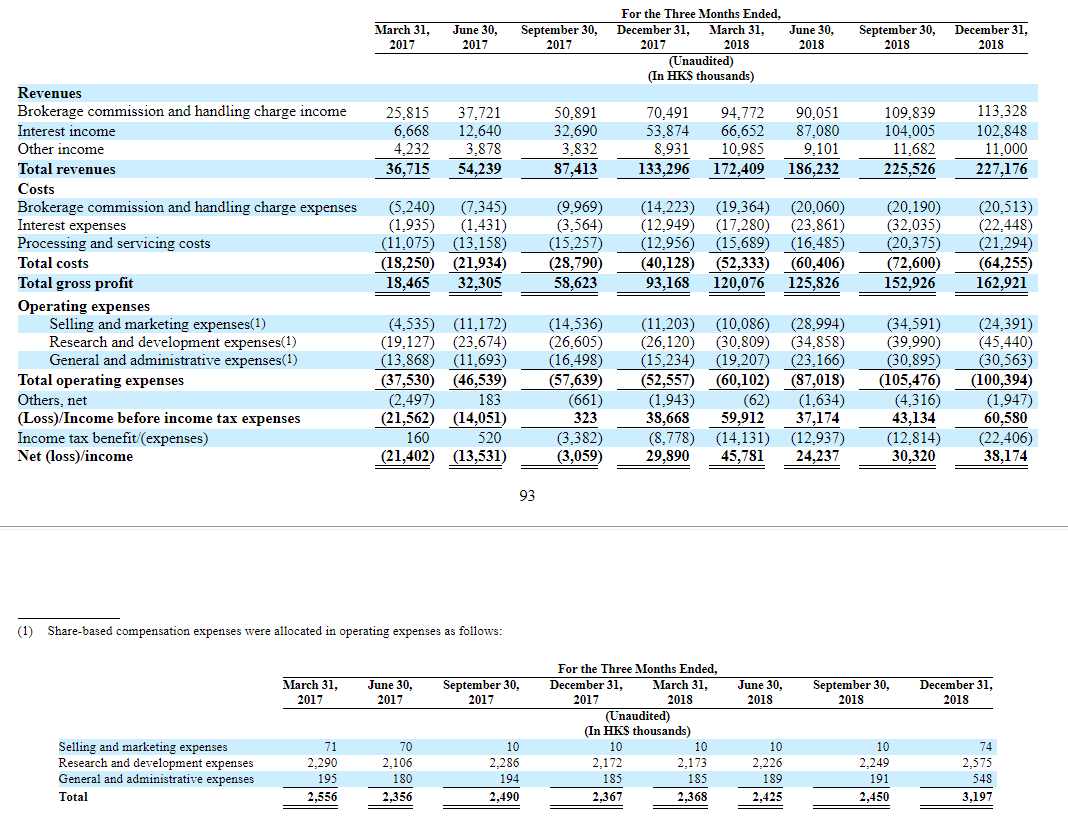

4. SYNEX: New Smartphone Launches Help Drive Earnings Momentum in 2019

SYNEX’s 4Q18 net profit was at Bt190m (+16%YoY, +18QoQ), in-line with our expectation

- Record-high level of sales at Bt10.38bn is the major contributor to impressive 4Q18 performance. Meanwhile , gross margin drops below 4% in the first time due to changing product mix towards more on device segment

- SYNEX post 2018 net profit of Bt721m (+15%YoY) driven by 18% increase in revenue

- We maintain our positive view toward FY19-20E earnings outlook driven by (1) number of flagship smartphone model launches and new brands for low budget users, Neffos, and, (2) higher sales contribution from high-margins product such as gaming desktops and post-sales services.

We maintain our BUY rating with a new target price of Bt16.80 (previous target price at Bt15.0) derived from 17xPE’2019E, which is the average of the World information and technology sector

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.